WTI Holds Gains Despite ‘Small’ Draw; US Crude Production Nears Record High

Oil extended its biggest gain in more than a week, as US President Donald Trump ramped up his rhetoric against Russia and traders watched for supply disruptions from the OPEC+ member.

Additionally, in the US, API showed crude inventories fell 3.8 million barrels last week, though holdings of distillates increased.

“Oil prices remain supported as inventories in the OECD stay low, and it looks like the US will have another large crude draw,” according to Giovanni Staunovo, an analyst with UBS Group AG. Still, he added, higher OPEC+ crude exports so far in September remain a headwind.

All eye snow on the official data…

API

-

Crude -3.8mm

-

Cushing +72k

-

Gasoline -1.00mm

-

Distillates +518k

DOE

-

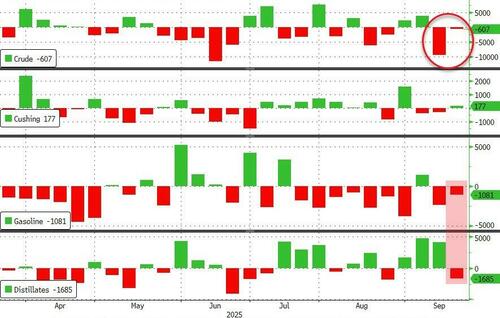

Crude -607k (-2.7mm exp)

-

Cushing +177k

-

Gasoline -1.08mm

-

Distillates -1.69mm

Following last week’s huge draw, crude inventories were expected to tumble once more (and did according to API), but the official data showed a very modest 607k drawdown in crude stocks while products saw significant draws too…

Source: Bloomberg

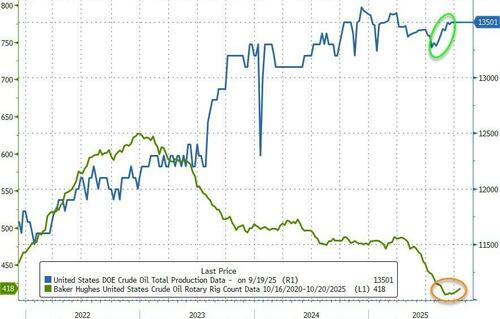

US production rose 19k barrels/day on the week, back near record highs, despite the big drop in rig counts…

Source: Bloomberg

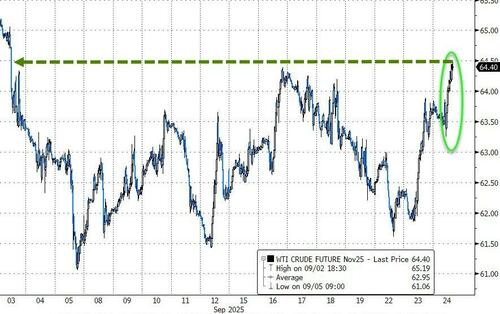

Oil prices held their gains after the official data hit, up near three week highs..

Source: Bloomberg

But as Bloomberg reports, oil is little changed this month as traders weigh a bearish fundamental outlook against long-running geopolitical tensions. On the supply front, Iraq is finalizing a deal to restart crude exports from its Kurdistan region following a two-year halt. That could bring about 230,000 barrels a day back to the international market, exacerbating a looming glut.

Some market metrics point to strengthening, with Brent’s prompt spread — the difference between its two closest contracts — at 77 cents a barrel in backwardation, more than double the level two weeks ago. Meanwhile, the difference between the two closest December contracts widened to $1.68 a barrel from less than $1 a fortnight ago.

Tyler Durden

Wed, 09/24/2025 – 10:38ZeroHedge NewsRead More

R1

R1

T1

T1