Futures Tumble As Yields, Dollar Spike; Gold Hits All Time High

Following our warning that September tends to be the worst month for the S&P by a wide margin…

September is by far the worst month for stocks in the broken markets (post QE) era pic.twitter.com/iEZxKja6Ui

— zerohedge (@zerohedge) September 1, 2025

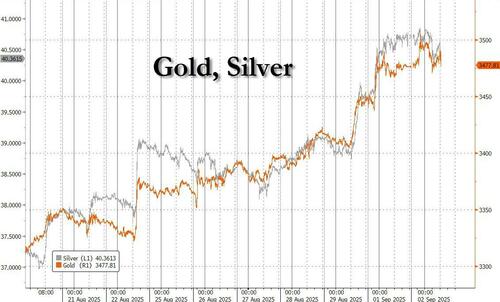

… US equity futures are acting accordingly and tumble on the first trading day of the month, dragged lower as part of a global risk-off tone sparked by a selloff in global government bonds which spooked investors and sent the dollar surging into a critical two weeks of macro data. As of 8:00am ET, S&P futures are down 0.8%, and Nasdaq futures slide 1%, deepening the tech-driven selloff that closed out last week. Nvidia led premarket losses among the Mag7 retreating 2.2% with all Mag7 names lower in premarket trading. Energy names are outperforming as crude rallies ahead of an OPEC+ meeting this week. Commodities are weaker ex-Energy complex as WTI heads for its best day since late July; gold hit a record high above $4,500 before retracing some of the move; silver also broke out to a new 11 year high, however subsequent USD strength is pressuring precious metals. The dollar posted its biggest gain since July, putting it on course for a first advance in six days. Today’s macro data focus is on ISM-Mfg and Construction Spending.

In premarket trading, Magnificent Seven stocks slide alongside index futures (Nvidia -2.3%, Amazon -1.4%, Meta -1.2%, Alphabet -1.2%, Tesla -1.3%, Microsoft -0.8%, Apple -0.6%).

- Cytokinetics (CYTK) climbs 29% after the heart-drug developer gave data from a late-stage trial of its experimental therapy for a heart disease that impressed Wall Street.

- Constellation Brands (STZ) falls 8% after cutting its fiscal 2026 profit outlook.

- Frontier Group (ULCC) jumps 12% after Deutsche Bank raised the recommendation on low-cost carrier to buy, saying the firm is best-positioned to benefit from rival Spirit’s bankruptcy.

- Ideaya Biosciences (IDYA) rises 7% after entering into an exclusive license agreement with Servier for regulatory and commercial rights to darovasertib outside the US.

- Ionis Pharmaceuticals (IONS) rises 23% after the company announced that olezarsen reduced triglycerides and acute pancreatitis events in Phase 3 studies for people with severe hypertriglyceridemia.

- Mineralys Therapeutics (MLYS) jumps 37% after competitor AstraZeneca gave results for its experimental hypertension pill that Jefferies sees as “numerically worse” than Mineralys’ data.

- PepsiCo (PEP) rises 4% after the WSJ reported that activist investor Elliott Investment Management has built a roughly $4 billion stake in in the company and plans to push the beverage giant to make changes.

- Signet Jewelers (SIG) rises 4% after the company boosted its adjusted earnings per share forecast for the full year.

- Telus Digital (TIXT) gains 14% after Telus Corp. agreed to acquire all remaining shares of the company that it doesn’t already own.

- United Therapeutics (UTHR) shares rise 49% after saying its Teton-2 study evaluating the use of nebulized Tyvaso inhalation solution for the treatment of idiopathic pulmonary fibrosis met its primary efficacy endpoint.

Wall Street returned from a long weekend to renewed anxiety over frothy technology stocks and stretched government budgets. Global bonds staged a broad retreat and gold briefly touched an all-time high. The yield on 30-year Treasuries climbed five basis points to 4.98%, while their UK counterparts hit the highest since 1998. Britain’s need to fund a widening budget gap came into focus amid a 10-year debt sale that raised a record £14 billion. The pound fell more than 1%.

This year’s record-breaking stock rally enters a decisive stretch, with markets about to see whether bets on the first Fed rate cut of 2025 will play out this month and whether expectations for further easing remain intact. Adding to the pressure are tariff tensions and concerns that President Donald Trump’s attacks on the Fed could stoke inflation.

