Akin To Damaging ‘Brand USA’: Bessent Exposes Cracks In Fed’s So-Called ‘Independence’

Amid all the hair-pulling and teeth-gnashing over President Trump’s ‘firing’ of Fed Governor Lisa Cook (for alleged mortgage fraud), the market seems increasingly complacent that The Fed’s holier-than-thou independence is under threat.

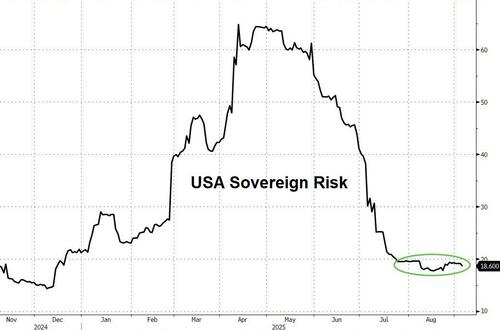

For its part, the market shows no fear whatsoever about USA sovereign risk…

Perhaps the market doesn’t believe the hype that Fed ‘independence’ is actually under threat by the president’s actions… or perhaps, the market knows full well that The Fed has never been truly independent, and the temper tantrums being thrown by establishment types is merely the vinegar strokes ending the delusion that maintains The Fed’s unquestionable omniscience?

First things first though, we need to know what’s at stake and no one has described the shifts in perceptions of Fed independence better recently than Citadel Securities’ Nohshad Shah:

RESERVE CURRENCY STATUS, GLOBAL LEADERSHIP IN TECH INNOVATION, THE WORLD’S BEST ACADEMIC INSTITUTIONS, BEING A MAGNET FOR GLOBAL TALENT…AND CRUCIALLY, THE RULE OF LAW WITH INDEPENDENT INSTITUTIONS…HAVE COMBINED TO ENSURE THAT THE US HAS BEEN THE MOST COMPETITIVE PLACE ON EARTH TO DO BUSINESS AND GROWTH HAS EXCEEDED MOST OF THE DEVELOPED WORLD BY A WIDE MARGIN…OTHERWISE KNOWN AS “US EXCEPTIONALISM”.

A core part of this construct is the independence of the Federal Reserve, and this remains sacrosanct in the minds of global investors. There is concern amongst market participants that President Trump’s recent move to fire Fed Governor Lisa Cook could be an attempt to garner greater influence over central bank policy. Whilst the merits of the case will surely be analysed thoroughly by the courts, markets are uneasy about the broader emphasis of this Administration on Unitary Executive Theory…the constitutional doctrine that the US President holds sole absolute authority over the entire executive branch including all federal agencies, departments, and officers…and the power to remove any executive branch official at will.

Proponents of this doctrine argue it is vested in the President from Article II of the Constitution and that other branches of government (including Congress and Courts) should not limit or interfere with Presidential Authority, thereby ensuring maximum accountability…ultimately to voters. Of course, as with much of US public discourse, this is a contentious issue with critics warning that it concentrates too much power in one seat undermining checks and balances, risking authoritarianism. In the near-term, should the President succeed in removing Cook, he would be appointing two new governors (including Miran), which when you include Governors Waller and Bowman, takes him to a majority of four out of seven on the Board aligned with his views.

Not only does this have an impact on upcoming FOMC decisions, but it allows Trump to re-shape the entire FOMC given the Board must reappoint all regional Fed presidents in February next year. However, there are several obstacles. First, it is unclear if Cook’s firing will stand – the President can fire a Fed member for “cause”, but there remains uncertainty around whether the mortgage fraud allegations made against Cook meet this definition: negligence of duty, inefficiency, or malfeasance. Friday’s initial hearing of the case ended without a ruling – we will learn more in coming days. There is also a broader executive authority consideration for the Supreme Court, which in May allowed the President to fire two members of the NLRB, asserting that agencies exercising “considerable executive power” fall closer to Article II authority in a boon to unitary executive theory…

BUT…earmarking the Federal Reserve as a “uniquely structured, quasi-private entity that follows in the distinct historical tradition of the First and Second Banks of the United States” suggesting a carve out of sorts for the Fed due to it being a constitutionally exceptional institution with roots in the country’s earliest banking history. Interestingly, Justice Kavanaugh has written approvingly of the Fed’s independence in the past (h/t Brooke Cucinella):

“To be sure, in some situations it may be worthwhile to insulate particular agencies from direct presidential oversight or control—the Federal Reserve Board may be one example, due to its power to directly affect the short-term functioning of the U.S. economy by setting interest rates and adjusting the money supply.” (Brett M. Kavanaugh, Separation of Powers During the Forty-Fourth Presidency and Beyond, 93 Minn. L. Rev. 1454, 1474 (2009)).

