US Futures Set For Another Record, Nasdaq On Pace For 10th Straight Gain

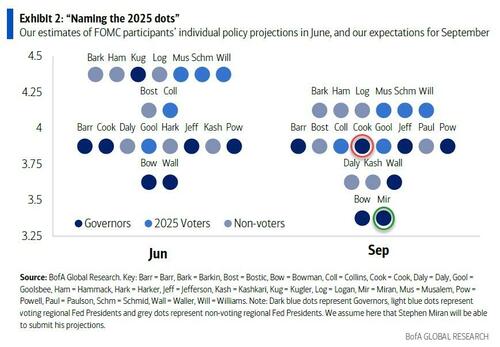

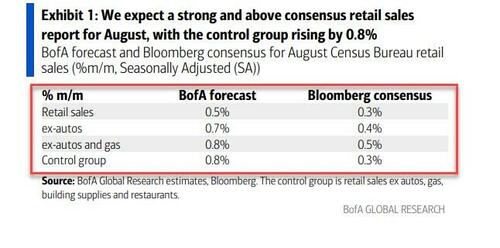

US equity futures are higher (duh) outperforming global counterparts, while the Nasdaq is on pace for a historic 10th day of gains. As of 8:00am ET, S&P and Nasdaq 100 futures were higher by 0.2% with Oracle rising more than 5% in premarket trading on news it may soon be handed control of TikTok. S&P 500 contracts edged higher after the US benchmark powered through the 6,600 mark on Monday. Pre-mkt, Mag7 is displaying strength across multiple members with add’l TMT support from AVGO (+1.4%) and ORCL (+3.7%). Cyclicals and Semis are poised to lead but with pockets of strength in Defensives (HC, Staples) also seen. Europe’s Stoxx 600 fell 0.2%. Bond yields are flat to down 1bps with the US Dollar broadly weaker ahead of a widely expected 25bp cut and the resumption of the Fed’s easing cycle which paused in Dec 2024 (right after Trump was elected). US Treasuries have been racing past peers, the euro is nearing four-year highs and Goldman strategists caution that the next pain point for bond traders may come in the five-year part of the curve. Both Cook and Miran will be a part of the vote. Today’s macro data focus is on Retail Sales where Feroli is below the Street seeing a 0.1% MoM print and 0.3% for the Control Group.

In premarket trading, Mag 7 stocks are mostly higher: Tesla rises 1.3%, paring earlier gains after the National Highway Traffic Safety Administration opened a probe over issues with door handles on certain Model Y vehicles. Alphabet gains 1.3% a day after the Google-parent on Monday joined an elite group of companies valued at more than $3 trillion (Nvidia -0.2%, Microsoft +0.1%, Apple -0.01%, Amazon +0.5%, Meta Platforms +0.6%)

- Bloom Energy (BE) jumps 7% after Morgan Stanley boosted its price target on the fuel-cell manufacturer to a Street-high, saying the company is much more favorably positioned for success in powering AI data centers.

- Dave & Buster’s (PLAY) tumbles 15% after the restaurant operator reported adjusted earnings per share and revenue for the second quarter that came in well below the average analyst estimate.

- Hershey’s (HSY) gains 2% after Goldman Sachs double upgraded the shares. Analysts said market-share trends are improving, and there are incremental tailwinds ahead for the chocolate and confectionery company.

- New York Times (NYT) shares slip 1.9% after President Donald Trump filed a $15 billion defamation and libel lawsuit against the news organization.

- Oracle (ORCL) rises 5% after CBS News reported that the software giant is among a consortium of firms that would enable TikTok to continue operations in the US if a framework deal is finalized.

- Warner Bros Discovery (WBD) shares fall 1.5% as TD Cowen downgraded to hold from buy after the stock rallied even as Paramount is still to make an official offer.

- Webtoon Entertainment (WBTN) soars 47% after Walt Disney said it plans to acquire a 2% equity interest in the online comics company.

