Meme Markets: Investing Vs Entertainment

Authored by Lance Roberts via RealInvestmentAdvice.com,

Financial markets have transformed; today, trading and speculation have merged into performance art. The “Meme Market” culture now permeates mainstream finance. There was once a time when CEOs reigned as icons leading powerful companies, but today, some executives who once managed companies now lead cults.

For example, Palantir, driven by “Palantarians,” rallied more than 100% this year. Its fans call CEO Alex Karp “Daddy Karp.” Simultaneously, they ignore fundamentals, such as a 520x P/E ratio, a 12.9 PEG ratio, and a 108x price-to-sales. Yes, the company can certainly grow into some of that overvaluation, but most likely not all of it..

Another group remains unyielding to Michael Saylor, who heads up the one flailing company of MicroStrategy, which has been rebranded to just “Strategy,” to signify its new course of converting the company into a leveraged play on bitcoin. He regularly encourages his base with memes to further promote his leverage strategy. His followers congregate on Reddit and X under tags like “Irresponsibly Long $MSTR,” which tells you these investors have also disregarded fundamentals, like a 210x price-to-sales ratio, in favor of a “story.”

These are not investment conversations; they are fandom rituals.

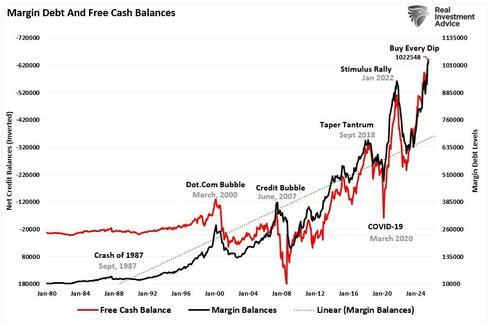

Speculation rides on leverage. As we showed recently, margin debt has exploded over the last two months to the highest level on record, exceeding $1 trillion.

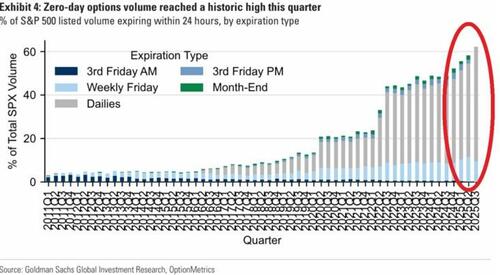

Furthermore, options volumes at meme‑linked names are at records, with short-dated, zero-day-to-expiration (0DTE) contracts now accounting for more than 61 percent of daily S&P 500 option volume. Retail “meme market” investors are responsible for half to 60 percent of that. That sensation feels more like gambling than investing.

The term, coined by Howard Lindzon, “degenerate economy,” captures this shift.

“A ‘degenerate economy,’ or ‘degen economy,’ refers to a speculative and high-risk financial environment where the lines between investing, trading, and gambling are blurred, often accelerated by mobile technology and social media.”

Specifically, in a degenerate economy, financial activities like trading meme stocks, cryptocurrencies, and betting are treated as entertainment rather than a disciplined investment strategy. The thrill of the

“meme market” and the dreams of fast profits are difficult to resist. Howard Lindzon’s index catalogs companies thriving on speculative excess. It includes Robinhood, CME, and Bitcoin-linked stocks. That basket has advanced roughly 23 percent this year versus the S&P 500’s near 10 percent rise.

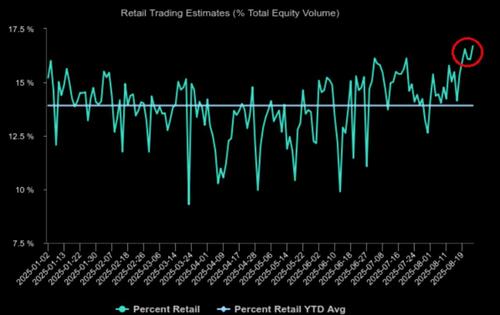

The “meme market” concept has gone viral. As demand for risk has surged, product providers (aka Wall Street) have been happy to oblige. From a return of SPACs to IPOs, a slew of new ETFs, extreme options, and even event betting. For example, the CME teamed with FanDuel to offer event betting, as Coinbase offers 10× leveraged perpetual futures. In other words, the retail markets now mirror casinos. With all that, it is unsurprising that retail trading volume has reached an all-time high as a percentage of total volume.

The question is, what could go wrong?

What Could Go Wrong With A “Meme Market?”

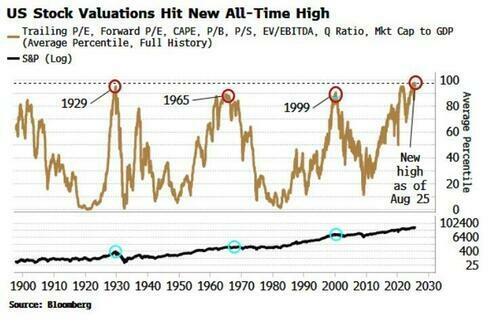

Entertainment-first markets distort the decision-making process. Investors respond to narrative instead of earnings, speculation instead of valuation. Leverage amplifies outcomes, and options magnify risk. In a ‘Meme Market,” bubbles can expand quickly and reversals can be severe. As we noted in last week’s #BullBearReport, valuations are a terrible timing metric as they are a function of investor sentiment in the short term. However, historically, high valuations have always been linked to a form of “Meme Market,” whether it was the 1920s “Golden Age,” the 1960s “Nifty Fifty,” or the 1990s “Dot.com” boom.

