Futures Hite New All Time High After Oracle’s Ridiculous Forecast, PPI Looms

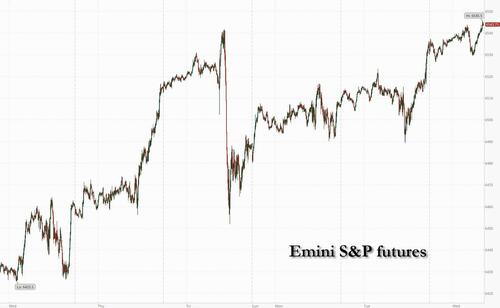

US stock futures are trading at another record high, with European and Asian also pushing higher after Oracle underpinned the strong sentiment in tech with blowout guidance sending its shares up by 30% in premarket trading, while the market awaits inflation data today and tomorrow. As of 8:15am, S&P futures are 0.3% higher with Nasdaq futures rising 0.4%…

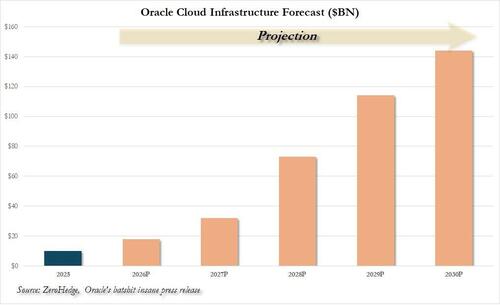

… with all eyes on ORCL as earnings missed across the board, but it was the ridiculous hockeystick guidance – with cloud infra guide going from $18bn in FY25 to $144bn in FY30 – that sent the stock +30% pre-mkt and fueled optimism that the AI infrastructure roll-out is speeding up. Chipmaker Nvidia Corp. and AI infrastructure firms also advanced (NVDA +1.9%, AVGO +2.3%). Large-cap Cyclicals poised to outperform Defensives.

Keep an eye on Poland / Russia as Poland invoked Article 4 of NATO (military defensive consult); for ref, Article 5 is the call to arms of all members, used only once by the US after Sept 11. Trump looks to implement secondary tariffs on India / Russia. The yield curve is twisting steeper with the 30Y yield +1bp and USD is flat. Cmdtys are mostly higher led by crude and precious. Today’s macro data focus is on PPI with CPI tomorrow. TSMC also said its August sales rose 34% to signal sustained, strong demand for AI tech.

With the latest leg of the stock rally driven by hopes that the Fed will rapidly lower rates, investors believe that sticky wholesale and consumer inflation will remain sufficiently contained and give officials room to shore up the jobs market.

The likelihood of lower financing costs is supporting rate-sensitive sectors such as tech, allowing markets to remain resilient against recurring risks ranging from geopolitical tensions to trade wars. Over the past day alone, the S&P 500 advanced despite escalating frictions in the Middle East and Eastern Europe alongside fresh US tariff threats targeting India and China.

“The prospect of far easier financial conditions remains supportive,” said Geoff Yu, FX and macro strategist for EMEA at BNY Mellon. “Barring any really large upside shocks in today and tomorrow’s PPI/CPI figures, it’s really a case of ‘as you were.’”

August’s producer price figures are due at 8:30 a.m. Eastern time, with the consumer inflation report following 24 hours later. Those reports, along with retail figures due Sept. 16, will be the last major data points before Fed Chair Jerome Powell announces next week’s rate decision.

Oracle is poised to add roughly $200 billion in market value if its early surge carries through Wednesday’s session. The company’s outlook underscores how AI developers must continue ramping up spending, with its customer OpenAI alone projecting that trillions of dollars will eventually be needed to build and operate infrastructure.

“I don’t know if their guidance is actually realistic but the market is buying it and buying it fully,” said David Kruk, head of trading at La Financiere de l’Echiquier. “Maybe the outlook has been overbought, it’s hard to tell.”

The renewed excitement over AI and strong corporate earnings are prompting Wall Street strategists to boost their forecasts for the S&P 500. Deutsche Bank’s Binky Chadha lifted his year-end target for the US benchmark to 7,000, signaling potential gains of more than 7% from current levels. Analysts at Barclays also raised their estimate, while Wells Fargo Securities forecasts an 11% increase by the close of next year.