Stock bulls are riding high ahead of a widely expected 25-basis-point Fed cut on Wednesday (potentially as high as 50), the first move in a policy easing round projected to run into 2026. Rate-sensitive tech shares have led the charge in the post-Liberation Day rebound, fueled by enthusiasm over artificial intelligence. Asset managers are growing even more bullish according to the latest BofA survey. But stretched positioning in pockets of the market, with some funds already “maximum long”, is leaving it vulnerable to a shock.

“Capex and profit forecasts linked to AI are overwhelming,” said Thomas Brenier, head of equities at Lazard Freres Gestion. “Look at Oracle, it seems that the sky is the limit.”

Expectations of aggressive Fed rate cuts drove the dollar toward its weakest level since July. The euro climbed 0.4%, nearing its highest mark since 2021. The divergence reflects the Fed’s shift toward easing, in sharp contrast with the European Central Bank, where policymakers have signaled an end to their own loosening cycle.

As the Nasdaq prints a nine-day winning streak, hedge funds net bought IT stocks at the fastest pace in seven months across all regions, according to Goldman’s prime desk. With CTAs max long, corporates increasingly moving into buyout blackouts, and hedge funds likely only able to add at the margin, retail and discretionary investors are left to support equities.

Meanwhile, the tensions between the Fed and Trump administration escalated Monday. An appeals court temporarily halted the effort to oust Governor Lisa Cook, while the Senate separately approved Trump’s economic adviser Stephen Miran for a seat on the board.

Later on Tuesday, traders are set for a final read on the American consumer. Retail sales data for August are forecast to show a 0.2% increase, following stronger advances in the previous two months, although real -time card spending data hints at an even higher print. Bloomberg economists Eliza Winger and Estelle Ou expect headline retail sales likely grew 0.2% in August, down from 0.5% in July, as auto sales slowed, noting spending remains modest overall with consumers concerned about tariffs and the economy. With the jobs market softening and prices rising, questions remain over how long consumers will keep spending freely.

“In the session ahead, we navigate US retail sales and that poses a degree of risk to markets,” wrote Chris Weston, head of research at Pepperstone Group. “However, with the Fed meeting looming large in the following session, it will likely take an outsized surprise in retail sales to really move the dial on risk.”

Stocks may have further upside as rising expectations for economic growth continue to buoy bullish sentiment, according to Bank of America’s Michael Hartnett. His latest fund manager survey found that a net 28% of global investors are overweight equities, the strongest reading in seven months. Views on growth also showed the biggest positive shift in nearly a year, with only a net 16% of respondents still anticipating an economic slowdown, Hartnett said.

Europe’s Stoxx 600 falls 0.1% as the rally that sent US and Asian stocks to fresh highs sputters in Europe. Italian banks dip on news that the government was drafting plans to raise another €1.5 billion ($1.8 billion) from lenders, while miners gained on the back of rising iron ore prices. Here are the biggest movers Tuesday:

- European mining shares are the best performers in the Stoxx 600 benchmark on Tuesday after iron ore advanced, with China’s daily steel output showing signs of improvement

- Embracer gains as much as 5.5%, the biggest contributor to the Stoxx 600 Index, after Kepler Cheuvreux reiterated its buy rating and boosted its price target for the Swedish gaming group ahead of a spinoff of its Coffee Stain subsidiary

- ASML shares continue to rally Tuesday after JPMorgan said that the worst of newsflow is likely behind the chip-gear firm as better trends in both memory and logic end-markets bode well for the 2027 sales outlook

- Kering shares gain as much as 2.4% after CIC upgraded the French luxury firm to buy from hold on improved outlook following the new CEO’s plans, a creative revamp at Gucci, and its delayed Valentino purchase agreement

- Fresnillo rises as much as 4.6% in London after JPMorgan upgraded the precious metals firm’s price target to 2,500 pence from 2,100 pence and reiterated its overweight rating, as the bank sees further upside for the miner

- Kier Group rises as much as 9.4% as the infrastructure services and construction company reported full-year results that beat estimates on better-than-expected current trading and solid order book

- VusionGroup rises as much as 20%, the most since February, after the French tech group’s full-year sales forecast beat expectations and broker Gilbert Dupont upgraded its rating for the stock

