Gold Hits New Record High As Dalio Fears Trump Stoking Imminent “Debt-Induced Heart Attack”

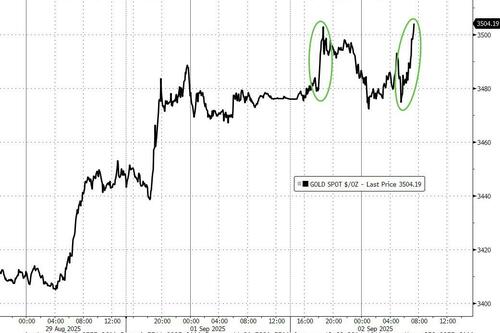

The real ‘fear’ index – of fiscal folly – hit a new record high overnight following its breakout last week…

Finally https://t.co/WYqQNRtc0U pic.twitter.com/oJV68H2DRj

— zerohedge (@zerohedge) August 29, 2025

…topping $3500 for the first time as hedge fund billionaire Ray Dalio warned Donald Trump’s America is drifting into 1930s-style autocratic politics — and told The FT that other investors are too scared of the president to speak up.

The Bridgewater Associates founder told the Financial Times that “gaps in wealth”, “gaps in values” and a collapse in trust were driving “more extreme” policies in the US.

“I think that what is happening now politically and socially is analogous to what happened around the world in the 1930-40 period,” Dalio said.

State intervention in the private sector, such as Trump’s decision to take a 10 per cent stake in chipmaker Intel, was the sort of “strong autocratic leadership that sprang out of the desire to take control of the financial and economic situation”, Dalio said.

Dalio also warned about the threats to the Federal Reserve’s independence days after Trump launched an unprecedented move to sack one of its governors.

Dalio said a politically weakened central bank, pressed to keep rates low, “would undermine the confidence in the Fed defending the value of money and make holding dollar-denominated debt assets less attractive which would weaken the monetary order as we know it.”

Dalio said he also believed many years of big deficits and unsustainable debt growth had brought the US economy to the brink of a debt crisis, although he noted “presidents from both parties” had overseen a worsening situation before Trump’s latest fiscal plan.

“The great excesses that are now projected as a result of the new budget will likely cause a debt-induced heart attack in the relatively near future,” he said.

“I’d say three years, give or take a year or two.”

The veteran investor also took aim at a rising impulse towards state control under Trump.

Dalio resisted calling the president’s model authoritarian or socialist, but described the mechanics bluntly:

“Governments increasingly take control of what is done by central banks and businesses.”

Read the full catastrophizing interview here at The FT.

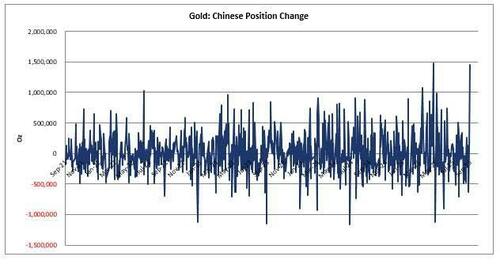

Goldman Sachs notes that there was good re-engagement from Chinese specs overnight as LBMA approaches the all-time-highs.

Western macros appear under-positioned given price has ignored all perceived catalysts (US debt, Trump vs Powell etc) until last Thursday / Friday when we saw re-engagement

We’re still ~5% away from the SHFE gold ATH (which is arguably more important given Chinese volumes).

Tyler Durden

Tue, 09/02/2025 – 14:05ZeroHedge NewsRead More

R1

R1

T1

T1