Futures Rise Despite US Government Shakedown Of Nvidia, AMD

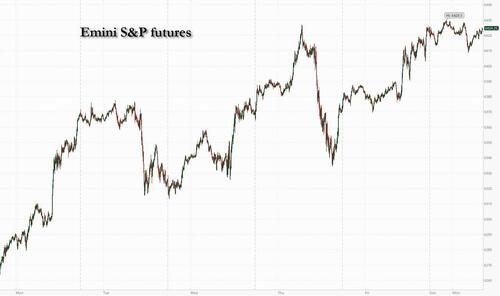

US equity futures are up small with Russell/small caps outperforming, and yields dip at the start of a data-heavy week that will be pivotal for the Fed’s rate cuts later this year. As of 8:00am ET, S&P 500 contracts rose 0.2% after the index ended Friday just shy of a record high; Nasdaq futures were flat. In premarket trading, AMD fell 2.3% and NVDA was 1% lower after the chipmakers agreed to remit to the US government 15% of their revenue from AI chip sales to China in exchange for export licenses. Bond yields are lower as the curve flattens and the USD rises. Cmdtys are lower with Energy/Metals weaker but Ags stronger. Meanwhile, Trump asked China to increase soybeans purchases 4x ahead of tomorrow’s trade deadline although Lutnick last week said another extension is likely. Geopolitics is also in focus with a larger impact on EMEA and the Trump/Putin summit this Friday. Bitcoin rises back to $122K and Ethereum surge to $4350 overnight, hitting the highest since 2021. There are no major macro data prints today but market will focus on CPI on Tuesday.

In premarket trading, Mag7 stocks are mixed: Tesla +1.2%, Microsoft +0.3%, Amazon +0.2%, Apple -0.5%, Meta +0.06%, Alphabet -0.2%, Nvidia -0.6%. Here are some other notable premarket movers:

- Cryptocurrency-exposed stocks rally as Bitcoin extended gains to rise to within striking distance of an all-time high. Coinbase (COIN) +3%, MARA Holdings (MARA) +3%, Riot Platforms (RIOT) +3%

- Lithium stocks rally after operations were halted at a major Chinese mine, spurring speculation that Beijing might move to suspend other projects to tackle overcapacity. Albemarle (ALB) +12%, SQM ADRs (SQM) +7.7%, Lithium Americas (LAC) +9%

- Biotech stocks fall after news that ousted US Food and Drug Administration vaccine regulator Vinay Prasad is set to return to the agency. Capricor Therapeutics (CAPR) -11%, Sarepta Therapeutics (SRPT) -4% and Replimune (REPL) -6%

- Aaon (AAON) drops 18% after the air-conditioning equipment firm reported earnings per share for the second quarter that missed the average analyst estimate.

- Aveanna Healthcare (AVAH) rises 4% after Raymond James upgraded the stock to outperform following the health-care services company’s 2Q results that were well above company guidance and consensus forecasts.

- Barrick Mining (B) falls 3% after the miner reported second-quarter gold production and sales volumes that missed the average analyst estimate.

- Monday.com (MNDY) tumbles 18% after the software company reported its second-quarter results.

- Rumble (RUM) jumps 15% as the online video network platform announces its intent to buy AI firm Northern Data. Meanwhile, shares in Northern Data AG sink as much as 29%.

- Sapiens (SPNS) rises 20% after Calcalist reported that Formula Systems is in advanced talks to sell control of the software company at a valuation of about $2 billion.

After last week’s Big Tech rally took the Nasdaq 100 to fresh highs, prospects for further gains rest with an inflation reading that may help persuade the Fed to cut interest rates and hopes for US-Russia talks over the war in Ukraine. Tomorrow’s release of July inflation data will give traders a chance to assess the impact of tariffs on consumer prices amid growing signs of a cooling labor market. Swaps are currently pricing in an 80% probability of a quarter-point rate cut in September, with core inflation expected to have risen 0.3% in July from June. “That is a number that can probably be seen as acceptable for the Federal Reserve to proceed with a September cut,” noted ING Groep NV currency strategists.