- Yellow Cake shares rise as much as 8.4% in London, hitting their highest level since December, tracking a rise in global peers after the US Energy Secretary said the US should boost its strategic uranium reserve

- Shelf Drilling jumps as much as 34%, the most since August, after Ades increased its cash consideration for the offshore drilling contractor to NOK18.5 per share, from the Aug. 5 offer of NOK14 per share

- Haleon drops as much as 6.1% as Barclays downgrades its rating on the consumer-health company to equal-weight from overweight, based on a tough backdrop in the US

- Granges falls as much as 6.9% after Nordea cut its recommendation on the Swedish aluminum group to hold from buy, saying that while the company is set to gain market share, Nordea struggles to find an inflection point

- Schindler shares slide as much as 2.8% after one of its investors offloaded shares at a discount to Monday’s close. The stock is sliding for a second consecutive session after ending last week at an all-time high

- SThree shares plummet by as much as 28%, their biggest drop this year, after the recruitment company warned it is expecting subdued activity to persist into FY26, hitting its guidance for the year

- Italian banks underperformed on Tuesday after Bloomberg reported that the country’s government is working on a preliminary plan to raise an extra €1.5 billion from lenders in 2027 by postponing their tax deductions

Earlier in the session, Asian stocks surged to a fresh intra-day record, propelled by a rally in chip stocks after Beijing’s anti-monopoly ruling on Nvidia. The MSCI Asia Pacific Index rose as much as 0.8% to reach its highest level on record, as chip stocks such as TSMC and Samsung Electronics led gains. Investor sentiment remained upbeat also on expectations of a Federal Reserve rate cut this week. Chip stocks jumped on Tuesday after a Chinese regulator ruled that Nvidia violated anti-monopoly laws in its 2020 acquisition of networking gear maker Mellanox Technologies Ltd. The decision was interpreted by some investors as a signal of Beijing’s push to promote localization and self-sufficiency in chip technology, sparking gains in Chinese home-grown semiconductor firms. Asian equities have been on a tear recently, repeatedly testing a previous high set in 2021. Investor sentiment has gradually improved since April, boosted by easing trade tensions with the US and a resurgence in Chinese stocks due to AI developments and government efforts to cut overcapacity. Here Are the Most Notable Movers

- The unlisted shares of India’s National Commodity & Derivatives Exchange Ltd. have surged after investors including global high-speed trading firms bought stakes in the company ahead of its foray into equities.

- Nintendo lost 3.3% after fans were left disappointed by the lack of a new Mario game announcement. Disco shares gained 8.2% after Morgan Stanley said it was its top pick in Japan’s chip sector.

- GCL Technology Holdings Ltd.’s stock rose after the Chinese company announced a share sale to help fund efforts to reduce overcapacity in the solar polysilicon sector.

- Disco shares rose as much as 7.6%, their biggest intraday gain since June 27.

- Nintendo shares lost as much as 4%, the most since June 20, after the firm’s Nintendo Direct event ended without an announcement of a major new Mario game for its Switch 2 console.

- LG Display shares surge as much as 14% on expectations that Apple’s new iPhones will help the Korean display panel supplier report stronger earnings.

- Yunfeng Financial shares slide as much as 15% in Hong Kong after the financial services company and a shareholder offer 191 million shares at HK$6.10 each in a top-up placement.

- Genda shares jump as much as 20% to the daily limit after the Japanese arcade operator reported half-year earnings, with operating profit rising 0.9% from a year earlier.

- Nitto Denko shares fall as much as 3.4%, the most since Aug. 4, after the Japanese specialty chemicals company conducted its annual investor’s meeting on Friday that saw an outlook decline in its new circuit products from the year before.

In FX, the dollar weakens for a second day, boosting G-10 peers. The euro touches highest since July, closing in on its strongest level in four years. Sterling hits a two-month high too after UK jobs data backed a slower pace of cuts by the Bank of England.

