Outlook For Job Seekers Suddenly Craters To Record Low Amid Steady Inflation Expectations, NY Fed Finds

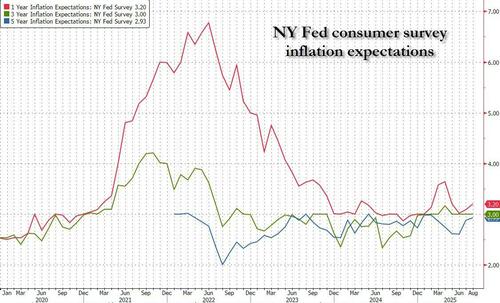

After sliding every month since April, short-term inflation expectations (inside a 1 year horizon) as polled by the Ny Fed survey of consumer expectations appear to have bottomed and after rising modestly in July from 3.0% to 3.1%, rose again in August, this time to 3.2%. At the same time, inflation expectations were They were unchanged for the 3rd consecutive month at the three-year horizon at 3.0%, and also unchanged at 2.9% for the five-year-ahead horizon (median inflation uncertainty, or the uncertainty expressed regarding future inflation outcomes, increased at the one- and three-year-ahead horizons and declined at the five-year-ahead horizon.)

One place where consumers may be disappointed is that median home price growth expectations remained unchanged for the third consecutive month at 3.0%. This series has been moving in a narrow range between 3.0% and 3.3% since August 2023. However, as recent data has shown, home price growth is stalling fast, and at this rate will turn negative within a month or two at which point home price expectations will reprice dramatically.

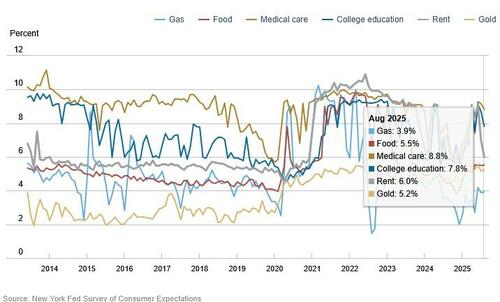

What is curious is what while short-term inflation expectations rose fractionally, the declined across the board when disaggregated by various components. to wit: median year-ahead commodity price change expectations declined by 0.9% points for the cost of college education to 7.8%, by 1.0% point for rent to 6.0%, and by 0.4 percentage point for the cost of medical care to 8.8%. Median year-ahead price change expectations remained unchanged for gas (3.9%) and food (5.5%) for the third consecutive month.

Turning to household finance expectations, the median expected growth in household income remained unchanged for the second consecutive month at 2.9% in August, equaling its 12-month trailing average. Median household spending growth expectations increased by 0.1 percentage point to 5.0%. The series has been moving in a range between 4.8% and 5.2% since February 2025.

Perceptions of credit access compared to a year ago improved with a smaller share of households reporting it is harder to get credit. Expectations for future credit availability deteriorated somewhat, with a smaller share of respondents expecting it will be easier to obtain credit in the year ahead.

While the average perceived probability of missing a minimum debt payment over the next three months increased by 0.8% to 13.1%, it remained below its 12-month trailing average of 13.5%.

Somewhat amusingly, median year-ahead expected growth in government debt declined by 2.5% points to 6.6%. Spoiler alert: this will not happen. What also will not happen is that average interest rates on savings accounts will rise – on the contrary, once the Fed starts cutting rates in 2 weeks, expect much lower rates – but that didn’t stop 24.3% of respondents, up 0.7% on th month, from expecting that saving accounts will be higher in 12 months.

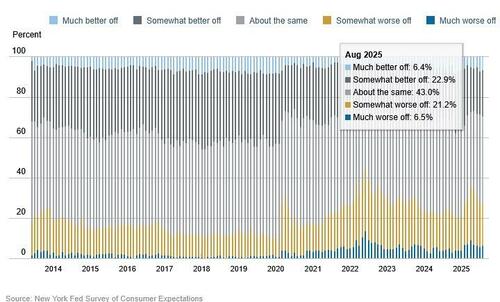

On the flip side, perceptions about households’ current financial situations compared to a year ago worsened with a larger share of households reporting a worse financial situation and a smaller share of households reporting a better financial situation. Year-ahead expectations about households’ financial situations became more dispersed. A larger share of households are expecting a worse financial situation, and an equally larger share of households are expecting a better financial situation in one year from now.