Ironically, this means the Fed will cut when a record number of investors think US stocks are too expensive, according to the latest Bank of America Fund Managers survey. About 91% of participants indicated that American stocks are overvalued, the highest-ever proportion in data going back to 2001. While investor allocation to global equities climbed to the highest since February, a net 16% were still underweight the US, the poll showed.

Among other economic data in the coming week, a Fed report is likely to show stagnant factory output as manufacturers contend with evolving tariff policy. Friday’s July retail figures are expected to show a solid gain as incentives helped fuel vehicle purchases and Amazon’s Prime Day sale drew in online shoppers.

European stocks surrendered early gains as traders dialed back optimism that a meeting between US President Trump and Russian President Putin raises the likelihood of ending the war in Ukraine. The Stoxx 600 is flat as gains in health care and telecommunication shares are offset by losses in industrial and travel. Wind power firm Orsted A/S fell as much as 29% in Denmark on the back of a $9.4 billion rights issue announcement. Here are the biggest movers Monday:

- Orsted falls as much as 29% in its biggest-ever drop, taking the stock below its 2016 IPO price, after the Danish wind-power firm announced plans for a DKK60 billion ($9.4 billion) rights issue alongside its second-quarter report

- European defense stocks are significantly underperforming on Monday morning, with markets looking to US President Donald Trump’s efforts to broker an agreement to end the war in Ukraine

- Oxford Nanopore drops as much as 3.8%, underperforming the FTSE 250 Index, after the British DNA-sequencing firm said Gordon Sanghera has notified the board of his intention to step down as CEO by the end of 2026

- Plus500 shares fall as much as 6.5%, the most since April, after the London-listed trading platform reported first-half results. Peel Hunt cuts rating to hold from buy, saying the shares may pause

- Northern Data shares fall as much as 29% after US firm Rumble announced plans to buy the company; as of Friday’s close, Northern Data shares had fallen 48%

- Recordati rallies as much as 4.4% on Monday after Jefferies upgrades to buy, saying the shares had seen a “disproportionate” decline since the Italian pharmaceutical company’s latest results

- Novartis shares rise as much as 2.5% after the Swiss drugmaker said late-stage clinical trials for its experimental medicine ianalumab met the primary endpoint in patients with Sjögren’s disease, a chronic autoimmune disorder

- Chesnara rises as much as 3.4% to hit their highest level in over five years. Analysts at Peel Hunt upgraded the life insurer to buy in wake of the “transformational deal” to buy HSBC’s life insurance business in the UK

Earlier in the session, Asian equities edged higher amid expectations geopolitical tensions may relax, ahead of a meeting between US and Russian leaders. Shares gained in China. The MSCI AC Asia Pacific Excluding Japan Index rose as much as 0.4%, with SK Hynix and Alibaba among the top contributors. Lithium stocks jumped after a suspension at Contemporary Amperex Technology Co.’s mine eased oversupply concerns. Key gauges advanced in Indonesia and mainland China. Markets were closed in Japan and Thailand for a holiday. Some chip stocks in the region declined after Nvidia and AMD agreed to pay 15% of their revenues from China to the US government as part of a deal with the Trump administration to secure export licenses. Analysts said the move is mostly priced in.

“Asian markets are set to remain on high alert ahead of an eventful — and potentially historic — week that could force investors to reassess risk exposure,” said Hebe Chen, an analyst at Vantage Markets in Sydney. Additionally, any breakthrough in US–China tariff truce “would likely fuel further gains in Asian equities and commodities, while a breakdown could unleash a wave of disappointment and sharp risk-off flows across the region,” Chen said.

In FX, the Bloomberg Dollar Spot Index is flat. The Norwegian krone outperforms its G-10 peers, rising 0.4% against the greenback after CPI topped estimates.

In rates, the yield on 10-year Treasuries slipped two basis points to 4.27%, supported by wider gains in gilts which fell 4bps stoked by UK wage-growth data, and edging toward a three-month low of 4.18% touched last week. The dollar was little changed. US yields are 1bp-2bp richer across tenors with curve spreads little changed; 10-year is near 4.265%, trailing UK’s by 1.5bp while Germany’s lags by ~2bp. Monday’s US session has no calendar events, but weekly slate includes July CPI and PPI reports that could influence pricing for Federal Reserve interest-rate cuts later this year.