“I think the long end of the curve should continue to rise because we have big fiscal deficits that need to be funded,” David Zahn, head of European fixed income at Franklin Templeton, told Bloomberg TV. “And how is that going to be done? It will have to be termed out.”

A raft of data is due this week, starting with the ISM’s August surveys of manufacturers and service providers on Tuesday. Friday’s nonfarm payrolls report is expected to show a fourth straight month of sub-100,000 job growth, the weakest stretch since the onset of the pandemic in 2020. Swaps currently imply a 90% chance of a quarter-point Fed rate cut later this month, with three more similar moves expected by June.

“There’s a lot of caution around moving closer to key US inflation and labor market data,” said Andrea Tueni, head of sales trading at Saxo Banque France. “That warrants some prudence moving forward.”

In Europe, the Stoxx 600 is down 0.7% with 501 members down, 91 up and 8 unchanged. European stocks were weighed down by Nestle, after the world’s largest food company dismissed its chief executive officer. Here are some of the biggest movers on Tuesday:

- Ferrari shares rise as much as 2.5% after Deutsche Bank upgraded the stock to buy from hold, saying it expects the supercar maker to unveil ambitious mid-term targets at its capital markets day next month.

- Wise shares rise as much as 4.7% after Goldman Sachs reiterates its buy recommendation and increases its price target to the highest of all analysts tracked by Bloomberg.

- Partners Group shares rise as much as 5.6% after the Swiss investment firm’s higher performance fees fueled unexpectedly strong first-half earnings.

- Coloplast shares rise as much as 3.7% to the highest since May 21 after the Danish medical-products maker provided new financial targets.

- Grenergy Renovables shares rise as much as 7.8%, the most since May, after the Spanish renewable energy company agreed to sell phase 4 of the Oasis de Atacama project.

- Nestlé shares decline as much as 3.6% after the world’s biggest food company dismissed CEO Laurent Freixe after only a year in charge, following an undisclosed workplace affair.

- SMA Solar shares fall as much as 27% after the German solar-energy equipment maker issued a profit warning.

- BAT shares fall as much as 2.9% after RBC downgrades it to underperform from sector perform, saying the profit expectations for the new category businesses are “seriously overblown.”

- Oxford Nanopore shares fall as much as 5.7% after the British DNA-sequencing firm reiterated its guidance for the full year and reported an adjusted Ebitda loss in the first half-year that was narrower than expected.

- Ithaca plunges as much as 17%, its biggest drop on record, after investors offloaded shares in the oil and gas company at a discount to Monday’s close.

Earlier in the session, Asian stocks edged lower, weighed by Chinese tech firms amid profit-taking after a recent rally. Gauges in Japan and South Korea traded higher. The MSCI Asia Pacific Index fell as much as 0.3% in a volatile session. Samsung Electronics and Xiaomi were among the biggest boosts to the benchmark gauge, while Chinese tech stocks, including Alibaba, were key drags after strong advances in the previous session. Optimism in technology shares have helped bolster gains in Asia’s risk assets this year, with sentiment getting a boost from earnings and developments in artificial intelligence. Bullish sentiment in China’s markets remained, with margin trades surging to a fresh record of 2.28 trillion yuan ($320 billion) on Monday. While some correction is expected after a strong run-up in equities, according to Xin-Yao Ng, a fund manager at Aberdeen Investments, liquidity tailwinds can persist in the near term. A sub-gauge of regional technology stocks has climbed more than 14% in 2025. Elsewhere in the region, Indonesia’s stock benchmark rebounded after the nation’s finance minister promised a step-up in the government’s policies, a move seen to quell political tensions. The Jakarta Composite Index rose more than 1% after falling sharply on Monday. Shares in India failed to hold early gains, with the benchmark NSE Nifty 50 gauge slipping as much as 0.4%.

In FX, the Bloomberg Dollar Spot Index rises 0.6% as the greenback emerged as the haven of choice. Sterling leads G-10 losses, dropping 1.1%, while the yen weakens 1% on Japanese political uncertainty.

In rates, the selloff in global government bonds spooked investors and prompted a broader risk-off move, hitting equities and lifting the dollar. UK 30-year yields earlier rose to the highest since 1998 with the Autumn budget approaching. French 30-year yields also topped 4.5% for the first time since 2011 amid political turmoil, with the US 10-year yields rising 5 bps to 4.28% and 30Y yields on the verge of 5.00%.

