Mediocre 2Y Auction Stops Through, As Foreign Buyers Fail To Step Up

At the start of a new week of coupon issuance, the market (the bond market at least) has been remarkably stable, with yields today barely budging and trading where they closed last Friday, just around 4.13%. Which is why the market barely moved after today’s 2Y auction passed without a glitch.

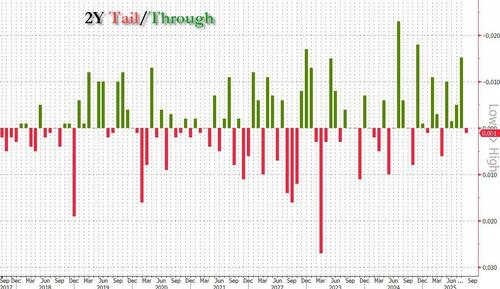

The first coupon auction of the week closed without a glitch, with the $69 billion in 2Y bonds offered pricing at 3.571%, down from 3.641% last month and the lowest since Sept 2024 when the US underwent its latest growth scare. The auction also stopped through the 3.572% When Issued by 0.1bps, a smaller margin than last month’s 1.5bps, but the fifth consecutive through in a row.

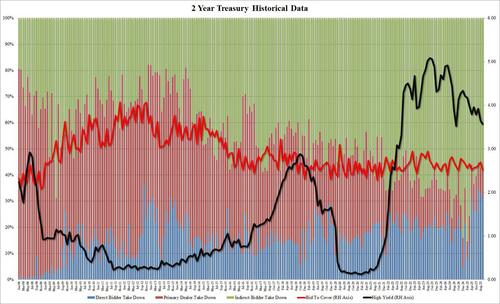

The bid to cover dropped to 2.513, down from 2.691 and the lowest since October 2024; obviously it was below the six auction average of 2.605.

The internals were also mediocre, with Indirects taking down 57.8%, up from 57.1% last month but below the recent average of 61.4%. And with Directs once again awarded a near record 30.8% (the highest ever here was 34.4% in July), Dealers were left with 11.5%, the highest since June.

Overall, today’s auction was completely unremarkable, with all the metrics pricing well within safe parameters, and generating zero waves in a market that was much more focused on what Powell was saying at the same time.

Tyler Durden

Tue, 09/23/2025 – 13:39ZeroHedge NewsRead More

R1

R1

T1

T1