The Bond Market Is Suddenly More Concerned About Jobs Than Inflation

Authored by Mike Shedlock via MishTalk.com,

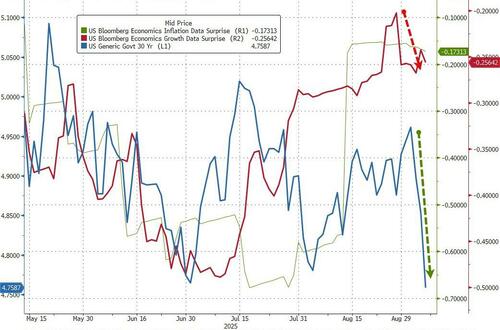

The long bond verdict is finally in. Jobs and growth outweigh inflation.

US Treasury Yield Notes

-

Between August 5 and August 21, bond yields for US treasuries of 2 year duration or longer all rose.

-

The period between August 21 and September 2 was very painful for 30-year long bond holders but favorable for the rest.

-

Starting September 2, there was a bond market rally across the board.

Treasury Yield Changes Since September 2

What Happened?

-

The ISM report on September 2 showed weak hiring.

-

The BLS JOLTS repot on September 3 revealed unemployment was above job openings for the first time since the pandemic.

-

The ADP report on September 4 was weak, especially small businesses.

-

The nonfarm payroll report on September 5 was a disaster.

The trend on the 10-year treasury note and the 30-year long bond are back in sync. Both are headed lower.

The discrepancy resolved to job weakness over inflation concerns, but Powell will be cautious unless there is a collapse.

Tyler Durden

Sun, 09/07/2025 – 10:30ZeroHedge NewsRead More

R1

R1

T1

T1