In commodities, Gold erases an earlier rally to a record above $3,500 and is little changed. WTI crude jumps 2.8% to $65.80. Bitcoin rises 1.5%, trading above $110,000.

Looking ahead, today’s US data includes the ISM manufacturing report for August, while the Euro Area will release its flash CPI for the same month. Central bank speakers include the ECB’s Müller.

Market Snapshot

- S&P 500 mini -0.5%

- Nasdaq 100 mini -0.6%

- Russell 2000 mini -0.7%

- Stoxx Europe 600 -0.7%

- DAX -1.2%

- CAC 40 -0.1%

- 10-year Treasury yield +5 basis points at 4.28%

- VIX +1 points at 17.14

- Bloomberg Dollar Index +0.6% at 1208.26

- euro -0.7% at $1.1627

- WTI crude +2.8% at $65.82/barrel

Top Overnight News

- Trump may declare a national housing emergency this fall, Scott Bessent told the Washington Examiner. The Treasury secretary said in a Semafor interview that several candidates for Fed chair are also contenders for the two open board seats. BBG

- US Treasury Secretary Bessent said the Fed is and should be independent, but added the Fed has also made a lot of mistakes and commented that ‘we haven’t seen anything yet’ regarding the market reaction to President Trump’s pressure on the Fed. Bessent also commented that Fed Governor Cook should be removed or should step down if mortgage allegations are true and noted that Cook hasn’t denied them. Furthermore, Bessent said he thinks there will be a good chance that Stephen Miran is seated before the September meeting: Reuters and Semafor.

- US Senate Republicans are on track to trigger the so-called “nuclear option” to make it easier for the Senate to confirm Trump’s nominees: Punchbowl.

- A continuing resolution will be needed to avoid a US government shutdown on October 1st, adding that there is no way Congress can pass 12 spending bills by then as there are just 14 legislative days left: Punchbowl

- Donald Trump said India offered to cut its import tariffs to zero. Elsewhere on the trade front, the US is preparing new measures against Banco do Brasil and Brazil’s diesel imports from Russia. BBG

- Kraft Heinz shares rose premarket after it announced a plan to separate into two publicly traded companies via a spin-off. The move unwinds a $46 billion merger a decade ago that united the two brands. BBG

- China and Russia have signed an agreement to build the Power of Siberia 2 pipeline, a gas project that could reshape global energy flows as both countries seek to outline an alternative to Trump’s US-led global order. FT

- China’s homegrown robot makers are driving a wave of low-cost automation that is helping local factories churn out more goods at lower prices, allowing the country to increase its share of exports, even in labor intensive products. FT

- BOJ deputy governor said on Tuesday the central bank should keep raising interest rates but warned that global economic uncertainty remains high, suggesting it was in no rush to push up still-low borrowing costs. While Japan’s trade deal with the U.S. helps alleviate uncertainty over the economy, the exact impact of U.S. tariffs remained unknown at this time, he said. RTRS

- Eurozone CPI for Aug was inline on the headline at +2.1% (up from +2% in Jul) and a bit firmer in Jul (+2.3% vs. the Street +2.2% and inline w/Jul). BBG

- Russian President Vladimir Putin is expanding his strikes on Ukrainian cities, threatening escalation against Kyiv’s backers and pressing for further military gains in defiance of President Trump’s deadlines to enter serious peace talks. WSJ

- France’s far-right National Rally said on Monday it was preparing for the possibility of snap elections, adding that Prime Minister Francois Bayrou’s efforts this week to try to stave off the collapse of his government would fail. RTRS

Corporate News

- Klarna Group Plc and some of its shareholders are seeking to raise as much as $1.27 billion as the financial-technology company revives a New York initial public offering.

- Activist investor Elliott Investment Management has built a roughly $4 billion stake in PepsiCo Inc. and plans to push the beverage and snacks giant to make changes to boost its sagging share price, the Wall Street Journal has reported.

- Air Lease Corp., the aviation finance firm built by industry pioneer Steven Udvar-Hazy, agreed to a $7.4 billion sale to a group led by Sumitomo Corp. and rival SMBC Aviation Capital.

- Kraft Heinz Co. said it will split into two separate, publicly listed companies to streamline operations and unlock value.

- Banca Monte dei Paschi di Siena SpA added as much as €750 million ($877 million) in cash to its bid for Mediobanca SpA and lowered the acceptance threshold, closing in on a plan to create Italy’s third-largest bank.

