This Is A RINO Market: ‘Recession In Name Only’

CPI Completed? Check!

ATH Equity? Check!

US equity markets remain resilient, underpinned by strong cross-asset flows.

The rally appears set to extend through Labor Day, driven by:

-

Robust corporate earnings broadly exceeding expectations

-

Diverse participation from corporates, institutions, and retail investors

-

Concentrated leadership in AI, large-cap, quality, and tech names

That said, momentum may fade in September – historically, the weakest month – amid seasonality and investor re-engagement post-summer.

As Scott Rubner (former Goldman flows guru) now explains from his seat at Citadel Securities, This is a #RINO market, recession in name only…

I. Citadel Securities On-the-Ground Sentiment

Client activity remains elevated at equity market all-time highs:

-

Cash Equities: Retail net buyers in 15 of the past 17 weeks

-

Retail Options: 15-week net buying streak, 16 of last 17 weeks

-

Institutional Options: Bullish tone in 5 of the last 6 weeks

II. This Week’s Strategic Debate: When Does Cash Rotate Back into Risk Assets?

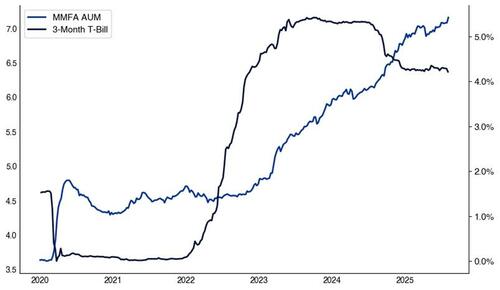

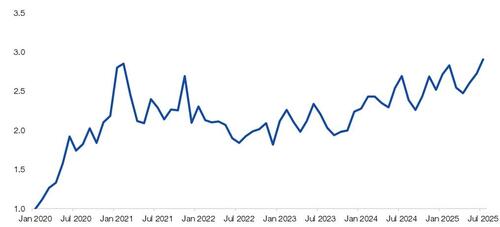

With ICI reporting money market AUM at $7.15T (up from $3.63T in early 2020), the key question becomes: what level of yields would prompt reallocation into risk assets if the Fed changes policy?

-

A 10% shift (~$700B) could energize dividend-yielding equities, high-grade credit, and risk assets, like the “January Effect” (a seasonal anomaly where equities tend to rise)

-

Q4 Rotation Watch: As rate expectations soften, this “dry powder” could power the next leg higher into the other 493 stocks in the S&P 500

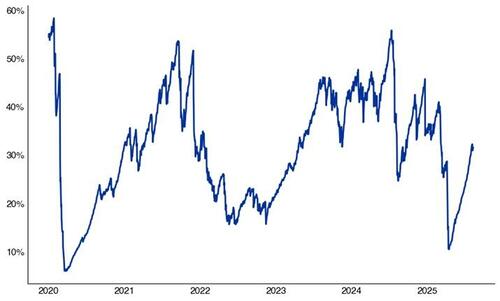

Money Market Assets (trillion) vs. US Treasury 3-month money market yield (%)

January 2020 – August 2025

Source: ICI, as reported by Bloomberg and compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

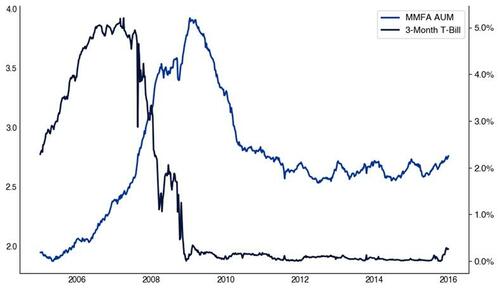

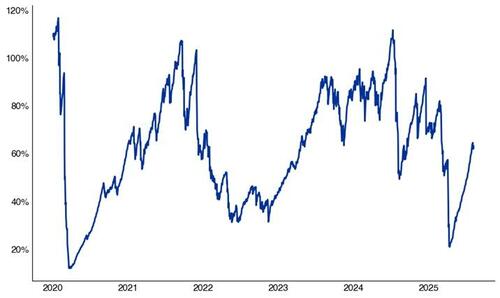

Historical Analog: In 2010, money market assets dropped -27% as yields declined—preceding a rotation into equities