Poland shot down drones that crossed into its territory during a Russian air strike on Ukraine. France has appointed Sebastien Lecornu as prime minister, the fifth in two years and starting on a day of mass protests in the country. French yields are unchanged, bund yields are edging lower and Treasuries are mixed.

In premarket trading, Mag 7 stocks are mixed, with Nvidia outperforming after Oracle’s report (Nvidia +2%, Tesla +0.4%, Alphabet +0.1%, Microsoft +0.7%, Meta -0.1%, Apple -0.4%, Amazon -0.5%).

- Oracle (ORCL) surges 32% after the software company gave a robust forecast for its cloud-infrastructure business, a sign of strong AI-related demand. Stocks tied to AI computing infrastructure are rallying after Oracle forecast faster-than-expected revenue growth in its cloud infrastructure unit. CoreWeave (CRWV) +7%, Arista Networks (ANET) +3%, AMD (AMD) +3%

- Asset Entities (ASST) soars 121% after holders approved a merger with Vivek Ramaswamy’s Strive Enterprises, marking the next step in creating a public Bitcoin treasury company.

- Bill Holdings (BILL) is up 6% after the Financial Times reports Elliott Management has built a large stake in the payments automation company.

- Fifth Third Bancorp (FITB) fall 3% after the bank said it discovered allegedly fraudulent activity at one of its commercial borrowers. The lender will present at an industry conference later on Wednesday.

- GameStop (GME) jumps 10% after the video-game retailer reported Hardware and Accessories net sales for the second quarter that beat the average analyst estimate.

- Nio ADRs (NIO) are down 8% after the Chinese EV maker announced an equity offering of as much as 181.8 million class A shares.

- Synopsys (SNPS) shares are down 22% after the software company reported third-quarter results that featured a weak read on Design IP revenue. It also gave an earnings outlook that was weaker than expected.

- Travere Therapeutics (TVTX) soars 15% after the FDA informed the company that an advisory committee is no longer needed for its supplemental drug application for the treatment of a rare kidney disorder.

In Europe, the Stoxx 600 rises 0.2% with retail and technology shares leading gains, while travel and chemicals stocks are the biggest laggards. Sentiment was boosted by jump for Spanish retailer Inditex which means Spain’s IBEX benchmark is outperforming. Novo Nordisk is rising after announcing 9,000 job cuts, though also cutting guidance. Here are the biggest movers Wednesday:

- Inditex shares gained 6.9%, the most since April, after the Spanish retailer said sales at the start of the third quarter were up 9%. Jefferies analysts note that the firm benefits from strong customer traction

- Anglo American rises as much as 3.7% in London, its highest intraday level since Jan. 20, after Berenberg upgraded to hold from sell after the miner moved to acquire Canada’s Teck Resources

- Novo Nordisk shares gain as much as 3.2%, reversing an earlier 3% drop, after the Danish drugmaker said it will cut 9,000 jobs globally as it tries to regain ground in the competitive market for obesity treatments

- EssilorLuxottica gains as much as 4.5% as Barclays starts coverage of the eye-wear maker with an overweight rating, saying the company offers an “exciting” growth profile

- Haleon shares rise as much as 3.2%, the most in more than four months, after Goldman Sachs upgraded the stock to buy from neutral, citing an attractive valuation

- AB Foods shares drop as much as 12%, the most intraday since March 2020, after the British conglomerate gave a trading update that showed weakness in both its sugar unit and the Primark budget clothing chain

- Vistry shares fall as much as 8.9%, the most since April, as the house-builder delivers first-half results that Goodbody describes as “disappointing”

- Zurich Airport drops as much as 2.3%, the most in almost three months, as Oddo BHF starts coverage with an underperform recommendation, citing both execution and regulatory risks

Earlier in the session, Asian stocks rose, on course for a fifth-straight day of gains, with the technology-dominated markets of South Korea and Taiwan leading the charge to close at record highs. The MSCI Asia Pacific Index jumped 1.1% to the highest level since February 2021, with TSMC, Softbank, Tencent and SK Hynix among the biggest boosts. An upbeat cloud-business outlook from Oracle Corp. provided the latest boost for tech sentiment. South Korea’s Kospi closed at a record high, buoyed further by optimism that a proposal to lower the threshold for capital-gains tax will be scrapped. Taiwan’s benchmark also closed at a new all-time high. Elsewhere, key equity gauges advanced more than 1% in Hong Kong and Singapore. Mainland China shares edged up but underperformed their regional peers, as sentiment softened after last week’s military parade and following the strong rally in August.

