Why Diversification Is Failing In The Age Of Passive Investing

Authored by Lance Roberts via RealInvestmentAdvice.com,

Diversification has been the backbone of “buy and hold” strategies for the last few decades. It was a boon to financial advisors who couldn’t actively manage portfolios, and it created a massive Exchange-Traded Funds (ETFs) industry that allowed for even further simplification of investing. The message was basic: “Buy a basket of assets, dollar cost average, and given enough time, you will grow your wealth.”

But where did that marketing revolution come from? Based on the premise of index investing, it created massive firms like Vanguard, Fidelity, BlackRock, and others. For that answer, we need to go back in time to 1952. Then, Harry Markowitz revolutionized investment strategy with his portfolio choice theory. His work, for which he received a Nobel Prize, gave rise to what we now know as Modern Portfolio Theory (MPT), which proposed that the best portfolios don’t focus on individual securities but on how groups of assets interact.

The goal was to combine uncorrelated assets to reduce overall volatility while optimizing returns. This model encouraged investors to spread risk through diversification. Critically, it assumes that assets wouldn’t all move together in times of stress. This theory served as the bedrock of portfolio construction for decades, especially for institutional investors. The strategy worked well before the turn of the century, when sectors rotated leadership and assets moved independently based on distinct economic drivers. Back then, diversification across asset classes, sectors, and geographies was a reliable way to reduce portfolio risk.

However, over the last 15 years, following the financial crisis, the investing environment has changed. Monetary and fiscal interventions, global central bank interest rate policies, the maturity of algorithmic and computerized trading strategies, and concentration have reduced diversification’s value. As shown, any portfolio “diversified” between large, mid, and small-cap stocks, international and emerging markets, real estate, and gold, has significantly underperformed being invested solely in the S&P 500 index. Furthermore, in times of crisis, like 2020, the diversification failed to protect investors from the downturn as correlations went to “1.”

The reality is that markets have changed.

The assumptions that supported MPT, uncorrelated assets, stable relationships, and rational price behavior, have eroded. Central banks have injected liquidity, distorted yields, and suppressed volatility. Meanwhile, passive investing has reshaped how money flows into stocks.

The basic premise of diversification is under pressure from structural shifts that Markowitz could not have anticipated.

Passive Investing’s Impact on Market Structure

Passive investing has grown from a niche strategy into the dominant force in equity markets. Index funds and ETFs now account for over half of U.S. equity ownership. These vehicles allocate capital based on market capitalization, not valuation, fundamentals, or business quality. As more money flows into these funds, the largest companies receive the lion’s share of new capital. That’s created a powerful feedback loop, where price drives flows, and flows drive price.

This shift has radically changed the effectiveness of diversification. Investors who think they’re diversified across multiple ETFs often have overlapping exposure to the same few mega-cap names. For example, Apple, Microsoft, and Nvidia are top holdings in technology ETFs, dividend funds, and large-cap growth portfolios. In the U.S., there are roughly 4000 ETFs, and 771, approximately 20%, own Apple. Therefore, if you own an S&P index fund, a Nasdaq index ETF, and a technology-focused ETF, you have multiple holdings of the same companies. This overlap increases portfolio risk and concentration. What looks like diversification is often just duplicated exposure dressed up as balance.

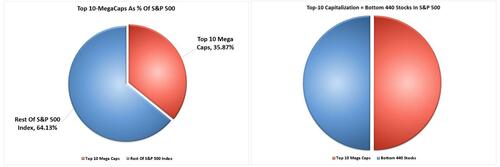

As noted in “The Bull Market Is Alive And Well,” the top 10 stocks have a hefty weighting in the S&P 500 index, which absorbs $0.36 of every dollar invested. Furthermore, the top 10 stocks impact the S&P 500 index the same as the bottom 440 stocks combined.

Furthermore, the top ten stocks in the S&P 500 now account for more than 70 percent of the index’s return. These names dominate the performance of most portfolios, even those that appear broad on the surface. As passive flows continue to distort market mechanics, the ability of traditional diversification to reduce risk has declined. Assets that once behaved independently now rise and fall together, leaving portfolios more vulnerable when markets correct.

But that is where we find the demise of Modern Portfolio Theory, which assumes that asset classes will not move in perfect unison. Historically, this was true. Sector correlations typically ranged between 0.3 and 0.6, allowing diversification to smooth out returns. When one part of the market fell, others could rise or stay flat. That dynamic gave portfolios resilience. But today, those correlations are breaking down. During market stress, correlations spike as high as 0.9. Nearly every asset class sells off together, erasing the protective benefit of diversification.

This shift is driven by the rise of passive ownership, which has increased the linkage between stocks, sectors, and even asset classes. Academic research from INSEAD and UC Irvine confirms that companies with high passive ownership become more volatile and exhibit stronger co-movement, especially during sell-offs. Central bank interventions have added another layer of distortion by suppressing price discovery and inflating asset prices indiscriminately. Liquidity flows, not fundamentals, now drive much of market behavior.

Even portfolios designed to be “all-weather” or “risk-parity” have failed to deliver protection during sharp downturns. Diversification fails when everything is tied to the same flows and narratives. The illusion of balance breaks down exactly when it is most needed. This environment has made it harder to rely on traditional asset allocation strategies.

Therefore, given this change to market dynamics, investors must now think differently about managing risk.

New Approaches to Diversification in a Concentrated Market

Yes, diversification still matters. In fact, it matters more now than ever. While the traditional benefits of diversification have weakened due to high correlations and market concentration, the need to reduce risk remains unchanged. The objective is not to eliminate volatility, but to manage it intelligently. That means ensuring portfolios can withstand market downturns while still participating in upside when leadership changes or new trends emerge.

Surface-level diversification is no longer enough in a market increasingly driven by passive flows and dominated by a few mega-cap names. Owning multiple funds or asset classes does not guarantee protection if the underlying exposures overlap. Investors must go deeper and look beyond labels and into the actual drivers of risk and return. Here are seven strategies to help achieve more effective diversification in today’s environment:

-

Limit Overlap Across Holdings: To reduce concentration risk in your portfolio, ensure you limit duplicate positions across your funds.

-

Prioritize High-Conviction, Quality Holdings: Reduce broad exposure in favor of companies with consistent earnings, low debt, and durable competitive advantages. Quality stocks tend to be more resilient across market cycles.

-

Allocate by Investment Factors, Not Just Sectors: Diversify based on factors like value, size, momentum, and low volatility. These traits respond differently to economic conditions, creating more effective diversification than sector spreads alone.

-

Don’t Forget About Cash: When uncertain markets arrive, remember the value of cash as a hedge against volatility risk.

-

Use Active Management Where It Adds Value: Tactical funds or active managers can navigate around crowded trades and avoid the systematic exposures built into passive indexes.

-

Incorporate Alternative Allocation Models: Explore risk-based strategies like Hierarchical Risk Parity (HRP), which adapt to changing correlations and distribute risk more evenly than traditional mean-variance approaches.

-

Monitor Correlations Over Time: Correlations are dynamic, especially in periods of stress. Review your portfolio regularly to ensure your holdings are not moving in lockstep when it matters most.

Each of these steps is designed to restore the core purpose of diversification: risk control without sacrificing the opportunity for return.

In a market where broad ownership no longer guarantees safety, discipline, and deeper analysis make the difference.

Tyler Durden

Mon, 09/08/2025 – 12:40ZeroHedge NewsRead More

R1

R1

T1

T1