In commodities, gold futures in New York declined as traders awaited clarification from the White House over its tariff policy. Lithium prices and stocks spiked after battery giant Contemporary Amperex Technology (CATL) halted operations at a major mine in China. Brent crude futures fall 0.1% to $66.50 a barrel. Spot gold falls $40. Bitcoin rises 2.5% toward a record.

Meanwhile, Bitcoin approached an all-time high, supported by strong demand from institutional investors and corporate buyers, which are helping to lift the entire cryptocurrency market.

Looking ahead, there is no US economic data or Fed speakers are scheduled for Monday. Ahead this week are CPI, PPI, retail sales, Empire manufacturing, industrial production and University of Michigan sentiment, and appearances by Fed’s Barkin, Schmid, Goolsbee and Bostic

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini +0.4%

- Stoxx Europe 600 little changed

- DAX -0.3%, CAC 40 -0.3%

- 10-year Treasury yield -3 basis points at 4.26%

- VIX +0.8 points at 15.96

- Bloomberg Dollar Index little changed at 1204.81

- euro little changed at $1.1643

- WTI crude -0.1% at $63.81/barrel

Top Overnight News

- Ukraine’s President Volodymyr Zelenskiy said Kyiv won’t cede territory to end the war with Russia, though NATO Secretary General Mark Rutte said this week’s US-Russia summit may open the door to talks on Ukrainian land. BBG

- Bessent says tariffs could be dialed back if trade deficit conditions improve between the US and its economic partners (he thinks all ongoing trade negotiations will be concluded by Oct). Nikkei

- Trump is expected to activate hundreds of National Guard troops for Washington DC, while a final number and what role they could play are still being decided, according to Reuters citing a US official.

- Trump’s administration is considering reclassification of marijuana as a less dangerous category of drug: WSJ.

- Nvidia and AMD will pay 15% of their China AI chip revenues to the US in exchange for export licenses, a person familiar said. Shares of both companies fell premarket. The FT said the US started approving China sales of Nvidia’s H20 chip. BBG

- Trump has called on China to quadruple its imports of American soybeans to reduce its trade surplus with the US, a day before a crucial truce between the 2 countries is due to expire. FT

- American companies are repurchasing their shares at a record pace, boosting their balance sheets and fueling the U.S. stock rally. U.S. companies have announced $983.6 billion worth of stock buybacks so far this year, the best start to a year on record. They are projected to purchase more than $1.1 trillion worth overall in 2025, which would mark an all-time high. WSJ

- From McDonald’s and Coca-Cola to Amazon and Apple, U.S.-based multinationals are facing calls for a boycott in India as business executives and Prime Minister Narendra Modi’s supporters stoke anti-American sentiment to protest against U.S. tariffs. BBG

- China wants the US to ease export controls on a critical component of AI chips (HBM chips) as part of a trade deal ahead of a possible summit between Trump and Xi. FT

- Lithium prices and stocks spiked after CATL halted operations at a major mine in China’s Jiangxi province. The mine accounts for some 6% of global output. BBG

- A record share of fund managers see US stocks as too expensive after the sharp rally since April lows, according to a monthly survey. About 91% of participants indicated that American stocks are overvalued, the highest ever proportion in data going back to 2001. While investor allocation to global equities climbed to the highest since February, a net 16% were still underweight the US, the poll showed. BBG

- Fed’s Bowman (voter) said core PCE inflation appears to be moving much closer to the 2% target than is shown in the data and it is appropriate to look through temporarily elevated inflation, while she added that upside risks to inflation have diminished and she has more confidence that tariffs won’t mean persistent inflation. Furthermore, Bowman said delayed action risks further labor market erosion and the need for a possible bigger cut, as well as noted that the latest job market data reinforces her forecast for three rate cuts this year.