In FX, the Bloomberg Dollar Spot Index little changed, Norway’s krone is stronger, with euro and Canadian dollar weaker.

In rates, treasuries are mixed in early US trading with front-end yields slightly richer on the day and long-end underperforming, steepening the curve around the 10-year, which is little changed. Focal points of US session include August PPI data in the morning and 10-year note reopening in early afternoon. Front-end yields are 1bp-2bp richer on the day, long-end cheaper by similar amounts and the 10-year near 4.09%, widening 2s10s and 5s30s spreads steeper by 1bp-2bp.French bonds underperform slightly as Lecornu’s first day as prime minister was marked by mass protests against the government’s budget proposals; bunds trade broadly in line with Treasuries. In the US, Treasury auction cycle continues with $39 billion 10-year reopening at 1pm New York time and concludes Thursday with $22 billion 30-year sale. Demand was strong for Tuesday’s 3-year note auction, which stopped through by 0.7bp and produced a record low primary-dealer allotment

In commodities, brent futures are up 0.9% to $67/barrel while gold is up by about $19/oz to around $3,646/oz.

Looking at today’s calendar, US economic data slate includes August PPI (8:30am) and July wholesale trade sales (10am)

Market Snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 mini little changed

- Russell 2000 mini -0.3%

- Stoxx Europe 600 +0.1%

- DAX little changed

- CAC 40 +0.1%

- 10-year Treasury yield little changed at 4.08%

- VIX +0.2 points at 15.19

- Bloomberg Dollar Index little changed at 1200.72

- euro little changed at $1.1709

- WTI crude +0.8% at $63.16/barrel

Top Overnight News

- US judge temporarily blocked President Trump from removing Federal Reserve Governor Cook.

- NATO fighter jets have shot down Russian drones over Polish airspace for the first time, after what Warsaw described as “unprecedented violation” of its territory that led it to trigger emergency consultations in the alliance. FT

- US employer health insurance costs are projected to rise about 9.2-9.5% in 2026, the steepest increase in at least 15 years: WSJ

- Trump has asked the EU to impose tariffs of up to 100% on India and China as part of a joint effort to increase pressure on Russia to end its war in Ukraine. A second US official said Washington was prepared to “mirror” any tariffs on China and India imposed by the EU, potentially leaded to further increase in US levies on imports from both countries. FT

- Trump is will crack down on pharmaceutical adverts on TV and social media, while he signed a memo requiring pharma ads to disclose all risks.

- White House could impose severe restrictions on drugs from China, delivering a blow to the US pharma industry (which has been racing to buy the rights to drugs created in China) while bolstering the small-cap US biotech industry. RTRS

- US has warned of hidden radios that could be embedded in solar-powered highway infrastructure: RTRS

- Trump and Indian Prime Minister Narendra Modi voiced optimism about reaching a trade deal on Tuesday, softening rhetoric after months of friction over tariffs and Russian oil purchases. CNBC

- US Commerce Secretary Lutnick floats taking a share of university patent money; US should get half the benefit from patients, via Axios.

