Record Direct Demand For Stellar, Stopping-Through 20Y Auction

After 3 stellar coupon auctions last week, with 10Y yields trading effectively at the lowest level since last October (excluding the Liberation Day basis trade freak out) , and with the Fed set to cut by at least 25bps, there was little anxiety ahead of today’s 20Y coupon auction. And with good reason: moments ago the day’s coupon auction, a reopening of the 19-Year, 11-Month cusip UN6, went without a glitch in what was a very solid auction.

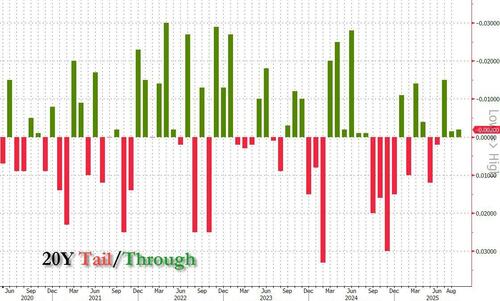

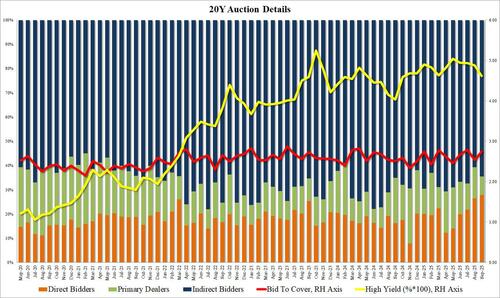

The auction priced at a high yield of 4.613%, down from 4.876% last month and the lowest since October 24. It also stopped through the When Issued 4.615% by 0.2bps, the 3rd consecutive through auction in a row.

The bid to cover was 2.74 up from 2.54 in July, the second highest since March and above the 2.65 six-auction average.

The internals were a bit weaker, with Indirects taking down 64.6%, up from 60.6% last month (which was the lowest since Feb 24), and with Directs taking down 27.9%, the highest on record…

… Dealers were left holdings just 7.6%.

Overall, this was a very solid auction, whose highlight this month was the record Direct award, any in any event the demand was clearly there and the yield on the 10Y is now back down to session lows with just 24 hours left until tomorrow’s FOMC decision.

Tyler Durden

Tue, 09/16/2025 – 13:27ZeroHedge NewsRead More

R1

R1

T1

T1