Rebounds In The Dollar Set To Get Ever More Fleeting

Authored by Simon White, Bloomberg macro strategist,

The dollar’s primary trend will be lower for longer as the speculative short positioning has been covered, while the fiscal outlook for the US will deteriorate further as the economy slows.

The DXY is in the process of another failed attempt to bounce. It’s the second try to rebound off its early July low to hit the buffers in recent weeks. That’s likely to be the pattern for the time being as the fundamental outlook for the dollar will keep it under pressure.

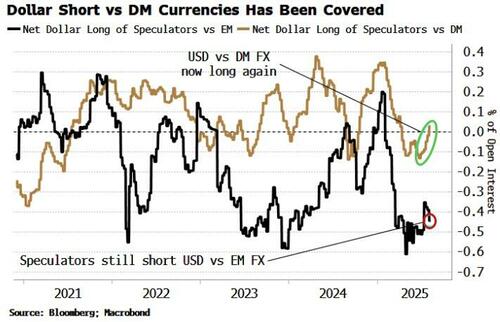

The short dollar trade had become so crowded that it was a case of when, rather than if, we would see a bounce. Short positioning of speculators in USD currency-futures had become quite stretched, based on CFTC Commitment of Traders data.

While there is a still a net short position in the dollar overall, the short versus developed-market currencies such as the euro and sterling has been covered, and positioning is now net long again. Speculators are still net short the dollar versus emerging-market currencies (and that’s getting shorter), but when it comes to the DXY, it is only developed currencies that matter (mainly the euro).

Macro and CTA hedge funds, too, look to have covered their dollar short. The sensitivity of their returns to returns in the dollar had become more negative than it had been for over three years; now it is back to being neutral.

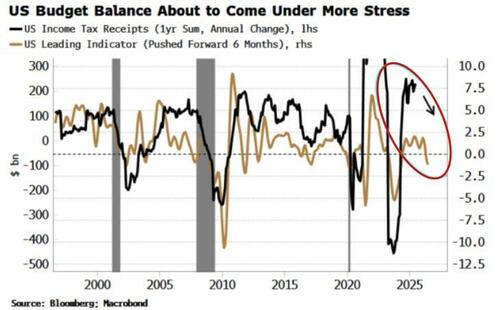

Of course, speculators and hedge funds might start to go long the dollar, but not if they are paying attention to the US fiscal situation. The deficit is already in the order of $2 trillion a year. If there is a recession, however, a 6-7% of GDP deficit could easily become double digits.

That risk of one is rising.

The economy is beginning to slow, which means a drop in tax revenues – already anticipated by leading indicators — will stress the government budget further.

Markets never move in straight lines, least of all currencies, but for the dollar the up moves are likely to prove increasingly transient in the face of dominant down ones.

Tyler Durden

Mon, 08/11/2025 – 12:40ZeroHedge News

R1

R1

T1

T1