- China’s consumer prices fell more than expected in August while deflation in wholesale prices persisted, as calls mounted for Beijing to ramp up measures to bolster sluggish domestic demand and cushion weakening exports growth. China’s PPI was inline w/the Street in Aug (-2.9%, a modest improvement vs. -3.6% in Jul) while the CPI undershot the consensus (-0.4% vs. the Street -0.2% and vs. 0.00% in Jul). CNBC

- Oracle shares jumped 30% premarket after providing a blowout outlook for its cloud business. The company is on track to add about $190 billion in market value today. BBG

- U.S. holiday sales are projected to grow at their slowest pace since the pandemic, Deloitte said in a forecast released on Wednesday, as macroeconomic uncertainties weigh on consumer spending. RTRS

- The Supreme Court plans to move quickly on the IEEPA tariff case (oral arguments will be during the first week in November). WaPo

- A judge on Tuesday night blocked President Donald Trump from firing Federal Reserve Governor Lisa Cook as a lawsuit challenging her removal continues. CNBC

Trade/Tariffs

- US President Trump reportedly asked the EU to hit China and India with 100% tariffs to pressure Russian President Putin to end the war, while a US official said that Washington was prepared to mirror any tariffs on China and India imposed by the EU, according to FT.

- US President Trump posted that India and the US are continuing negotiations to address trade barriers and he looks forward to speaking with his very good friend, Indian PM Modi, in the upcoming weeks, while Trump added that he feels certain that there will be no difficulty in coming to a successful conclusion for both nations.

- Indian PM Modi said he is confident India and US trade negotiations will pave the way for unlocking the limitless potential of the India-US partnership, while he added that their teams are working to conclude discussions at the earliest and he looks forward to speaking with US President Trump. It was separately reported that India and US officials are likely to have an exchange of trade delegations soon and an in-person meeting later in September, according to CNBC-TV18.

- US Supreme Court agreed to hear the Trump administration’s appeal of the judicial ruling that invalidated most of President Trump’s tariffs and it fast-tracked the appeal in the tariffs case.

- US Treasury Secretary Bessent is confident that the Supreme Court will back Trump tariffs, while he added there is a fallback tariff plan, though it is more cumbersome.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the mostly positive handover from Wall St, where the major indices shrugged off large downward job revisions and geopolitical escalation, to approach record levels. ASX 200 eked mild gains as outperformance in financials, tech and telecoms atoned for the losses in the mining and materials sectors. Nikkei 225 edged higher despite the recent hawkish source reports that the BoJ sees some chance of hiking this year, despite the political situation, with some officials even said to view that a hike could be appropriate as early as October. Hang Seng and Shanghai Comp gained with the Hong Kong benchmark led higher by strength in tech, while the mainland lagged after deflationary CPI data and with US President Trump said to have asked the EU to hit China and India with 100% tariffs to pressure Russian President Putin.

Top Asian News

- Japan’s economic revitalisation minister Akazawa said wage gains should be prioritised over tax cuts.

- South Korea may scrap the plan for a capital gains tax rule revision, while it was separately reported that South Korea will establish 15 task forces made up of members from both the public and private sectors to lead individual projects aimed at creating new growth engines.

- China to make full use of proactive fiscal policy, via Xinhua.

European bourses opened mostly firmer across the board, but sentiment has slipped on comments from the Polish PM who asked to evoke Article 4. European sectors hold a strong positive bias, and with those industries in the red only marginally so. Retail is by far and away the clear outperformer today, boosted by post-earning strength in Zara-owner Inditex (+7.5%); the Co. reported fairly in line metrics but saw a strong start to Autumn sales, which has boosted sentiment.

Top European News

- UK PM Starmer’s “Budget board” is set to meet weekly and has been tasked with coordinating pro-growth policies in the run-up to the November 26 Budget and with keeping business and City leaders engaged, according to officials cited by the FT.

- UK Chancellor Reeves has told her cabinet colleagues that government departments will have their access to the Treasury’s emergency funds limited ahead of the budget, according to BBC sources. Note: “The GBP 9bln Treasury Reserve, designed to be used for “genuinely unforeseen, unaffordable and unavoidable pressures” has recently been used to fund higher public sector pay and compensation payouts”, BBC writes.

- European Commission President von der Leyen announces a EUR 1.8bln package to boost European battery production. Will propose a new long-term trade instrument to replace the expiring steel safeguards. EU plans short-term rental law to boost housing affordability. Intend to implement a short-term rental law to bolster housing affordability.