- Nestlé SA dismissed Chief Executive Officer Laurent Freixe after only a year due to an undisclosed workplace affair, extending the management turmoil at the world’s biggest food company that’s known for its conservative corporate culture. The shares fell.

- SMG Swiss Marketplace Group AG announced plans to list on the SIX Swiss Exchange, which would mark Switzerland’s first substantial offering in more than a year.

Trade/Tariffs

- US Treasury Secretary Bessent said he plans to write a brief for the US Solicitor General to file that defends US President Trump’s tariffs, as well as commented that he is confident the Supreme Court will uphold Trump tariffs and noted there are other statutes that could be used to justify tariffs, but they are not as efficient and not as powerful. Bessent stated the US is making headway with Europe on the need to crack down on India over Russian oil purchases, while he played down the significance of the China-hosted meeting of leaders from non-Western countries as performative, and accused China and India of being ‘bad actors’ by fuelling the Russian war machine.

- Brazil’s President Lula called for a virtual BRICS meeting on September 8th to discuss US tariffs.

- EU Council President Costa said it would have been an imprudent risk to escalate trade tensions with the US whilst Europe’s eastern border is under threat, and that is why they chose diplomacy over escalation.

- Japan’s trade negotiator Akazawa said there is no gap in understanding with the US on the trade deal and the schedule of his next visit is not yet set, while he added it is not true that Japan agreed to cut tariffs on farm products.

- Indian Trade Minister says India is in talks with the US over bilateral trade agreement.

European bourses (STOXX 600 -0.6%) opened mixed, trading on either side of the unchanged mark. But sentiment took a hit seemingly after UK assets (GBP/Gilts) took a beating. As it stands, bourses are lower across the board and trading near lows – the CAC 40 manages to hold afloat, with the Luxury sector doing much of the heavy lifting. European sectors hold a strong negative bias; initially opening with a very narrow breadth, but has widened, particularly as the losers slip further. Real Estate is found right at the foot of the pile, dragged lower by the higher yield environment, which has been sparked by continued pressure in Gilts. Thereafter, a couple of cyclical sectors (Retail / Travel & Leisure) take a beating amidst the risk-off tone. Despite the subdued sentiment, Consumer Products tops the pile – this is thanks to a couple of broker upgrades for the Luxury sector. HSBC upgraded both LVMH (2.8%) & Kering (+3.3%), whilst Hermes (U/C) was downgraded.

Top European News

- ECB’s Schnabel says rates are already mildly accommodative; Tariffs are on balance inflationary; Do not see a reason for a further rate cut. Less worried about the exchange rate. Inflation risks are tilted to the upside. Global rate hikes may come earlier than people think. Highly unlikely inflation expectations de-anchor to the downside.

- ECB’s Kocher advocates caution ahead of next rate decision.

- ECB’s Simkus says, “additional negative information might lead us to discuss a cut again in October”, via Econostream on X. “More true than not” that another cut is coming, and it is just a matter of timing. Many force now at work that point to lower future inflation. Risks to the economy and to inflation are tilted to the downside. Some risks are already materialising.

- Santander expects the BoE to keep rates at 4% until end-2026 (prev. saw two cuts in 2026).

APAC stocks traded mostly lower with the region cautious amid a lack of fresh drivers and following the holiday lull stateside. ASX 200 was subdued amid underperformance in the consumer-related sectors, real estate, telecoms and energy, although the downside was somewhat cushioned by gains in the top-weighted financial industry. Nikkei 225 initially benefitted from currency weakness but pulled away from best levels following somewhat varied comments from BoJ’s Himino who reiterated it is appropriate to continue raising interest rates in accordance with improvements in the economy and prices, but also noted high uncertainty surrounding the global economy and trade policy. Hang Seng and Shanghai Comp were pressured owing to weakness in tech and with a lack of fresh macro drivers, while participants also digested several automaker monthly updates and there were recent comments from US Treasury Secretary Bessent who downplayed the significance of the China-hosted meeting of leaders from non-Western countries as performative, and accused both China and India of being ‘bad actors’ by fuelling the Russian war machine.

