US Home Prices Plunge For 4th Straight Month In June

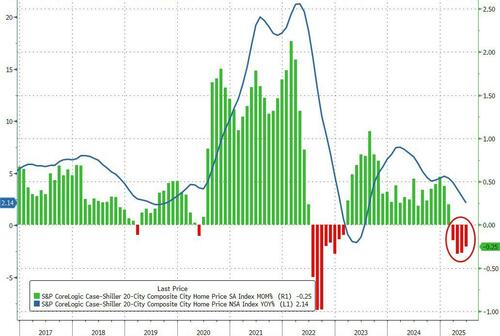

Home prices in America’s 20 largest cities fell for the 4th straight month in June (the latest data available from S&P CoreLogic’s Case-Shiller data released this morning).

The 0.25% MoM drop was larger than expected and dragged the YoY price growth down to +2.15% – the weakest since July 2023…

Source: Bloomberg

“June’s results mark the continuation of a decisive shift in the housing market, with national home prices rising just 1.9% year-over-year—the slowest pace since the summer of 2023,” according to Nicholas Godec, S&P Dow Jones Indices.

“Looking ahead, this housing cycle’s maturation appears to be settling around inflation-parity growth rather than the wealth-building engine of recent years”

San Francisco, LA, and DC contributed the most to the MoM decline in prices while New York and Chicago contributed to the upside.

On the bright side, given the shift lower in mortgage rates in recent weeks, we may see price pressure relieved…

Source: Bloomberg

Additionally, home price appreciation does seem to track very closely with bank reserves at The Fed (6mo lag), which implies prices could re-acclerate once again...

Source: Bloomberg

Declining home prices (and the follow through into PCE/CPI calculations for Shelter costs) could more than offset any tariff-driven anxiety over the next few months.

The question remains, that after slashing rates by 100bps, home prices have started to decline (with significant lag)… is that what The Fed wants?

Tyler Durden

Tue, 08/26/2025 – 09:12ZeroHedge NewsRead More

R1

R1

T1

T1