Trade/Tariffs

- US President Trump posted “China is worried about its shortage of soybeans. Our great farmers produce the most robust soybeans. I hope China will quickly quadruple its soybean orders. This is also a way of substantially reducing China’s Trade Deficit with the USA. Rapid service will be provided. Thank you President XI.”

- US Treasury Secretary Bessent expects trade issues to be finished by October, according to Nikkei.

- US licensed NVIDIA (NVDA) to export chips to China after CEO Huang met with US President Trump, while it was also reported that NVIDIA and AMD (AMD) will pay 15% of China chip revenues to the US government, according to FT.

- China wants the US to relax export controls on chips as part of a trade deal, according to FT.

- Mexico’s government said it fixed minimum prices for exports of fresh tomatoes following the end of an antidumping investigation suspension agreement with the US, while it noted that the decision protects producers, prevents market distortions and ensures national supply.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks were mostly in the green but with gains limited and price action contained in the absence of notable catalysts from over the weekend and with Japanese markets closed for a holiday. ASX 200 notched a fresh intraday record high with lithium miners boosted after CATL temporarily suspended operations at the Jianxiawo lithium mine in China. Hang Seng and Shanghai Comp kept afloat following reports that the US licenced NVIDIA to export chips to China, with the Co. and AMD to pay 15% of China chip revenue to the US government, although gains were capped as participants continued to await an extension to the US-China tariff truce deadline which expires on Tuesday, while inflation data from China was mixed as CPI topped estimates to print flat Y/Y but coincided with a deeper-than-expected deflation in factory gate prices.

Top Asian News

- Chinese Industry Association said July vehicle sales +14.7% Y/Y (vs +13.8% in June); January-July vehicle sales +12% Y/Y (prev. +4.4% in January-July 2024). New energy vehicle (NEV) sales +27.4% Y/Y in July. January-July NEV sales +38.5% Y/Y

European bourses began the session on the front foot, attempting to add to a two-day win streak, though early morning gains pared amid pressure in the risk tone alongside the opening of the US Premarket: NVIDIA (-1.4%), AMD (-2.7%), after reports that they will pay 15% of China chip revenues to the US government, according to FT. European sectors opened almost entirely in the green, though in line with the broader risk tone, have since turned more negative. Healthcare outperforms after Novartis (+2.2%) said both Ianalumab Phase III clinical trials met primary endpoints. Utilities lags, dragged down by Orsted (-27%) after a DKK 60bln rights issue.

Top European News

- European defense stocks are significantly underperforming on Monday morning, with markets looking to US President Donald Trump’s efforts to broker an agreement to end the war in Ukraine

- Orsted falls as much as 29% in its biggest-ever drop, taking the stock below its 2016 IPO price, after the Danish wind-power firm announced plans for a DKK60 billion ($9.4 billion) rights issue alongside its second-quarter report

- Oxford Nanopore drops as much as 3.8%, underperforming the FTSE 250 Index, after the British DNA-sequencing firm said Gordon Sanghera has notified the board of his intention to step down as CEO by the end of 2026

FX

- USD is relatively flat intraday during the European morning after kicking off APAC the week, marginally softer in APAC trade with little fresh major macro catalysts from over the weekend, and as participants look ahead to US CPI data due on Tuesday. In terms of Fed speak, there were comments from Fed’s Bowman over the weekend who warned that delayed action risks further labour market erosion and the need for a possible bigger cut, as well as noted that the latest job market data reinforces her forecast for three rate cuts this year. Several Fed speakers are scattered throughout the week after Tuesday’s US CPI data. Aside from US data and Fed speak this week, attention will also be on the Trump-Putin summit on Friday, which has the intention of ending the war between Russia and Ukraine. DXY is currently confined to a narrow 98.03-98.27 range, still within Friday’s 97.95-98.35 parameter.

- EUR/USD mildly strengthened but with price action contained within Friday’s parameters amid quiet newsflow from the bloc, albeit potentially underpinned by the Russia-US meeting on efforts to end the war in Ukraine. EUR/USD resides in a 1.1635-1.1675 range, within Friday’s 1.1628-1.1679 range.

