Home Depot Misses Across The Board But Stock Jumps On Sticky Guidance

Home Depot’s sales improved during its fiscal second quarter as consumers remained focused on smaller projects amid cost concerns and economic uncertainty, but its performance missed Wall Street’s expectations.

Revenue for the three months ended August 3 climbed to $45.28 billion from $43.18 billion, but fell short of the $45.41 billion estimated by about 30bps. Gross margins beta by 20 bps and operating margins were largely in-line. Comp store sales rose 1%, also missing the 1.3% estimate. In the U.S., comp store sales increased 1.4%. According to Goldman, “comp sales were about 30 bps light and exactly what almost all previews and inbounds suggested.” While customer transactions declined ~1% in the quarter, the amount shoppers spent rose to $90.01 per average receipt from $88.90 in the prior-year period.

Q2 EPS of $4.68 also missed consensus $4.72. The company earned $4.55 billion, or $4.58 per share, for the second quarter. A year ago, the Atlanta-based company earned $4.56 billion, or $4.60 per share.

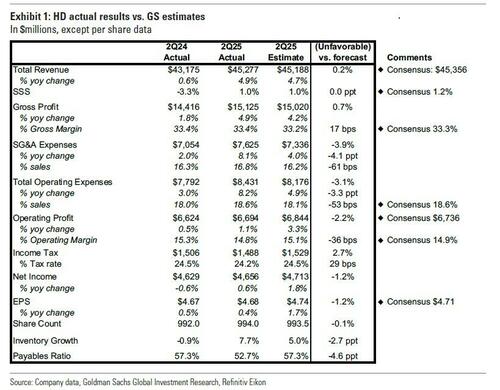

Here is a snapshot of Goldman’s first take analysis (full note available to pro subs):

-

Average ticket increased +1.2% y/y to $90.0 from $88.9 in the prior year, while

-

Total customer transactions decreased -0.9% y/y to $446.8mn from $451.0mn in the prior year. Management noted that trends that began in the 2H of last year continued through the 1H of this year as customers engaged more broadly in smaller home improvement projects.

-

Gross margin increased +2 bps y/y to 33.4%, above GS/consensus estimates of 33.2%/33.3%.

-

Total operating expenses increased +8.2% y/y to $8.4bn, while total operating expenses as a % of sales increased +57 bps y/y to 18.6%.

-

Adjusted operating margin decreased -56 bps y/y to 14.8%, below thenGS/consensus estimates of 15.1%/14.9%, and adjusted operating profit of $6.7bn compares to $6.6bn in the prior year (+1.1%).

-

Inventory increased +7.7% y/y (vs. +14.9% in 1Q) which we note compares to the sales increase of 4.9%. The company’s payable ratio of 52.7% increased

And here is a snapshot of the company results vs Goldman estimates:

“Our second quarter results were in line with our expectations,” Chair and CEO Ted Decker said in a statement. “The momentum that began in the back half of last year continued throughout the first half as customers engaged more broadly in smaller home improvement projects.”

The print was in line with buyside whisper expectations of a small miss, with Goldman writing that the direction of the stock today likely won’t be too heavily influenced by this exact result, which does not feel like thesis changing.

More importantly, the company reaffirmed full year guidance, with commentary on the call about improved trajectory to end the quarter after some weather headwinds earlier in the quarter: The company reaffirmed its fiscal 2025 forecast for total sales growth of about 2.8%. It still expects adjusted earnings to decline about 2% from $15.24 per share a year earlier, although it cited momentum continuing that started to build in 2H prior year.

Neil Saunders, managing director of GlobalData, said that Home Depot saw consumers concentrating on smaller projects and gardening during the quarter: “As the largest improvement player, Home Depot is getting the lion’s share of this growth and remains the number one destination for consumers due to strong customer service, a comprehensive range, and sharp pricing,” he said. “The latter factor will serve it well as consumers become more price conscious.”

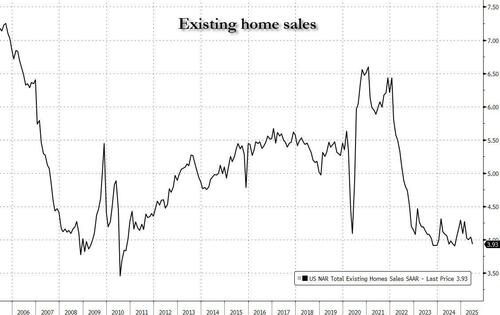

Home improvement retailers like Home Depot have been dealing with homeowners putting off bigger projects because of increased borrowing costs and lingering concerns about inflation.

The US housing market has been in a sales slump dating back to 2022, when mortgage rates began to climb from pandemic-era lows. Sales of existing homes have slumped as elevated mortgage rates and rising prices discourage home shoppers. Sales of such homes in the U.S. slid in June to the slowest pace since last September as mortgage rates remained high and the national median sales price climbed to an all-time high of $435,300.

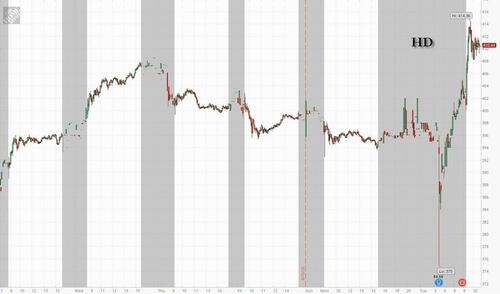

After initially sliding as much as 5%, Home Depot stock eventually surged over 4% in early Tuesday trading and was responsible for about half of all the DJIA gains.

Tyler Durden

Tue, 08/19/2025 – 11:20ZeroHedge News

R1

R1

T1

T1