In rates, US Treasuries were little changed, with the 10-year yield at 4.04% and European bond markets, mixed for gilts. US government bonds have outpaced global peers this year, delivering a 5.8% return as expectations for policy easing reversed widely held bearish views.

In commodities, gold hits another record high, trading about $19 higher on the session to around $3,697/oz. Oil prices dip, with Brent slipping closer to $67/barrel.

Today’s economic data slate includes August retail sales and import/export prices and September New York Fed services business activity (8:30am), August industrial production (9:15am), and July business inventories and September NAHB housing market index (10am).

Market Snapshot

- S&P 500 mini +0.2%

- Nasdaq 100 mini +0.3%

- Russell 2000 mini +0.2%

- Stoxx Europe 600 -0.1%

- DAX -0.3%

- CAC 40 little changed

- 10-year Treasury yield -1 basis point at 4.03%

- VIX -0.2 points at 15.48

- Bloomberg Dollar Index -0.2% at 1191.97

- euro +0.4% at $1.1808

- WTI crude -0.4% at $63.03/barrel

Top Overnight News

- Lisa Cook is set to take part in the FOMC meeting today and tomorrow after an appeals court blocked Donald Trump from firing the Fed governor. So is Stephen Miran, who was confirmed in a 48-47 Senate vote. BBG

- The SEC said it’s prioritizing Trump’s proposal to reduce the frequency of earnings reports after the president called for an end to quarterly disclosures. BBG

- Trump said Congressional Republicans are working on a short-term clean extension of government funding to stop Senate Minority Leader Schumer from shutting down the government.

- Trump signed a Presidential Memorandum to establish the Memphis Safe Task Force which was said to be a replica of efforts in Washington DC and will include the National Guard. Furthermore, Trump stated they are probably going to go in Chicago next and want to get to New Orleans, while he also commented that they need to save St. Louis.

- A group of GOP senators are working on legislation to extend Affordable Care Act subsidies with policy changes designed to win over conservatives, according to four people granted anonymity to disclose private discussions. Politico

- US reportedly looks to boost national strategic uranium stockpile: BBG

- Trump has filed a defamation lawsuit against the NYT seeking $15bn in damages from the media organization he accused of being a “mouthpiece” for the Democratic party. FT

- China has significant leverage when it comes to trade negotiations with Washington, including rare earth supplies and agricultural product purchases (China has halted US soybean purchases, delivering a punishing blow to American farmers). NYT

- The world must invest $540 billion annually in oil and gas exploration through 2050 to sustain output, the IEA said. Without new discoveries or demand shifts, supply may shrink by more than 5 million b/d each year — around 40% higher than it was in 2010. BBG

- The US will start formally implementing a lower 15% tariff on imports of Japanese autos and parts starting today. BBG

- Switzerland’s conservative central bank has quietly become one of the world’s biggest tech investors, amassing a stock portfolio that is equivalent in value to nearly a fifth of the national economy’s annual output. The Swiss National Bank has US equity holdings amounting $16bn, with more than $42bn invested in megacap tech. FT

- The UK labor market showed stabilizing signs after a slump triggered by higher taxes. Payrolls dropped by 8,000 in August and vacancies increased for the first time since early 2024, leaving the BOE on track to hold rates later this week. The pound gained. BBG

Trade/Tariffs

- US President Trump said he is undecided regarding a TikTok stake, and he will speak with Chinese President Xi about a significant agreement, while he believes discussions with Xi will confirm key matters.

- US opened an inclusions window for the section 232 on steel and aluminium in which the Bureau of Industry and Security established a process for including additional derivative steel and aluminium articles within the scope of the duties authorised by the President under section 232 of the Trade Expansion Act of 1962.

