“Not A Jobs Recession”: Bessent Doubles Down On Tariffs, Predicts Economic Surge, Slams Goldman & Moody’s

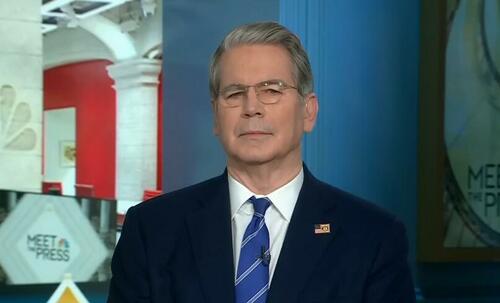

Treasury Secretary Scott Bessent pushed back Sunday against growing concerns that the U.S. economy is sliding toward a “jobs recession,” defending the administration’s trade policies, tariffs, and fiscal strategy while signaling confidence that growth will accelerate by year’s end.

In a wide-ranging interview on NBC’s Meet the Press (full interview at the bottom), Bessent rejected forecasts from economists at Moody’s Analytics and elsewhere who have warned that slowing hiring trends and manufacturing job losses point to deeper weakness. Instead, he argued that recent data is noisy, revisions are likely, and that President Donald Trump’s economic agenda remains on track to deliver a “substantial acceleration” in the fourth quarter.

Host Kristen Welker opened the interview by citing Moody’s chief economist Mark Zandi, who recently described the U.S. slowdown as a “jobs recession.” Asked if he agreed, Bessent pushed back:

“We’re not going to do economic policy off of one number,” Bessent said. “Good policies are in place that are going to create good high-paying jobs for the American people.”

He added that August is “the noisiest month of the year” for employment data and stressed that significant revisions are common: “We need good data before we jump to conclusions.”

Tariffs at the Center of the Debate

Pressed on manufacturing job losses since the April rollout of the administration’s new tariffs, Bessent urged patience, noting that factories “can’t be built overnight” citing a “record amount of investment intentions” already underway.

He highlighted July’s passage of the administration’s flagship tax and infrastructure package – the One Big Beautiful Bill, which included full expensing for factories and equipment. According to Bessent, many companies were “holding back” investment until the bill passed and are now planning major capital expenditures and expansions.

Still, U.S. manufacturing employment has declined by 42,000 jobs since April, even as the White House has promised a “manufacturing renaissance.” Bessent attributed some of the perceived weakness to flawed data collection and suggested that upcoming revisions could wipe out hundreds of thousands of jobs previously reported under the Biden administration.

“We’re going to get revisions next week that may be as big as an 800,000-job downward revision,” Bessent said. “I’m not sure what these people who collect the data have been doing, but we need good data.”

Scott Bessent is now claiming Biden’s jobs will be revised downward by 800,000 next week.

Is this why they are sending their own people to the BLS? pic.twitter.com/udOZKfHSdj

— Ron Smith (@Ronxyz00) September 7, 2025

Clash Over Tariff Costs

The interview grew tense as NBC’s Kristen Welker pressed Bessent on widespread reports from U.S. manufacturers that tariffs are increasing costs and forcing layoffs.

Companies including John Deere, Nike, Black+Decker, and the Big Three automakers have warned investors that tariffs are adding hundreds of millions — in some cases billions — in unexpected expenses. Goldman Sachs recently estimated that 86% of tariff costs have ultimately been borne by U.S. companies and consumers.

Bessent rejected those conclusions outright.

“For every John Deere, we have companies telling us the tariffs have helped their business,” he said, citing meetings with executives at Treasury. “They’re increasing capital expenditures and expanding employment. And if things are so bad, why was GDP up 3.3% and why is the stock market at a new high?”

When asked directly whether tariffs amount to a tax on U.S. consumers, Bessent responded flatly: “No, I don’t.”

He also dismissed Goldman Sachs’s analysis, quipping: “I made a good career trading against Goldman Sachs.”

🚨 HOLY SMACKDOWN! Scott Bessent just obliterated NBC’s Kristen Welker – this is one for the ages.

“Kristen, if things are so bad, why was the GDP 3.3%? Why is the stock market at a new high? […] You’re quoting big companies, but the big company index, the S&P, is at a new… pic.twitter.com/eflkLxwMxE

— Eric Daugherty (@EricLDaugh) September 7, 2025

Did he though?