FX

- DXY paused overnight after strengthening on Tuesday in a rebound from the two-day post-NFP selling, despite the worse-than-feared BLS revisions. While the announcement that a US judge temporarily blocked US President Trump from removing Fed Governor Cook spurred little reaction as participants now await incoming inflation data including PPI data later, followed by CPI tomorrow. DXY resides in a 97.693-97.932 range at the time of writing.

- EUR lacked firm demand and eventually dipped beneath the 1.1700 handle after it recently gave up ground to the rebound in the dollar. The single currency was also not helped by the geopolitical backdrop with Poland responding to the violation of its airspace by Russian drones and with US President Trump reportedly calling for the EU to impose 100% tariffs on China and India to pressure Russian President Putin. On this, Polish PM Tusk said Poland asked to evoke Article 4 of NATO treaty; there is no reason to claim that Poland is in a state of war. EUR/USD trades in a 1.1683-1.1719 range.

- JPY took a breather after its recent oscillations through the 147.00 level with headwinds for the pair stemming from hawkish BoJ sources yesterday. During the European morning, the pair has been uneventful and moving in tandem with the buck, whilst focus has been firmly on geopolitics. USD/JPY trades on either side of its 50 DMA (147.52) in a 147.27-147.59 range.

- GBP continues to struggle for direction in European hours, after similar was seen during APAC hours following yesterday’s price swings, whereby early upward momentum stalled just shy of the 1.3600 territory before reversing course. At home, UK PM Starmer’s “Budget board” is set to meet weekly and has been tasked with coordinating pro-growth policies in the run-up to the November 26 Budget and with keeping business and City leaders engaged, according to officials cited by the FT. GBP/USD resides in a 1.3512-1.3543 range.

- Antipodeans are holding an upward bias and largely moving in tandem with the buck after risk waned off best levels, with gains capped after softer-than-expected and deflationary Chinese CPI data.

- PBoC set USD/CNY mid-point at 7.1062 vs exp. 7.1359 (Prev. 7.1008)

Fixed Income

- USTs are softer, but only marginally. In a very thin sub five tick range which itself is almost entirely in Tuesday’s 113-07 to 113-20 band. The session ahead is theoretically headlined by PPI and then followed by supply; though, geopolitical events may take precedence. Supply is a 5yr tap, follows Tuesday’s 3yr auction which was well received overall though direct demand was a little soft. That aside, a US judge has ruled that Fed’s Cook cannot be fired for now, this means she will be partaking in the September FOMC policy announcement.

- A contained start for OATs. Largely unreactive to President Macron appointing a new PM, Sebastien Lecornu. His appointment has drawn huge criticism from the Right while those on the left, and particularly the Socialist Party (PS), haven’t been quite as animated, but still see the appointment as Macron going down a “path in which no Socialist will participate”.

- Bunds are firmer, propped up by some risk premia amid the overnight drone incident in Poland. In brief, several Russian drones entered Polish airspace and were intercepted by Polish defence systems. An incident that has since concluded, but Poland has referred the matter to NATO. We are now waiting to see what the response by NATO formally is, but the initial take appeared to be that as the incursion is not being treated as an attack. Bunds hit a 129.44 peak amidst the NATO commentary, before pulling back. Thereafter, German paper slipped into the 2040/2041 auction, which was ultimately mixed – pressure continued following the outing.

- Gilts are marginally firmer in quiet trade with UK specific catalysts light and focus on the above events. Gilts firmer by 20 ticks at most, lifted alongside the discussed Bund move, but have since reverted back to gains of just a handful of ticks in 91.36 to 91.58 parameters. Note, no real move on the morning’s DMO sale.

- UK sells GBP 4bln 4.00% 2031 Gilt: b/c 3.27x (prev. 3.1x), average yield 4.208% (prev. 4.517%), tail 0.2bps (prev. 0.5bps).

- Germany sells EUR 1.17bln vs exp. EUR 1.5bln 2.60% 2041 & EUR 602mln vs exp. EUR 1bln 4.75% 2040 Bunds.

