Yes, We Need Serious Economic Data. And No, We Don’t Have It

By Michael Every of Rabobank

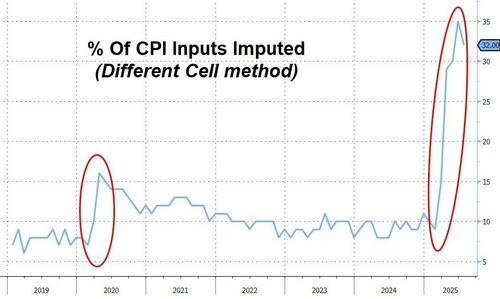

In British English there’s a pejorative noun, “jobsworth”, for those who uphold petty rules at the expense of effectiveness. It’s my job’s worth to share that with you today in the wake of a US CPI report we went into knowing the underfunded agency producing it was guessing around 1/3 of the prices used on top of statistical polishing that raises questions of methodology and policy.

For recent examples of the former, the US CPI basket understates how hard inflation hits lower income households: ‘Americans making under $50,000 said they needed an average $157,000 a year to live comfortably, while those making at least $100,000 said they would need $246,000’, as CNBC said today. That’s partly why rich politicians and comfortable financial media are so often surprised by election results and opinion polls (like the one in Germany today where the AfD is on 26% vs 24% for the governing CDU of Chancellor Merz). There were also questions over why the CPI shelter component lagged actual rent increases in recent years; and a new methodology for health insurance over 2023-24 that saw major implied price swings.

For examples of policy, Bulgaria’s 82.8% fall in healthcare costs is helping it meet the inflation criteria to join the Euro: “Physician, heal thyself” – and thy fiscal deficit as hospitals are told to slash daily fees from 5.8 to 1 Lev. Australia’s government is subsidizing utility bills with estimates putting the impact on CPI at -0.5ppts; and it’s working – the RBA cut rates another 25bps to 3.60% while flagging “a few more” cuts to come despite the Bank warning the economy can’t grow more than 2% due to no productivity growth as the population rose 1.8% in the year to September 2024. How adding people without adding value, or a matching number of houses, sits with low inflation/rates rather than higher requires central-banking expertise I sadly lack. The Bank of England seems to understand this, however.

Anyway, the US July CPI report saw headline slightly lower than expected at 2.7% y-o-y, but still above the 2% markets think is ‘natural and good’, while core was 3.1%, in-line, and ‘super core’ rose for a third consecutive month. That wasn’t the tariff-led inflation explosion some feared, but neither was it a low-inflation/deflation environment outside key areas such as eggs, an example of what’s needed to bring prices down to please voters – higher supply. Which, to be fair, is what tariffs, and broader economic statecraft, are designed to do: they just aren’t instantaneous.

Yet Treasury Secretary Bessent suggested the next Fed move should be a 50bps cut. President Trump also lashed out at Fed Chair Powell again and is considering a lawsuit against him –for ‘not cutting rates?’… “Lock him up!”– and also called on Goldman Sachs to replace their economist who said tariffs would be inflationary. That’s as the FT carries an op-ed asking what happens if Trump appoints an “inflation nutter” as Fed Chair. Yes, that’s where we are at.

The key message is that we should all take inflation deadly seriously: Lenin’s warning that “The way to crush the bourgeoise is to grind them down between the millstones of taxation and inflation” was right – and he was just named as inspiration for the leader of the UK’s new left wing party. Yet those who study it most, and are supposed to keep it locked up in the study, are not taking it seriously, for all that they profess to be doing so and that many in markets believe them – and it goes way beyond Trump if you are willing to look. The price of gold or Bitcoin is also good evidence. ‘Trump appointments could spell breakdown of economic trust’, says comfortable Axios — tell that to the people talking to CNBC: it broke down for them years ago.

If that were not enough, we also saw an attack on the joint highest altar in the macrostrategist’s pantheon, the payrolls report. The Trump admin is weighing “new options for data collection and technologies that could make the process more efficient.” More concretely, the new head of the BLS suggested that until the jobs numbers “are corrected” the agency should suspend issuing the monthly job report entirely but keep publishing the more accurate quarterly data. Again, people are rightly having kittens but wrongly missing that payrolls have long been an absolute joke.

We are talking about a survey with: a ridiculously low response rate; that doesn’t understand the rapid shifts taking place in the economy; with a comical births/deaths model that decides when jobs appear based on their own interpretation of the economic cycle; that somehow overlooked the arrival of 10-20 million undocumented workers in the last few years; and which has constant, huge revisions changing the supposedly-accurate picture we are looking at. Indeed, it’s trying to measure the (normally) three-digit monthly change in a large nine-digit US labor force: it’s a rounding error, at best – what else could it ever really be? Yet it’s sacrosanct say jobsworths who otherwise can’t take a punt on second derivatives of said rounding error at pre-arranged times. Again, yes, we need serious economic data. Again, no, we don’t have it as things stand.

Meanwhile, in the actual economy, OPEC raised its 2026 oil demand forecast and trimmed non-OPEC supply growth, signalling tighter global markets, which was much more upbeat than the wider industry. If they are right, is it wrong to expect rate cuts?

Europe is reindustrialising via rearming, says the same FT that carries an op-ed about Europe’s “Happy Vassal” status; timely as Ukrainian President Zelenskyy says he won’t cede any land that could be a Russian springboard for a new war, which seems to contradict yesterday’s news, and points to the ongoing need for that EU arms production.

On the ‘vassal’ front, Italy’s government is reportedly considering plans to curb the holdings of Chinese investors at key Italian companies, as China cuts off relations with the Czechs over a visit by the Dalai Lama.

More importantly, Politico just argued; ‘Lagarde’s ‘euro moment’ busted by dollar-linked stablecoins’, which comes just weeks after her mid-June op-ed calling for a ‘euro moment’ as doubts about the dollar increase’. In short, if $tablecoins are free to circulate in Europe — which it can’t prevent without reopening wounds on NATO, tariffs, LNG, and more — then a parallel currency could be embedded within Europe, and globally. All it might take is the US to say it will pay exporters to it in $tablecoins, and for US-allied oil-exporters like Saudi, the UAE, and Qatar with its LNG, to say they want to be paid in them too, and it could be a fait accompli. This was blatantly obvious when Lagarde spoke in mid-June, as I pointed out at the time, and everyone was busily buying the Euro. But markets were insisting that Europe ‘has such nice CPI (if not jobs) data’, etc.… which should put things in perspective. It’s not “because markets, or payrolls” anymore.

In related geoeconomics, the Washington Post recently underlined the US used tariff negotiations to pressure others to take broader anti-China actions: that’s called economic statecraft. In turn, China put 75.8% duties on Canadian canola and told its firms not to buy the AI chips Trump just controversially offered to sell them for a 15% fee due to security fears seeing Chinese tech ripped out of US systems. On which note, Microsoft also just suspended its services to a Rosneft-backed India refiner, deepening Indian mistrust of the US. However, Bloomberg underlines ‘Modi’s Trade Dilemma: Protect Textiles or Cotton’, in that keeping out US cotton doesn’t help Indian textile firms who then can’t sell their output to the American market. Something has to give, or Indians need to wear vastly more clothing.

And fantastically important if it happens, Google and IBM believe the first workable quantum computer is in sight. Somebody is about to get vastly more productive and powerful: not the Europe or Australia – it’s surely between the US and China.

Tyler Durden

Wed, 08/13/2025 – 10:25ZeroHedge News

R1

R1

T1

T1