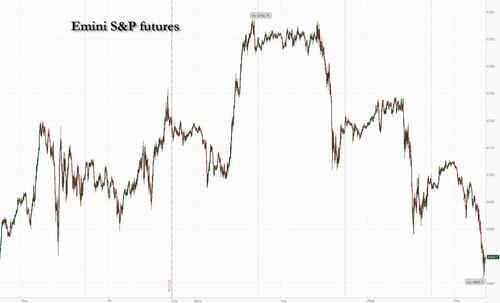

Futures Slide As Record-Breaking Rally Cracks

US equity futures are lower after giving up overnight gains with bond yields reversing earlier losses and rising by 1-2bp and the USD is at session highs; yesterday was the best USD performance since Sep 2. As of 8:10am ET, S&P futures are down 0.4% after concerns over stretched valuations and the pace of interest-rate cuts dragged the main gauge back from a record high. Nasdaq futures are down 0.6% with Mag7 and TMT stocks weaker pre-market, with Oracle falling more than 2%. Intel is higher on reports that it is seeking an investment from AAPL. Defensives are leading Cyclicals pre-market. Commodities are mixed with silver +2% and coffee +1.5% the standouts. US launches a Section 232 (sectoral tariffs) probe on Machinery, Med Devices, and Robotics. Today’s macro data focus is on Q2 GDP data, Durable / Cap Goods, Jobless data, Existing Home Sales, Adv. Goods Net-Exports, and Inventories. While none of these macro releases is expected to be market-moving, they may provide a holistic view of a stable / resilient economy that may be inflecting higher.

In premarket trading, Mag 7 stocks are lower (Amazon -0.1%, Microsoft little changed, Apple -0.1%, Tesla -0.5%, Nvidia -0.5%, Meta Platforms -0.6%, Alphabet -0.8%). Cipher Mining (CIFR) rises 9% as Google will receive warrants to buy about 24 million shares of the company’s stock as part of Cipher’s 10-year AI hosting agreement with Fluidstack.

- Immuneering Corp. (IMRX) gains 24% after the biotech firm reported 86% overall survival at nine months in first-line pancreatic cancer patients treated with atebimetinib in combination with mGnP.

- Jabil (JBL) climbs 2% after the manufacturing services company posted net revenue for the fourth quarter that beat the average analyst estimate.

- Lithium Americas (LAC) jumps 16% after nearly doubling on Wednesday, following reports the Trump administration is pursuing a stake in the company.

- Oracle (ORCL) falls 2% as Rothschild & Co Redburn initiates coverage of the software giant with a sell rating, saying the market is materially overestimating the value of the firm’s cloud revenues.

- Transocean (RIG) is down 14% after the company offered 125 million shares.

- UniQure (QURE) rises 9%, extending gains for a second day. Guggenheim boosted its price target on the drug developer to a Street-high, citing a “compelling” data readout.

There’s also a lot of corporate news: HSBC said it’s achieved a world-first breakthrough in deploying quantum computing in financial markets, using IBM’s Heron quantum processor to improve bond price predictions. Disney is preparing for a legal fight in case the Trump administration retaliates against the company for putting Jimmy Kimmel back on the air. Intel is set to extend Wednesday’s rally after the ailing chipmaker was said to have approached Apple about securing an investment.

Bullishness fueled by rate cut anticipation and the artificial intelligence boom culminated last week when the Federal Reserve signaled a faster pace of easing to support a weakening jobs market. Since then, higher oil prices and caution from some officials have tempered the optimism amid a lack of clear catalysts. Swaps currently imply around a 60% chance of two quarter-point US rate cuts for the rest of the year, down from 70% immediately after the Fed meeting. Policymakers penciled in two cuts in their projections. Friday’s release of the Fed’s preferred inflation gauge may offer clues on the path ahead, with consensus forecasts pointing to a slower pace of price growth last month.

“Prosperity targeting being the new mantra of the Federal Reserve, doesn’t mean the central bank is inflation-blind,” said Florian Ielpo, head of macro research at Lombard Odier Investment Managers. “Markets, being addicted to Fed cuts, could experience a temporary hangover.”

The coming corporate reporting season could offer the next trigger for stocks to move higher. S&P 500 earnings are facing limited risk from any potential disappointment in AI spending, according to Barclays Plc strategists. The team led by Venu Krishna said the AI theme is “on solid footing” as demand outpaces supply, even with major spending commitments.