Money Market Assets (trillion) vs. US Treasury 3-month money market yield (%)

January 2005 – January 2015

Source: ICI, as reported by Bloomberg and compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

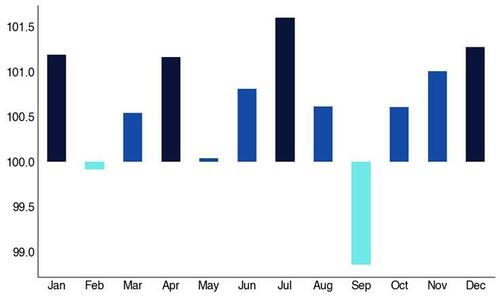

III. Seasonality Watch

September Setup

-

September 3rd often marks the monthly high for SPX since 1928

-

Post-Labor Day FOMO participation typically fades, limiting buy the dip behavior

-

SPX and NDX historically show August strength followed by September weakness

SPX 500 Monthly Performance

1928 – Today

Source: Bloomberg as compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

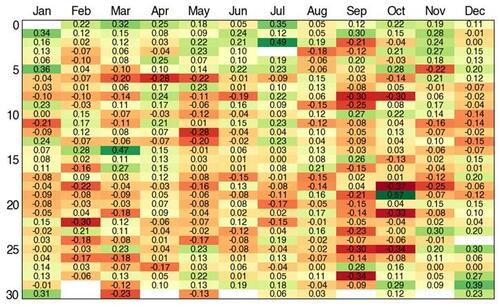

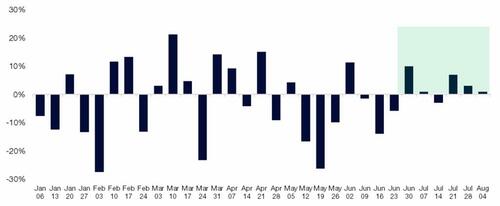

SPX 500 Daily Performance Quilt

1928 – Today

Source: Bloomberg as compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

IV. Retail Positioning

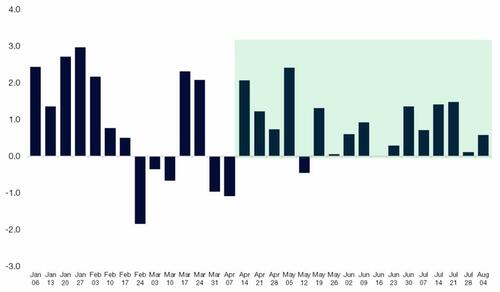

1. Citadel Securities’ retail cash equities: Net buyers in 15 of the last 17 weeks, following a soft April.

Retail Cash Equities – Net Notional by Week

STD Dev January – Aug 2025

Source: Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

2. Ongoing strength with 19 straight months of net notional and shares buying.

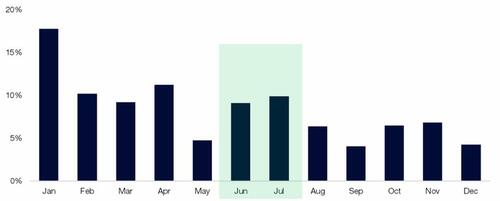

3. Citadel Securities’ retail cash seasonality trends based on data from August 2017- July 2025.

-

June & July = Strong

-

August = Slower

-

September = Weakest

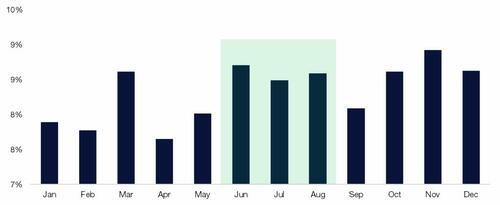

Retail Cash – Proportion of Net Notional By Month

August 1, 2017 – July 31, 2025

Source: Citadel Securities, as of 8/5/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

V. Volatility and Options Positioning

4. Retail Options Activity: July 2025 set a new monthly volume record at Citadel Securities.

Retail Options – Average Daily Volume by Month

Normalized to January 2020

Source: Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

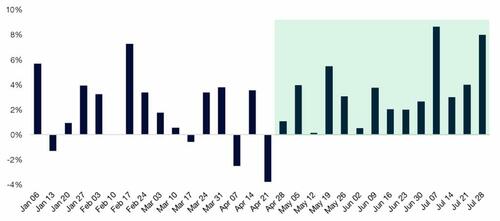

5. Citadel Securities’ Retail Option Buying Streak

-

15-week net buying streak and 25 of the last 27 trading days.

