Trump Admin Weighs Annual Chip Supply Licenses For Samsung, SK Hynix In China

The Trump administration has proposed annual approvals for chipmaking supply exports to Samsung Electronics and SK Hynix’s factories in China, potentially replacing the Biden-Harris era waivers that it criticized as a “Biden-era loophole.”

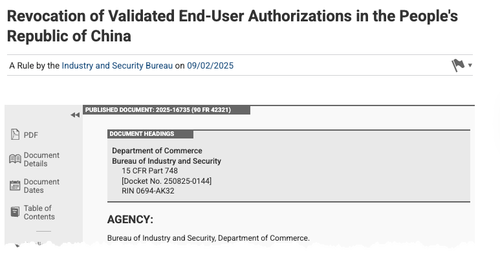

Bloomberg reports that the U.S. Commerce Department proposed a one-year “site license” model for South Korean chipmakers, rather than the validated end-user (VEU) waivers.

The annual site licenses would provide more predictability for chipmakers compared to the previous model, which required companies to apply for new U.S. approvals on a shipment-by-shipment basis.

“Bureau of Industry and Security estimates that these new removals of these entities from the Validated End-User program under the Export Administration Regulations will result in the submission of an additional 1,000 license applications annually, which would be an increase of 495 burden hours,” the U.S. Commerce Department wrote in a notice.

According to the federal notice, VEUs are set to expire at the end of the year.

Here’s more color on the potential rule change:

The VEU system granted Samsung and SK Hynix perpetual approval to ship estimated quantities of supplies, based on up-front security and monitoring commitments, to factories in China — where the U.S. has broadly curbed shipments of semiconductors and the tools needed to make them. The Trump team’s proposal instead requires South Korea’s two largest companies to seek Washington’s approval for a year’s worth of restricted gear, parts and materials at a time, spelled out in exact quantities, the people told Bloomberg.

That introduces newfound complexity to the process, but also a way for South Korea’s top chipmakers to keep operating giant factories in China that churn out components used in everything from smartphones to data centers. U.S. officials have said they don’t want to disrupt operations at those facilities, but also won’t approve shipments of gear that could be used to upgrade or expand them.

South Korean officials and industry insiders are relieved that a framework exists, but they are frustrated by the added administrative hurdles. Lingering concerns include difficulty in forecasting spare parts needs and the mounting risk of delays if emergency approvals are required.

The takeaway is that the Trump administration seeks a more in-depth understanding of the supply chains of South Korean chipmakers’ plants in China amid a multi-front tech war with the world’s second-largest economy.

This revelation comes weeks after South Korea’s President Lee Jae Myung visited the White House to meet with Trump, focused on deepening economic ties.

Tyler Durden

Mon, 09/08/2025 – 07:45ZeroHedge NewsRead More

R1

R1

T1

T1