“It would take a lot to derail this rally” Amundi SA Chief Investment Officer Vincent Mortier told Bloomberg News. “Whatever one may think about price-earnings ratios, the macro backdrop, geopolitics, fact is this market is technically well bought, notably by US retail.”

European stocks fall as a drag from health care and financials offsets continued strength in miners. Europe’s Estoxx 50 trading down 0.5% with health stocks dragged down by a US probe on device imports, while miners get a further boost from copper holding gains after a force majeure at a major mine. Here are the biggest movers Thursday:

- H&M shares rise as much as 12%, the most since March 2024, after the Swedish clothing retailer reported quarterly margins and profits that blew past expectations. Jefferies says there could be upside to sell-side estimates

- European car makers gain in early trading after figures showed industry sales edged up again in August; new-car registrations across the region rose 4.7% last month from a year earlier to 791,349 units,

- SSP Group shares rise as much as 11%, the most since last December, after the Financial Times reported activist hedge fund Irenic Capital Management is encouraging private equity groups to launch a takeover of company

- Canal+ shares rise as much as 5.5% after the media and entertainment company said it’s launching a share buyback, in an announcement released after markets closed on Wednesday

- Computacenter shares rise as much as 3.5% after the IT services provider had its price target and estimates lifted by JPMorgan, with analysts predicting that all three of its profit engines should be firing through FY26

- Pepco jumps as much as 14% to a 15-month high after the discount retailer reported acceleration of like-for-like sales, amid a positive turnaround in the Polish market, and announced a share buyback

- Petershill Partners shares jump 34% in London after the Goldman Sachs-backed investor in alternative fund managers announced plans to return capital to investors and delist from the London Stock Exchange

- Target Healthcare shares rise as much as 3.1% before paring gains, after the company said it has sold a number of care homes. Analysts at Panmure Liberum said it is a significant disposal conducted a premium valuation

- PolyPeptide climbs as much as 9.1% on Thursday as Jefferies initiates coverage of the company with a buy rating and Bachem at underperform, which retreats as much as 11%

- European medical products and equipment stocks drop after the Trump administration launched an investigation into imports, setting the stage for fresh tariffs

- Hexagon shares slip as much as 3.1% as Pareto Securities downgrades to hold, noting the stock is now trading broadly in line with its peers following a rally over the past three months

- Colruyt shares drop as much as 5.9%, to the lowest since early May, after the Belgian retailer provided a summary of its annual general meeting including comments about a “challenging and uncertain” macroeconomic context

- Mitchells & Butlers falls as much as 8.2%, the most since 2023, as the restaurant and pub group behind brands including All Bar One, Toby Carvery, Harvester and Browns reports slower sales growth

- Glenveagh shares drop as much as 4.6% following the housebuilder’s results. Jefferies cut its earnings forecasts for FY26 and FY27 to reflect lower levels of profitability from its housebuilding arm

Earlier in the session, Asian stocks held steady, helped by an advance in technology stocks in China and Japan, while TSMC led a selloff in Taiwan. The MSCI Asia Pacific Index was mixed, with TSMC among biggest drags and Sony among gainers. Equity benchmarks rose in mainland China, while they declined in Taiwan, Singapore and India. BHP and other materials shares climbed, tracking copper after Freeport-McMoRan declared force majeure on contracted supplies from a mine in Indonesia following an accident. The AI theme has provided a fresh tailwind for China’s stock rally ahead of upcoming Golden Week holidays. Meanwhile, investors are also awaiting key US inflation data due Friday for clues on the Federal Reserve’s monetary policy.

In FX, the Bloomberg Dollar Spot Index rises 0.1% to trade at session highs and extends its previous day’s rally to a two-week high in response to strong data and rising Treasury yields. USD/JPY was flat at 148.83. Some leveraged long spot positions were trimmed after the Bank of Japan’s meeting minutes, but the majority are retaining risk carried over from New York, according to Asia-based FX traders. Swiss franc holds decline against most G-10 currencies after the SNB keeps rates at 0%, as widely expected, with the central bank also playing down tariff-related fallout.

