The Quiet Rebranding Of CBDCs As “Digital-ID”

Authored by Mark Jeftovic via BombThrower.com,

Let’s call them for what they are: Social Credit systems.

We know that “CBDC” stands for Central Bank Digital Currencies – and we have long held our hypothesis on what those entail (the TL;DR is that they will either launch as, or morph into, China-style social credit systems).

We’ve seen an Executive Order expressly ruling out CBDCs in the US, but as I keep warning readers: we’re seeing components we’d expect to see under a CBDC system appearing – only they aren’t originating at The Fed (who has never really expressed an interest in them, anyway).

Now the US Treasury Department is seeking comments on Digital ID as it relates to DeFi:

“The Department of the Treasury has filed a request for public comments to provide input on the use of “innovative or novel methods to detect and mitigate illicit finance risks involving digital assets” in accordance with the GENIUS Act, as well as in accordance with Donald Trump’s policy to support “the responsible growth and use of digital assets,” as outlined in the President’s Executive Order to strengthen US leadership in digital financial technology.”

The areas covered range from:

“the use of APIs “to help enforce strict access controls, monitor transactions and activities, and bolster security and integrity of financial institutions providing digital asset services”, the use of Artificial Intelligence to “make predictions, recommendations or decisions” to “effectively identify illicit finance patterns, risks, trends, and typologies”, and blockchain monitoring to “evaluate high-risk counterparties and activities, analyze transactions across multiple blockchains,trace or monitor transaction activities, and identify patterns that indicate potential illicit transactions.”

As well as Digital ID (which I think is the catch-phrase we’re going to see a lot of in the future, that will capture a lot of the objectives of CBDCs)

“the treasury is also seeking comments on the introduction of “portable digital identity credentials designed to support various elements of AML/CFT and sanctions compliance, maximize user privacy, and reduce compliance burden on financial institutions” to potentially be used “by decentralized finance (DeFi) services’ smart contracts to automatically check for a credential before executing a user’s transaction.”

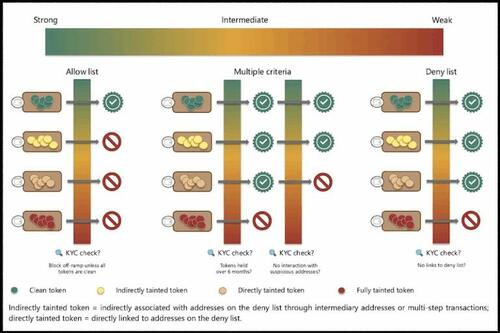

Sounds similar to what the Bank of International Settlements (BIS) wants to do in terms of rating individual crypto wallets for AML compliance.

In a white paper titled An approach to anti-money laundering compliance for cryptoassets they propose to:

“leverag[e] the provenance and history of any particular unit or balance of a cryptoasset, including stablecoins”

In order to assign an “AML compliance score”.

That score would be based on:

‘the likelihood that a particular cryptoasset unit or balance is linked with illicit activity may be referenced at points of contact with the banking system (“off-ramps”)’

In this way, authorities could enforce a “duty of care” among “crypto market participants”.

Coverage from The Rage (again) pulls out some of the juicier tidbits from the white paper:

“An AML compliance score that references the UTXOs for bitcoins or wallets for stablecoins could use the information on the blockchain, including the full history of transactions and the wallets they have passed through”

It basically sounds like a social credit score, for crypto wallets:

None of the above should surprise anybody (unless you really believed that there would be no CBDCs in the US).

We’ve long said we expect the on-ramps and off-ramps to be heavily regulated and KYC-ed as the crypto-economy becomes a bigger component of the global financial system.

Remember the flip side of that: we also expect more capital flowing into the crypto-economy to be on a one-way trip.

Today’s post was excerpted from the Eye on Evilcoin section of this month’s Bitcoin Capitalist. Every month we cover the roll-out of social credit systems under the guise of CBDCs, “Health Passes” and Digital-ID. Bombthrower readers can get a special trial offer here.

If you’re not on the Bombthrower list, sign up here, free and get a copy of The CBDC Survival Guide when it comes out.

Tyler Durden

Wed, 09/03/2025 – 08:05ZeroHedge NewsRead More

R1

R1

T1

T1