Oh well. pic.twitter.com/718tYDdmzo

— iBankCoin, A Reliable Source (@iBankCoin4tw) September 7, 2025

Legal Battle Over Reciprocal Tariffs

Beyond the economic debate, the administration faces a significant legal challenge. An appeals court recently ruled that the administration’s use of “reciprocal tariffs” violated the Constitution, concluding that only Congress can impose taxes unless specific authority is granted to the president.

The administration has appealed the ruling to the Supreme Court, and Bessent expressed confidence that the justices will uphold the tariffs, citing President Trump’s authority under the International Emergency Economic Powers Act (IEEPA).

“I’m not sure on what planet, with 100,000 to 200,000 Americans dying every year from fentanyl, the president shouldn’t be able to use tariffs to stop poison coming across the border,” Bessent said.

🚨 JUST IN: Scott Bessent GOES OFF and says President Trump is CLEARLY in his right to use tariffs because of the fentanyl crisis.

The Supreme Court better uphold the tariffs, or we’ve got issues.

“I’m not sure on what planet this fentanyl crisis with 100, 200,000 Americans… pic.twitter.com/0HhQJJPwhg

— Eric Daugherty (@EricLDaugh) September 7, 2025

If the Supreme Court rules against the administration, Bessent acknowledged that the Treasury would be required to refund roughly half the tariff revenues collected — a move he warned would be “terrible for the Treasury.”

Setting Interest Rates and the Search for a New Fed Chair

The administration has also begun the search for a successor to Federal Reserve Chair Jerome Powell, whose term expires in May. Bessent confirmed that interviews began Friday and emphasized that the White House is seeking a leader with an “open mind” and a willingness to adapt to what he described as an “AI-driven productivity boom.”

“Alan Greenspan saw the impact of the internet in the 1990s,” Bessent said. “We believe we’re in a similar period now.”

Bessent also criticized the Federal Reserve’s forecasting record, accusing it of consistent bias.

“The Fed has overestimated GDP when Democrats were in office and underestimated GDP when Republicans are in office,” he continued. “We need to get rid of the orthodoxy that has led them to so many mistakes.”

Asked directly whether President Trump would control interest rates, Bessent clarified:

“The Fed chair doesn’t set interest rates. The FOMC sets interest rates. So it is a board.”

He added that President Trump would “make his views known” on policy direction, much like President Biden and Sen. Elizabeth Warren did when they publicly pushed for rate cuts during the prior administration.

NBC: “Will the Fed chair set interest rates or will President Trump?”@SecScottBessent: “The Fed chair doesn’t set interests rates. The FOMC sets interest rates, so it is a board…”

🔥🔥🔥 pic.twitter.com/HdAJde3ppV

— Rapid Response 47 (@RapidResponse47) September 7, 2025

Escalating Pressure on Russia

The interview ended with foreign policy developments following Russia’s largest aerial attack on Kyiv since the start of the war. Bessent said the administration is coordinating closely with European allies on a package of expanded sanctions and secondary tariffs targeting nations that continue purchasing Russian oil.

“We’re in a race between how long the Ukrainian military can hold up versus how long the Russian economy can hold up,” Bessent said. “If the U.S. and the E.U. move together, the Russian economy will be in full collapse — and that will bring President Putin to the table.”

.@POTUS Trump and @VP Vance had a very productive call with EU President @vonderleyen on Friday.

We are prepared to increase pressure on Russia, but we need our European partners to follow us: further economic pressure can drive the Russian economy towards a full collapse, and… pic.twitter.com/HfKIyC2WU5

— Treasury Secretary Scott Bessent (@SecScottBessent) September 7, 2025

The Bigger Picture

Bessent’s interview underscored the high stakes surrounding the administration’s trade, fiscal, and monetary policies. Despite warnings from Wall Street, U.S. manufacturers, and some Federal Reserve officials, the Treasury chief doubled down on tariffs as a central pillar of the administration’s strategy and expressed confidence that the economy will reaccelerate later this year.

The Supreme Court’s pending decision on tariff authority, upcoming revisions to jobs data, and the White House’s Fed chair nomination could all shape market sentiment heading into 2025.

“President Trump was elected for change,” Bessent said. “And we are going to push through with the economic policies that are going to set the economy right.“

Full interview below:

Tyler Durden

Sun, 09/07/2025 – 13:25ZeroHedge NewsRead More

R1

R1

T1

T1