In rates, treasuries are marginally cheaper across the curve, although yields remain within a basis point of Wednesday close. European bonds moving marginally higher, with UK gilts slumping across the curve, as market jitters started to impact demand at government auctions ahead of November’s budget. Treasury 10-year yields are rangebound overnight, trading at about 4.155% and near Wednesday’s closing levels — in the 10-year sector gilts lag by around 3bp on the day while bunds trade broadly inline. Treasury auctions conclude at 1 p.m. New York time with $44 billion 7-year note sale, follows solid 2- and 5-year note auctions seen so far this week. The WI 7-year at around 3.915% is ~1bp richer than August sale which tailed the WI by 0.3bp. IG dollar issuance slate empty so far and likely to ease after $54.4 billion of deals this week capped by Oracle’s $18 billion jumbo offering on Wednesday. September has seen the most high-grade supply this year and is just $5 billion shy of becoming only the fifth month to top $200 billion in issuance.

In commodities, Oil prices weaken, with Brent slipping back below $69 following its biggest jump since July in the previous session. Gold rallies again, though short of a record high, up by about $20 to $3,756/oz. Bitcoin and other cryptocurrencies weakened as the week neared a potentially volatile close, with $22 billion in large options expiries looming.

Looking at today’s calendar, the US economic data slate includes 2Q third GDP print, August advanced trade balance, durable goods orders, weekly jobless claims (8:30 a.m.), August existing home sales (10 a.m.) and September Kansas City Fed manufacturing activity (11 a.m.). Fed speaker slate includes Miran (8:15 a.m.), Goolsbee (8:20 a.m.), Williams, Schmid (9 a.m.), Bowman (10 a.m.), Barr (1 p.m.), Logan (1:40 p.m.) and Daly (3:30 p.m.)

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini little changed

- Stoxx Europe 600 -0.3%

- DAX -0.4%

- CAC 40 -0.5%

- 10-year Treasury yield -1 basis point at 4.14%

- VIX +0.3 points at 16.43

- Bloomberg Dollar Index little changed at 1201.55

- euro little changed at $1.1743

- WTI crude -0.9% at $64.41/barrel

Top Overnight News

- The White House budget office is telling federal agencies to prepare plans for permanent mass firings during a possible government shutdown. The move would represent a substantial escalation beyond normal shutdown protocols. BBG

- More rate cuts are probably needed, but the Fed should move with caution, SF President Mary Daly said. The risk of a US recession is low right now, she added. BBG

- China urged its companies with U.S. operations not to bring their domestic price-cutting playbook to the U.S. market, signaling Beijing’s intent to maintain recent trade calm with Washington. WSJ

- The Swiss National Bank halted its easing cycle, avoiding a return to negative interest rates as officials judge the impact of US tariffs to be containable for now: BBG

- One member of the BOJ’s policy board said the central bank shouldn’t be overly cautious and risk missing an opportunity to raise rates, according to minutes of the July meeting. BBG

- South Korea’s investments in the US will remain in limbo until visa issues are resolved, PM Kim Min-seok said. His office later clarified that his remarks are unrelated to the $350 billion investment scheme under discussion. BBG

- South Korea’s central bank warned that risks from US tariffs, prolonged industrial weakness and housing market imbalances could undermine financial stability, highlighting the need to keep macro prudential policies tight: BBG

- HSBC said it used IBM’s Heron quantum processor to get a 34% improvement in predicting how likely a bond will trade at a given price. McKinsey projects revenue from quantum computing may climb to as much as $72 billion in a decade, up from $4 billion in 2024. BBG

- H&M shares rose the most since March 2024, after it reported quarterly margins and profits that blew past expectations. BBG

- EU officials fear Trump’s latest rhetoric on Ukraine aims to set them an impossible mission that will allow the US president to shift blame away from Washington if Kyiv falters in the war or runs short of cash. FT

- The UK’s gilt market jitters are starting to impact demand at government auctions as fiscal concerns grow ahead of the budget in November: BBG

- As ChatGPT nears its third birthday, at least one in 10 retail investors is using a chatbot to pick stocks, fueling a boom in the robo-advisory market, but even fans say it is a high-risk strategy that cannot replace traditional advisors just yet. RTRS

- Chinese government bond issuance is set to plunge by year-end, offering relief to a market also pressured by a rotation into equities: BBG

Trade/Tariffs

- US President Trump to sign executive orders at 15:30 ET (20:30 BST) on Thursday.. Potentially relating to TikTok

- A non-principal-level Chinese delegation will visit the US Treasury on Thursday for staff-level technical discussions on trade and the economy. The talks are not the next round of trade negotiations and TikTok will not be addressed. A source added that no negotiations will occur during the visit and US principals will not meet with Chinese technical staff while they are in Washington, according to FBN’s Lawrence.