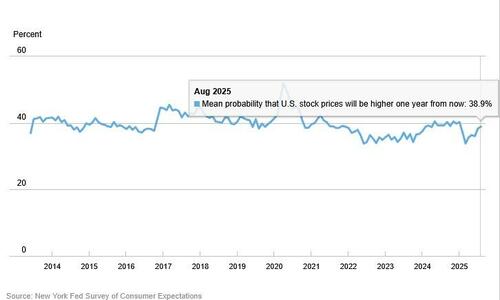

And yet despite the apparent deterioration in outlook, at least households can still cling to hopes for higher stock prices: the mean perceived probability that US stock prices will be higher 12 months from now increased by 0.6 percentage point to 38.9%.

While the latest inflation and household finance readings were relatively tame the same can not be said for expectations about the Labor Market. Here, the most notable shift came from responses by those who lose a job now, and say that the prospects of finding new employment within three months dropped by almost 6 percentage points in August to the lowest reading since the New York Fed began asking the question in 2013. That’s also the sharpest downturn in one month since the pandemic. Specifically, the perceived probability of finding a job if one’s current job was lost fell markedly by 5.8 ppt to 44.9 percent, the lowest reading since the start of the series in June 2013.

The darkening outlook for job seekers was broad-based across age, education and income groups, the New York Fed said. Yet it was most pronounced for those with a high school diploma as their highest level of education.

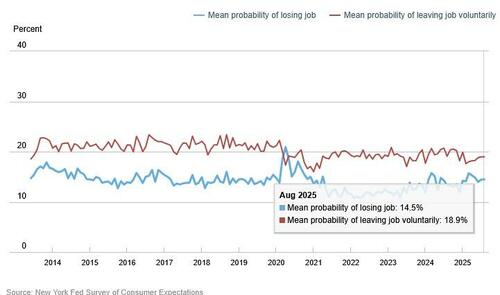

A bit less dramatic, but tied to that, is that the mean perceived probability of losing one’s job in the next 12 months ticked up by 0.1% point to 14.5%. The reading is above the series’ 12-month trailing average of 14.0%. The mean probability of leaving one’s job voluntarily in the next 12 months decreased by 0.1% point to 18.9%, remaining slightly below its 12-month trailing average of 19.0%.

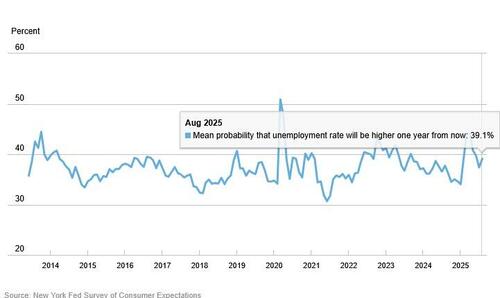

Additionally, mean unemployment expectations, or the mean probability that the U.S. unemployment rate will be higher one year from now, increased by 1.7 ppt to 39.1% which however is well below the recent April highs of 44.1%.

The results followed a dismal employment report last Friday showing firms added just 22,000 net new positions in August. Revisions also revealed that companies shed workers in June. The unemployment moved up to 4.3%, and cemented the odds of a 25bps rate cut in two weeks.

Fed officials say concerns are shifting from the inflation risks posed by tariffs to weakness in the job market. Many businesses have delayed price increases after stocking up on inventory at the beginning of the year.

And sure enough, the latest NY Fed survey confirms that while fears of runaway inflation expectations are now long gone (except perhaps a dozen or so blue haired Karens which UMich polls relentless month after month), the labor market continues to deteriorate at an accelerating pace, and absent a jumbo rate cut soon, the deterioration will be sufficient to trigger a recession.

Tyler Durden

Mon, 09/08/2025 – 12:20ZeroHedge NewsRead More

R1

R1

T1

T1