Wind Giant Orsted Suffers Worst Week On Record As Green Energy Demise Accelerates

Wind company Orsted A/S was once the poster child of the green energy movement, debuting on European stock exchanges nine years ago. Now, with the green energy industry in shambles as common-sense energy policies return under the Trump administration, Orsted has suffered its worst weekly decline ever, trading far below its IPO price.

At the beginning of the week, Orsted announced a rights offering of up to 60 billion kroner ($9.4 billion), sending shares crashing and leaving them down about 33% by week’s end.

Shares have fallen below their 2016 IPO price.

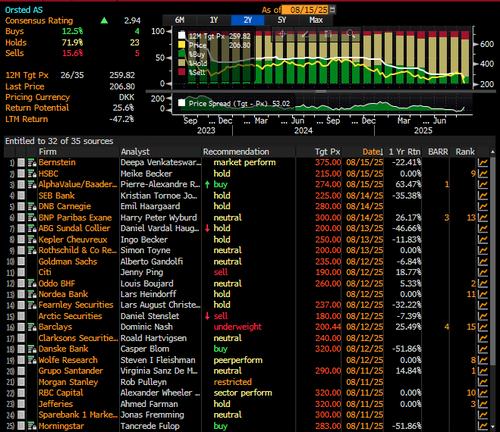

Wall Street analysts are 71.9% “Hold,” 15.6% “Sell,” and 12.5% “Buy”…

With wind farm construction as its core business, Orsted has been exposed to more canceled projects than any of its industry peers, including ones in the US and the UK. The funding gap swelled after scrapping a stake sale in the Sunrise Wind project off New York.

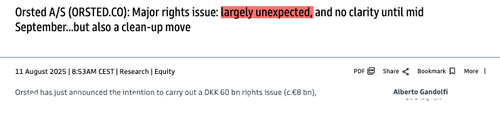

Goldman analysts led by Alberto Gandolfi called the rights offering “largely unexpected, with clarity expected by mid-September… but also a clean-up move.”

Compounding problems for Orsted, S&P Global Ratings downgraded the company’s long-term credit rating to BBB-, just one notch below junk status. The rating agency cited Orsted’s inability to carry out project refinancing and divest 50% of its Sunrise project.

At Orsted’s market capitalization peak, it was once worth more than BP and flagged a ‘green’ success by Wall Street, politicians, and leftist climate nonprofits.

Orsted’s collapse in market value, credit downgrade, and capital raise mirrors the implosion of the entire green industry. We suspect that Solyndra-type failures could be on the horizon. Keep in mind, one of the Democratic Party’s pillars is all things green.

Tyler Durden

Fri, 08/15/2025 – 07:45ZeroHedge News

R1

R1

T1

T1