- US Treasury Secretary Bessent said the US-South Korea alliance remains strong and that challenges can be overcome, according to Yonhap. South Korea discussed an FX swap with US Treasury Secretary Bessent on Wednesday, according to the Finance Ministry.

- The US is in talks with the G7 and EU on broader rare earth trade measures to prevent price dumping, which could include tariffs, price floors, or other actions, according to Reuters citing a Trump administration official.

- US President Trump reportedly plans to visit Japan on 28th or 29th of October, according to TV Asahi. Japanese Chief Cabinet Secretary Hayashi said no decision has yet been made regarding US President Trump’s visit, according to Reuters.

- US opened a 232 probe into robotics, machinery and medical devices, according to Bloomberg

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed for most of the session following a softer Wall Street handover, with the breadth of the market narrow and price action uneventful amid a lack of fresh catalysts heading into quarter-end. The region then tilted into a modestly positive picture despite a lack of drivers. ASX 200 was initially in the red, pressured by gold miners as the yellow metal pulled back from near USD 3,800/oz levels, while notable gains in Energy helped offset some of the downside. Nikkei 225 moved between modest gains and losses and found some support at the 45,500 mark. BoJ minutes from two meetings ago suggested one member said rates should be raised when possible, as policy is still below neutral and the BoJ should not be too cautious, whilst one member added the BoJ could exit its wait-and-see mode as soon as this year if the US economy proves resilient. Hang Seng and Shanghai Comp were choppy, with Hong Kong and Mainland China initially trimming their modest opening gains before recouping. Participants overlooked reports that a non-principal-level Chinese delegation will visit the US Treasury on Thursday for staff-level technical discussions on trade and the economy. Sources suggested the TikTok issue will not be discussed and emphasised these talks are not the next round of trade negotiations but rather a technical meeting. KOSPI traded with mild losses amid a lack of progress in US-South Korea trade talks. Nifty 50 kicked off the session flat but remained above the 25,000 mark following its recent H-1B-related losses.

Top Asian News

- China President Xi said the country aims to bring total installed capacity of wind and solar power to over six times the 2020 level, and that NEVs will become the mainstream of new car sales, according to Reuters.

- BoJ July meeting minutes showed many members said the US-Japan trade deal reduced uncertainty on the outlook, but the tariff impact on the economy and prices must be scrutinised for the time being. One member said the BoJ must look at more data before making policy decisions, given uncertainty in US monetary policy and FX, while another said rates should be raised, when possible, as policy is still below neutral and the BoJ should not be too cautious. One member added the BoJ could exit its wait-and-see mode as soon as this year if the US economy proves resilient, and another stressed that hiking at the appropriate time would be important from a risk management perspective, via the BoJ.

- PBoC Deputy Governor said the global impact and attractiveness of the Chinese bond market have greatly increased in recent years. He noted the total balance of the market reached CNY 192tln as of August 2025, making it the world’s second-largest, and said global bond investors remain confident, with foreign investors holding 2% of Chinese yuan bonds, according to Reuters.

- Chinese Commerce Ministry says US should take steps to remove “unreasonable” tariffs. Says removing unreasonable tariff will create conditions to expand two-way trade.

European bourses (STOXX 600 -0.4%) opened lower across the board and have traded sideways throughout the morning. Nothing really driving sentiment this morning, but perhaps some continuation of the pressure seen on Wall St in the prior session. Most recently, the European Commission has opened a formal investigation into possible anticompetitive practices by SAP (-2.1%) – news which has put further pressure on the DAX 40 and Euro Stoxx 50, both at fresh session lows. European sectors opened with a strong negative bias, but are now a little more mixed. Basic Resources is found right at the top of the pile, driven by upside in underlying metals prices – namely copper. As a reminder, copper prices soared in the prior session after one of the world’s largest copper mines, Grasberg, halted operations and declared a force majeure; Rio Tinto (+2.7%), Anglo American (+2.2%). Retail is found in second place, boosted by considerable upside in Swedish-listed H&M (+8.7%); the Co. reported a beat on its Q3 Op. Profit metrics, whilst Sales were more-or-less in line. On trade, it said tariff costs are expected to have an increased impact on gross margin in Q4. Elsewhere, JD Sports (+2.7%) gains after the Co. announced a GBP 100mln share buyback. Construction & Materials is found right at the foot of the pile, joined closely by Healthcare; losses are broad-based, following reports that the US opened a probe into robotics, machinery and medical devices. Names that have been hit today include; Siemens Healthineers (-4.5%), Philips (-3%), Getinge (-4%) and others.

