Market Valuations Don’t Matter… Until They Do

Authored by Lance Roberts via RealInvestmentAdvice.com,

One of the hallmarks of very late-stage bull market cycles is the inevitable bashing of long-term market valuation metrics. In the late 90s, if you were buying shares of Berkshire Hathaway, it was mocked as “driving Dad’s old Pontiac.” In 2007, valuation metrics were dismissed because the markets were flush with liquidity, low interest rates, and “Subprime was contained.”

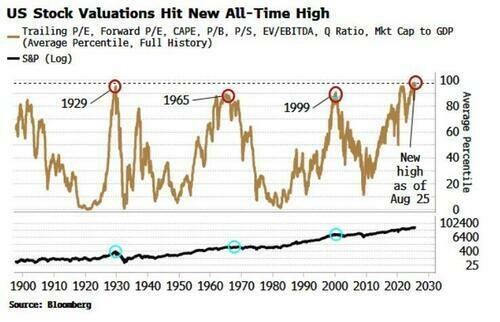

“Valuation is the capstone of proximate causes for a market top, and the one most indicative of the potential magnitude of any subsequent selloff. It’s well known that valuations are high for the US market, but I thought I’d update my aggregate indicator, which combines the main measures of long-term stock-market worth. It previously peaked in April, but has just made a new all-time high this month. Not a welcome sign if you’re a long-term bull.” – Simon White, Bloomberg

Of course, just as we have seen so many times, we again see repeated arguments about why “this time is different.” For some, it is the belief that the Fed will bail out markets if something goes wrong. For others, “Artificial Intelligence” and “Cryptocurrencies” are a new paradigm of investment returns. Of course, it is hard to blame investors for feeling this way, given the market’s outsized gains over the last 15 years.

Regardless of the reasoning, there is little argument that current trailing market valuations are elevated.

However, we need to understand two crucial points about valuations.

- Market valuations are not a catalyst for mean reversions, and;

- They are a terrible market timing tool.

Furthermore, investors often overlook the most essential aspects of valuations.

- Valuations are excellent predictors of return on 10 and 20-year periods, and;

- They are the fuel for mean-reverting events.

Critics argue that valuations have been high for quite some time, and a market reversion hasn’t occurred. However, to our point above, valuation models are not “market timing indicators.” The vast majority of analysts assume that if a measure of valuation (P/E, P/S, P/B, etc.) reaches some specific level, it means that:

- The market is about to crash, and;

- Investors should be in 100% cash.

This is incorrect.

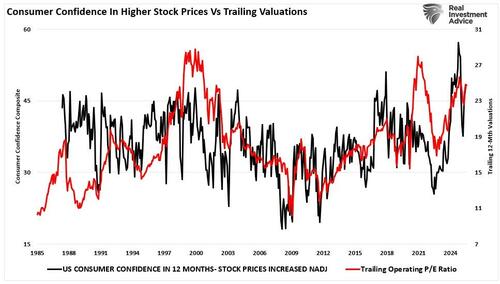

Market valuation measures are just that—a measure of current valuation. Moreover, market valuations are a much better measure of “investor psychology” and a manifestation of the “greater fool theory.” This is why a high correlation exists between one-year trailing valuations and consumer confidence in higher stock prices.

What market valuations express should be obvious. If you “overpay” for something today, the future net return will be lower than if you had paid a discount for it.

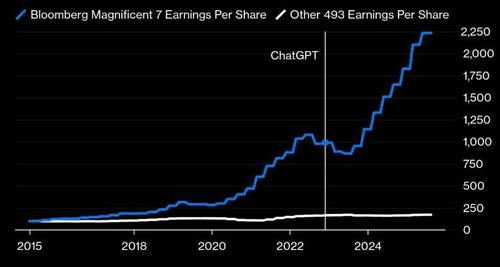

Current market valuations are not sustainable. Fundamentals, revenue growth, earnings power, free cash flow, margins, and debt govern valuation over time. This is particularly true when the vast majority of the market generates little to no earnings growth, but growth is only a function of a handful of companies.

Markets eventually will revert toward fundamentals. That process takes time, but it is both inevitable and relentless

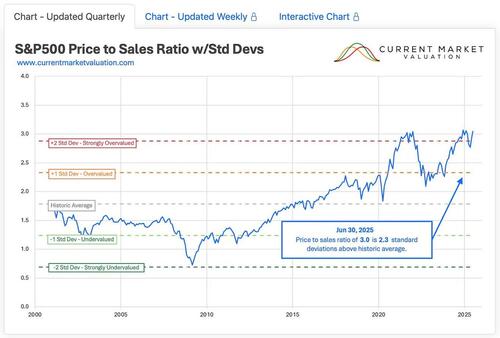

Price‑to‑Sales and Market‑Cap‑to‑GDP Send a Warning

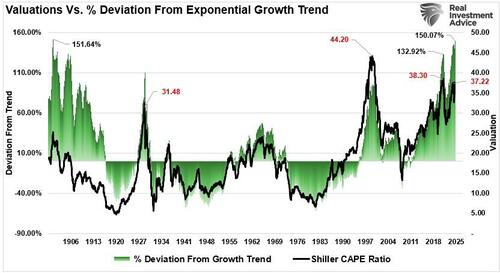

The Price‑to‑Sales (P/S) ratio measures how much investors pay for each dollar of a company’s sales. The S&P 500 currently trades around 3.2 times trailing sales. The long‑term average is closer to 1.6 times. For perspective, a P/S ratio above “2″ signals elevated valuations. The market P/S ratio is currently more than 2-standard deviation above its historic average.

