Nvidia Slides After Data Center Revenues Miss, Solid Guidance Fails To Wow Bulls

Earlier today we wrote an extensive preview of what to expect from Nvidia’s Q1 earnings (here), but for those who missed it here is the summary: if Nvidia beats and raises, revisions might restart, and high valuation could sustain. However, if the results are just in line or even lower, as what happened in the last two quarters, the market may assume margins have peaked, and the story will become less about hypergrowth and more about stabilization.

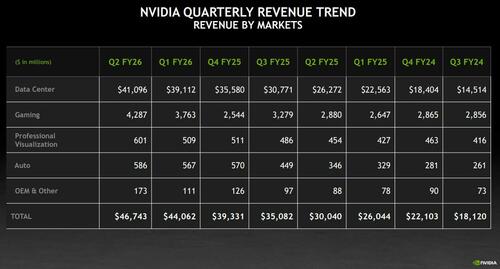

Here are the bogeys:

- The revenue consensus for fiscal Q3 revenue is $53.46 billion. But there’s a much wider range than usual going into that average.

- For fiscal Q2 that target is $46.23 billion.

- Adj EPS for fiscal Q2 should be $1.01

- Nvidia’s data center division is expected to post $41.3 billion in fiscal Q2 revenue.

That’s the 30,000 foot snapshot. In reality, a lot more has happened, starting at the end of July, when President Trump put American chips and other infrastructure at the heart of his AI plan, even prompting a standing ovation for Jensen Huang during a grand speech in DC. Then news: Nvidia got a quid pro quo deal with the Administration to sell China-specific AI accelerators, if the US gets 15% of the sales. Then the President, quite skillfully, dropped a hint that Huang and Nvidia are pushing for a new China-specific chip based on Blackwell architecture. Still, a lot of questions remain on how much of this is real on Nvidia’s side and whether it has not changed the near term trajectory for Nvidia’s top line. Or is this still far from moving the needle for a company that already dominates the market for AI chips. In any case, one area to keep an eye on is any update around its H20 chips, which is a hot-button issue for investors

China aside, Nvidia – which is the world’s largest company and accounts for 8% of the S&P – is growing quickly and Wall Street, which has revenue estimates going as far out as 2030, projects steady increases in that time. The question is at what rate? Any hint of disappointing numbers and investors will once again raise concerns that the massive spending in AI infrastructure has to eventually slow down.

Those concerns will get even louder after the company’s earnings which just came out and leave quite a bit to be desired, especially since data centers missed. Here is what the company just reported for Q2:

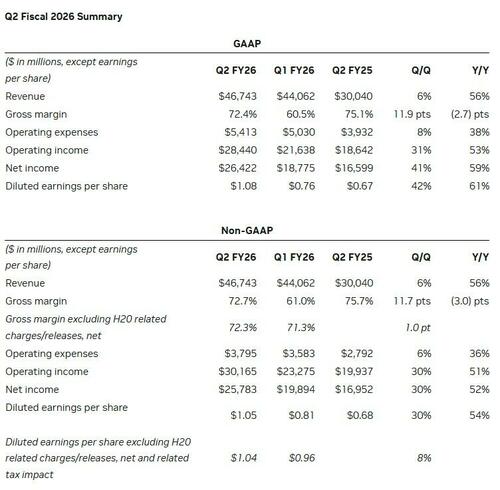

- Adjusted EPS $1.05, beating estimates of $1.00 (NVIDIA benefited from a $180 million release of previously reserved H20 inventory, from approximately $650 million in unrestricted H20 sales to a customer outside of China.)

- Revenue $46.74 billion, +56% y/y, beating estimates of $46.23 billion

- Data center revenue $41.1 billion, +56% y/y, missing estimates of $41.29 billion; this was the second consecutive quarter in which data centers missed.

- Gaming revenue $4.3 billion, +49% y/y, beating estimates of $3.82 billion

- Professional Visualization revenue $601 million, +32% y/y, beating estimates of $532 million

- Automotive revenue $586 million, +69% y/y, missing estimate $592.7 million

Going down the income statement:

- Adjusted gross margin 72.7%; beating est of 72.1%

- Excluding the $180 million release, non-GAAP gross margin for the quarter would have been 72.3%.

- Adjusted operating expenses $3.80 billion, +36% y/y, below estimates of $4.02 billion

- Adjusted operating income $30.17 billion, +51% y/y, beating estimates of $29.36 billion

- R&D expenses $4.29 billion, +39% y/y, below the estimates of $4.44 billion

- Free cash flow $13.45 billion, -0.2% y/y

Addressing the elephant in the room, NVDA said that there were no H20 sales to China-based customers in the second quarter, and the question whether there will be any sales in the future will likely be discussed on the call. NVIDIA also said that it benefited from a $180 million release of previously reserved H20 inventory, from approximately $650 million in unrestricted H20 sales to a customer outside of China.

In his comments, tit-signing CEO Jensen Huang said that “Blackwell is the AI platform the world has been waiting for, delivering an exceptional generational leap — production of Blackwell Ultra is ramping at full speed, and demand is extraordinary.” He added that “NVIDIA NVLink rack-scale computing is revolutionary, arriving just in time as reasoning AI models drive orders-of-magnitude increases in training and inference performance. The AI race is on, and Blackwell is the platform at its center.”

NVDA also announced that while it returned $24.3 billion in stock repurchases and cash dividends in Q1, leaving it with $14.7 billion remaining under its share repurchase authorization, on August 26, 2025, the Board of Directors approved an additional $60.0 billion to the Company’s share repurchase authorization.

While the Q2 results were generally ok if not stellar (and data center missed), the company’s guidance came slightly on the weak side of the buyside expectations we discussed in our premium preview.

