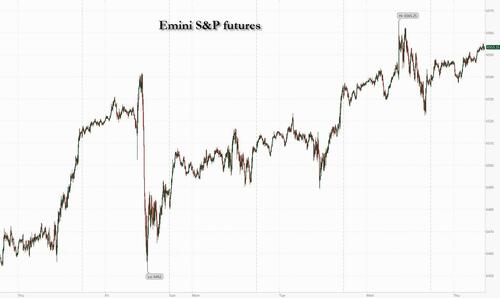

Futures Rise To New All Time High Ahead Of CPI Report

US equity futures have a slight bid into today’s CPI print – the last key macro datapoint ahead of next week’s rate decision – rising to another daily record high, let by Tech. As of 8:10am, S&P futures rise 0.2% after back-to-back all-time highs while Nasdaq 100 futures rise 0.3% with AAPL and AMZN leading the Mag7 higher and ORCL +1.4% after its +36% move yesterday. In a familiar pattern this week, Cyclicals are outperforming Defensives pre-mkt. European stocks also drifted higher while Chinese stocks capped their biggest advance since March, led by companies seen as major beneficiaries of the nation’s push for homegrown technology. Treasuries held steady, with the 10-year yield at 4.05%; the USD is up small as the yen slumps after prominent LDP dove and conservative Sanae Takaichi said she is running for PM; commodities are seeing some profit-taking with both Energy and Metals lower. CPI and Jobless Claims are the focus for today as investors solidify views into next week’s Fed as well as Oct / Dec meetings.

In premarket trading, Mag 7 stocks are all higher (Tesla +1%, Amazon +0.6%, Nvidia +0.5%, Microsoft +0.4%, Meta Platforms +0.3%, Apple +0.2%, Alphabet +0.1%).

- Avidity Biosciences (RNA) plunges 19% after offering $500 million in shares, planning to use some of the proceeds to advance clinical programs.

- Ecovyst Inc. (ECVT) climbs 8% after Technip Energies NV agreed to buy the company’s advanced materials & catalysts business.

- Opendoor Technologies Inc. (OPEN) shares soar 36% after the company said co-founders Keith Rabois and Eric Wu will rejoin the board and named Shopify’s Kaz Nejatian as chief executive officer.

- Oxford Industries (OXM) jumps 18% after the Tommy Bahama owner posted second-quarter profit that beat expectations.

- Red Cat Holdings (RCAT) rises 9% after the drone company said its Black Widow System has been approved and added to the NATO Support and Procurement Agency catalog.

- Revolution Medicines (RVMD) gains 9% after the company reported updates from Phase 1 trials of daraxonrasib in pancreatic cancer.

In corporate news, Citigroup’s CEO sees a pickup in dealmaking as US companies gain confidence from clearer policy signals. Real estate giant Brookfield has declared the debate over remote work is over. Tricolor, a used car seller and subprime lender that focuses on undocumented immigrants in the US Southwest, filed to liquidate in bankruptcy.

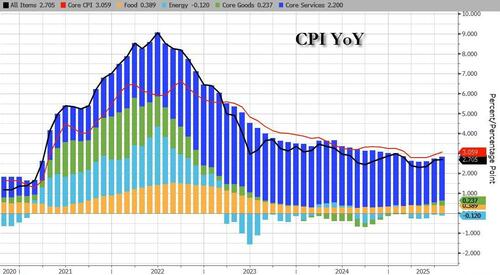

Expectations that the Fed will resume monetary easing this month have soared in recent weeks, as data increasingly point to a US labor market under strain. Wednesday’s surprise decline in producer inflation further bolstered the view that tariffs are not placing excessive pressure on prices. Core CPI, a measure of underlying inflation excluding food and fuel, likely rose 0.3% for a second month, according to the median estimate in a Bloomberg survey (our preview is here). Money markets are currently betting on as many as three quarter-point cuts by December, with some wagers pointing to a jumbo 50-basis-point reduction when the Fed meets next week.

A softer-than-expected print could fuel bets on an initial outsized cut, while a stronger reading would bolster the case for more gradual moves.

