Transshipment’s Dead End

Authored by Jake Scott via the Foundation for Economic Education (FEE),

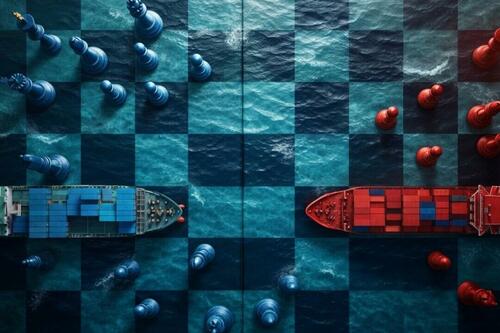

President Donald Trump’s executive order of July 31st, effective Aug. 7th, has upended global trade dynamics in a single stroke. Slapping a 40 percent tariff on all “transshipped goods”—products rerouted through third countries to dodge U.S. duties—this is merely the natural development of his evolving protectionist agenda.

Just a week after the order, the move is a clear shot at China’s sprawling manufacturing empire, which has long exploited methods like transshipment and “nearshoring” to skirt American tariffs in general, and Trump’s tariff policies in particular.

While applied globally, China stands to take the biggest hit (and likely already is), with its vast factory networks and knack for rerouting goods through Southeast Asia, Mexico, and beyond. This isn’t just a tariff hike; it’s a calculated escalation in Trump’s ongoing crusade to reshape U.S. trade policy and the global economy in the United States’ favor. But ripple effects that bruise consumers are already visible—and this move is likely to strain relationships with key allies as well.

The new tariffs build on Trump’s first-term strategy—so extensive that it now has a Wikipedia entry—when he wielded America’s economic heft like a sledgehammer to renegotiate or smash trade deals he deemed unfair. Back then, Chinese firms sidestepped U.S. tariffs by setting up shop in countries like Vietnam and Mexico, funneling goods through these hubs to mask their origins.

This nearshoring strategy buoyed many economies that had pre-existing arrangements with the United States or were treated more favorably than China, such as Canada and Latin American nations. It is also seen as a natural part of globalization: shipping parts from where they are constructed (like China), assembling them in developing nations (like Mexico), and then exporting to high-value markets (like the United States). Nearshoring has a long history, but the fragility of extended global supply chains was exposed in the Covid pandemic; since then, manufacturers have sought to mitigate their damage.

The U.S. trade deficit with China (roughly $295 billion) has long been a sore point for Trump, who sees transshipment and nearshoring as sneaky workarounds. The 40 percent duty on these goods, layered atop existing tariffs, aims to plug this loophole. As Stephen Olson, a former U.S. trade negotiator, noted in the New York Times, China will likely view this as a direct attempt to “box them in,” potentially souring already tense talks.

As FEE’s readers will know, this isn’t Trump’s first use of tariffs as a stick to beat the horse. Earlier this year, he raised duties on EU goods to 15 percent from the 1.2 percent that preceded his second term, a move that sparked both relief—for averting a threatened 30 percent rate—and criticisms over the increased cost of European imports. This is especially likely to hit Trump’s own voter base, given the prevalence of pharmaceuticals and car imports from the EU.

Now, with this global imposition of transshipment and nearshoring, Trump is doubling down on his economic geopolitical strategy, targeting not just China but any country facilitating indirect shipments. Data from Asia Financial underscores the urgency: China’s exports to the United States plummeted 22 percent in July 2025 compared to last year, but those goods didn’t vanish—they were redirected to ASEAN nations, surging by 17 percent, signaling a pivot to transshipment hubs. Countries like Vietnam have tightened inspections to curb this practice, but the scale of China’s manufacturing makes enforcement a Herculean task.

Broader implications include a risky pivot towards China. Tariffs could accelerate integration via the Belt and Road Initiative, and Regional Comprehensive Economic Partnership, deepening ASEAN-China ties as U.S. access wanes. Beijing’s threatened countermeasures against U.S. deal-makers, in turn, force ASEAN nations to tread carefully and potentially choose between their top export market (America) and largest trading partner (China).

Trump’s order also tweaks other tariffs, ranging from 10 percent to 41 percent, with a hefty 100 percent levy on microchips and pharmaceuticals and a 25 percent tax on goods from nations buying Russian oil—a move that is already disrupting relations with India and pushing the BRICS countries even closer together.

These moves align with Trump’s broader economic geopolitical strategies: shrinking the U.S. trade deficit and bolstering domestic industries. But the cost is steep for American consumers. Higher tariffs may generate revenue for the Treasury in the short term, but they also mean pricier goods in the long term. China’s cost advantage keeps its exports competitive despite duties. Ironically, it’s China’s massive level of onshored manufacturing that Trump is attempting to rebalance. As Richard Baldwin wrote, “[China’s] production exceeds that of the nine next largest manufacturers combined.”

Of course, China may be the primary target of this bludgeoning, but it is not the only nation affected: Vietnam, with a $120 billion U.S. trade surplus, negotiated a cut from 46 percent to 20 percent, a move that attempted to offset its place as a transshipping hub for Chinese exports. Cambodia’s garment sector, employing a million workers, celebrated the tariff slash from 49 percent to 19 percent, but its reliance on Chinese inputs keeps transshipment risks high.

Still, ASEAN markets are complex and multifaceted. Some celebrated the tariffs as “leveling” the trading field. Werachai Lertluckpreecha, a representative of the Thailand-based Stars Microelectronics, praised Trump’s tactics for putting Thailand “on par with Indonesia and the Philippines and lower than Vietnam … we’re happy.”

This tariff gambit echoes broader themes of sovereignty and control—and Trump is usually the last one to blink. His tariffs assert U.S. dominance, forcing trading partners to bend or break, yet the risk of overreach looms. Broader impacts include U.S. consumer price hikes (e.g., shoes up 40 percent, cars projected to cost $5,800 more on average, according to the Tax Foundation), potentially fueling inflation and debt reliance. Markets shrugged somewhat, with minor S&P 500 dips, but volatility looms.

Tyler Durden

Sun, 08/24/2025 – 14:00ZeroHedge News

R1

R1

T1

T1