-

Friday’s activity hit the 99th percentile, 41% above 12-month avg.

Retail Options – Put / Call Direction Ratio by Week

January – July 2025

Source: Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

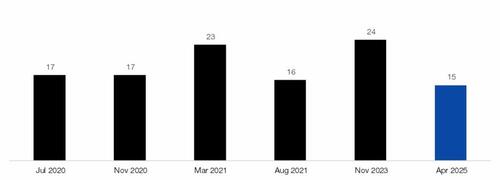

6. Citadel Securities’ Bullish Retail Options Streak Watch

-

6th longest bullish options streak since 2020

-

Average duration of the top 5 streaks is 18 weeks → room for Labor Day upside?

Longest Retail Weekly Option Buying Streaks on Record, since 2020.

# of weeks

Source: Citadel Securities, as of 8/5/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

7. Seasonal Drop Ahead?

Citadel Securities’ retail options volume typically wanes in September.

Retail Options – Proportion of Contract Volume by Month

January 2020 – December 2024

Source: Citadel Securities, as of 8/5/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

8. Citadel Securities Institutional Options

Bullish in 5 of the last 6 weeks, peaking at the 89th percentile. Note that Institutional Options clients moved from bearish to bullish in the last month.

Institutional Options –Call/Put Direction Ratio by Week

January – August 2025

Source: Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

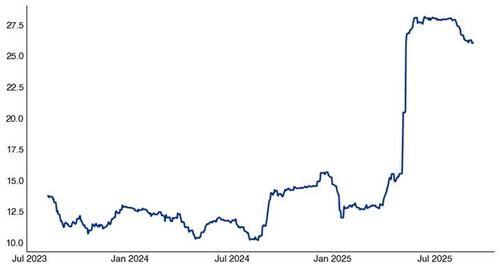

9. Volatility trend: Realized vol continues to fall. VIX at the time of typing = 15.20

-

3-month: 26

-

1-month: 9

-

1-week: 12

SPX 3-month realized volatility

August 2023 – August 2025

Source: Bloomberg as compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

VI. Corporate Earnings & Passive Flow Dynamics

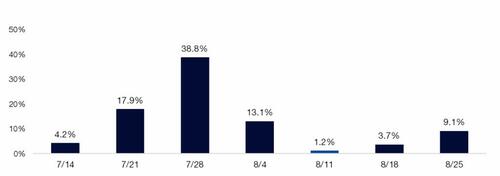

10. Q2 Earnings: 75.2% of SPX market cap has reported.

SPX Market Cap reporting by week

Q2 earnings

Source: Bloomberg as compiled by Citadel Securities, as of 8/5/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

11. Surging Corporate Buybacks

According to Birinyi Associates, US corporates have announced $983 billion worth of authorizations YTD, which makes it the best start to the year on record. In addition, corporate executions are on pace for $1.1 trillion, which would also set a record.

US companies announced share repurchases totaling $166 billion last month, the highest dollar value on record for July. The prior record was $88 billion in July 2006.

12. 2025 Corporate Daily Flow Math: $1.1 trillion over 251 trading days → $4.4 billion/day in equity demand, according to Birinyi Associates. August is historically one of the best months of the year for executions.

13. Sector reporting concludes, ending with Nvidia on 8/27.

SPX GICS Sector by Market Cap

Earnings reporting schedule

Source: Bloomberg as compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

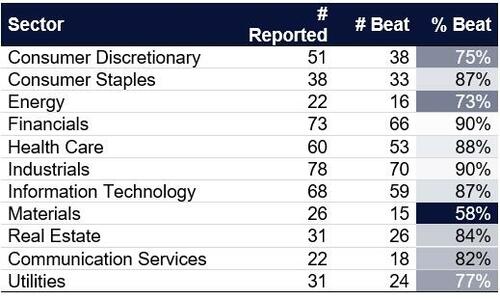

14. Q2 EPS Growth: +11.4% vs. 5% expected — strongest since Q2 2021

- According to Bloomberg, Q2 EPS beat rate of 81% exceeds the 10-year average of 74%.