- JPY was initially modestly firmer in choppy trade despite a relatively flat Dollar in a move that coincided with a rise in US Treasuries. This comes after JPY lacks demand overnight amid the absence of Japanese participants due to the Mountain Day holiday closure. USD/JPY resides in a 147.33-147.79 range with Friday’s range between 146.71-147.90, and with the 21 DMA also at 147.90 today.

- GBP remains afloat and takes a breather around last week’s best levels, albeit with trade muted alongside a quiet calendar for today, which is set to pick up on Tuesday, including with the release of the latest UK employment data.

- Antipodeans struggled for direction in APAC trade owing to a lack of drivers overnight, and with the RBA kick-starting its 2-day policy meeting, which is unanimously expected to result in a 25bps cut.

- RBI has reportedly sold at least USD 5bln to boost FX in a bid to prop up the INR after it weakened to a record low, according to Bloomberg.

Fixed Income

- UST futures are trading higher by just under 5 ticks in very quiet newsflow and after a lacklustre session overnight, given JGB cash trade was shut as Japan enjoyed its Mountain Day holiday. Price action this morning has only really been upwards, alongside global peers. Nothing quite behind the upside, but potentially amid a deterioration in the risk tone (stocks moving lower & JPY bid). Upside in fixed income could be explained by: a) latest dovish commentary from Fed’s Bowman, b) Russia-US meeting, c) trade updates (and lack of US-China updates). Currently trading towards the upper end of a 111-25+ to 112-00 range; the peak for the day is just shy of last Friday’s best at 112-02 – further upside could see the potential test of the high from a day earlier at 112-04+.

- Bunds are currently firmer but have waned off best levels in recent trade, in a 129.67 to 130.00 range. As above, nothing behind the upside today, but in line with the risk tone. For Europe specifically, the move could also be explained by less demand for defence-related spending, should a Russia-Ukraine deal be struck on Friday.

- Gilts are also firmer, and are outperforming vs peers. Nothing quite behind the marginal outperformance, particularly in the context of slow UK-specific newsflow. UK paper is currently trading towards the upper end of a 92.00 to 92.37 range; this has breached last Friday’s high at 92.31, with the next level to the upside at 92.66 (8th Aug high).

Commodities

- Crude futures were initially pressured as focus was on the US-Russia meeting, but is now flat. Initial pressure due to some geopolitical risk premia unwinds ahead of the Trump-Putin meeting scheduled for this coming Friday, with no sanctions imposed against Russia after Trump’s deadline passed last Friday. US President Trump said he will meet with Russian President Putin on August 15th in Alaska, while Russia’s Kremlin confirmed an agreement was reached to organise a meeting between Russian President Putin and US President Trump. The White House is reportedly considering inviting Ukrainian President Zelensky to the Alaska summit, and President Trump is open to a trilateral meeting in Alaska, although the White House is currently planning for a bilateral summit as requested by Russian President Putin. WTI currently resides in a 63.02-63.91/bbl range while Brent sits in a USD 65.81-66.66/bbl range.

- Spot gold pulled back after the choppy performance on Friday, and with resistance around the USD 3,400/oz level. The yellow metal may also be experiencing a geopolitical risk unwind ahead of the Trump-Putin summit in Alaska this coming Friday. Price action this morning has seen the yellow metal slide from a USD 3,401.40/oz peak to a current low at USD 3,358.80/oz, with the 50 DMA seen at USD 3,349.80/oz.

- Copper futures traded indecisively overnight in the absence of major catalysts and after mixed inflation data from its largest buyer, China. Thereafter, the base metals complex tilted mostly lower shortly after the European open as risk waned further.

- Iraq set September Basrah medium crude official selling price to Asia at plus USD 2.15/bbl vs Oman/Dubai average and to Europe at minus USD 1.30/bbl vs Dated Brent, while it set the OSP to North and South America at minus USD 1.00/bbl vs ASCI, according to SOMO.

- Chile’s Codelco said the El Teniente copper mine was approved for a restart by the labour authority and it later announced that it restarted sectors of the El Teniente mine, plant and smelter.