“Valuation is the capstone of proximate causes for a market top, and the one most indicative of the potential magnitude of any subsequent selloff. It’s well known that valuations are high for the US market, but I thought I’d update my aggregate indicator, which combines the main measures of long-term stock-market worth. It previously peaked in April, but has just made a new all-time high this month. Not a welcome sign if you’re a long-term bull.” – Simon White, Bloomberg

Investors have always been drawn to memes throughout the last century. The latest “memes” of cryptocurrency and Artificial Intelligence will eventually meet the same outcomes as reality. While fantastic, those fundamental realities will likely fall short of outrageous expectations. When that happens, the adrenaline-fueled chase will likely result in a “panic-driven” reversal. The psychology of the meme-market and options trading addiction is real, and there have been numerous reports that liken options trading to “crack‑cocaine” for individuals.

“A new type of addict is showing up at Gamblers Anonymous meetings across the country: investors hooked on the market’s riskiest trades. At Gamblers Anonymous in the Murray Hill neighborhood of Manhattan, one man called options “the crack cocaine” of the stock market. Another said he faced hundreds of thousands of dollars in trading losses after borrowing from a loan shark to double down on stocks. And one young man brought his mom and girlfriend to celebrate one year since his last bet.” – WSJ

There are certainly many similarities between cocaine addiction and options trading.

When trading is driven by “sentiment” rather than fundamentals, problems tend to manifest. Such is particularly the case today when “social media sentiment” now leads price action. Algorithms trained on Reddit posts can outperform buy-and-hold in bull markets. How much better? About 70% better in 2023 and 84% in 2021. However, they underperformed during the subsequent market declines, but the influence is material.

“Meme Markets” is structured on entertainment psychology and can defy fundamentals for sustained periods. Retail-driven rallies lift meme-linked equities, and fans hold fast through volatility. The S&P 500 index, as discussed in “Buy Every Dip,” stays buoyed by passive flows that fuel the top-10 stocks in the index regardless of earnings growth.

“While passive flows now dominate the tape, investors are not making decisions. Michael Green noted that “the market has become a giant mindless robot” in describing the enormous, passive capital flows that automatically push stock prices higher. This metaphor refers to the mechanical, non-discretionary purchasing by index funds and other passive investment vehicles that dominate today’s market. The problem is that these flows are “valuation insensitive.” We made such a point in Jesse Livermore’s Approach to Speculation.” To wit:

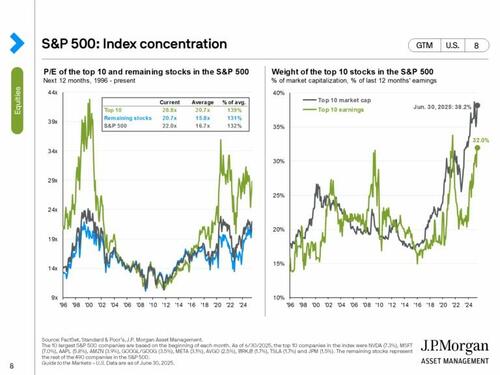

Passive funds track indexes weighted by market capitalization. As stock prices rise, these funds buy more of the same names, regardless of valuation or fundamentals. This mechanical process has inflated the market value of the largest companies. The top 10 stocks in the S&P 500 now account for more than 38% of the index. That level of passive index concentration has not been seen since the peak of the dot-com bubble. While such concentration may be worrisome, as it elicits memories of the “Dot.com crash,” in the short term, this handful of companies’ performance determines the entire market’s direction.”

Investors mustn’t mistake recent market performance for stability. Meme-market rallies often concentrate within speculative corners. Therefore, the unwinding can intensify swiftly when the narrative shifts, whether triggered by macro shocks, monetary policy surprises, or regulatory whispers. Notably, institutional investors still apply fundamentals. That anchors the broad market to earnings, dividends, and macro data. High forward valuations, rising margin debt levels, and elevated short interest in meme stocks are all textbook signals warning of fragile structure.

An eventual reckoning will arrive. When it does, it will likely be swift and severe. Meme names will tumble, leverage will unwind, and volatility will spike. Like we saw in 2022, the broader market may dip modestly, but speculative components will suffer extensive damage. For long-term capital, the key will be to avoid the blowups while staying invested in fundamentals. And when entertainment fades, only those anchored in valuation, diversification, and discipline will hold through the storm.

Tyler Durden

Sun, 08/31/2025 – 15:10ZeroHedge NewsRead More

R1

R1

T1

T1