Top Asian News

- BoJ Deputy Governor Himino said despite the three policy interest rate hikes by the central bank thus far, real interest rates have remained at significantly low levels as inflation has stayed strong, while he reiterated it is appropriate to continue raising interest rates in accordance with improvements in the economy and prices. Himino said there are various upside and downside risks to the economy and prices, as well as noted the baseline scenario is for Japan’s corporate profits to come under pressure from the global slowdown and the impact of trade policy. Himino said uncertainty surrounding the global economy remains high, and there is uncertainty over how trade policies could affect the economy and the fate of China’s ongoing trade negotiations with the US. Furthermore, he commented that as tapering moves forward, there may be a need to start exploring the amount of JGB monthly buying that is consistent with appropriate reserve levels, and it would be prudent to reduce the size of the BoJ’s balance sheet over time. There is no intention to signal the timing for the offloading of the BoJ’s ETF and REIT holdings. Will make rate decision looking not just at whether the likelihood of underlying inflation achieving 2% heightening, but upside and downside risks to baselines. If it becomes clear US tariff impact on Japan’s economy does not materialise, that would work in favour of raising rates. Hard to say exactly when BoJ can judge the impacts of US tariffs on Japan’s economy would be limited. Wants to pay close attention to the impact of US tariffs on US/Japanese corporate profits. Wants to look not just at numerical data but mechanism in which the impact could spread, re. US tariffs.

- Japanese PM Ishiba is reportedly making arrangements to instruct ministers as early as this week to compile economic measures to address inflation and Trump tariffs, according to Sankei newspaper. It was separately reported that Japanese Finance Minister Kato said the government will continue monitoring the impact of inflation and US tariff policies on corporate profits, while he added that he is not aware of plans for new economic stimulus package.

- South Korea and the US agreed to increase South Korea’s defence budget from 2.4% to 3.5% of GDP, costing KRW 30tln, according to Dong-A Ilbo.

- Russian President Putin says they are ready to support a strategic partnership with China and the strengthening of contacts on a high level, via Ria.

- Fast Retailing (9983 JT) UNIQLO Japan SSS August 5.3% Y/Y (prev. 2.4%).

- Possible meeting between Russian President Putin and North Korean leader Kim Jung Un will be discussed after the latter’s arrival to China, according to Tass.

- Japan’s Ruling LPD’s Moriyama intends to step down, according to Kyodo.

- Japan’s LDP Policy Chief Onodera will reportedly resign, according to TV Asahi

- Japanese PM Ishiba says there is responsibility for addressing various challenges the LDP faces; will decide on responsibility at the appropriate time. On the economy, says, need to swiftly conduct economic policies including tariffs.

FX

- DXY is very much on the front foot following Monday’s market holiday with the dollar showing the greatest gains vs. JPY and GBP. In terms of fresh fundamental drivers from the US, there hasn’t been much fallout from the US appeals court ruling that most tariffs issued by US President Donald Trump are illegal. US Treasury Secretary Bessent has since noted that other statutes could be used to justify tariffs, but they are not as efficient and not as powerful. Market focus this week is set to be dominated by the data slate with today’s highlight coming via ISM Manufacturing PMI metrics. Current session high at 98.44. Next target comes via the 27th August peak at 98.73.

- EUR is in-fitting with the performance seen in peers, EUR is on the backfoot vs. the USD. Albeit with some support provided by cross-related flows into EUR/GBP. Today’s Eurozone inflation data showed an unexpected uptick in inflation to 2.1% from 2.0%, super-core held steady at 2.3% (Exp. 2.2%) and services ticked low to 3.1% from 3.2%. The data is non-incremental for the near-term policy outlook with an unchanged rate next week priced at 99%. EUR/USD has reverted back onto a 1.16 handle and slipped below its 50DMA at 1.1660. Current session low sits at 1.1624 with focus on a potential test of 1.16.

- JPY sits near the foot of the majors following a combination of BoJ rhetoric and political instability. On the former, remarks from Deputy Governor Himino appeared at first glance hawkish with the central banker noting that despite the three policy interest rate hikes by the central bank thus far, real interest rates have remained at significantly low levels as inflation has stayed strong. He subsequently reiterated it is appropriate to continue raising interest rates in accordance with improvements in the economy. On the political front, reports suggest that following the party’s poor electoral performance, LDP sec gen Moriyama and policy chief Onodera will resign from their positions. USD/JPY has ripped through the 148 mark and is approaching its 200DMA at 148.85

- GBP is getting hit pretty hard this morning with ongoing focus on the UK’s desperate fiscal outlook. This has been reflected in fixed income markets with the UK 30yr yield hitting its highest level since 1998. In terms of what has changed since the start of the week, focus has been on PM Starmer’s decision to bring in several economic advisers to oversee the Autumn budget. The changes have been framed by the PM as a move to help improve economic growth. However, as the budget comes into view, markets are becoming increasingly concerned over the prospect of higher taxation and other market-unfriendly policies given the lack of scope to cut spending further. The timing of the budget is yet to be confirmed. Cable has crashed through the 1.35 mark and briefly made its way onto a 1.33 handle with a session low at 1.3376.