The elevated P/S reflects bullish expectations that when you pay over $3 per $1 of sales, you expect future growth to justify it. That means investors expect strong revenue gains ahead. But if growth slows, valuations must adjust downward. In other words, the market is currently “priced for perfection,“ which leaves a lot of room for disappointment.

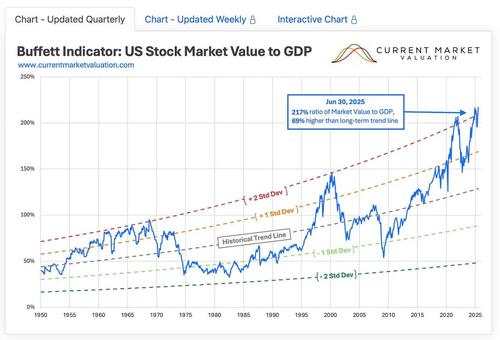

Another measure is Market‑Cap‑to‑GDP, known as the Buffett indicator. This measure compares total stock market value to national output. Given that earnings and revenue growth come from economic activity, the market valuation should represent the strength of the overall economy. Currently, that measure of market valuation resides at 217%. Notably, the long‑term average is around 155%. At current levels, valuations are well above what the economy can generate, and two standard deviations above the long-term trend.

That signals broad market overvaluation versus economic size. It suggests prices may be disconnected from the real economy that generates earnings.

Both metrics send a clear message: valuations exceed long‑term norms. That means excess return potential is limited. Downside risk rises if sentiment shifts or fundamentals falter.

These high valuations can be sustained longer than expected if sentiment remains jubilant. But you cannot ignore the math. Expectations already baked into the price are high. Therefore, you must realize that you tolerate a limited margin of safety unless fundamentals outperform.

Valuation Exuberance Increases The Overall Risk Profile

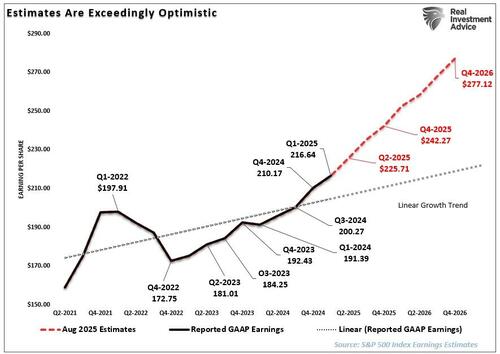

Still, the current level of exuberance is unsurprising given the strongly trending bull market, particularly when Wall Street needs to justify higher valuations. The problem is that such exuberant forecasts rarely come to fruition. For example, in March 2023, S&P Global predicted that 2024 earnings would grow by 13% for the year. In reality, earnings grew by just 9% despite the market rising nearly 28%. In other words, given that actual earnings fell well short of previous estimates, the 2024 market was primarily driven by valuation expansion.

Current earnings projections for 2025 suggest a nearly 20% increase, well above historical growth trends. While such detachments of the market from earnings are not uncommon, they tend not to be sustainable over more extended periods. We suspect that the risk to stocks in 2025 will be a failure of earnings to meet optimistic expectations.

When sentiment and expectations exceed economic realities, there is the potential for stock repricing. As noted, “stocks are priced for perfection,” which means any shortfall could lead to a more substantial decline in price. For instance, the S&P 500’s P/E ratio has reached levels that some analysts consider concerning, reflecting investor optimism that may not align with underlying economic fundamentals.

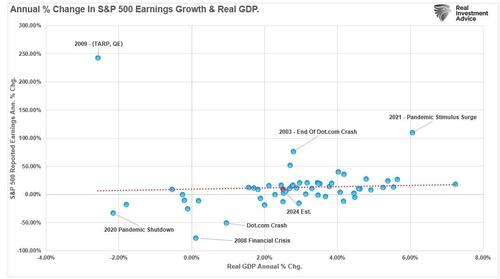

Given the interdependence between earnings and economic growth, valuations present a more serious challenge. A better way to visualize this data is to look at the correlation between the annual change in earnings growth and inflation-adjusted GDP. There are periods when earnings deviate from underlying economic activity. However, those periods are due to pre- or post-recession earnings fluctuations. Currently, economic and earnings growth are very close to the long-term correlation.

It is worth repeating that valuations are unreliable market-timing tools. Elevated valuations reflect heightened investor optimism and expectations of robust earnings growth in bull markets and can remain that way for extended periods.

However, excess market valuations leave investors vulnerable to unexpected, exogenous events. Those “events,” when they occur, lead to sharp sentiment reversals. What would cause such a sentiment reversal? No one knows. This is why when the “unexpected” happens, Wall Street’s immediate response is to suggest that “no one could have seen that coming.”

As such, investors must continue managing risk into 2025 and navigate the markets accordingly.

Tyler Durden

Sun, 08/24/2025 – 12:50ZeroHedge News

R1

R1

T1

T1