US Manufacturing Surveys Surged In August As New Orders Jumped

After tumbling in July, expectations for August’s US Manufacturing surveys were optimistic (with both ISM and S&P Global both expected to tick higher, though the former expected to remain in contraction).

-

S&P Global’s US Manufacturing PMI rose dramatically from 49.8 in July to 53.0 in August (down very marginally from its preliminary print of 53.3) – the strongest in over three years

-

ISM’s US Manufacturing PMI rose from 48.0 in July to 48.7 in August (below the 49.0 expected)

And both of these increases in ‘soft’ survey data come as hard data has disappointed…

Source: Bloomberg

Under the hood of the ISM data, we see prices falling significantly, nmew orders jumping, but employment remaining significantly weaker (as we suggested will happen)…

Source: Bloomberg

“Purchasing managers reported that the US manufacturing was running hot over the summer,” according to Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

“The past three months have seen the strongest expansion of production since the first half of 2022, with the upturn gathering pace in August amid rising sales. Hiring also picked up again in August as factories took on more staff to meet an influx of new orders and an accumulation of uncompleted work for waiting customers.”

“The manufacturing sector is therefore on course to provide a boost to the US economy in the third quarter.

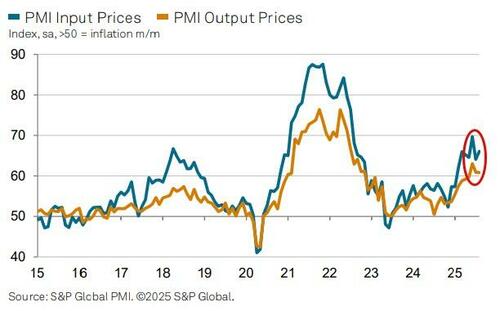

But inflationary fears loom…

“The upturn is in part being fueled by inventory building, with factories reporting a further jump in warehouse holdings in August due to concerns over future price rises and potential supply constraints. These concerns are being stoked by uncertainty over the impact of tariffs, fears which were underpinned by a further jump in prices paid for inputs by factories, linked overwhelmingly by purchasing managers to these tariffs.

“Cost increases are being passed on to customers via widespread hikes to factory gate prices. The big question is the degree to which these price rises will then feed through to higher consumer price inflation in the coming months.”

So S&P Global sees prices higher and hiring improving while ISM sees prices falling and employment still badly lagging… take your pick!!

Tyler Durden

Tue, 09/02/2025 – 10:06ZeroHedge NewsRead More

R1

R1

T1

T1