- Antipodeans are softer vs. the dollar alongside the soft risk tone and broadly stronger USD. Overnight, little reaction was seen following the marginally better-than-expected Current Account Data and Net Exports Contribution to GDP from Australia.

- PBoC set USD/CNY mid-point at 7.1089 vs exp. 7.1325 (Prev. 7.1072)

Fixed Income

- JGBs opened higher by a couple of ticks before treading water into supply, an outing that was strong with a b/c near 4x. This lifted JGBs by over 20 ticks to a 137.62 peak for the session, with gains of just under 40 ticks at most. However, much of this then pared and JGBs have since reverted back to pre-auction levels of c. 137.40. Since, though not spurring any significant JGB action thus far but potentially driving some of the post-supply pullback, LDP members Moriyama and Onodera reportedly intend to resign. Resignations seemingly framed as the LDP taking responsibility for the recent Upper House defeat, and adds pressure on PM Ishiba to resign.

- Gilts opened in the red by a handful of ticks but have since slumped to downside of 40 ticks at worst in 90.16-89.82 confines. A bout of pressure that has been reflected across the broader fixed income space with significant moves seen across assets as well (USD bid, Equities hit). The move appeared to begin with UK assets, despite a lack of fresh newsflow at the time. Action has propelled the 30yr yield to yet another multi-year high, at 5.69%, and taken the 10yr yield to 4.806% and approaching the zone which, at the time of the Spring Statement, was seen as sufficient to erode Reeves headroom via heightened funding costs.

- Bunds are lower and currently trading off by around 30 ticks, in a 128.77 to 129.24 range. A couple of ECB speakers today, but not really adding too much – Simkus said that additional negative information could see the Bank discuss a cut in October. Today’s Flash HICP data will alleviate some of those fears as it came in hotter-than-expected for the headline and super-core Y/Y metrics while the core printed as forecast and the services figure moderated from the prior. No reaction to ECB pricing, implies just 6bps of further easing this year.

- On France, we continue to count down to Monday’s confidence vote. Major updates a little light since Sunday’s media rounds from PM Bayrou, though National Rally (RN) has reportedly begun preparing for the possibility of the vote sparking a snap election, according to Les Echos. OAT-Bund 10yr yield spread is wider today, but thus far remains around the 80bps mark

- USTs are also lower, following peers. Overnight focus was on trade and Fed commentary from US officials. Firstly, Treasury Secretary Bessent said they are confident the Supreme Court will uphold Trump’s tariffs and highlighted that there are other ways of justifying tariffs. On the Fed, Bessent said we haven’t seen anything yet’ regarding the market reaction to President Trump’s pressure on the Fed, and believes there is a good chance Miran is in place before the September FOMC. USTs lower by 11 ticks at most, holding just off lows in a 112-05 to 112-16 band. Focus for the day is on any further trade updates, developments on Fed’s Cook (court document submission deadline) and ISM Manufacturing.

- Price guidance for UK’s 4.75% Oct 2035 Gilt set at 8.25bps above March 2035 Gilt; Books set to close at 09:30BST, according to bookrunner cited by Reuters.

- Germany sells EUR 3.552bln vs exp. EUR 4.5bln 1.90% 2027 Schatz: b/c 2x (prev. 2.50x), average yield 1.96% (prev. 1.90%) and retention 21.07% (prev. 21.68%).

Commodities

- Crude is firmer and edging higher this morning, totally ignoring headwinds from a firmer dollar and broader risk aversion, with the gap in intraday price changes between WTI and Brent a function of yesterday’s lack of settlement amid the US Labor Day holiday. Focus appears to be on the lack of peace progress between Russia-Ukraine and as Israel intensifies its attack on Gaza. WTI currently resides in a 63.66-65.35/bbl range while Brent sits in a USD 68.15-68.83/bbl range.

- Mixed fortunes for precious metals but with outperformance in gold vs peers. Spot silver pulls back after yesterday’s outperformance, whilst palladium succumbs to broader risk aversion. Spot gold eked a fresh record high overnight at USD 3,508.79/oz before pulling back towards lows on USD strength, albeit losses remain cushioned.