“Even if we do have a bit of a bump in CPI, there is a theory that it can be short-term, driven by tariffs,” said Nataliia Lipikhina, head of EMEA equity strategy at JPMorgan Private Bank. “As long as it is not such a big increase, I don’t think you’ll see a very big negative reaction on the market.”

Bloomberg economist Anna Wong expects a hot CPI number driven by discretionary services like airfares and hotels. “Ironically, those gains are the indirect result of easing financial conditions spurred by the reduction of tariffs,” she wrote. Wall Street desks, as we wrote yesterday, expect a muted reaction from stocks. Market drift on Wednesday afternoon and a barbell performance within indexes coincides with some investors bidding up put options to protect this year’s gains. At the same time, a key momentum indicator is flashing warning signs, with the 14-day RSI showing negative divergence with the index. That means while the broader market is grinding higher, its underlying strength is fading.

Equity investors are weighing diverging narratives: easier financial conditions are sustaining the rally, especially with Fed easing on the horizon, yet Wednesday’s PPI data also showed tightening trade margins as inflation is not being passed through to consumers — casting doubt on optimistic earnings forecasts. A weak US CPI print later today could prompt the market to “romance” the idea of a 50-bps rate cut week, but a series of quarter-point reductions is more likely, according to JPMorgan AM. Elsewhere in strategy, JPMorgan said US share buybacks could jump by $600 billion over the coming years as repurchases increase from the $1.5 trillion record expected in 2025.

The prevailing bullish sentiment carries the risk of a volatility comeback. Strategists warn that after one of the strongest rallies in decades, a measure of caution is warranted, especially with stretched positioning, the aggressive pricing in of rate cuts and the seasonally weak September-October period.

“The market has been steadily pricing in a Goldilocks scenario where soft data was perceived positively — ‘bad is good’ — as long as it improved the odds of rate cuts,” said JPMorgan strategists led by Dubravko Lakos-Bujas. After a weak payroll print, “the ‘bad has become less good.’ If inflation comes in hotter this week, we see the current Goldilocks market positioning at risk of correcting.”

In Europe, the Stoxx 600 rose 0.3%, with travel and construction shares leading gains, while automobile and mining stocks are the biggest laggards. re are the biggest movers Thursday:

- Buzzi rises as much as 7.2% after JPMorgan upgrades to overweight, with the bank saying it prefers heavyside exposure within European building materials

- Technip Energies shares rise as much as 5.8% to their highest value on record after the engineering and technology company announced the acquisition of Ecovyst’s Advanced Materials & Catalysts business

- Tate & Lyle shares rise as much as 3.8%, the most since July, as BNP Paribas Exane analysts suggest the ingredients group could be a takeover target

- Covestro rises 8.1% in Frankfurt trading after Reuters reported ADNOC is said to be readying remedies to address an EU subsidy investigation into its bid for the German chemical maker that will likely see it convert a proposed €1.2 billion ($1.4 billion) capital hike to a shareholder loan

- Energean shares gain as much as 2.2%, reversing earlier losses. The oil and gas company delivered what analysts saw as a relatively robust set of results following a mandated and temporary shut-in of its operations in Israel during the period

- Playtech surges as much as 12%, the most in a year, following the gambling technology provider’s first-half results, which analysts say demonstrate a solid performance

- THG PLC shares rise as much as 8.8%, most since June, after the online retailer reported a strong outlook for the second half of the year. Peel Hunt analysts flag the nutrition division’s growing momentum

- Novo Nordisk shares drop as much as 2.4%, paring some of Wednesday’s advance following the Danish drugmaker’s plans to cut jobs

- Rusta falls as much as 12%, the most since its October 2023 IPO, after the Swedish discount retail group reported its latest earnings

- Avio shares declined as much as 10% in Milan trading, the most since December 2022, after Bloomberg reported that the Italian rocket maker may consider a capital increase to strengthen its satellite-launch business

