It’s Quiet. Too Quiet

By Bas van Geffen, Senior Market Strategist at Rabobank

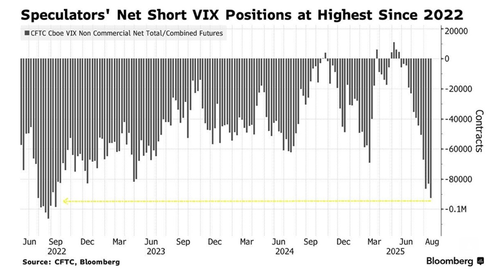

Today’s headlines are more of the same, which should spell bad news for longer-term government bonds. The long end of the Treasury curve has been struggling since President Trump moved to terminate Lisa Cook position at the Fed on Monday. However, considering the potential implications, markets have arguably been eerily calm in the face of this news. Long-term yields are up, but not massively, and Bloomberg headlines today that speculators have accumulated the biggest net short positions on the VIX index since 2022, essentially betting that the calm will last. Is that a setup to another volmageddon?

As my colleagues pointed out in this daily over the past couple of days, the president is trying to align the central bank with his broader agenda. So why stop here?

If the dismissal of Cook holds up in court, Trump-appointees will have a majority in the Fed’s Board of Governors. But the Federal Open Market Committee, which makes policy decisions, also consists of the presidents of the 12 regional Federal Reserve banks. The next headline should therefore not be surprising. Bloomberg reports that the Trump administration is looking at its options to increase its influence over the nomination process of the regional Fed presidents.

According to one of Bloomberg’s sources, candidates for Fed Chair Powell’s job may also be considered to head one of the regional banks. However, it is not exactly clear how that would happen.

Unlike the Fed’s Board of Governors, the presidents of the regional Fed banks are not nominated by the US president and confirmed by the senate. Instead, they are appointed by private-sector boards and the Board of Governors. The Fed’s board confirms the appointments once every five years, and the next reappointments are scheduled for February. If Cook is replaced, the Trump loyalists in the Fed’s board could potentially block appointments. But there is currently no sure-fire way for Trump to get anyone in particular nominated for the job.

Likewise, the Trump administration is looking to expand its control over US supply chains. Following last week’s announcement that the White House will take a 10% stake in Intel, Secretary of Commerce Lutnick suggested that defence companies may be next: “They are basically an arm of the US government.”

So, as noted in yesterday’s daily, the US are taking a page from China’s playbook. Because markets alone cannot compete with China’s state-directed framework. Where does that leave Europe and its attempts to regain strategic autonomy?

Internally, France is descending into another political crisis after PM Bayrou called for a confidence vote on September 8. At 114%, Frances debt ratio is the third highest in the Eurozone, but the large budget deficit is particularly worrying. The minister of Finance said that he cannot rule out that the IMF may ultimately have to intervene if parliament does not take the necessary austerity measures. Although that scenario is still a long way off, what would the IMF have to offer? Advice about structural reforms and privatization? How will such policies fare against not only a state-led China, but also an increasingly coordinated US economy?

With this vote of confidence, Bayrou essentially wants to seek parliament’s support to continue drafting a budget for 2026. The prime minister wants to avoid that these efforts are shot down at a later stage, but in doing so, Bayrou now takes a very risky gamble with the future of his minority government.

Prior to the holidays, Bayrou’s proposed budget cuts had already sparked anger amongst the opposition parties. The hard left simply does not see the need for any austerity. Both Le Pen’s National Rally and the Socialists support austerity to some degree, but they want to cut in different areas than proposed by Bayrou.

Normally, this would leave room for negotiations. And the government’s budget cuts might have survived in an altered, perhaps somewhat diluted form. The vote of confidence is not a de facto approval of any budget – parliament will have to vote on that towards the end of the year. However, by calling for a vote of confidence, the prime minister is essentially putting pressure on these opposition parties to support his efforts to consolidate the budget. And that may be hard to swallow.

So, the risk has grown substantially that France’s government will fall, which would also raise the risk that the 2026 budget will not include any material spending cuts. The coming days will tell if Bayrou can work the opposition parties to get them on board. The Socialists have said that it’s “inconceivable” that they will vote in favor of the government, but they seem to be the prime minister’s best chance for survival at this point

Tyler Durden

Wed, 08/27/2025 – 13:05ZeroHedge NewsRead More

R1

R1

T1

T1