These Are The Best And Worst Countries For Taxes

When global companies decide where to invest, the quality of a country’s tax code can be as important as market size or labor costs.

A simpler, more neutral code helps investors forecast returns and reduces compliance headaches.

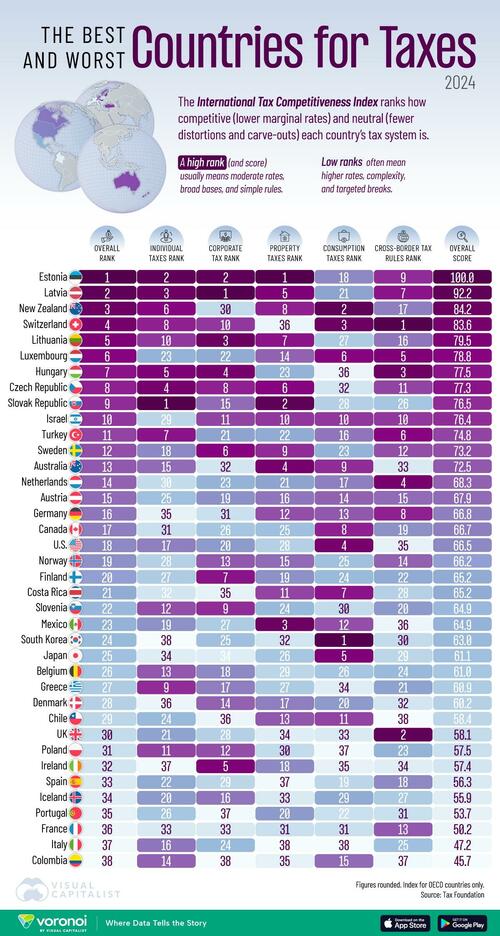

The data for this visualization from Visual Capitalist’s Pallavi Rao, comes from the Tax Foundation’s 2024 International Tax Competitiveness Index.

It benchmarks Organisation for Economic Co-operation and Development (OECD) members on how efficiently they raise revenue through individual, corporate, property, and consumption taxes, plus their rules on cross-border profits.

Estonia: Best Tax Code in the World?

Estonia tops the index for the 11th straight year, scoring a perfect 100.

| Rank | Country | Score | Individual Taxes Rank |

Corporate Tax Rank |

|---|---|---|---|---|

| 1 | 🇪🇪Estonia | 100.0 | 2 | 2 |

| 2 | 🇱🇻Latvia | 92.2 | 3 | 1 |

| 3 | 🇳🇿New Zealand | 84.2 | 6 | 30 |

| 4 | 🇨🇭Switzerland | 83.6 | 8 | 10 |

| 5 | 🇱🇹Lithuania | 79.5 | 10 | 3 |

| 6 | 🇱🇺Luxembourg | 78.8 | 23 | 22 |

| 7 | 🇭🇺Hungary | 77.5 | 5 | 4 |

| 8 | 🇨🇿Czech Republic | 77.3 | 4 | 8 |

| 9 | 🇸🇰Slovak Republic | 76.5 | 1 | 15 |

| 10 | 🇮🇱Israel | 76.4 | 29 | 11 |

| 11 | 🇹🇷Turkey | 74.8 | 7 | 21 |

| 12 | 🇸🇪Sweden | 73.2 | 18 | 6 |

| 13 | 🇦🇺Australia | 72.5 | 15 | 32 |

| 14 | 🇳🇱Netherlands | 68.3 | 30 | 23 |

| 15 | 🇦🇹Austria | 67.9 | 25 | 19 |

| 16 | 🇩🇪Germany | 66.8 | 35 | 31 |

| 17 | 🇨🇦Canada | 66.7 | 31 | 26 |

| 18 | 🇺🇸U.S. | 66.5 | 17 | 20 |

| 19 | 🇳🇴Norway | 66.2 | 28 | 13 |

| 21 | 🇨🇷Costa Rica | 65.2 | 32 | 35 |

| 20 | 🇫🇮Finland | 65.2 | 27 | 7 |

| 23 | 🇲🇽Mexico | 64.9 | 19 | 27 |

| 22 | 🇸🇮Slovenia | 64.9 | 12 | 9 |

| 24 | 🇰🇷Korea | 63.0 | 38 | 25 |

| 25 | 🇯🇵Japan | 61.1 | 34 | 34 |

| 26 | 🇧🇪Belgium | 61.0 | 13 | 18 |

| 27 | 🇬🇷Greece | 60.9 | 9 | 17 |

| 28 | 🇩🇰Denmark | 60.2 | 36 | 14 |

| 29 | 🇨🇱Chile | 58.4 | 24 | 36 |

| 30 | 🇬🇧UK | 58.1 | 21 | 28 |

| 31 | 🇵🇱Poland | 57.5 | 11 | 12 |

| 32 | 🇮🇪Ireland | 57.4 | 37 | 5 |

| 33 | 🇪🇸Spain | 56.3 | 22 | 29 |

| 34 | 🇮🇸Iceland | 55.9 | 20 | 16 |

| 35 | 🇵🇹Portugal | 53.7 | 26 | 37 |

| 36 | 🇫🇷France | 50.2 | 33 | 33 |

| 37 | 🇮🇹Italy | 47.2 | 16 | 24 |

| 38 | 🇨🇴Colombia | 45.7 | 14 | 38 |

Its 20% flat tax on both personal and corporate income is only due when profits are distributed, rewarding reinvestment and limiting double taxation.

