Mystery Trader Makes Record Bet On 50bps Rate Cut Tomorrow

With a 25bps rate-cut fully priced in tomorrow, a mystery trader made a massive bet yesterday to hedge against the possibility of a much larger 50bps cut – very much against the consensus in the market.

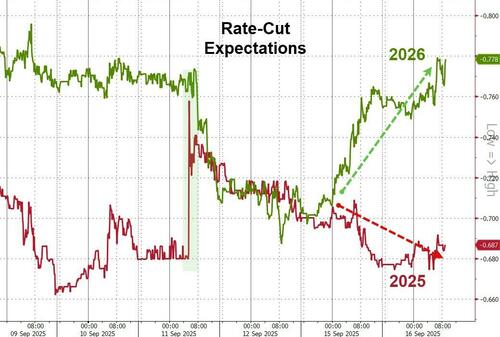

After last week’s jobless claims and CPI/PPI malarkey, there has been some rotation in the market relating to The Fed’s rate-cut trajectory (with 2025 expectations declining and 2026 expectations increasing)…

The 2025 shift has seen September odds of a 50bps cut tumbled (from almost 20% to only around 4% now) while October’s odds of a 25bps cut are also falling…

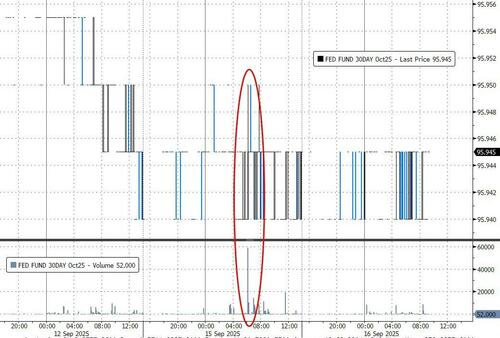

So, despite that hawkish shift, Bloomberg’s Ed Bolingbroke reported an eventful morning session in the US yesterday for flows in the front-end of the curve included the largest ever block trade in fed funds futures.

The trade took place in the October fed funds, for an amount of 84,000 contracts which is equivalent to $3.5 million per basis point in risk.

As Bolingboke notes, the price and timing of the trade was consistent with a buyer, potentially indicating a hedge against a half-point rate cut at Wednesday’s policy meeting, given a quarter-point cut is now fully baked into the swaps market.

The CME confirmed this was the largest ever block trade in Fed Funds Futures…

The largest ever Fed Funds futures block trade was executed this morning (84,000 contracts, equivalent to $3.5m per basis point), underscoring the significant risk transfer enabled by CME Group’s deeply liquid markets. pic.twitter.com/eV3EsnUMKe

— CME Group Interest Rates (@Interest_Rates) September 15, 2025

Along with the massive fed funds futures flow, and perhaps reflecting the shift seen in the first chart above, there was also a huge SOFR spread trade via a September 2026/March 2027 steepener.

This position may reflect a wager on more front-loaded and deeper rate cuts vs. current policy pricing.

As we noted earlier, and bearing in mind these new large positions, Goldman believes the main near-term risk to equity markets would be an unwind of Fed cutting expectations, particularly for some of the lower quality pockets of the market that have benefited from a more ‘goldilocks’ backdrop.

Tyler Durden

Tue, 09/16/2025 – 13:00ZeroHedge NewsRead More

R1

R1

T1

T1