SPX Earnings Reporting

As of August 12, 2025

Source: Bloomberg as compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

Key Insight: Concentration = Earnings beats → passive inflows → price momentum.

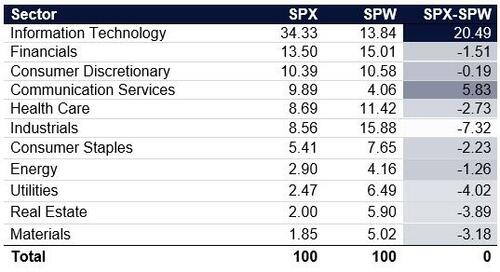

Sector Concentration Observations:

Here are the 11 S&P 500 GICs sectors for the S&P 500 market capitalization index (‘SPX’) and S&P 500 equal weighted index (‘SPW’).

Tech weighting in SPX: 34.3% vs. 13.8% in SPW → +20.5% spread

11 S&P 500 GICs sectors by SPX % market capitalization:

Source: Bloomberg as compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

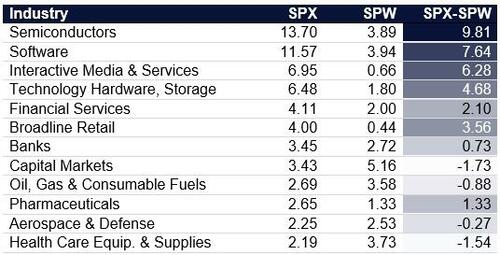

This concentration intensifies passive flows into a narrower band of equities; this drives “Magnificent 7” vs. remaining 493.

-

Semiconductors: 13.7% (SPX) vs. 3.9% (SPW)

-

Software: 11.6% (SPX) vs. 3.9% (SPW)

→ This narrow breadth in the top names, has created more frequent unwinds and squeezes on the short leg of the pair trade.

Top 12 S&P 500 GICs industries by SPX % market capitalization:

Source: Bloomberg as compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

15. August Positivity Bias

The S&P 500 peaks around September 3rd, going back to 1928.

The final week of August often coincides with low positioning due to vacations, BBQ parties, contributing to upward drift in stocks, especially in low-volume environments.

SPX August Daily Performance

Since 1928

Source: Bloomberg as compiled by Citadel Securities, as of 8/5/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

NDX August Daily Performance

Since 1985

Source: Bloomberg as compiled by Citadel Securities, as of 8/5/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

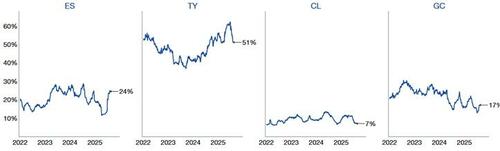

VII. Institutional Positioning and Systematic Re-Leveraging

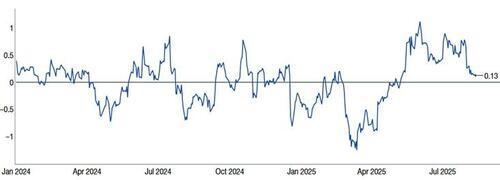

16. CTA’s: We estimate trend followers are now near fully exposed heading into late August, suggesting limited incremental upside. Our model indicates this cohort is no longer adding exposure at current levels