Earlier in the session, Asian equities struggled for direction after a five-day rally, as gains in mainland China countered declines in Hong Kong. The MSCI Asia Pacific Index traded in a narrow range. Hong Kong megacaps including Meituan and Tencent weighed on the regional gauge. Taiwan’s heavyweight component TSMC climbed to a new high as the chipmaker’s sales report added further optimism on the AI trade. China’s CSI 300 Index jumped 2.3%, driven by shares of companies that are seen as major beneficiaries of the nation’s push for homegrown technology. US investor interest in Chinese equities has jumped to the highest since the Covid pandemic due to the Asian nation’s tech innovation, steps to stabilize the economy and improving liquidity, according to Morgan Stanley. The onshore market rally was “mostly driven by the AI craze,” said Steven Luk, chief executive officer at FountainCap Research & Investment in Hong Kong. Oracle’s deal with OpenAI also “boosted demand outlook for upstream and downstream AI related names in China,” he said.

“Asia stocks are drifting with little conviction as investors await the next big cue — US CPI due tonight,” said Hebe Chen, an analyst at Vantage Markets in Melbourne. “Markets feel like they’re treading water, holding gains, but reluctant to chase ahead of an inflation print that could lay the final stone for next week’s Fed cut.”

In Fx, the yen slipped after reports that hard-line conservative Sanae Takaichi will run for of Japan’s ruling LDP. Treasuries were little changed and bund yields ticked higher at the short end before the ECB.

In rates, treasury yields are within a basis point of Wednesday’s closing levels ahead of Thursday’s August CPI report, weekly jobless claims data and 30-year bond reopening. Bunds underperform slightly before ECB rate decision at 8:15am New York time. In Asia, the yen slipped after reports that hard-line conservative Sanae Takaichi will run for of Japan’s ruling LDP. US 10-year is little changed near 4.05% with German counterpart about 1bp cheaper on the day. Curve spreads hold most of Wednesday’s sharp flattening move on the back of strong demand for 10-year note auction. Auction drew lower-than-anticipated yields and produced record-low allotments to primary dealers, signs of strong demand from end users.

In commodities, brent traded above $67 even as the IEA said the record oil surplus for next year is looking even bigger. Gold retreated from a record, down $25 to about $3,616 an ounce.

Turning to the day ahead now, US economic data slate includes August CPI and weekly jobless claims (8:30am), 2Q household change in net worth (12pm) and August Federal budget balance (2pm). Elsewhere, the ECB will be making their latest policy decision.

Market Snapshot

- S&P 500 mini +0.1%

- Nasdaq 100 mini +0.2%

- Russell 2000 mini little changed

- Stoxx Europe 600 +0.2%

- DAX little changed, CAC 40 +0.7%

- 10-year Treasury yield +1 basis point at 4.05%

- VIX -0.2 points at 15.19

- Bloomberg Dollar Index +0.2% at 1202.92

- euro little changed at $1.1687

- WTI crude -0.4% at $63.42/barrel

Top Overnight News

- Manhunt underway after conservative activist Charlie Kirk shot dead on Utah campus: RTRS

- Reports that U.S. President Donald Trump asked the European Union to slap tariffs of up to 100% on China and India for their Russian oil purchases has raised eyebrows on both sides of the Atlantic, with Europe seen as unlikely to acquiesce to the White House’s request. CNBC

- US President Trump’s administration appealed the court ruling blocking the removal of Fed Governor Cook.

- G7 sovereign debt levels becoming a growing concern for investors as yields creep higher on back of extreme fiscal imbalances, political instability, and elevated inflation, with a particular focus on France, the UK, the US, and Japan. RTRS

- Stephen Miran, Trump’s temporary Federsal Reserve pick, could be confirmed to the Fed as soon as Monday, allowing him to participate in next week’s FOMC meeting. Politico

- China is preparing to tackle a backlog of unpaid local government bills to the private sector, people familiar said, with some estimates putting the arrears at more than $1 trillion. BBG

- Hong Kong regulators have begun allowing companies to avoid stringent rules on bond issuances and share buybacks, following the success of a $5bn transaction launched by Alibaba last year. FT