- Playbook citing officials reports that the forum for any UK-US talks on steel/aluminium would be a bilateral meeting, however as of Monday night there was reportedly no sign of a sit-down between UK Chancellor Reeves and US Treasury Secretary Bessent.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed amid some cautiousness ahead of upcoming risk events and despite the fresh record levels on Wall St, where the mega-caps did most of the lifting as Alphabet joined the USD 3tln market cap club. ASX 200 marginally gained with the index led by strength in mining, resources and materials, but with gains capped by weakness in defensives. Nikkei 225 swung between gains and losses following an early unprecedented climb to above the 45,000 milestone on return from the extended weekend, while the calendar was quiet, although lower US tariffs on Japan took effect. Hang Seng and Shanghai Comp were subdued despite the recent talks in Madrid where the US and China reached a framework agreement on TikTok although the details were scarce, while US President Trump and Chinese President Xi are scheduled to talk on Friday.

Top Asian News

- Japan’s Finance Minister Kato reiterated it is not appropriate to lower the consumption tax and he has decided to support Agricultural Minister Koizumi in the LDP leadership race.

- China is issuing measures on increasing consumption, according to Xinhua. Will launch a series of consumption promotion activities. Will enhance supply of quality services. Will promote an orderly opening up of sectors including the internet and cultures. Will expand pilots in telecoms, medicine and education sectors. Will extend business hours for tourist sites and museums. Will increase consumption credit support. Will coordinate funding channels, including local government special bonds, for new cultural and tourism facilities.

European bourses (STOXX 600 -0.1%) opened around the unchanged mark, but sentiment then slipped as markets turned risk-off across the board in the continent. That pressure has since slowed down a little and are off worst levels – but indices are still broadly lower. European sectors are broadly on the backfoot, in-fitting with the risk tone. IT is towards the top of the pile, boosted by strength across Dutch semiconductor names; nothing really driving the upside today, but it does come after ASML (+3%) once again overtook SAP, to become Europe’s largest company. Consumer Staples is found towards the bottom of the pile; Unilever (-1%) moves lower after it appointed a new CFO.

Top European News

- ECB’s Villeroy says French growth is not strong enough, but remains positive.

FX

- DXY is on the backfoot; currently trading towards lows of 96.96 Another weak start of the session for the index which remained subdued in APAC hours after weakening yesterday alongside softer US yields and with the greenback not helped by a drop in the NY Fed Manufacturing Survey. Participants now await Industrial Production and Retail Sales data scheduled later today, while the FOMC will also begin its 2-day policy meeting which will be attended by Fed’s Cook and Miran, after a US Appeals Court denied the Justice Department’s request to put on hold a judge’s ruling temporarily blocking Trump from removing Cook, and the US Senate confirmed Miran to join the Fed board.

- EUR/USD mildly benefits from recent dollar weakness and after ECB officials reiterated that interest rates are in a good place. In data, EUR held onto gains following mixed German ZEW survey (Economic Sentiment beat and surprisingly improved but Current Conditions missed and deteriorated), whilst the EZ metrics improved. EUR/USD eventually eclipsed 1.1800 to a current high at 1.1817.

- USD/JPY is softer amid USD weakness and broader JPY strength, with analysts at ING attributing some of the JPY upside to “the more moderate Shinjiro Koizumi is entering the LDP leadership race against Sanae Takaichi, who is seen as yen bearish for her views on loose monetary and fiscal policy.” USD/JPY found resistance near its 21 DMA (147.65) to trade in a current range between 146.69-147.54.

- GBP is benefitting from broader dollar weakness and ahead of US President Trump’s state visit to the UK, with a presser (likely joint) due on Thursday before the US leader’s departure. UK jobs data this morning were largely in line, but a slightly above-forecast employment change prompted a couple of pips of upside in cable, but nothing to write home about. Pricing remains unchanged with markets firmly expecting no change at the BoE this Thursday, with some 97% chance of a hold. Cable trades in a 1.3598-1.3642 range.

- Antipodeans trade rangebound with a slightly softer bias and following an uneventful APAC session. Comments from RBA’s Hunter and Hauser provided little to shift the dial – the former noted they are close to getting inflation to the target and that risks around the outlook are balanced.