- Contemporary Amperex Technology (300750 CH) suspended production at a major lithium mine in China’s Jiangxi province for at least three months, according to sources familiar with the matter.

- China’s Baosteel (600019 CH) said it is to lift hot and cold rolled coil prices for September delivery by USD 200/metric ton and USD 300/metric ton respectively.

- Saudi Crude supply to China set to fall to around 43mln barrels in September, according to Reuters sources.

- Salzgitter (SZG GY) expects muted steel demand through 2025 but forecasts a rebound in 2026 due to German fiscal stimulus and increased EU construction and defence spending. Record-high Chinese steel exports to Europe intensify competitive pressures despite rising domestic prices since July 2025.

Geopolitics: Middle East

- Israeli PM Netanyahu said Israel has no choice but to complete the job and defeat Hamas due to the group’s refusal to lay down its arms, while the new Gaza offensive plans aim to tackle two remaining Hamas strongholds and Israel expects to conclude the new Gaza offensive plan fairly quickly.

- Israeli PM Netanyahu spoke with US President Trump and discussed Israel’s plan to take control of the remaining Hamas strongholds in Gaza to bring an end to the war in Gaza.

- White House Special Envoy Witkoff was reported to meet with Qatar’s PM on Saturday for discussions regarding an end to the Gaza war and the release of hostages.

- Australia’s PM Albanese said Australia will recognise the state of Palestine at the UN General Assembly in September, while recognition will be predicated on commitments from the Palestinian Authority. Furthermore, Albanese said the situation in Gaza has gone beyond the world’s worst fears and that Israel continues to defy international law, while it was also reported that New Zealand is considering recognition of the state of Palestine with the New Zealand cabinet to make a formal decision in September.

- Iran said an IAEA official is to visit for talks to determine a framework for cooperation, although there are no plans for the IAEA to visit Iranian nuclear sites until there is a framework for cooperation.

- Jordan said it will host a Jordanian-Syrian-American meeting on Tuesday to discuss ways to support the rebuilding of Syria.

- Iranian Foreign Ministry said Tehran may agree to specific restrictions on nuclear activities in exchange for lifting sanctions, via Al Arabiya. Channels with the US still open, via an intermediary

Geopolitics: Ukraine

- US President Trump said he will meet with Russian President Putin on August 15th in Alaska, while Russia’s Kremlin confirmed an agreement was reached to organise a meeting between Russian President Putin and US President Trump.

- White House is reportedly considering inviting Ukrainian President Zelensky to the Alaska summit and President Trump is open to a trilateral meeting in Alaska, although the White House is currently planning for a bilateral summit as requested by Russian President Putin.

- US VP Vance said the US is in the process of scheduling when Russian President Putin and Ukrainian President Zelensky can sit down and discuss an end to the conflict, while the US will keep dialogue open with Ukraine but doesn’t think it will be productive to have Putin sit down with Zelensky ahead of a meeting with Trump. Furthermore, Vance said President Trump is thinking about tariffs on China for buying Russian oil but hasn’t made any firm decisions, according to a Fox News interview.

- Ukrainian President Zelensky said Ukraine cannot violate the constitution on territory and Ukrainians will not give their land to occupiers, while he added that any solutions without Ukraine will be solutions against peace.

- Russian President Putin was reported on Friday to demand that Ukraine cede Donetsk, Luhansk and Crimea, for Russia to halt the war, while Putin told Witkoff he would agree to a complete ceasefire if Ukraine agreed to withdraw forces from all of Ukraine’s Eastern Donetsk region, according to WSJ citing Ukrainian and European officials.

- Joint statement from several EU and UK leaders stated they welcome US President Trump’s work to stop the killing in Ukraine and end Russia’s war of aggression, as well as achieve just and lasting peace and security for Ukraine. Furthermore, the joint statement noted they are convinced that only an approach that combines active diplomacy, support to Ukraine and pressure on the Russian Federation to end the war can succeed.

- Joint statement of the leaders of the Nordic-Baltic eight said they stand ready to contribute diplomatically, while maintaining substantial military and financial support to Ukraine. The joint statement also stated that they will continue to uphold and impose restrictive measures against the Russian Federation.