Commodities

- Crude traded higher following recent geopolitical developments, including Israel striking Hamas officials in Qatar, while US President Trump reportedly asked the EU to hit China and India with 100% tariffs to pressure Russian President Putin to end the war in Ukraine. The focus of the day has been on Poland announcing it conducted a military operation to neutralise targets after its airspace was repeatedly violated by Russian drones attacking Ukraine. On this, Polish PM Tusk said Poland asked to evoke Article 4 of the NATO treaty; there is no reason to claim that Poland is in a state of war. Article 4 talks are meant for consultations when “a member country feels threatened.” WTI currently resides in a 62.72-63.44/bbl range while Brent sits in a USD 66.66-67.20/bbl range.

- Precious metals recovered overnight after retreating yesterday alongside a firmer buck despite dovish BLS revisions. Spot gold currently resides in a USD 3,620.14-3,655.06/oz range after printing fresh record highs on Tuesday at USD 3,674.69/oz.

- Mixed/flat trade across base metals with the dollar also uneventful whilst broader risk remains cautious amid geopolitics and ahead of US PPI. 3M LME copper resides in a USD 9,914.50-9,962.35/t range at the time of writing.

- US Private Energy Inventory Data (bbls): Crude +1.3mln (exp. -1.0mln), Distillates +1.5mln (exp. +0.0mln), Gasoline +0.3mln (exp. -0.2mln).

Geopolitics: Middle East

- Israel’s ambassador to Washington told Fox News if they can’t eliminate Hamas leaders now, they will succeed next time.

- US President Trump said the attack on Hamas officials in Doha was a decision made by Israeli PM Netanyahu and not a decision made by himself, while he added that unilaterally bombing inside Qatar, which is a close ally of the US, does not advance Israel or America’s goals and he views Qatar as a strong ally and friend to the US.

- Algeria asked the UN Security Council to meet after Israeli strikes on Qatar.

Geopolitics: Poland

- Ukraine’s military said Kyiv was under a drone attack and air defence units are trying to repel strikes, while Ukraine’s Air Force also warned that Russian drones entered Poland’s airspace and that the city of Zamosk was under threat.

- Poland’s Defence Minister said aircraft have deployed weapons against hostile objects and territorial defence forces have been activated for ground searches of downed drones, while it was later reported that Polish PM Tusk informed NATO Secretary General Rutte about actions they’ve taken regarding objects that violated their airspace.

- Poland’s Army said Polish airspace was repeatedly violated by drones during today’s attack by Russia on Ukraine and an operation was conducted to identify and neutralise the targets, while it noted the most vulnerable areas are the Podlaskie, Mazowieckie, and Lublin voivodeships. Polish Army said as a result of Russia’s attack on Ukrainian territory, there was an unprecedented violation of Polish airspace by drone-type objects and that this was an act of aggression that posed a real threat to the safety of citizens.

- Warsaw’s main airport and the Rzeszow airport were closed due to unplanned military activity related to ensuring state security.

- Polish PM Tusk says Poland is ready to react to attacks and provocations, says there is no reason to panic; no reason for restrictions that would make citizens’ lives difficult; situation seems to be under control now

- NATO is not treating the drone incursion into Polish territory as an attack; indications that it was an intentional incursion, at least six to ten drones entered Polish airspace, according to NATO sources cited by Reuters.

- NATO’s North Atlantic Council meets today to review response to drones entering Polish airspace, according to the NATO spokesperson.

- European Commission President von der Leyen says sanctions discussions focus on accelerating phase-out of Russian fossil fuels, and considers extending oil sanctions to include shadow fleet and third-country entities.

- Belarus Defence Ministry says its air defence forces tracked drones that had lost their tracks; warned Poland and Lithuania of the approaches of drones.

- Polish President Nawrocki says Poland discussed the possibility of NATO Article 4.

- Polish PM Tusk says Poland asked to evoke Article 4 of NATO treaty; there is no reason to claim that Poland is in a state of war.