- Mostly lower trade across base metals amid the firmer dollar and broader risk aversion across the complex. 3M LME copper resides in a USD 9,850.00-9,944.85/t.

- European Union countries are looking to ways to plug any remaining loopholes to ensure that Russian gas won’t be furtively mixed into the bloc’s supplies once a ban takes effect by the end of 2027, according to Bloomberg News.

- Gazprom CEO Miller states Power of Siberia 2 gas supply deal with China agreed for 30 years, with pricing below European levels; Russia and China continue work on new possibilities in gas supplies.

- Russian oil product loadings from the Black Sea Port of Tuapse planned at 1.098mln tonnes in September (vs 1.068mln tonnes in August), according to traders cited by Reuters.

- Commerzbank expects gold to reach USD 3,600/oz by end the of next year (unchanged from June).

- Shell (SHEL LN) will begin a major turnaround at its Pernis refinery (404k BPD capacity) from mid-September, according to a statement.

Geopolitics: Middle East

- “The Israeli prime minister is holding a meeting to discuss the possibility of full control of the West Bank and measures against the Palestinian Authority”, according to Iran International citing i24.

- Huge explosions reportedly shook Gaza City and northern areas, according to Al-Haddath via X.

- “Iranian Foreign Ministry: We have not yet made a decision on continuing negotiations with the International Atomic Energy Agency (IAEA)”, according to Al Jazeera.

Geopolitics: Russia-Ukraine

- Russian President Putin stated that for a Ukrainian settlement to be sustainable and lasting, the root causes of the crisis that he has spoken about many times before must be addressed, and a fair balance in the sphere of security must be restored.

- French President Macron said he has spoken to the NATO Secretary General about preparations for the “Alliance of the Willing” meeting on Thursday in Paris. Macron also said they will move forward with their partners and in cooperation with NATO to define strong security guarantees for Ukraine, while he added that Ukraine’s security guarantees are a prerequisite for real progress towards peace.

- Russian President Putin says Russia has no intention of attacking anyone; claims about Russia’s intention to attack Europe are either a provocation or incompetence; West and NATO are trying to absorb the post-Soviet space, says “we have to react to this”. Russia is now responding seriously to Ukrainian attacks on energy infrastructure. Ukraine’s membership of NATO remains unacceptable to Russia. Believes there is an opportunity to find a consensus, in the context of matters discussed during the Alaska summit.

- Finnish President, on security guarantees for Ukraine, says, “we are making progress on this and hopefully will get a solution soon”; not very optimistic that Ukraine ceasefire or framework for peace will be achieved in the near future.

- NATO Secretary General Rutte says NATO takes the jamming of GPS signals very seriously.

Geopolitics: Other

- Chinese President Xi met with Russian President Putin, while Putin commented that Russia-China close communication reflects the strategic nature of Russia-China relations which are at an unprecedentedly high level. Furthermore, it was also reported that North Korean leader Kim travelled to China via train ahead of China’s Victory Day Parade.

US Event Calendar

- 9:45 am: Aug F S&P Global U.S. Manufacturing PMI, est. 53.3, prior 53.3

- 10:00 am: Aug ISM Manufacturing, est. 48.95, prior 48

- 10:00 am: Aug ISM Prices Paid, est. 65, prior 64.8

- 10:00 am: Jul Construction Spending MoM, est. -0.1%, prior -0.4%

DB’s Jim Reid concludes the overnight wrap

We have exciting news this morning as I return from holiday, delighted to be back at work—mainly to escape the kids. Over the last 10–15 years, I’ve had countless requests to turn the EMR into a podcast. It’s never quite been practical: the admin hassle and logistics of recording an audio version after writing are considerable, and there’d always be a delay before we could start to record since compliance approval only comes just before the email hits your inbox.

However, thanks to the wonders of AI, today we’re launching a podcast version of the EMR, read to you daily by our AI hero, “conversational Joe”. This will arrive almost simultaneously with the email. You’ll see the link to listen in the email itself—indeed, you may be doing so right now. You can listen on any device, including your personal phone, as long as your research entitlements are set up. It’s very easy and you can create your own app on your phone that takes you straight there every day by clicking the share button and pressing “Add to Home Screen” when you’re on the audio landing page that you can also find here (https://research.db.com/research/audio).