- Ukraine’s military said on Sunday that it struck an oil refinery in Russia’s Saratov region overnight, while it also announced that Russia attacked Zaporizhzhia with guided aerial bombs which hit residential areas, a bus station and a clinic.

- Polish PM Tusk said Russia must recognise the West rejects demands for Ukraine to cede territory.

Geopolitics: Other

- Thai soldiers were injured in a landmine blast near the Cambodia border.

- South Korea’s military said North Korea is dismantling loudspeakers from the border area.

- North Korea condemned upcoming US-South Korea joint military drills and said it will exercise its sovereign right against provocation regarding military drills, according to Yonhap.

US Event Calendar

- Nothing Scheduled

DB’s Jim Reid concludes the overnight wrap

As we move into mid-August, markets are bracing for a surprisingly busy week, with several key events and data releases likely to shape sentiment. The most closely watched will be tomorrow’s US CPI report, which could prove to be one of the larger events of the summer for markets.

Also on the radar is Friday’s high-stakes meeting between Donald Trump and Vladimir Putin in Alaska as the US has pushed for a ceasefire in Ukraine. Last Friday Trump said a deal would involve “some swapping of territories” with reports suggesting that it would see Ukraine ceding Russia the parts of Donbas that it still controls. Ukraine’s President Zelenskiy was quick to reject the idea and European leaders have called for any peace talks with Russia to include Kyiv. Bloomberg reported yesterday that European leaders are seeking to speak with Trump before his meeting with Putin.

Elsewhere, tomorrow marks the deadline for the pause in levies between the US and China, and markets will be watching closely to see whether the truce is extended. There are also expectations that the long awaited pharmaceutical and semiconductor sector tariffs will be announced by the US.

Beyond geopolitics, the economic calendar is busy even beyond the CPI release. In the US, we’ll also get PPI data on Thursday, retail sales figures that may show a boost from Amazon’s extended four-day Prime Day event (up from two days previously), and industrial production numbers on Friday. Internationally, Japan’s PPI is due Wednesday, while China’s monthly data dump arrives Friday. Tomorrow also brings Germany’s ZEW survey and UK labour market statistics, followed by Q2 GDP releases for the UK on Wednesday and Japan on Friday.

Central banks will also be in focus. Australia announces its rate decision tomorrow, with Deutsche Bank expecting a cut, while Norway follows on Thursday, after CPI releases today from both Denmark and Norway.

Turning to tomorrow’s US CPI, Deutsche Bank economists expect a 2.4% decline in seasonally adjusted gas prices to weigh on the headline figure, forecasting a +0.24% monthly increase versus +0.29% previously. In contrast, core CPI is expected to rise +0.32%, up from +0.23%. This would push year-over-year growth rates for headline and core CPI up by a tenth to 2.8% and 3.0%, respectively, with a risk that core rounds up to 3.1%.

Shorter-term trends for core inflation are expected to be mixed. The three-month annualised rate is projected to rise three-tenths to 2.7%, while the six-month rate is seen falling by the same amount to 2.4%. Our Economists also anticipate a notable increase in core goods categories (+0.42% vs. +0.20%), which are already showing signs of tariff-related price pressures. This impact is expected to extend to vehicle prices as well. It’s worth recalling that last month’s headline CPI appeared soft, but rates still sold off as the underlying details revealed growing evidence of tariff-driven inflation.

Thursday’s PPI report is expected to show a +0.2% increase for both headline and core, with attention focused on categories feeding into core PCE. Deutsche Bank is currently tracking a +0.31% increase for July’s core PCE, which would lift the year-over-year rate to 2.9%, with rounding risks toward 3.0%.

Fed commentary will also be in the spotlight. Richmond Fed President Thomas Barkin (non-voter) speaks tomorrow following the CPI release. On Wednesday, Chicago’s Austan Goolsbee (voter) and Atlanta’s Raphael Bostic (non-voter) will share their views. Bostic recently reiterated his expectation for one rate cut this year, despite increased risks to the labour market outlook following the July employment report. Markets are likely to pay closer attention to Goolsbee, given his voting status at the upcoming September 17 FOMC meeting and his previous concerns about the inflationary impact of tariffs.