US Event Calendar

- 7:00 am: Sep 5 MBA Mortgage Applications +9.2%, prior -1.2%

- 8:30 am: Aug PPI Final Demand MoM, est. 0.3%, prior 0.9%

- 8:30 am: Aug PPI Ex Food and Energy MoM, est. 0.3%, prior 0.9%

- 8:30 am: Aug PPI Final Demand YoY, est. 3.3%, prior 3.3%

- 8:30 am: Aug PPI Ex Food and Energy YoY, est. 3.5%, prior 3.7%

- 10:00 am: Jul F Wholesale Inventories MoM, est. 0.2%, prior 0.2%

DB’s Jim Reid concludes the overnight wrap

Markets faced a few more challenges yesterday, as investors grappled with heavy downward revisions to US payrolls, alongside a flareup of Middle East tensions after Israel carried out a strike in Qatar against Hamas’ leadership. That meant risk assets initially took a hit, whilst oil prices spiked higher as fears grew about some sort of escalation in the Middle East. However, the peak negative reaction was around London going home time with the S&P 500 (+0.27%) recovering to post a new record high. Still, bond yields closed near their intra-day highs as investors toned down Fed rate cut expectations ahead of the US PPI and CPI data today and tomorrow.

In terms of those different stories, the Middle East dominated market attention as Israel confirmed they’d made a strike in Qatar. That’s a significant development, because Qatar is a US ally and hasn’t been involved in the conflict, acting as a mediator in the negotiations between Israel and Hamas. Qatar called the strikes a “blatant violation” of international law, with Hamas claiming that its leadership had survived the strike. US President Trump posted that the strike was “a decision made by Prime Minister Netanyahu”, adding that it “does not advance Israel or America’s goals” and calling it an “unfortunate incident”.

The news of the strike led to an oil price spike as investors were reminded of what happened in June, back when Israel and Iran came into direct conflict and there were fears of a broader escalation across the Middle East. But this mostly reversed later on, with Brent crude ending the session up +0.56% at $66.39/bbl, having been as high as $67.38/bbl. The news also added initial upward pressure on gold, but this was -0.26% lower by the close as rates moved higher. Still, gold is up +38.2% so far this year. Oil is up a further +0.9% overnight after Trump last night said he’d back more tariffs on India and China to pressurise Russia, but only if the EU did the same.

The other big news yesterday came from the Bureau of Labor Statistics in the US, who announced some sizeable negative revisions to payrolls. The headline was that total payrolls were revised down by -911k in March 2025, meaning that the labour market was in a weaker state than we previously thought. To be fair, these numbers don’t cover the most recent jobs reports and only go up to March. But if you smooth that adjustment over the year, then it means that the payroll numbers over April 2024 to March 2025 were around 75k lower each month than we thought. So, depending on what the final numbers show in Q1 2026, it’s quite possible that we had a couple of negative payrolls prints in 2024 already with yesterday’s revision implying -5k in August and -29k in October. So as it stands this cycle didn’t ultimately reach the second longest payroll expansion in history we were previously led to believe. In fact, it’s now in 5th place behind the runs that ended in 1979, 1990, 2007 and 2020.

Despite the negative revisions, markets were fairly unreactive to the release, given that the direction of travel was already expected to be negative. Moreover, the weaker numbers didn’t ramp up expectations of a 50bp cut from the Fed either as 27bps of cuts are now priced for next week, -1.5bps on the day. So, things were fairly steady, and there’s even a positive interpretation which says that the downgrades to 2024 and early 2025 make the recent slowdown in payrolls a lot less obvious if you consider that the baseline should be around 75k lower each month. In a Fox Business interview yesterday, Treasury Secretary Bessent did say that the Fed should recalibrate policy given the revised data, having also posted earlier that Trump is “right to say the Fed is choking off growth with high rates”.

However, Treasuries struggled to sustain the sharp rally of the previous four sessions, focusing more on the geopolitical shock and the inflationary impact of higher oil prices ahead of today’s PPI data and tomorrow’s CPI print. So, yields saw a decent move higher across the curve, with the 2yr yield (+7.2bps) rising to 3.56%, whilst the 10yr yield (+4.7bps) rose to 4.09%. Indeed, investors dialled back the likelihood of rapid rate cuts over the months ahead, with the amount of cuts priced by the June 2026 meeting falling -9.8bps on the day to 117bps.