- The Bank of Japan is firming up a strategy to unload its huge holdings of risky assets that will likely center on a plan to gradually sell exchange-traded funds (ETF) in the market. RTRS

- The US immigration raid that detained hundreds of South Korean workers may have a “significant impact” on future investments, President Lee Jae Myung warned. The 330 people are scheduled to return home today on a charter flight. BBG

- The IEA expects an oil glut next year, forecasting supply will exceed demand by 3.33 million barrels a day. The US and Brazil will lead non-OPEC+ growth at twice the pace of demand. OPEC’s monthly report is due next. BBG

- Goldman expects a 0.36% increase in August core CPI (vs. +0.3% consensus), corresponding to a year-over-year rate of 3.13% (vs. +3.1% consensus). It expects a 0.37% increase in headline CPI (vs. +0.3% consensus), reflecting higher food (+0.35%) and energy (+0.6%) prices: GIR

Trade/Tariffs

- South Korean President Lee said there will be more ways to negotiate with the US, and a final conclusion on trade negotiations with the US is expected to be rational, while he added they are in discussions with the US to operate visa systems normally and that Korean businesses will now be hesitant about investing in the US following the immigration raid. Lee also noted that various factors are involved in trade negotiations with the US, including nuclear material reprocessing and defence costs. Furthermore, South Korea’s Industry Minister is to travel to the US today for follow-up trade negotiations.

- US President Trump reportedly halted the deportation of Korean workers to encourage them to train Americans, and Seoul officials said Trump gave those at the Hyundai Motor (005380 KS)-LG Energy Solution (373220 KS) battery plant an option to stay, according to FT.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks followed suit to the mixed performance stateside, where the S&P 500 and Nasdaq printed fresh record highs after cooler-than-expected PPI data, but with some cautiousness seen as participants braced for the incoming US CPI report. ASX 200 was subdued in the absence of any notable data or drivers, and with the downside led by healthcare, consumer discretionary and financials. Nikkei 225 returned to above the 44,000 level and extended on record highs despite mixed data. Hang Seng and Shanghai Comp were mixed with the Hong Kong benchmark dragged lower by pharmaceutical stocks after reports that the US is considering severe restrictions on medicines from China, while the mainland was underpinned after recent policy pledges by China’s state planner.

Top Asian News

- BoJ is firming up a strategy to unload its huge ETF holdings and is centring on gradual market sales, according to sources cited by Reuters, who added there is no consensus yet on the timing, with political uncertainty complicating the decision.

- South Korean President Lee held a conference on his first 100 days in office, where he stated the domestic economic indicators are showing signs of recovery and the stock market is recovering at a fast pace, while he added that measures on stabilising property prices will continue to be rolled out. Lee said unreasonably undervalued stocks are prevalent in the South Korean market and tax policies can be modified to revitalise stock markets, but noted that capital gains tax rules will not change, and he will leave it to Parliament to decide on capital gains tax rules. Furthermore, he said it is time for expansionary fiscal policy to achieve economic growth, even if it raises national debt.

- China is said to be mulling aiding local governments with USD 1tln of bills, according to Bloomberg sources. Chinese government reportedly considers directing state lenders and policy banks to provide loans to local authorities for overdue payments.

- Japan LDP senior member Takaichi confirmed that they will be running for LDP leadership, via Newsjp.

European bourses (STOXX 600 +0.4%) are modestly firmer across the board, with some outperformance in the CAC 40 (+0.7%). European sectors hold a strong positive bias, albeit with the breadth of the market fairly narrow. There are only a handful of industries holding marginally in the red. Retail is once again leading the pile, continuing the strength seen in the prior session. Energy follows closely behind, and Construction & Materials completes the top three.

Top European News

- UK Chancellor commits to exploring pro-growth tax reforms to support small businesses expanding operations.

- Germany’s BGA Trade Association says German exports are expected to fall 2.5% in 2025 and imports to rise 4.5%.