Fixed Income

- USTs are flat, awaiting the FOMC on Wednesday, but before that, we have a Tier 1 release in the form of retail sales. Expected at +0.2% M/M in August (prev. 0.5%), while the ex-autos measure is seen rising +0.4% M/M, matching the July reading, and the Retail Control group is seen +0.4% M/M (prev. +0.5%). Thereafter, issuance in focus with a 20yr Bond auction scheduled. No concession seen in trade this morning, but that could change in the hours ahead. Elsewhere, the composition of the Fed remains in focus as Cook will remain on the board for at least the September meeting following a court update. Additionally, White House official Miran has been formally approved and will be partaking in the September meeting. Currently, USTs reside in a very thin 113-11 to 113-16 band.

- Bunds are in-fitting with peers throughout the European morning. Gapped higher around the cash equity open, seemingly as a function of the pressure seen in the equity space around this point. German ZEW for September was mixed. Economic sentiment came in above consensus and seemingly spurred some modest pressure in Bunds with financial market experts cautiously optimistic. However, the current situation has deteriorated amid ongoing US tariff concern and into the German fiscal reform window. As such, Bunds quickly retraced that pressure and are back to pre-release levels. Thereafter, a weaker-than-prior German 2030 auction spurred another bout of pressure in Bunds, back towards earlier lows of 128.54.

- Gilts are modestly lower. No significant follow-through from the morning’s jobs data. Overall, the release was broadly in-line with consensus with the labour market continuing to cool though the pace of this is seemingly beginning to slow. While the continued slowing is arguably a dovish sign, it is counteracted by the (as expected) uptick in wages, which remain at levels likely inconsistent with inflation sustainably settling at target over the medium term. Note, the next CPI release is Wednesday, where the headline Y/Y is expected at 3.8% (prev. 3.8%). Elsewhere, supply was soft. A sub-3x cover and a chunky tail, reminiscent of the auction before last. Results of this sent Gilts lower by just under 10 ticks, but comfortably within existing parameters. Gilts opened the morning unchanged from Monday’s close at 91.47, before briefly dipping to a 91.31 low and then retracing to a 91.57 peak.

- UK sells GBP 3bln 4.375% 2040 Gilt: b/c 2.95x (prev. 3.69x), average yield 5.048% (prev. 5.066%) & tail 0.9bps (prev. 0.1bps)

- Germany sells EUR 3.491bln vs exp. EUR 4.5bln 2.20% 2030 Bobl: b/c 1.70x (prev. 1.90x), average yield 2.29% (prev. 2.32%) & retention 22.42% (prev. 23.19%)

Commodities

- Subdued trade in the crude complex with aggressive losses seen around the time of the European cash equity open which also came despite USD weakness. One of the bearish factors could be reports that the 19th EU sanctions package against Russia is no longer expected to be presented on Wednesday, via Politico citing an EU diplomat (since corroborated by other reports); no detail on when the sanctions would be unveiled. WTI currently resides in a USD 62.89-63.55/bbl range while Brent sits in a USD 67.01-67.68/bbl range.

- Spot gold holds an upward bias as it continues printing fresh records on its way to USD 3,700/oz against the backdrop of a softer dollar and heightened geopolitics. Spot gold currently resides in a USD 3,674.70-3,697.40/oz range with the top end of the band the latest all-time high.

- Base metals are mostly softer despite the softer dollar and gains in US futures, albeit the mood in Europe is slightly more mixed. 3M LME copper holds above USD 10k/t and resides in a USD 10,087.90-10,177.70/t range at the time of writing.

- Commerzbank revises its gold price forecast upward to USD 3,600/oz for end-year; raises silver year-end forecast for 2025 to USD 41/oz and 2026-end forecast to USD 43/oz.

- Thai Central Bank says they have discussed tax on gold trades; to support gold trades in Dollars; other measures on gold trades were discussed.

- Ukraine’s military says it struck Russia’s Saratov oil refinery (140k BPD) in overnight attack.

Geopolitics: Middle East

- Israel has launched its ground incursion into Gaza City, two Israeli officials told CNN early Tuesday; One of the officials said the ground incursion is going to be “phased and gradual” at the beginning.

- Israel military official says will be increasing the amount of troops into Gaza city as the days go by.

- US President Trump said Israel won’t be attacking Qatar.