This backdrop created some cross-winds for equities but the S&P 500 (+0.27%) still reached a new all-time high as the Mag-7 (+0.83%) powered ahead to a new record of their own. Those tech gains came even as Apple (-1.48%) sank after its annual product launch. I’ve already ordered the new headphones, with the new iPhone and possibly the watch to follow! The breadth of the equity performance was also on the softer side, with 60% of the S&P 500 lower on the day and the small-cap Russell 2000 down -0.55%. Meanwhile in Europe, it was a pretty flat session, with the STOXX 600 up just +0.06%. S&P 500 (+0.23%) and NASDAQ 100 (+0.19%) futures are rising after Oracle delivered a strong cloud infrastructure outlook in its results last night.

Over in France, attention has continued to focus on the political situation, with President Macron wasting little time yesterday in naming Sebastien Lecornu as France’s new prime minister, just hours after Francois Bayrou officially resigned from the post. Lecornu is a long-time ally of Marcon, most recently serving as Defence Minister in the outgoing government. He will now have the task of trying to steer a budget through the National Assembly, which is still completely fractured between the political groups. There were no signs last night that this task will become easier, with the far-right and far-left maintaining calls for snap elections while the centre-left Socialists said that Macron “persists in a path in which no socialist will participate”.

Notably yesterday we even saw France’s 10yr yield briefly poke above Italy’s 10yr yield in trading, although it eventually settled just beneath. That was partly a technicality to be honest because France’s 10yr yield benchmark rolled from the May 2035 bond to the November 2035 bond, so that mechanically pushed the yield higher. But even so, it was still notable given that France has been considered the safer sovereign of the two for much of recent history, and you have to go back to 1999 for the last time that France’s 10yr yield closed above Italy’s. Nevertheless, aside from the bond roll, French assets actually outperformed yesterday, with the 10yr OAT yield down -0.9bps on the session, in contrast to a rise in yields for 10yr bunds (+1.7bps), BTPs (+0.6bps) and gilts (+1.7bps).

Staying on Europe, today we’ll hear from Commission President Ursula von der Leyen, who’s delivering her State of the Union address to the European Parliament. This is usually a high-level strategic agenda for the next 12 months, but it could also contain some new policy measures, with the 2023 speech announcing the anti-subsidy investigation into Chinese EVs and the commissioning of the Draghi report. Speaking of the Draghi report, yesterday was the one-year anniversary of its release, and our European economists have published a note looking at how progress is measuring up on EU competitiveness in light of the report (link here).

Asian equity markets are extending gains this morning with the KOSPI again leading the charge, up +1.57%, and eyeing a record close, with major chipmakers Samsung Electronics and SK Hynix also seeing significant increases of +1.40% and +5.03% respectively. Elsewhere, the Hang Seng (+1.19%) is also advancing, rising to a four-year high amid hopes that China will cut interest rates after consumer prices fell further (more details below). On the mainland, the CSI (+0.12%) and the Shanghai Composite (+0.17%) are also seeing small gains. Meanwhile, the Nikkei (+0.52%) continues to trade higher, hovering just below record highs reached in the previous session.

Returning to China, consumer prices fell more than anticipated in August, while deflation in wholesale prices continued, as calls intensified for Beijing to enhance measures to stimulate sluggish domestic demand and mitigate the decline in export growth. The CPI decreased by -0.4% y/y in August (compared to the -0.2% expected), primarily due to a high base effect and weaker-than-normal seasonal increases in food prices. The PPI dropped by -2.9% y/y in August, improving from July’s -3.6% decline. This narrowing marks the first improvement since March and indicates stronger industrial demand following government initiatives to support growth. Our Chinese economist has reviewed the inflation data here including a discussion on what was the first test of the new “anti-involution” movement, which started in July with a goal of curbing excess price competition.

To the day ahead now, and data releases include the US PPI reading for August, and Italy’s industrial production for July. In the political sphere, European Commission President Von der Leyen will deliver the State of the Union address to the European Parliament.

Tyler Durden

Wed, 09/10/2025 – 08:30ZeroHedge NewsRead More

R1

R1

T1

T1