Rounding out the week, corporate earnings in the US will feature Cisco, Applied Materials, Deere and CoreWeave. In China, investors will be watching results from Tencent, JD.com and Lenovo.

Asian markets are slightly higher this morning, with the Hang Seng (+0.19%), Shanghai Comp (+0.51%), and S&P/ASX 200 (+0.32%) all in positive territory. S&P 500 (+0.14%) and Nasdaq (+0.13%) futures are also edging higher. In an unusual move, Nvidia and AMD have agreed to pay the US 15% of its revenues from AI chip sales to China.

Elsewhere, the KOSPI is flat and Japan is closed for a holiday. Over the weekend, China released their latest inflation data, with yoy CPI at 0.0% (vs. -0.1% expected) and yoy PPI at -3.6% (vs. -3.3% expected).

Recapping last week now and Equities continued their upward momentum, with the S&P 500 climbing +2.43% overall and gaining +0.78% on Friday alone, ending the week just a whisker—less than 0.01%—from its all-time high. Technology stocks led the charge, as the Nasdaq advanced +3.87% (+0.98% on Friday), while the Magnificent 7 surged +5.42% over the week (+1.54% on Friday). In Europe, the Stoxx 600 posted its strongest weekly performance since early May, rising +2.11% (+0.19% on Friday). The DAX gained +3.15% despite a slight pullback on Friday (-0.12%), and the FTSE MIB rallied +4.21% (+0.56% Friday), buoyed by optimism surrounding potential talks between the US and Russia over Ukraine.

These gains came in spite of fresh US tariffs that took effect on August 7. President Trump announced that imported semiconductors could face tariffs of up to 100%, though exemptions would apply to companies pledging to manufacture domestically. Pharmaceutical tariffs are also set to be phased in gradually, reaching as high as 250% over the next 18 months. Further details on these measures are expected in the coming week. In a surprise move on Friday, Trump also declared that gold bars would be subject to tariffs of up to 39%, a development that helped December gold futures rise +2.69% over the week (+1.09% on Friday). Earlier in the week, he also announced a doubling of tariffs on India to 50% in response to its purchases of Russian oil. However, Brent crude prices fell -4.42% on the week to two-month lows, as the implementation of these tariffs was delayed by 21 days and amid anticipation of the upcoming Trump-Putin meeting.

On the data front, the US July ISM services index disappointed, coming in at 50.1 versus expectations of 51.5. The employment component contracted further, while the prices paid index rose to its highest level since October 2022, fuelling concerns that tariffs may be nudging the US economy toward a stagflationary path. Meanwhile, Trump nominated Stephen Miran, Chairman of the Council of Economic Advisers, to temporarily fill Governor Kugler’s seat on the Federal Reserve Board.

In fixed income, 10-year Treasury yields rose +6.6bps over the week (+3.3bps on Friday) to 4.28%, pressured by soft demand across the week’s 3-year, 10-year, and 30-year auctions. In Europe, economic data was more encouraging, with the euro area’s July composite PMI rising to 50.9 from 50.6 in June. This prompted markets to scale back expectations for ECB rate cuts, with just 13bps of easing now priced in by year-end, down -2.4bps on the week. German 10-year bund yields rose +1.1bps over the week, including a +5.9bps jump on Friday.

Finally, the Bank of England delivered a 25bp rate cut to 4.00%, but the decision was far from straightforward. The initial vote split was an unprecedented 4-4-1, with four members favouring no change. A second vote was required to reach a 5-4 majority—something never seen before in the Bank’s history. Market pricing for the BoE’s policy rate at the end of 2025 rose +11.7bps over the week, with 17bps of easing now expected by December. The FTSE 100 underperformed its European peers, rising just +0.30% on the week. Our UK economist, Sanjay Raja, now anticipates one further rate cut from the BoE this year

Tyler Durden

Mon, 08/11/2025 – 08:26ZeroHedge News

R1

R1

T1

T1