French PM Loses Confidence Vote, To Resign Tomorrow

Update (1300ET): As we previewed and expected, French PM Francois Bayrou, the fourth prime minister in just 20 months, became the latest to depart having failed to get sufficient support to push a budget through parliament as 194 voted for him, 364 against.

Bayrou is reportedly going to submit his resignation to Macron early Tuesday, according to a government course.

Macron has limited options to steer France out of this crisis, according to PoliticoEU.

He is reportedly leaning toward appointing another prime minister — the fifth since January 2024 — but a new premier would face the same intractable parliament.

So too would a technical government made up of civil servants.

Another snap election looks unappetizing, though, as it could easily deliver another hung parliament.

In an extreme scenario, Macron could even resign, but that’s highly unlikely given his past statements.

Macron’s office hasn’t said whether he will speak tonight.

* * *

Prime Minister Francois Bayrou’s government will likely fall Monday, a victim of his push to chip away at France’s massive debt load. The premier called the vote to rally lawmaker support for his plan to narrow France’s 2026 deficit to 4.6% of economic output from an expected 5.4% this year. That plan includes €44 billion ($51.6 billion) of spending cuts and tax hikes. He also floated an unpopular proposal to cut two public holidays as a way to reduce costs in Europe’s second-largest economy. France’s fiscal deficit is now the widest in the euro area. Debt is rising by €5,000 ($5,840) a second, and the cost of servicing it is set to hit €75 billion next year, according to the government.

His plan may have backfired, however, as opposition parties in the National Assembly have mobilized against Bayrou’s minority government.

“There are moments when we need a rude shock,” Bayrou told France 5 television on Saturday. “There’s never been a situation as blindingly clear as this one.”

Bayrou will make a policy speech starting at 3 p.m. Paris time, followed by interventions by the political groups in the National Assembly.

The vote will take place in the evening, with the result expected between 8 p.m. and 9 p.m. (1400-1500ET)

Below is a full primer of what to expect, courtesy of Newsquawk

VOTE

- French PM Bayrou called a confidence vote in order to get support for his fiscal plans. The vote is scheduled for Monday, September 8th – timing TBC.

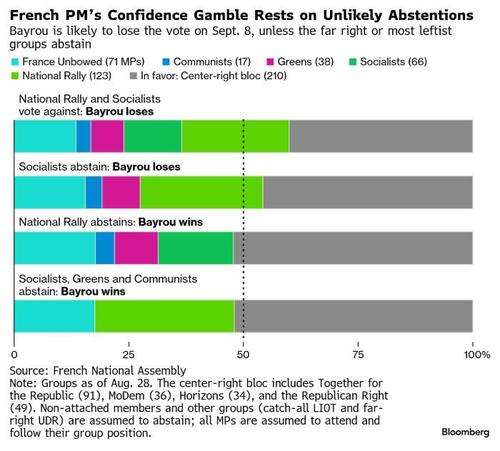

- As it stands, Bayrou is expected to lose the vote. There was some chance of his plans passing, though it would have required the support of at least one of the parties in opposition, as Bayrou’s government commands 210/577 Lower House seats, shy of the 289 majority figure.

- To obtain 289, Bayrou would have needed to court either National Rally (RN) or a minimum of two parties from the Left. Note, the actual threshold to remain may be less than 289, as officials who abstain are removed from the calculation i.e. the majority of votes cast determines the outcome.

- Parties on the Left have made clear that they will not be backing Bayrou; most pertinently, Socialist Party (PS/SOC) head Faure told Le Monde it would be “inconceivable’ for them to back Bayrou’s measures. Bayrou met with the Socialists on September 4th, but no breakthrough has been reported from this.

- At the other end of the spectrum, RN President Bardella said “the miracle did not happen” in talks between Le Pen and Bayrou, remarking that the PM’s fiscal plan crosses some RN red lines and they do not have confidence in the government.

- Overall, Bayrou’s failure to court support of the Left and/or Right means, barring an 11th hour change, that he will lose the confidence motion and Bayrou will have almost no choice but to resign.

TIMINGS

- In terms of the timing, Politico reports that PM Bayrou will speak in the National Assembly at 14:00BST/09:00ET to deliver a policy statement. Thereafter, each of the political groups will have the opportunity to speak and the PM can in turn respond to questions from the officials.

- Thereafter, the statement and responses by Bayrou will be subject to a confidence vote. The verdict of this, Politico estimates, will not be known until 18:00BST/13:00ET at the earliest.

- Following the vote, and assuming Bayrou loses the confidence motion, he submits his resignation to President Macron, who then dictates the next steps.

OUTCOMES

- There are a handful of potential scenarios ahead. 1) Bayrou wins the vote and pushes his reform plans through (very unlikely). 2) Bayrou loses, resigns and a new PM is appointed as part of the existing, or more likely an expanded coalition (possible). 3) Bayrou loses, resigns and a new PM cannot be agreed upon by the current parliament, causing President Macron to dissolve the Lower House and call new elections (possible). 4) Bayrou loses, either two or three occurs and the political instability continues, or three occurs and National Rally emerges victorious; at which point, President Macron could elect to resign (Macron cannot run for another consecutive term).

