WTI Holds Gains After Across-The-Board Inventory Drawdowns

Oil reversed some of Tuesday’s decline as investors looked ahead to stockpile data and weighed the start of a higher US tariff on Indian goods in reprisal for the nation’s imports of Russian crude.

Brent nudged above $67 a barrel after falling more than 2% in the prior session, though prices have largely been stuck in a $5 band this month.

As Bloomberg reports, the US raised the tariff on some Indian goods to 50% on Wednesday – the highest levy applied to any Asian nation – to punish the country for buying Moscow’s oil. Still, processors plan to maintain the bulk of their purchases.

Traders continue to look ahead to an outlook for oversupply later in the year, said Arne Lohmann Rasmussen, chief analyst at A/S Global Risk Management.

“There are also no signs that the increase in US tariffs on Indian goods from 25% to 50%, which took effect today as punishment for India’s purchases of Russian oil, has had any significant impact on global oil supply,” he said.

All eyes are now on this morning’s official data after API reported a smaller than expected crude draw last week…

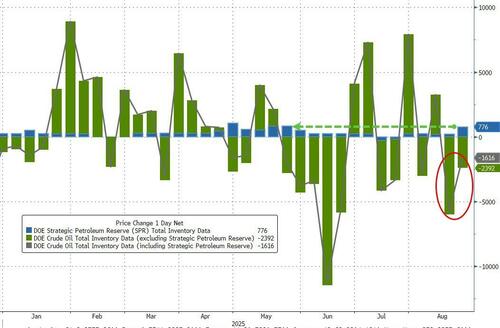

API

-

Crude -974k (-1.7mm exp)

-

Cushing

-

Gasoline +2.06mm

-

Distillates +1.49mm

DOE

-

Crude -2.4mm (-1.7mm exp)

-

Cushing -838k

-

Gasoline -1.236mm

-

Distillates -1.786mm

Official data showed a bigger than expected (and larger than API reported) crude draw. Additionally products saw inventory draws as stocks at the Cushing Hub tumbled for the first time in 8 weeks…

Source: Bloomberg

Despite a sizable 776k addition to the SPR (largest since May), US commercial crude stocks still fell for the second week in a row…

Source: Bloomberg

US Crude production hovered near record highs as the decline in rig counts has stalled…

Source: Bloomberg

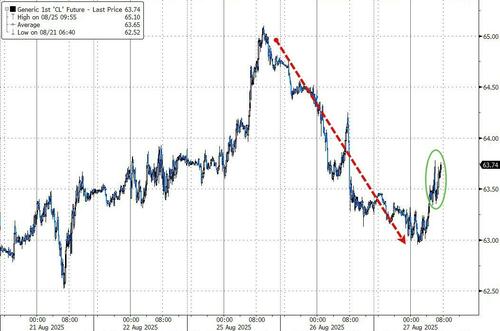

WTI prices sustained their earlier gains after the bigger than expected crude draw…

Source: Bloomberg

Finally, Bloomberg reports that a key physical market flashed a sign of weakness on Tuesday.

In a North Sea pricing window that helps underpin benchmark futures prices, top traders lined up with eight offers of benchmark grades and no willing bidders.

One grade fell to near a two-month low and related swaps contracts also softened.

Tyler Durden

Wed, 08/27/2025 – 10:42ZeroHedge NewsRead More

R1

R1

T1

T1