- US President Trump posted about Hamas moving hostages above ground to use them as human shields and stated “I hope the Leaders of Hamas know what they’re getting into if they do such a thing. This is a human atrocity, the likes of which few people have ever seen before. Don’t let this happen or, ALL “BETS” ARE OFF. RELEASE ALL HOSTAGES NOW!”

- US Secretary of State Rubio said before heading to Qatar, that they hope Qatar will re-engage on Gaza talks despite everything that’s happened, while he added that they have a very short window in which a deal on Gaza can happen and that they are on the verge of finalising an enhanced defence cooperation agreement with Qatar.

Geopolitics: Ukraine

- Polish government is boosting its cyber security budget to a record EUR 1bn this year, after Russian sabotage attempts targeted hospitals and urban water supplies, according to FT.

- Japanese Finance Minister Kato said Japan pledged to comply with WTO rules, but will consider measures to raise pressure on Russia and coordinate with G7 countries, when asked about US requests to G7 for higher sanctions on India and China for buying Russian oil.

- The 19th EU sanctions package against Russia is now off the agenda for Wednesday’s EU ambassadors meeting, no new date has been set, via an EU official. Confirmation of earlier reporting via Politico

- Russia says its drones have struck a Ukrainian gas distribution station reportedly used by the military.

US Event Calendar

- 8:30 am: Aug Retail Sales Advance MoM, est. 0.2%, prior 0.5%

- 8:30 am: Aug Retail Sales Ex Auto MoM, est. 0.4%, prior 0.3%

- 8:30 am: Aug Retail Sales Ex Auto and Gas, est. 0.4%, prior 0.2%

- 8:30 am: Aug Import Price Index MoM, est. -0.2%, prior 0.4%

- 8:30 am: Aug Import Price Index YoY, est. 0%, prior -0.2%

- 9:15 am: Aug Industrial Production MoM, est. -0.1%, prior -0.1%

- 9:15 am: Aug Capacity Utilization, est. 77.4%, prior 77.5%

- 10:00 am: Jul Business Inventories, est. 0.2%, prior 0.2%

- 10:00 am: Sep NAHB Housing Market Index, est. 33, prior 32

DB’s Jim Reid concludes the overnight wrap

I woke up this morning the father of a 10-year-old daughter. Where did the time go? Don’t tell my family as it’s a surprise for tonight, but I spent part of the summer writing and recording a new song and creating a video celebrating Maisie’s first decade. The world premiere at home will be after a night out at an escape room tonight… if we escape.

As we await tomorrow’s FOMC decision, markets have continued to power forward over the last 24 hours, with risk appetite supported by positive noises out of the US-China trade talks. That newsflow led to growing optimism that some kind of longer-term truce would eventually be reached between the two, and those hopes of a cooling in the trade war meant both the S&P 500 (+0.47%) and the NASDAQ (+0.94%) closed at another record high. Moreover, it was a decent session for sovereign bonds as well, thanks to mounting anticipation that the Fed would deliver another rate cut at tomorrow’s meeting. So, it was a strong day all round, and US Treasuries also rallied across the curve, with the 10yr yield (-2.8bps) falling back to 4.04%.

Ahead of today’s start to the FOMC, an appeals court last night blocked Mr Trump from firing Lisa Cook from the Fed board before her appeal against her dismissal is heard. So, she will likely be at the meeting barring any additional legal action. Stephen Miran could also sit as he was confirmed in his new post by the Senate last night. So, it’s shaping up to be an interesting 2-day meeting.

On those US-China headlines, Trump himself posted that the meeting in Madrid “has gone VERY WELL!” and that he would be speaking with President Xi on Friday. Separately, Treasury Secretary Bessent said that “we do have a framework for the deal with TikTok”. This collectively led to a fresh burst of optimism, particularly around stocks which are more exposed to US-China trade. For instance, the NASDAQ Golden Dragon China index (+0.87%) outperformed, which is an index made up of US-listed companies who do a majority of their business in China.

