ECB Keeps Rates Unchanged As Expected, Euro Drops After 2027 Inflation Forecast Trimmed

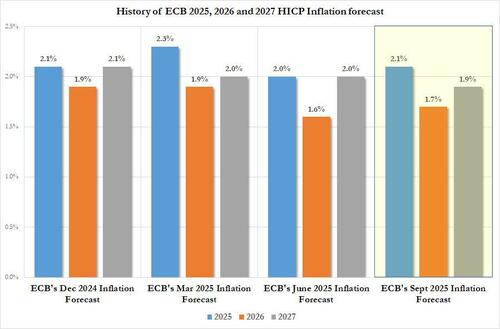

As expected, the ECB left its deposit rate unchanged at 2% and maintained the data-dependent and meeting-by-meeting language in the statement. It highlighted that inflation is currently at around 2% and fresh projections show it close to that level also in 2027, although while it raised inflation forecasts for 2025 and 2026, it trimmed them for 2027. The growth outlook was also similar to the one from June.

Here are the highlights from the ECB statement (link here):

- Will follow a data-dependent and meeting-by-meeting approach to determining appropriate monetary policy stance

- Reiterates that rate decisions will be based on its assessment of inflation outlook and risks surrounding it, in light of incoming economic and financial data, as well as dynamics of underlying inflation and strength of monetary policy transmission

- Not pre-committing to a particular rate path

INFLATION:

- Inflation is currently at around 2% medium-term target and ECB s assessment of inflation outlook is broadly unchanged

- New staff projections present a picture of inflation similar to that projected in June

ECONOMIC PROJECTIONS:

HICP INFLATION:

- 2025: 2.1% (exp. 2.1%, prev. 2.0%)

- 2026: 1.7% (exp. 1.9%, prev. 1.6%)

- 2027: 1.9% (exp. 2.0%, prev. 2.0%)

HICP CORE INFLATION (EX-ENERGY & FOOD):

- 2025: 2.4% (prev. 2.4%)

- 2026: 1.9% (prev. 1.9%)

- 2027:1.8% (prev. 1.9%)

GDP:

- 2025: 1.2% (exp. 1.1% prev. 0.9%)

- 2026: 1.0% (exp. 1.1 %, prev. 1.1 %)

- 2027: 1.3% (exp. 1.5%, prev. 1.3%)

Market Reaction

In response to the ECB hold, the euro extended an earlier fall, while European government bonds pared losses, after the European Central Bank kept interest rates steady as widely expected but cut its inflation forecast for 2027.

- EUR/USD drops 0.3% to 1.1664, before stabilizing around 1.1670

- German bonds pared losses, with yields on two-year bonds trading one basis point higher at 1.96%

- Traders price a 60% chance of another quarter-point cut by the middle of next year, after paring bets to close to 50% ahead of the meeting

Tyler Durden

Thu, 09/11/2025 – 08:29ZeroHedge NewsRead More

R1

R1

T1

T1