You can change the speed as with all normal podcasts. Please give it a listen and let us know if it’s of value to you. The tech is already in place for AI to replicate and use my voice to read the text, but for now we’re sparing you that. You’ll learn to love “conversational Joe”—in fact, in beta testing, my wife already prefers him.

Speaking of AI, Adrian Cox on my team has just published “The Summer AI Turned Ugly”, the first instalment of a two-part report on AI themes for the rest of the year. It explores the rising anxiety and acrimony surrounding the technology. Click on the link (here) for more.

Today marks the start of the final stretch of the year as the US returns from yesterday’s Labor Day holiday. While the US was out, European markets traded on familiar themes, with long-end bond yields creeping higher amid ongoing fiscal concerns. Yields on 30-year German, French, and Dutch bonds reached their highest levels since the Euro crisis in 2011, while the UK’s 30-year gilt yield hit its highest since 1998. Even in orderly markets, we’re seeing a slow-moving vicious circle: rising debt concerns push yields higher, worsening debt dynamics, which in turn push yields higher again.

The immediate catalyst has been the upcoming no-confidence vote in the French government, scheduled for Monday, 8 September. French 10-year yields rose 2.5bps to 3.53% yesterday—their highest since mid-March—despite no fresh news. Enough parties in the National Assembly still say they’ll vote against the government, so we may be heading for another collapse, similar to what happened to Michel Barnier last December. Investors fear that more political paralysis will make fiscal tightening harder, which is worrying given France’s current deficit levels.

But it wasn’t just France. Yields rose across the continent: 10-year bunds (+2.2bps), OATs (+2.5bps), and BTPs (+2.2bps) all moved higher. In the US, although markets were closed, Treasury futures lost ground across the curve. In Asia, 10-year US Treasuries are up +1.7bps. Rate cut expectations have been dialled back slightly, with the amount of Fed cuts priced by December 2026 falling -3.7bps to 136bps over the last 24 hours. Japanese yields have partly bucked the international trend this morning with the strongest 10-year auction since October 2023 helping yields dip -1.4bps. However, 30-year yields have followed their international peers and are up +1.7bps in Asia trading, hovering around their highest ever yield since they were first issued in 1999. This is ahead of a 30-year auction on Thursday.

Back to yesterday and equities were steady across Europe, with the STOXX 600 up +0.23%. Defence stocks outperformed following weekend comments from EU Commission President Ursula von der Leyen, who mentioned “pretty precise plans” for military deployments to Ukraine. Rheinmetall (+3.49%) led the German DAX (+0.57%), while BAE Systems (+1.91%) also gained. Elsewhere, gains were muted: FTSE 100 (+0.10%), CAC 40 (+0.05%), and US futures pointed to modest gains around the European close. As I type, S&P and NASDAQ futures are -0.10% and -0.15% lower respectively.

Asian equity markets are mixed this morning, with the Nikkei (+0.17%) and the KOSPI (+0.90%) recovering from losses in their previous sessions, while the Hang Seng (-0.61%), the CSI (-0.91%), and the S&P/ASX 200 (-0.28%) are lower.

Data released this morning indicated that South Korea’s headline inflation decreased for the second month in a row, reaching a nine-month low of +1.7% year-on-year in August (compared to an expected +1.9% and +2.1% in July). This decline has been primarily attributed to a 50% reduction in bills from SK Telecom, the country’s largest mobile service provider, thus helping to keep inflation below the central bank’s 2% target and opening the door for additional rate cuts to bolster the economy.

Another boost to risk assets yesterday came from supportive European data. The final August manufacturing PMI for the Euro Area was revised up two-tenths to 50.7, the highest in over three years. Meanwhile, the Euro Area unemployment rate fell to 6.2% in July, matching its joint lowest level since the euro’s inception in 1999. Together, these figures suggest the economy is holding up into Q3, despite the drag from expanding US tariffs.

In the background, precious metals continued their rally. Gold prices (+0.82%) closed at an all-time high of $3,476/oz, while silver (+2.46%) broke above $40/oz for the first time since 2011. This surge is largely driven by anticipation of rate cuts and persistent inflation fears, reinforcing their role as classic inflation hedges and safe havens during turbulent times.

Looking ahead, today’s US data includes the ISM manufacturing report for August, while the Euro Area will release its flash CPI for the same month. Central bank speakers include the ECB’s Müller.

Tyler Durden

Tue, 09/02/2025 – 08:38ZeroHedge NewsRead More

R1

R1

T1

T1