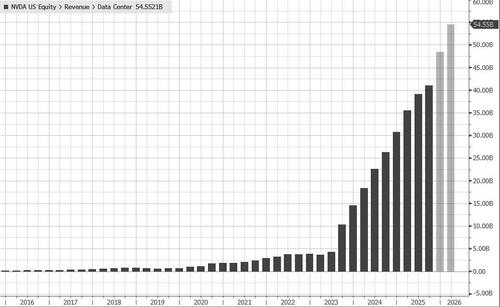

- Revenue is expected to be $54.0 billion, plus or minus 2%; which was above the consensus est of $53.46 billion but keep in mind some had estimates as high as $60 billion. That said, the surge in revenue continues: for Q2, its guidance was $45.0 billion, so a $9 billion sequential increase!.

- Sees adjusted gross margins at 73.5%, plus or minus 50 basis points, just above the 73.4% median estimate.

- Operating expenses are expected to be approximately $5.9 billion and $4.2 billion, respectively. Full year fiscal 2026 operating expense growth is expected to be in the high-30% range.

- Other income and expense are expected to be an income of approximately $500 million, excluding gains and losses from non-marketable and publicly-held equity securities.

- Tax rates are expected to be 16.5%, plus or minus 1%, excluding any discrete items.

Of note: the forecast excluded data center revenue from China, a market where it has struggled with US export restrictions and opposing pressure from Beijing. Expect China to buy a lot of NVDA chips as its own domestic AI chips are nowhere near good enough to power its latest LLMs.

Commenting on the results, CEO Jensen Huang said that “Global demand for NVIDIA’s AI infrastructure is incredibly strong. AI inference token generation has surged tenfold in just one year, and as AI agents become mainstream, the demand for AI computing will accelerate.”

Putting these results and forecasts in visual context, starting with revenue.

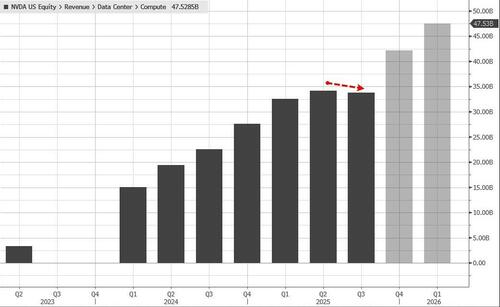

The thorn in today’s results: data center. It dipped sequentially. This was the second quarter in a row that data center revenues missed.

Here’s some more detail on what did happen with the data center business and Blackwell products in quarter gone (2Q) from the CFO commentary:

“We continue to ramp our Blackwell architecture, which grew 17% sequentially, including our newest architecture, Blackwell Ultra. We recognized Blackwell revenue across all customer categories, led by large cloud service providers, which represented approximately 50% of Data Center revenue.”

A growth number for the latest generation architecture Nvidia has confirmation the hyperscalers are still half of Nvidia’s data center business and the fact they are packing it all up and selling it through various channels.

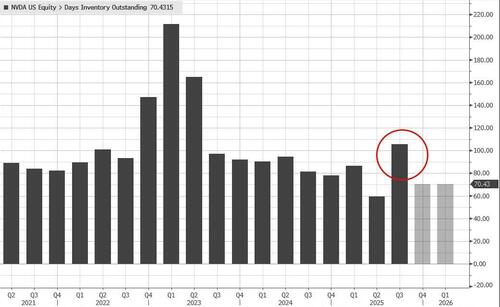

Somewhat concerning was the unexpected jump in inventories, although a more benign explanation is that the company is just stockpiling ahead of a Trump green light to sell to China.

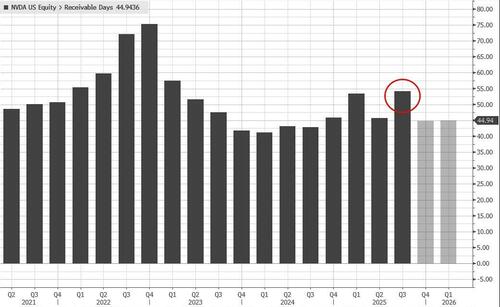

Receivables jumped too:

While NVDA’s results were fine, the tepid outlook adds to concern that pace of investment in artificial intelligence systems is unsustainable. Difficulties in China also have clouded Nvidia’s business. Though the Trump administration recently eased restrictions on exports of some AI chips to that country, the reprieve hasn’t yet translated into a rebound in revenue.

As we noted in our preview, Nvidia has been dealing with the fallout from a growing US-China rivalry, where semiconductor technology has become a major flashpoint. In April, the Trump administration tightened restrictions on exports of data center processors to Chinese customers, effectively shutting Nvidia out of the market. Washington has subsequently rolled that back, saying that the US will allow some shipments in return for a 15% slice of the revenue.

At the same time, Beijing has encouraged a move away from using US technology in AI systems accessed by the Chinese government. The shifting policies have made it difficult for Wall Street to predict how much revenue Nvidia might be able to recover in the market. Some analysts have made projections in the billions of dollars, while others have refused to predict any China sales until the company makes the situation clearer.

Nvidia shares fell about 4% in extended trading following the announcement before recovering much of the loss. They had rallied 35% this year through the close, lifting the company’s market capitalization above $4 trillion. Shares of other AI-related hardware stocks are also falling in after-hours trading following Nvidia’s results. CoreWeave shares are down about 3%, SMCI is down about 2%, Palantir is down 0.8% and Dell is also slipping.

Tyler Durden

Wed, 08/27/2025 – 16:47ZeroHedge NewsRead More

R1

R1

T1

T1