“A Black Swan Event”: Copper Prices Soar After FCX Declares Force Majeure At World’s 2nd Largest Mine

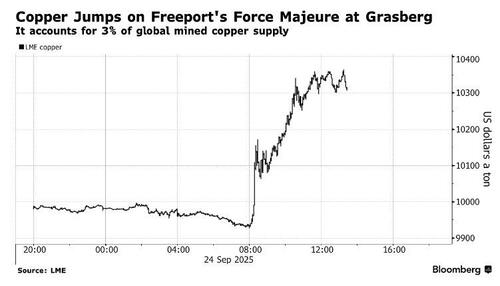

In what Goldman’s commodity team dubbed a “black swan event”, copper mining giaint Freeport-McMoRan (FCX) declared force majeure on contracted supplies from its giant Grasberg mine in Indonesia, the second-largest source of the metal, sending prices of the metal soaring.

The US company also cut its copper and gold sales guidance for the quarter, now seeing 4% lower copper sales and 6% lower for gold than July 2025 estimates – as it continues to search for five missing workers following an accident at the site two weeks ago. Two employees are confirmed to have died following a flow of about 800,000 metric tons of mud into Grasberg’s underground levels.

Production in the Grasberg minerals district had been halted following the incident. A prolonged disruption at the copper mine may further lift benchmark prices, while posing an additional challenge for the smelting industry as processors deal with a severe shortage of feedstock. Force majeure gives producers the right to miss supply obligations due to unforeseen events.

Teams are working around the clock at Grasberg in the province of Central Papua to clear mud and debris, and are making steady progress to reach areas where the workers were located at the time of the Sept. 8 incident, Freeport said in a statement.

While the company tried to minimize the impact as much as possible, Goldman’ commodity specialist James McGeoch was far less sanguine, calling the shocking development a “black swan event”. This is what he wrote this morning:

Force Majeure at Grasberg: Q3 loses 4% Copper and 6% Gold (incident was Sept 8 at Grassberg), Q4 will only see unaffected areas back operating my mid Nov (2 out of 5 areas), with sales “insignificant” (does that mean zero?), prev estimates 201kt Cu, and 345koz gold… Wow that’s material…. phased restart in 2026, 2/5 blocks and third in 2H and last 2 in 2027… Guide to 2026 being 35% of prev guide, which is 270kt of copper lost and 1.04m oz Gold. GIR model we model 700kt in 2025 and 730kt in 2026….

Summary: you are losing 500kt Copper over next 12-15 months, with a ramp in 2027, could argue another 100-200kt lost….. This is Cobre + Komao + Los Bronces all at once.

FCX: looking at 2026 cons this is c.39% of their Copper and 60% of the Gold. Grasberg to those in the weeds is a Gold mine (largest in the world). REMEMBER FCX owns 48.76%…so this is not as painful as it looks.

Copper has to rally on this. Remember what I say. Demand moves are linear, supply moves are exponential.

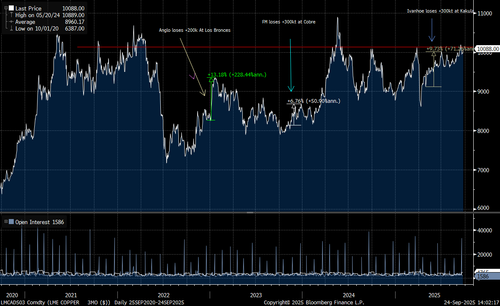

The below is a chart looking at these periods, obv there are many factors at play in each of these moves, i have been arguing for a number of days/weeks that Copper is poised, interest has been low (despite CTA creeping to record long on GS strat data and Managed money back at a reasonable level). Commodity franchise has been almost exclusively looking at precious for discretionary/macro accounts. This will light the fuse.

Copper for delivery in three months rose as much as 3.7% to $10,341 a ton on the London Metal Exchange, the biggest intraday jump since April 10, while FCX shares tumbled as much as 11% and rivals including Glencore and Teck Resources climbed.

As Bloomberg notes, the accident highlights the copper market’s vulnerability to global supply shocks, and is just the latest disruption to the industry. It follows Hudbay Minerals’ disclosure late Tuesday that it was shutting operations at a mill at its Constancia mine site in Peru due to ongoing political protests.

The development at Freeport shows “how little it takes to tighten up this market,” especially when two of the world’s top copper mines have problems at the same time, said Ole Hansen, head of commodity strategy at Saxo Bank. “Traders buy first before asking questions.”

The Grasberg mine accounted for about 3.2% of mined copper supply for this year prior to the disruptions, according to Grant Sporre, global head of metals and mining at Bloomberg Intelligence. It contributes nearly 30% of Freeport’s total copper production and 70% of gold output, underscoring the scale of the disruption.

“An accident of such scale is unheard of in Freeport’s history,” said Bernard Dahdah, an analyst at Natixis.

Glencore shares rose as much as 3.6% in London, while Antofagasta Plc added 9.6%. Teck Resources gained as much as 6% and Southern Copper Corp. climbed 10% in New York.

Tyler Durden

Wed, 09/24/2025 – 14:05ZeroHedge NewsRead More

R1

R1

T1

T1