FX

- DXY is fractionally higher following an indecisive session on Wednesday in the wake of soft PPI metrics and in the run-up to today’s CPI report. Expectations are for core M/M CPI to remain at 0.3% with the Y/Y rate seen holding steady at 3.1%. As such, the desk notes that the report “reinforces confidence that the upcoming CPI print is unlikely to exceed 0.3% M/M”. Elsewhere on the data slate are the weekly jobs figures with initial claims expected to slip to 235k from 23k. DXY has ventured as high as 97.96 with attention on a test of 98.00; not breached since 5th September.

- EUR is steady vs. the USD ahead of the latest ECB policy decision, which is widely expected to see policymakers stand pat on the Deposit Rate at 2%. These expectations come off the back of the EU-US trade agreement, resilient growth in the face of trade tensions and a modest uptick in inflation. Ahead focus will be on clarity on the split of the Governing Council and any potential guidance on the monetary policy path. EUR/USD has slipped back onto a 1.16 handle but is holding above Wednesday’s low at 1.1683.

- JPY sits at the bottom of the G10 leaderboard and has extended its mild losses vs. the USD seen on Wednesday. From a macro perspective, today’s session has been lacking in Japanese-specific updates, but traders remain mindful of political risk and its potential impact on the BoJ. USD/JPY has ventured as high as 147.96 with focus on a test of 148 to the upside.

- GBP is a touch softer vs. the USD as incremental macro drivers for the UK remain on the light side. Concerns over longer-term UK borrowing costs have temporarily abated with the 30yr yield having pulled back to circa 5.48% from its recent multi-decade high at 5.752% printed on 3rd September. GBP/USD is currently holding above the 1.35 mark after basing out at 1.3502.

- Antipodeans are both marginally softer vs. the USD with not much in the way of incremental newsflow for the pair.

- PBoC set USD/CNY mid-point at 7.1034 vs exp. 7.1157 (Prev. 7.1062)

Fixed Income

- USTs are softer, as was the case at this point on Wednesday. Once again, the action is relatively modest in nature as the complex awaits CPI and thereafter 30yr supply. Into the above, USTs at the low end of a 113-12 to 113-15+ band. Entirely within Wednesday’s 113-05 to 113-20 parameters; as a reminder, PPI drove USTs higher, but the mentioned peak printed a few hours later after the strong 10yr auction.

- Bunds began the morning firmer by 14 ticks at best, notching a 129.28 peak and matching Tuesday’s high but stopping shy of 129.33 and 129.44 from Monday and Wednesday respectively. However, initial impetus faded into the European cash equity open. A move that occurred alongside a broader modest pullback in the fixed income space and as the USD strengthened. No fresh fundamental catalysts emerged at the time. All focus now turns to the ECB. The Deposit Rate is expected to be maintained at 2.00%. Focus for the meeting will be on any insight into the divide between the doves/hawks, a point that could become starker depending on how the 2026 inflation forecast develops, with desks of the view that it will tick higher from 1.6% but remain beneath the 2% target.

- Gilts saw a softer start to the day, opened lower by just under 10 ticks and then slipped further to notch a 91.22 low. Action that followed the modest bearish bias that was in play for peers at that point. Since, Gilts have managed to lift off this low and move into the green, higher by near 15 ticks at best but stalling 11 ticks shy of Wednesday’s 91.58 peak. Upside that comes as Gilts are perhaps able to trade a little more freely than peers, as the UK docket is a very light one.

- UK DMO sells GBP 1bln 4.25% 2032 Gilt; b/c 3.72, average yield 4.206%.

- Italy sells EUR 3.25bln vs exp. EUR 2.75-3.25bln 2.35% 2029 & EUR 1.5bln vs exp. EUR 1.25-1.5bln 4.00% 2030 BTP.