The country also avoids wealth or inheritance taxes and keeps real-property levies local, reducing distortions.

Combined, these features create an easy-to-administer system that fuels the Baltic state’s startup scene and steady foreign investment.

The Baltic Cluster Outperforms Larger Peers

Latvia (2nd) and Lithuania (5th) join Estonia in the top five, underscoring a regional push for flat-rate, low-complexity regimes.

All three Baltic nations tax corporate profits only once and apply modest payroll charges, making cross-border hiring simpler.

Their high rankings contrast with many bigger EU economies—Germany (16th) and France (36th)—that rely on layered surcharges and targeted deductions, increasing compliance costs even as statutory rates fall.

Why Major Economies Lag Behind in the Tax Index

Size alone doesn’t guarantee a competitive tax code.

The U.S. ranks solidly middle-of-the-pack, weighed down by its citizenship tax system that can tax on overseas income and profits.

Meanwhile, France and Italy sit at the bottom of the table, burdened by high payroll taxes and narrow consumption-tax bases.

| Country | Property Taxes Rank |

Consumption Taxes Rank |

Cross-Border Tax Rules Rank |

|---|---|---|---|

| 🇪🇪Estonia | 1 | 18 | 9 |

| 🇱🇻Latvia | 5 | 21 | 7 |

| 🇳🇿New Zealand | 8 | 2 | 17 |

| 🇨🇭Switzerland | 36 | 3 | 1 |

| 🇱🇹Lithuania | 7 | 27 | 16 |

| 🇱🇺Luxembourg | 14 | 6 | 5 |

| 🇭🇺Hungary | 23 | 36 | 3 |

| 🇨🇿Czech Republic | 6 | 32 | 11 |

| 🇸🇰Slovak Republic | 2 | 28 | 26 |

| 🇮🇱Israel | 10 | 10 | 10 |

| 🇹🇷Turkey | 22 | 16 | 6 |

| 🇸🇪Sweden | 9 | 23 | 12 |

| 🇦🇺Australia | 4 | 9 | 33 |

| 🇳🇱Netherlands | 21 | 17 | 4 |

| 🇦🇹Austria | 16 | 14 | 15 |

| 🇩🇪Germany | 12 | 13 | 8 |

| 🇨🇦Canada | 25 | 8 | 19 |

| 🇺🇸U.S. | 28 | 4 | 35 |

| 🇳🇴Norway | 15 | 25 | 14 |

| 🇨🇷Costa Rica | 11 | 7 | 28 |

| 🇫🇮Finland | 19 | 24 | 22 |

| 🇲🇽Mexico | 3 | 12 | 36 |

| 🇸🇮Slovenia | 24 | 30 | 20 |

| 🇰🇷Korea | 32 | 1 | 30 |

| 🇯🇵Japan | 26 | 5 | 29 |

| 🇧🇪Belgium | 29 | 26 | 24 |

| 🇬🇷Greece | 27 | 34 | 21 |

| 🇩🇰Denmark | 17 | 20 | 32 |

| 🇨🇱Chile | 13 | 11 | 38 |

| 🇬🇧UK | 34 | 33 | 2 |

| 🇵🇱Poland | 30 | 37 | 23 |

| 🇮🇪Ireland | 18 | 35 | 34 |

| 🇪🇸Spain | 37 | 19 | 18 |

| 🇮🇸Iceland | 33 | 29 | 27 |

| 🇵🇹Portugal | 20 | 22 | 31 |

| 🇫🇷France | 31 | 31 | 13 |

| 🇮🇹Italy | 38 | 38 | 25 |

| 🇨🇴Colombia | 35 | 15 | 37 |

These choices are by design, in pursuit of broadening the social security net, but they also increase distortions and freeze cross-border capital flows.

The Other Side of “Tax Competitiveness”

Tax Competitiveness as measured by the Tax Foundation prioritizes business mobility and investment flows over other policy goals like:

-

Reducing inequality

-

Funding robust public services

-

Long-term fiscal sustainability

-

Democratic choice about the size of government

Estonia’s system works well for attracting capital and businesses, but may be sub-optimal for building a comprehensive welfare state or addressing inequality. And many would argue those are equally important measures of a good tax system.

If you enjoyed today’s post, check out Taxes Collected Relative to GDP Size in Every Major Economy on Voronoi, the new app from Visual Capitalist.

Tyler Durden

Thu, 08/28/2025 – 04:15ZeroHedge NewsRead More

R1

R1

T1

T1