That positive trade narrative spread across markets, helping to lift global equities as investors grew more hopeful on the path of US-China relations. After all, there’s still a lot of tension between the two sides, and it’s worth remembering that the tariffs are still subject to a temporary 90-day truce in place between the two sides, which currently runs out in November. The hope is that continued engagement will eventually lead to a more durable truce, avoiding the possibility of US tariffs jumping back up to the 145% rate seen after Liberation Day. Indeed, US Trade Representative Greer said on the tariff extension, that “We’re certainly open to considering further action there, if the talks continue in a positive direction”.

This backdrop led to a fresh global advance, with the S&P 500 (+0.47%) at another all-time high whilst in Europe the Stoxx 600 (+0.42%) closed 1% from its all-time high reached back in March. In fact, the S&P 500 is now on track to have risen for 6 of the last 7 weeks, which would be the most sustained advance of 2025 so far. Those moves were led by tech stocks, with both the NASDAQ (+0.94%) and the Magnificent 7 (+1.95%) hitting fresh highs of their own. Alphabet (+4.49%) became the fourth company to reach a $3trn valuation while Tesla (+3.56%) also outperformed following news that Elon Musk had purchased around $1bn worth of Tesla shares. Nvidia lost ground after China found they’d violated their antitrust law with a deal in 2020, but its stock was only down -0.04% by the close. The strong day ended with the S&P 500 up +12.47% for the year, even as most of its constituents were lower on the day.

For sovereign bonds, it was generally a strong day as well. But French bonds saw a relative underperformance after Friday’s news that Fitch Ratings had downgraded their credit rating from AA- to A+. Yields on 10yr OATs (-2.8bps) were only down a bit to 3.48%, whilst those on Italian BTPs fell by a larger -4.7bps to 3.47%. That’s a significant move, because it’s the first time since 1999 that France’s 10yr yield has closed above Italy’s, having briefly moved above on an intraday basis last week. Clearly this trend has been apparent for some time, but it’s a striking re-ordering of how investors perceive the risk of different sovereigns, having been in a completely different place at the height of the Euro crisis in the early 2010s.

In absolute terms however, it was still a strong day for sovereign bonds on both sides of the Atlantic. For example, US Treasury yields came down across the curve, with the 2yr yield (-1.9bps) falling to 3.54%, whilst the 10yr yield (-2.8bps) fell to 4.04%, which further helped to ease fears about the fiscal trajectory. The bond rally got a further push from the NY Fed’s Empire State manufacturing survey for September, which fell to a 3-month low of -8.7 (vs. +5.0 expected), coming in beneath every economist’s estimate on Bloomberg. So that helped to boost expectations for a faster cycle of Fed rate cuts, with the amount of cuts priced in by the June meeting up +2.0bps on the day to 120bps. And that move lower for yields was clear across the rest of Europe too, with those on 10yr bunds (-2.4bps) and gilts (-3.9bps) both falling as well.

The lower rates backdrop weighed on the dollar, with the dollar index (-0.25%) falling to its lowest in almost eight weeks. Meanwhile, gold (+0.98%) reached a record high for the ninth time in twelve sessions at $3,679/oz.

In Asia, the KOSPI (+1.18%) is leading gains, touching a new peak as heavyweight chipmakers Samsung Electronics and SK Hynix are sharply higher while the Nikkei (+0.50%) is also trading in positive territory after returning from a holiday. Elsewhere, the Hang Seng (+0.12%) is swinging between gains and losses while on the mainland the CSI (-0.39%) and the Shanghai Composite (-0.10%) are bucking the positive regional trend with both drifting lower after strong recent gains. Meanwhile, the S&P/ASX 200 (+0.31%) is also edging higher. S&P 500 (+0.09%) and NASDAQ 100 (+0.14%) futures are also trading slightly higher.

To the day ahead now, and data releases include US retail sales and industrial production for August, the German ZEW survey for September, Canada’s CPI for August, and the UK’s latest employment report. Central bank speakers include the ECB’s Escriva.

Tyler Durden

Tue, 09/16/2025 – 08:29ZeroHedge NewsRead More

R1

R1

T1

T1