Commodities

- Crude was subdued in early European hours following an uneventful APAC session and after their recent advances, which were facilitated by geopolitical developments in the Middle East and Eastern Europe, with an uplift seen after comments from US President Trump, who posted “What’s with Russia violating Poland’s airspace with drones? Here we go!”. The modest downside comes amid a cautious mood ahead of US CPI and ECB, whilst this morning the IEA raises its 2025 world oil demand growth forecast to 740k BPD (prev. 680k BPD), and maintains its 2026 forecast at 700k BPD. Some modest upside seen on commentary via Poland, Ukraine and Lithuania who said the Russian drone incursion is an unprecedented provocation. WTI currently resides in a narrow 63.34-63.80/bbl range while Brent sits in a USD 67.21-67.62/bbl range.

- Mixed trade across precious metals, with gold and silver taking a breather following recent advances ahead of US CPI. Spot gold currently resides in a USD 3,614.32-3,649.35/oz range and within Wednesday’s USD 3,620.13-3,657.61/oz range. All-time high still sits at USD 3,674.69/oz printed on 9th September.

- Copper futures gradually pulled back from Wednesday’s peak and eventually the USD 10k/t mark, with price action contained alongside the cautious risk sentiment heading into US CPI and the ECB, with the latter expected to hold rates at 2% for a second meeting. Attention will centre on guidance regarding further easing and the split of views on the Governing Council.

- IEA OMR: IEA raises 2025 world oil demand growth forecast to 740k BPD (prev. 680k BPD); 2026 growth forecast maintained at 700k BPD.

- Saudi Aramco has reportedly asked buyers to lift more October oil after recent deeper-than-expected price cuts, according to Reuters sources.

Geopolitics: Middle East

- Qatar said it condemns Israeli PM Netanyahu’s explicit threats of future violations to state sovereignty, and it will work with its partners to ensure Netanyahu is held accountable.

- US President Trump reportedly had a heated call with Israeli Prime Minister Benjamin Netanyahu on Tuesday regarding the Israeli strike in Qatar, according to senior US administration officials cited by WSJ.

- US Pentagon approved an estimated USD 14.2mln presidential drawdown authority package for Lebanon, which will build the capacity of Lebanese armed forces to dismantle weapons caches and military infrastructure of non-state groups, including Hezbollah.

- Doha is to host emergency Arab-Islamic summit on Sunday and Monday amid discussions over Israeli attacks on Gaza, according to the Qatar News Agency.

Geopolitics: Ukraine

- French President Macron said he discussed with US President Trump the troubling developments in Russia’s war of aggression against Ukraine.

- The UN Security Council was asked by five members to meet on Friday over Russia’s violations of Polish airspace.

- EU said sanctions against Russia are to be increased significantly, and the EU foreign policy chief commented that the serious violation of European airspace strengthens their resolve to support Ukraine.

- Foreign ministers of Poland, Ukraine and Lithuania warn of deliberate Russian drone incursion, call it unprecedented provocation. Ministers urge partners to bolster Ukraine’s air defence and extend support to Lithuania and Poland amid escalating tensions

Geopolitics: Other

- South Korean President Lee said North Korea’s reaction has been cold but stated that no matter how North Korea reacts, easing tensions will benefit South Korea, while he added North Korea’s nuclear and missile programs are a complex issue directly involving the US. Furthermore, he said South Korea doesn’t necessarily have to lead in improving relations with North Korea and that US President Trump can have the most powerful influence on North Korea issues, as well as noted that they will keep trying to restore trust with North Korea.

- North Korea’s leader Kim is believed to be expanding ties with China following his visit to China, and there is a higher chance that China will support North Korea via unofficial trade, according to South Korean lawmakers citing South Korea’s spy agency.

- The Philippines Foreign Ministry strongly protested the recent approval by China’s State Council of the establishment of the Kuanyan Island National Nature Reserve, and urged China to respect the sovereignty and jurisdiction of the Philippines over Scarborough Shoal, while the Philippines also urged China to refrain from enforcing and immediately withdraw its State Council issuance.

