Vietnam Q1 Auto Sales Outperform Asian Peers, Rising 24%, Led By Chinese Brands

Vietnam led Southeast Asia’s auto sales growth in Q1 2025, with a 24% year-on-year surge, outpacing larger markets thanks to strong economic momentum and rising public investment, according to Nikkei Asia.

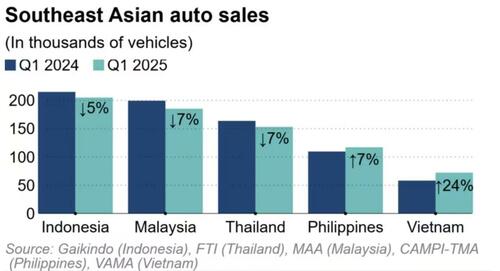

Nikkei Asia data shows total sales across Southeast Asia’s five biggest markets—Indonesia, Malaysia, Thailand, the Philippines, and Vietnam—fell 1.7% to 732,898 vehicles.

In Vietnam, hybrid vehicle sales soared 80% to 2,562 units, driven by new models from Toyota and Suzuki. Commercial vehicles and trucks also saw strong gains, rising 22% and 21% to 15,445 and 13,400 units, respectively, supported by a 19.8% jump in public investment to $4.67 billion.

“We expect Vietnam’s passenger car sales, excluding VinFast and some luxury brands, to grow 15% year on year in 2025,” said Thuc Than, an analyst at Vietcap Securities. “Our forecast does not take into account a possible negative outcome of the tariff negotiations,” she added, warning that higher tariffs could pose risks to growth.

Vietnam’s official auto sales stood at 118,813 vehicles, but including VinFast’s 35,100 units and Hyundai’s 11,464 units, total sales would surpass the Philippines’ 117,074 units.

The Philippines saw solid 7% growth, led by a 13.9% rise in commercial vehicle sales, even as passenger car sales fell 13.7%. EV and hybrid sales accounted for 5.73% of the market.

Thailand’s market shrank 7% to 153,193 vehicles, with ICE passenger car sales down 14% and pickup truck sales down 13%. EV sales, however, grew 19% to 22,737 units, boosted by Chinese brands like BYD, which saw March sales jump nearly threefold.

Nikkei Asia writes that despite the yearly decline, Thailand’s Q1 sales rose 14% quarter-on-quarter, topping 150,000 units for the first time in a year, aided by price cuts and promotions.

Malaysia, Southeast Asia’s second-largest market, also slowed. Sales fell 7.4% to 188,100 vehicles as backlogs cleared and the market normalized. March sales rose slightly by 2.2%, supported by aggressive marketing campaigns.

Chinese brands are making rapid inroads in Malaysia’s EV market. Proton’s first EV, the e.MAS 7, launched in December, has already received over 5,500 orders, with a second model, the e.MAS 5, expected later this year.

“The Chinese brands are offering very competitive and affordable prices,” said Periasamy Arumugam of Great Wall Motors. Jerry Chan of Jetour added, “Malaysian customers prefer big cars like SUVs,” noting that Jetour plans to manufacture vehicles locally in Johor to meet demand.

Tyler Durden

Sat, 05/17/2025 – 13:25ZeroHedge News