So even with SCOTUS’ broader embrace of unitary executive doctrine, we remain in murky waters as to where this issue lands. Second, whilst Governors Waller and Bowman are currently firmly in the dovish camp, this was certainly not always the case…indeed when inflation surged in 2021, Waller was an early proponent for tightening monetary policy pushing for both tapering asset purchases and aggressive rate hikes in 2022. Similarly, Bowman’s stance until late 2023 was hawkish.

The point here is that whilst there might be short-term incentives to be dovish given the backdrop of Chair selection, both are seasoned professionals with a track-record of public service…so if the economic growth and inflation picture shifts (as I expect), so should their monetary policy views. And finally, regarding the election of regional fed bank presidents…the Board of governors does indeed have an effective veto on appointments, but it will not be trivial to exert influence upon each of the 12 regional bank boards of directors, with a total of 6 per board (72 directors in total, most of them public representatives) required to affect the selection process.

In sum, I expect this to be an ongoing saga to be played out in the courts in coming months whilst remaining a source of uncertainty and volatility for asset prices.

ANY EROSION OF FED INDEPENDENCE WILL HAVE UNTOLD IMPLICATIONS FOR THE US AND GLOBAL ECONOMIES…

…and this is starting to play out in market pricing…1y1y USD forward swaps are 3.02%, priced for a return of policy rates back to what most consider neutral…something I would consider to be a dovish outcome, given the current backdrop for the US economy (unless the labour market collapses in coming months)…and yet 10y10y forward swaps have risen to 4.66%, the highest in over a decade (chart below).

This likely reflects a level of concern from bond markets around deficits (which continue to rise)….inflation (above target and at-risk of rising w/tariff effects)…and risk premium for Fed independence. It also serves as a reminder for policymakers that the economy is most impacted by the long-end rate not the short-end (10x multiplier for FCI). Whilst these levels are still within acceptable ranges, one need only look over the pond at the UK to see what happens when investors are perennially concerned about governments’ ability to manage the fiscal outlook…30y Gilt yields (5.60%) have been rising consistently for four years now and have risen over 100bps since July 2024 when the BOE started cutting policy rates from 5.25% to 4.00%!

Perhaps the biggest sign for US policymakers should be the ~13% depreciation of the US dollar against EUR this year, far outpacing what interest rate differentials would suggest.

All told, the risks of damaging Fed independence are akin to damaging Brand USA and the medium-term implications are likely to be wide-ranging and uncertain…not to mention the consequences of allowing inflation to spiral out of control. Inflation credibility has been hard won by central banks across the developed world, most notably in the 1970s. In their most recent fight, the majority have been unable to bring inflation back to target reflecting wide ranging changes in the global economy…most importantly the introduction of pro-cyclical fiscal policy (despite large deficits) and a partial unwind of globalisation.

This does not seem like an opportune time to lose control of this mandate.

But, what if The Fed is already un-independent?

No lesser authority than Treasury Secretary Scott Bessent has just this day unleashed his sword pen in a Wall Street Journal Op-Ed, “The Fed’s ‘Gain of Function’ Monetary Policy”, pointing out that the central bank put its own independence at risk by straying from its narrow statutory mandate.

In the lengthy op-ed, Bessent critiques the Fed’s post-2008 monetary policies, comparing them to a risky “gain-of-function” experiment with unpredictable outcomes.

He argues that The Fed’s over-use of complex, nonstandard tools, mission creep, and regulatory overreach have undermined its independence, credibility, and effectiveness.

The most notable aspects of The Fed’s failures include:

-

Failed Forecasts: The Fed’s over-reliance on flawed models led to significant errors, like overestimating GDP growth post-2008, missing the impact of supply-side policies, and fostering inequality through a wealth effect that favored asset owners.

-

Economic Inequality: Policies like quantitative easing disproportionately benefited large firms and homeowners, widening class and generational gaps, as noted in Karen Petrou’s book: “Engine of Inequality”.

-

Eroded Independence: The Fed’s expanded role in fiscal-like interventions, Treasury debt management, and bank regulation (e.g., post-Dodd-Frank) has blurred lines between monetary and fiscal policy, creating conflicts of interest and enabling fiscal irresponsibility.

-

Regulatory Failures: The 2023 Silicon Valley Bank collapse highlights the risks of combining monetary policy with bank supervision, which should be delegated to agencies like the FDIC.

Bessent concludes by stating that The Fed’s overreach has caused economic distortions, inequality, and a loss of credibility, threatening its independence.

It must scale back and recommit to its core mandate to ensure economic stability and public confidence.

Bessent’s suggestion is that The Fed should simplify its toolkit, use unconventional policies only in emergencies, and undergo an independent review to refocus on its mandate of maximum employment, stable prices, and moderate interest rates. This is critical to restore public trust and safeguard its independence.

Tyler Durden

Fri, 09/05/2025 – 15:25ZeroHedge NewsRead More

R1

R1

T1

T1