US Event Calendar

- 8:30 am: Aug CPI MoM, est. 0.3%, prior 0.2%

- 8:30 am: Aug CPI Ex Food and Energy MoM, est. 0.3%, prior 0.3%

- 8:30 am: Aug CPI YoY, est. 2.9%, prior 2.7%

- 8:30 am: Aug CPI Ex Food and Energy YoY, est. 3.1%, prior 3.1%

- 8:30 am: Aug CPI Index NSA, est. 323.94, prior 323.05

- 8:30 am: Aug CPI Core Index SA, est. 329.62, prior 328.66

- 8:30 am: Sep 6 Initial Jobless Claims, est. 235k, prior 237k

- 8:30 am: Aug 30 Continuing Claims, est. 1950k, prior 1940k

- 2:00 pm: Aug Federal Budget Balance, est. -340b, prior -380.08b

DB’s Jim Reid concludes the overnight wrap

Thirty years ago this morning, I stepped into the City for the first time as a fresh-faced graduate trainee, wearing a cheap, ill-fitting suit and brimming with misplaced confidence. I’d been hired with great fanfare by the graduate recruitment team, told I was going to be invaluable to the bank, and walked through the doors convinced I’d be running a major trading book within months.

Fast forward two years, and I was still photocopying and delivering the daily price sheet to 80–100 salespeople and traders, while also fetching their breakfasts and coffees. My spreadsheet skills were honed not through yield curve analysis, but by counting and allocating bacon sandwiches. Every time I raised concerns about my underutilised talents, I was met with a colourful barrage of profanities and told in no uncertain terms that I was lucky to be there—and to shut up and get on with it.

Safe to say, if I tried that management style on juniors today, HR might have a few thoughts.

So I thought I would be the oracle, but I was actually the breakfast strategist. Bagels.. not bonds. 30 years on and it’s a different oracle that has moved market over the last 24 hours as the enterprise software company Oracle rose +35.95% yesterday after the aggressive outlook for its cloud business that we discussed yesterday after its release after hours on Tuesday. This helped drive the S&P 500 (+0.30%) to another record and came alongside a fresh rally for US Treasuries after a soft US PPI reading for August. Next stop CPI today.

So, a perfect alignment of macro and micro. On the macro, the US PPI showed that headline producer prices fell by -0.1% in August (vs. +0.3% expected). Moreover, the previous month’s reading for July also got revised down from +0.9% to +0.7%, so that provided a lot of reassurance that tariff-driven inflation wasn’t obviously showing up. Indeed, the latest print and the revisions pushed the year-on-year PPI reading back to +2.6% (vs. +3.3% expected), which is actually a clear reduction from the start of the year, when it peaked at +3.8% in January. To be fair, the core measures were relatively stronger, and PPI excluding food, energy and trade services was still up +0.3% on the month as expected. Indeed, taking the PPI categories that feed into core PCE – airfares, portfolio investment and medical care services – our US economists see August core PCE inflation tracking at +0.32%, in line with their pre-PPI expectations. But the market focus was very much on the downside surprise in the headline number, as that was seen as giving the Fed more space to cut rates in the months ahead.

Of course, that core PCE signal will depend a lot on today’s CPI print, which our economists expect to come in at +0.36% for headline and +0.32% for core, a touch above consensus (+0.3% for both). That would bring the YoY rate to +2.9% and +3.1% for headline and core respectively. See also the CPI preview from our inflation strategists here for more.

For the Fed, that softness in the PPI print led investors to dial up their expectations for rate cuts this year. By the close, the amount of cuts priced by December was up by +1.5bps on the day to 68bps. In turn, that put downward pressure on Treasury yields across the curve, with the 2yr yield (-1.4bps) down to 3.54%, whilst the 10yr yield (-4.1bps) fell to 4.05%. The front-end rally did reverse a bit later in the day as Brent crude rose +1.66% to $67.49/bbl as investors became wary of possible new Western restrictions targeting Russian oil in response to the incursion of Russian drones into Poland the previous night. Meanwhile, gold prices (+0.39%) continued to benefit as investors priced in more rate cuts, reaching another record high of $3,641/oz.