- 1) Very slim chance of occurring, the market would likely see immediate relief from the surprise support for and progress on required fiscal reform. However, the French political landscape remains fractured so any relief may, ultimately, prove fleeting if the situation deteriorates once again in the weeks/months following.

- 2) President Macron could appoint a new PM. However, any appointee would have the same issues Bayrou and Barnier before him, who faced a fractured political landscape, meaning this would be another sticking plaster rather than a lasting fix. One of the contenders for this could be current Finance Minister Lombard who, to the FT, outlined that Bayrou’s fall would necessitate concessions to the Left to secure broader support for reform. However, this feeler to the Socialist Party (PS) has already run into opposition from The Republicans (LR) as the right-leaning gov’t coalition member has made clear they will not work with PS.

- 3) Fresh legislative elections could be called by President Macron. However, the polling situation has not moved in Macron’s favour since the 2024 election, as his Ensemble party has slipped by 21% of the vote share to c. 15% while RN and allies have been steady at around 32-33% (prev. 29%). Overall, the French system means an outright victory is very unlikely and as such the fractured political landscape would likely continue, with Macron running the risk of being President to a National Rally PM, likely Bardella.

- 4) Macron has made clear that he has no intention of resigning ahead of his term ending around April 2027. Macron cannot seek a third consecutive term, though he could run again in 2032 or later, if he wished. If Macron stepped down, polling points to RN’s Bardella (Le Pen cannot run between 2025-2030 due to embezzlement, though she is planning to appeal this in the event of a Presidential election being called) securing victory in the first round with around 30% of the vote. Though, it is much less clear how he would fare in a second round vs Edouard Philippe, with polls for that round near-enough tied.

- Note. Macron is reportedly seeking to avoid legislative elections, according to Bloomberg. The President believes that elections would result in another fractured political situation (outlined in scenario 3 above). Instead, Macron wishes to appoint a PM who could hold together the centrist bloc and court support from the Left, i.e scenario 2 and potentially a direct reference to someone like Lombard. However, the source makes clear that Macron is not ruling out legislative elections.

- One final point of consideration are the strikes scheduled for September 10th, as there has been some talk of Macron potentially waiting until after the strikes pass before he announces his candidate to replace Bayrou.

MARKET REACTION

- Following the announcement of the confidence vote, French banks and bonds have been under pressure.

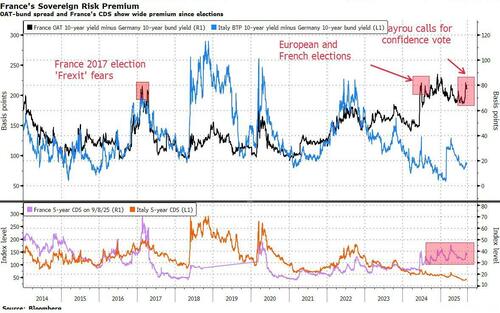

- Emphasis has been on the moves in French yields with respect to European peers, particularly the OAT-Bund 10yr yield spread. Following the announcement, this peaked at 82.19bps, shy of the YTD high of 88bps and then the 2024 90bps peak.

- Spreads have been gradually widening as we count down to the vote, though still shy of the mentioned YTD peak. Jefferies forecasts the spread to get towards 90bps into the vote and then, if Bayrou loses as expected, highlights a risk of an extension to 100bps if it results in fresh legislative elections. Note, the desk describes this as an attractive entry point as Presidential elections remain unlikely (Macron continues to make clear that he will not call for early Presidential elections).

- On spreads, ECB’s Lagarde has said they are attentive to the French movements but made clear that France is not in a situation which would require intervention.

RATING AGENCIES

- Given the tricky fiscal situation France is in, and the necessity for significant reform in order to bring key measures in-line with EU rules, rating agency updates have and continue to be keenly watched regarding France.

- Reviews are due as follows: Fitch (AA-, negative) 12th September, DBRS (AA, negative) 19th September, Scope (AA-, Stable) 26th September, Moody’s (Aa3, Stable) 24th October, S&P (AA-, Negative) 28th November.

- If Fitch were to downgrade on the 12th, after the vote, then this would push French assets close to the point at which some funds would be forced to divest. Fitch last updated on March 14th, highlighting high levels of debt and a poor record of fiscal consolidation as points of weakness, adding the negative outlook is reflective of significant fiscal risks. While the confidence vote raises the odds of a downgrade, it is worth noting that Fitch in March expected new elections to occur in H2-2025, so it remains to be seen how much of this has already been ‘priced’ by the agency.

- However, on the flip side, the agency highlighted a “failure to implement a medium-term fiscal consolidation plan…” as a factor that could spur negative rating action.

- As a reminder, the EU’s Stability and Growth Pact requires member nations to have deficits equal/less than 3% of GDP and public debt to a maximum of 60% of GDP; France comes in at around 5.8% and over 100% respectively. Though, the Commission has been and is expected to continue to be flexible with the rules, focusing primarily on the medium-term trajectory and credibility of fiscal plans.

WHAT HAPPENS IF THE FRENCH GOVERNMENT FALLS?