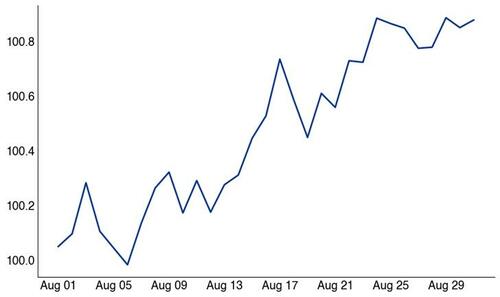

US Equity Aggregate CTA Positioning

January 2024 – July 2025

Source: Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

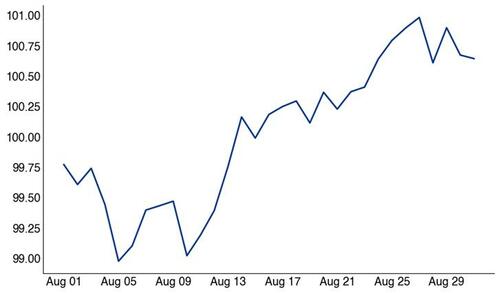

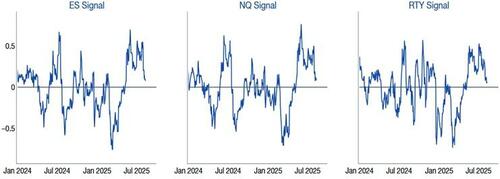

US CTA Signals

January 2024 – July 2025

Source: Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

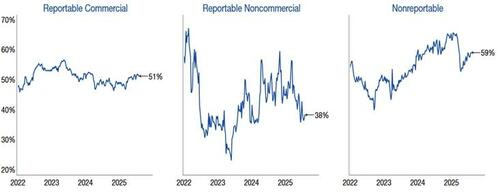

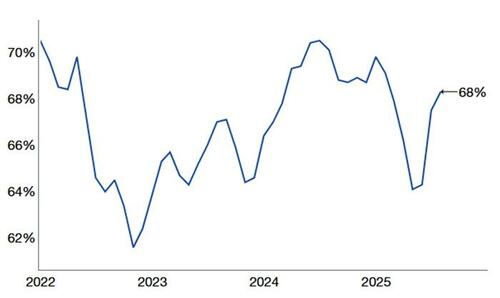

17. CFTC Net Longs: Continued increase in positioning back to historical levels.

CFTC S&P 500 Consolidated % Long

January 2022 – July 2025

Source: COT report, as compiled by Citadel Securities, as of 8/11/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

18. Vol-Control strategies – which take cues from the realized volatility market – have already increased exposure substantially.

5% risk target: 32% exposure (up from 10% in April)

Vol Target Exposure with 5% Risk Control

Exposure Rank since 2020

Source: Bloomberg as compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

19. 10% volatility target strategies are now at 63% exposure (up from 20% in April)

Vol Target Exposure with 10% Risk Control

Exposure Rank since 2020

Source: Bloomberg as compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

20. Risk Parity strategies – driven by cross-asset volatility – now hold equity exposure near their 3-year average of 25% exposure.

Systematic positioning remains elevated → watch for volatility moves, as flows skew moves to the downside.

Risk Parity Exposure

Jan 2022 – July 2025

Source: Citadel Securities, as of 8/5/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

21. Sentiment Normalization: AAII allocations back to historical averages → less upside from sentiment alone.

AAII Stock Allocation (%)

Jan 2022 – July 2025

Source: AAII, as reported by Bloomberg and compiled by Citadel Securities, as of 8/12/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

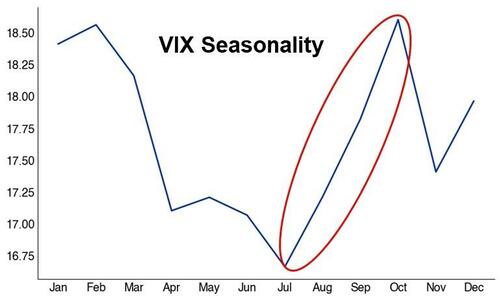

GMI | September Tactical Checklist

Systematic strategies (CTA/Vol-Control) near max exposure → headline and economic risks

September = statistically weakest month for SPX (since 1928)

Volatility rises historically in September (since 1990)

VIX August Monthly Performance

Since 1990

Source: Citadel Securities, as of 8/5/25. Figures are for illustrative purposes only. Past performance figures do not guarantee future results.

Retail participation wanes across cash and options

Cyclicals and high beta may mean revert

Anti-momentum rotation risk remains high

Tyler Durden

Wed, 08/13/2025 – 14:40ZeroHedge News

R1

R1

T1

T1