In the background, there were a few other Fed-related stories, as President Trump continued his criticisms, posting that “Powell is a total disaster, who doesn’t have a clue!!!”. Powell’s term as Chair still goes up until May, but there was progress on Trump’s nominee for the Fed Board of Governors, Stephen Miran, who currently is the chair of the Council of Economic Advisors. Miran’s nomination was approved by the Senate Banking Committee yesterday, who voted by 13-11 in favour on party lines. A full Senate vote is possible as soon as Monday, which could then allow Miran to take part in the FOMC meeting next week. Meanwhile, the US Justice Department yesterday launched an appeal to the federal appeals court against Tuesday’s court decision that temporarily blocked Trump from removing Fed Governor Lisa Cook.

This backdrop of decent micro and macro meant that equities put in another solid session. That pushed the S&P 500 (+0.30%) up to another record high, with the index getting a huge boost from Oracle (+35.95%), which posted its biggest daily gain since 1992. That comfortably left Oracle as the top performer in the entire S&P 500, but it was a more mixed session for other tech shares. Semiconductor stocks rallied, led by a +3.85% gain for Nvidia, but the overall Magnificent 7 (-0.53%) fell back amid sizeable declines for Apple (-3.23%) and Amazon (-3.32%). And for a second day running, a new high for the S&P came despite most of its constituents falling on the day. Meanwhile in Europe, equities were comparatively subdued, with the STOXX 600 -0.02% on the day.

Looking forward, a key highlight today will be the ECB’s latest policy decision, which is being announced at 13:15 London time. They’re widely expected to keep their deposit rate on hold at 2%, which would be the second meeting on hold in a row. In terms of what to expect, our European economists think that President Lagarde will repeat that policy is “in a good place” to navigate uncertainties. So that signals a pause, but without contradicting the data-dependent, meeting-by-meeting approach. It’s also a meeting with new forecasts, and back in June the most recent forecasts showed an undershoot of the inflation target in 2026. So if today’s projections show a deeper or longer undershoot, then they think the pressure for further cuts could build, even if their base case is that we’re already at terminal. For more info, see their full preview here.

Ahead of that meeting, European sovereign bonds were fairly stable, as they didn’t get as much support from the soft PPI print as US Treasuries did. So, yields on 10yr bunds (-0.8ps), OATs (-0.8bps) and BTPs (-1.3bps) only saw modest declines. Interestingly, we did see the French 10yr yield poke above Italy’s again in trading, but it ultimately closed -0.3bps beneath its Italian counterpart. So, we’ve only seen the crossover happen on an intraday basis so far, and you still have to go back to 1999 for the last time that the Italian 10yr yield actually closed beneath its French counterpart.

In France, new prime minister Sebastien Lecornu began his tenure vowing to work hard with opposition parties to resolve the budget challenges. And we heard a tentatively constructive tone on this from the centre-left Socialists as their leader Olivier Faure left open the door to discussions with the new government, while calling for a “budget proposal that spares the working and middle classes”.

Asian equity markets are mostly higher this morning. The Nikkei (+0.90%) is at a new record high following a near +10% surge in tech investment firm SoftBank. Furthermore, the resignation of PM Ishiba continues to foster some expectations that his successor may adopt more expansionary fiscal and monetary policies, which continues to bolster market sentiment. Conversely, the Hang Seng index (-0.37%), which recently reached its highest level in four weeks, has halted its recent rally as Chinese pharmaceutical stocks experience declines due to worries that the Trump administration might impose new restrictions on medicine exports from China. However, a big rebound in mainland stocks is offsetting this, with the CSI (+1.77%) and the Shanghai Composite (+1.12%) both trading significantly higher. Additionally, the KOSPI (+0.40%) is showing resilience, even after the country’s President refrained from abandoning a proposal that would have broadened the pool of stock investors subject to capital gains tax. US equity futures are flat alongside US Treasury yields.

To the day ahead now, and the main data highlight will be the US CPI for August, along with the weekly initial jobless claims. Elsewhere, the ECB will be making their latest policy decision.

Tyler Durden

Thu, 09/11/2025 – 08:20ZeroHedge NewsRead More

R1

R1

T1

T1