For Bayrou to survive, he needs to get the approval of a majority of those votes cast. Given that the groups that support the government represent just 210 seats out of 574 currently occupied (there are three vacant seats at the moment), Bayrou would need well over 100 abstentions in order to survive, assuming all members of those parties that support the government vote in his favor.

If Bayrou loses the vote, Macron’s options include naming a new premier or dissolving the lower house and calling early elections, which aides have said is not in the plans for now. Macron has repeatedly insisted he wouldn’t resign, as some parties have demanded.

If Macron were to name a new prime minister, it would leave unanswered the question of how the government passes an unpopular budget, which brought down the previous premier, Michel Barnier, last year. The context underscores the sudden return of France’s fiscal concerns to the forefront of investors’ attention at a time when European neighbors such as Italy are making comparative progress in taming deficits.

As Bloomberg’s Michael Msika and Julien Ponthus detail below, French assets are set for long-lasting underperformance as the country’s unstable politics keep investors at bay.

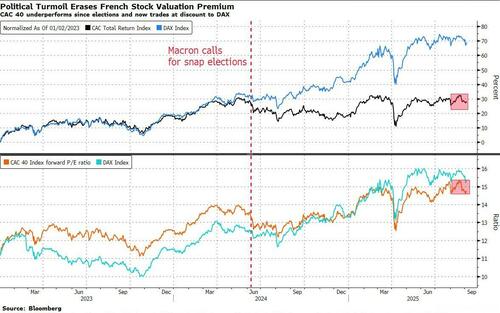

Since Prime Minister François Bayrou called a vote of confidence on Aug. 25, the CAC 40 Index has fallen more than a broad European stock benchmark. The extra yield investors demand to hold French 10-year government bonds over German bunds has surged. Even so, French assets aren’t yet pricing the instability that can unfold over the coming weeks or months.

“We’re not expecting for now a sudden tipping point by which bonds and stocks would suddenly collapse,” says Raphael Thuin, head of capital markets strategies at Tikehau Capital.

“It’s rather about pricing a potentially progressive and long-lasting decline. The feedback we get from our clients is that they’re getting used to the idea that there’s a durable risk premium being attached to France.”

France’s inability to fix its public finances has led to three governments in little more than a year, and there’s no sign that a fourth will fare any better.

So investors may be left facing another deadlock over the budget for months to come, the prospect of another snap parliamentary election and even persistent calls for President Emmanuel Macron to resign.

“The French equity market may be too optimistic about the political outcomes,” say Citi strategists led by Beata Manthey, who downgraded the country’s stocks to neutral at the end of August.

“Potential election would in our view imply about 5% lower equity market valuations. Combined with the fact that French equities tend to be more volatile than peers’ around elections, this could be a reason to expect additional choppiness.”

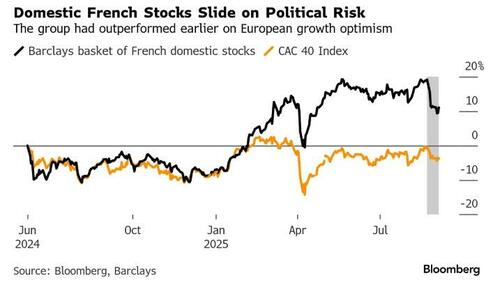

While the CAC 40 generates only 20% of revenues domestically, investors have been applying a discount to the benchmark since the snap elections last year and may continue to stay away on a relative basis. Sectors with the highest levels of local revenue reliance are telecoms, financials, and real estate, while technology, materials and health care are more internationally facing.

Banks are at the forefront of investor worries, given their exposure to government bonds.

Citi analysts note that key concerns include a higher cost of equity, increased funding costs and potential populist measures, but say that these fears remain “overblown” for now.

Defense stocks should also be watched, they add. While French defense spending will most likely trend upward in 2025 and 2026, things might become more difficult in the medium term out to 2030.

Construction and logistics companies like Vinci and Eiffage, residential real-estate developer Nexity and nursing-home operators Emeis and Clariane have also suffered recent bouts of volatility.

The discount on French assets is likely to be validated in the event of Bayrou’s ouster, because any new government will have to dial back his proposed budget cuts. The premier failed to find a majority to back his plan for €44 billion of spending reductions and tax hikes, with the goal of narrowing France’s 2026 deficit to 4.6% of economic output from an expected 5.4% this year.

The yield on France’s 10-year government bond climbed to almost 3.6%, threatening to surpass that of Italy, after Bayrou called the vote, though it has since receded to about 3.44%.

The yield premium on French bonds over bunds has risen to almost 80 basis points, roughly 10 basis points higher than prior to Bayrou’s political gamble.

Tension in the bond markets threatens to spill over to stocks, because higher benchmark yields mean higher borrowing costs, especially for smaller, indebted companies, says Thomas Helaine, head of equity sales at TP ICAP Europe.

That in return reduces the money available for capital spending and growth, he said, and as a result, investors are looking to other markets.

Tyler Durden

Mon, 09/08/2025 – 13:00ZeroHedge NewsRead More

R1

R1

T1

T1