US Treasury Shocks With Second Biggest Budget Surplus In History Thanks To Record Tariff Revenues

Two weeks ago, as part of its quarterly refunding announcement, the Treasury surprised the market when it unveiled a funding need for the current quarter that was $53 billion lower than it had initially forecast in February, and which we said “indicates that DOGE is indeed working and the US funding needs are actually declining.”

Needless to say, for a market that was habituated to Joe Biden’s debt-funded drunken sailor spending ways, the news that the US would needs less – not more – spending than previously expected, came as a shock, and yields slumped.

Today we got the reason why the borrowing need of the US was surprisingly lower than previously expected, and it was revealed in the latest Treasury Monthly Statement laying out the US government’s monthly deficit… or rather surplus. Yes, we are so used to describing the sum-total of the US government’s monthly income statement as a deficit (i.e., more spending than revenue) that it has become automatic to assume that every month the US will spend more than it brings in. Only this time that wasn’t the case.

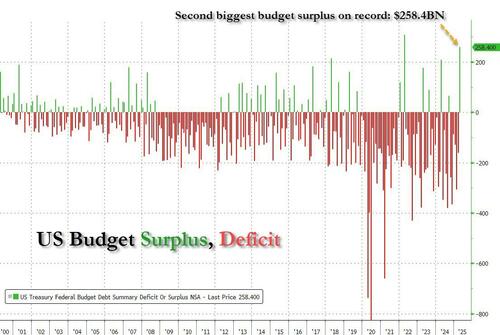

Presenting Exhibit A: in April, the US Treasury generated a $258.4 billion surplus after last month’s $160.5 billion deficit; this the second biggest surplus on record, with just the $308 billion bumper surplus in 2021 bigger.

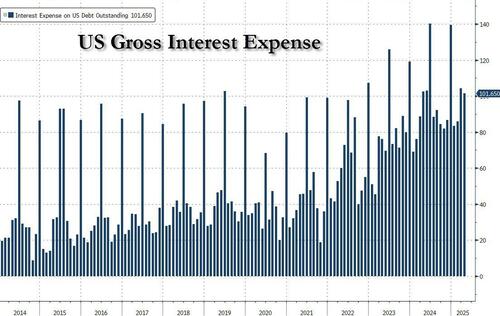

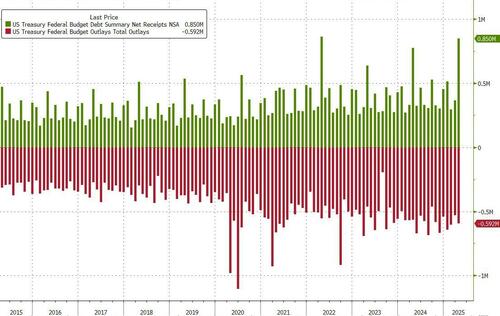

To be sure, while US surpluses are few and far between, the one time of the year when they can (occasionally) be seen, is in April, when a surge in tax income offsets the now chronic government bloat and spending. This April was just that, and while the US did spend a hefty $592 billion in April (slightly more than the $528 billion in March, and more than the $567 billion spent a year ago) of which very ominously more than $100 billion was gross interest on the record US debt (which at this moment is about $37 trillion) for the second month in a row…

… the revenue collected by the US treasury managed to more than offset this massive spend, and surged by a whopping $850 billion, just shy of the record $864 billion record in April 2022.

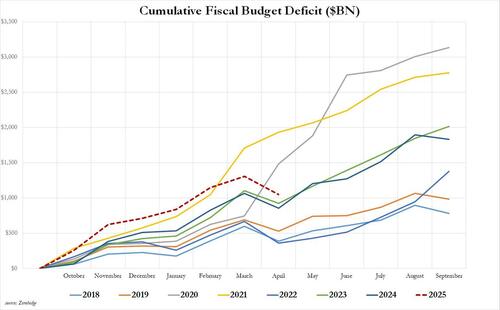

The unexpected surge in revenue, and the resulting budget surplus means that the cumulative deficit for fiscal 2025 suddenly doesn’t look catastrophic: recall that just four months ago, back in January, in the last month of Biden’s reign, the US had already spent a record $840 billion for the first 4 months of the year, on pace to blow away all previous records. But then something changed, and first March saw a big slowdown in spending which resulted in a much more tame cumulative deficit through March, and then the April data meant that the cumulative deficit in the first seven months of the year, was actually an improvement, and dropped to just $1049 billion, down from a peak of $1037 billion in March, and below the run-rate of both 2021 and 2024.

And while the primary reason for the unexpected budget surplus was a far bigger tax haul than expected, mostly thanks to a burst in capital gains tax which is unlikely to be repeated this year (unless we see the S&P rise another 20% from here by year end), there was another big reason for the April revenue surge, a reason we profiled previously in “Trump Trade War Results In Record $12 Billion Surge In Customs Revenues.” As shown in the chart below, Customs Duties in April doubled from $8.2 billion in March to a record $15.6 billion in April, thanks to surge in Trump tariffs.

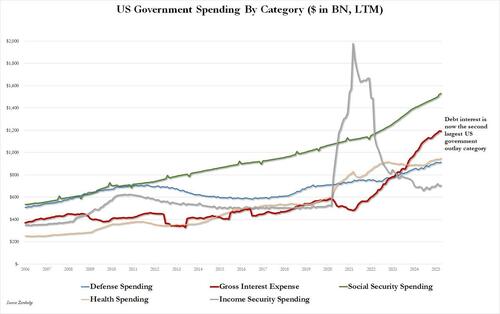

And while all of that is a good start, and certainly a big improvement in the US fiscal picture in the first three months of Trump’s regime, the big picture sadly remains a dismal one, largely because the US debt picture remains completely unsustainable and manifests itself in $1.2 trillion in gross interest expense per year, just $300 billion shy of the biggest spending category of them all: Social Security Spending.

That said, April’s bumper revenue aside, all five main spending categories are growing much faster than revenue, and something drastically has to change for this big picture to become viable. Unfortunately, we have now seen the wholsesale pushback Trump has faced when doing just that – trying to restructure a broken status quo – which is why unless Trump magically succeeds in this undertaking, the US is pretty much doomed (while DOGE’s achievements have been admirable, they are a drop in the bucket in the context of Congresionally appropriate spending) as nobody else will ever come close to Trump’s intended overhaul of the US fiscal picture.

Tyler Durden

Mon, 05/12/2025 – 22:10ZeroHedge News