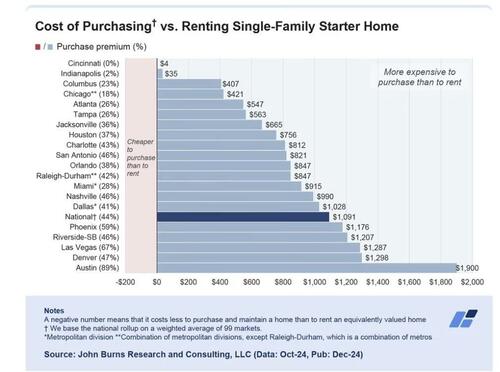

It’s Now Twice As Expensive To Buy An Entry-Level Home Than Rent

Authored by Mike Shedlock via MishTalk.com,

Thinking of buying a starter home? Be careful!

The above image from John Burns Research.

💭 When do you think owning will feel affordable again for first-time buyers?

— John Burns Research and Consulting (@JBREC) July 2, 2025

Burns Criteria

-

Home payment, entry-level home mortgage

-

5 percent down, 30-year fixed mortgage

-

Principal, Interest, Tax Payments, and Insurance (PITI) payment plus mortgage insurance payment

-

Annual maintenance costs ranging from 0.85 percent to 1.25 percent of home price

One might put down 10 percent to avoid mortgage insurance.

Looking ahead Burns see homeownership costs stubbornly high, 95 percent premium all the way through 2028.

That means home prices remain stubbornly high, mortgage rates remain stubbornly high, or the cost to rent drops.

20-City Comparison

The above image from John Burns Research via Realtor.Com article Top 20 Markets Where It’s Cheaper to Rent than Own a Single-Family Starter Home

Austin is the worst place to buy a starter home by percent and dollars.

In dollar terms, Denver is second. In percentage terms, Las Vegas is second. Phoenix and Riverside are high up the unaffordable list.

Better to Rent or Buy Calculator

The New York Times has a Better to Rent or Buy Calculator (free link, updated July 2025).

The NYT says the “winning choice is the one that makes more financial sense over the long run, not necessarily what you can afford today.”

The NYT philosophy assumes you can survive the short-term and you know where home prices are headed.

I know first hand of people who miscalculated what they can afford and now need tenants to manage.

A recession or job loss will complicate things greatly for millions.

The Housing Top Is Likely In, Case-Shiller Home Prices Drop Again

On July 29, 2025, I commented The Housing Top Is Likely In, Case-Shiller Home Prices Drop Again

Prices are now down the third consecutive month. [But it does not even register on a chart.]

Demographically, the upcoming boomer die-off will add tremendous supply to the housing market. Shutting down the border will slow the rate of current demand.

As a counter-balance, The Number of Housing Units Under Construction Continues to Crash

The impact on rent will be whether or not builders overbuilt.

The Fed Is Incompetent by Design

Blame the Fed for wild swings in housing affordability.

I discussed this in Fedthink! The Fed Is Incompetent by Design and Can’t Be Fixed

Today’s Pertinent Conclusion

We are trapped in “Fedthink”, especially the nonsensical proposition that two percent inflation is a good thing despite the fact that the Fed is clueless on how to measure inflation in the first place.

The Greenspan Fed, Bernanke Fed, Yellen Fed, and the Powell Fed all ignored housing prices as a measure of inflation.

Yellen even wanted to make up for lack of not enough inflation.

Powell Admits Prior Monetary Framework Was Hugely Flawed

At the annual Jackson Hole meeting this year Powell Admits Prior Monetary Framework Was Hugely Flawed

The Fed just announced a new monetary framework. Is it any better?

The short answer is the new framework is nearly as flawed as before, and the Fed still holds many disproved economic theories.

Tyler Durden

Sun, 08/24/2025 – 21:00ZeroHedge NewsRead More

R1

R1

T1

T1