Top European News

- Swiss SNB Policy Rate (Q3) 0.0% vs. Exp. 0.0% (Prev. 0.0%); willing to intervene in FX if needed, annual inflation forecasts maintained.

- SNB Chair Schlegel says uncertainty over inflation and economic developments remain elevated Inflation pressure virtually the same as prior quarter. Will tweak monetary policy as needed. Remains willing to be active in FX market as needed.

- SNB Chairman Schlegel says “the bar to go into negative rates is higher than for a normal cut; but if necessary, will be ready to use all tools”; large part of economy has not been affected by tariffs. Trade: Switzerland has very high tariffs, companies may find it challenging. Impact of tariffs as a whole is limited. Policy: Monetary policy is currently expansive. Inflation; Can have negative prints in the short term, stresses importance of medium-term outlook. FX: Are not speaking about re-introducing minimum exchange rate; the situation is different to 2011. Never intervenes in currency market to give companies an unfair advantage.

- SNB Vice Chairman Martin says global economic developments dampened by US tariffs and ongoing high uncertainty “Continuing high uncertainty is having a negative impact on companies’ investment activity”. “Our scenario for the global economy remains subject to high uncertainty”. “However, it also cannot be ruled out that the global economy will prove more resilient than expected”. “US tariffs are likely to curb global trade and reduce the purchasing power of US households.”

- SNB’s Tschudin says economic outlook for Switzerland has deteriorated due to significantly higher US tariffs Unemployment is likely to continue rising. The economic outlook for Switzerland remains uncertain. The main risks are US trade policy and global economic developments.

- French PM Lecornu is reportedly to unveil his first “budgetary guidelines” today, via Politico citing sources; will be posted in La Parisien, online at “the end of the day”.

- ECB’s Kazimir says the inflation goal has been met and will only act if required.

FX

- USD has paused for breath after a notable pick-up on Wednesday, which didn’t have a clear or obvious macro driver. Broadly, the USD has continued to pick up since last week’s FOMC policy announcement with comms from the Fed (ex-Miran and Bowman) largely adopting a cautious stance. Today’s docket sees a deluge of Fed speak with voters Goolsbee, Williams, Miran, Schmid, Barr, Bowman and non-voters Logan and Daly all due on deck. On the data slate, weekly claims will be eyed for any further deterioration in the labour market, alongside durable goods and trade metrics. DXY has ventured as high as 97.91.

- EUR is steady vs. the USD with incremental macro drivers for the Eurozone on the light side. Geopolitical headlines surrounding Ukraine/Russia and drone activity over certain nation’s remain frequent but so far not having any obvious impact on the FX space with ING making the observation that “if investors were substantially more worried about military conflict at NATO’s eastern border, CEE currencies would be a lot weaker, as would German equity markets”. The pair sits just above Wednesday’s trough at 1.1727 and the WTD low at 1.1726.

- USD/JPY was choppy overnight and within a tight range with the pair initially trimming some of Wednesday’s USD-driven gains before reversing back towards session highs in catalyst-light trade. BoJ minutes from two meetings ago discussed the case for future rate hikes if the economic and price outlooks are realised, though timing remained divided. Elsewhere, US President Trump reportedly plans to visit Japan on 28th or 29th of October, according to TV Asahi; Chief Cabinet Secretary Hayashi said no decision has yet been made on the visit. USD/JPY has pulled back a touch from Wednesday’s 148.91 high.

- GBP is flat vs. USD and EUR with macro drivers for the UK notably lacking and nothing of note on today’s agenda. Yesterday’s hawkish-leaning remarks from BoE’s Greene have had little sway on markets with the policymaker noting she is less concerned about a rapid decline in the labour market, risks from trade persist but have abated somewhat, and highlighted that the risks to the inflation outlook have shifted to the upside. As is the case with EUR/USD, the dollar is likely to dictate near-term direction for Cable.

- Antipodeans are both are a touch firmer vs. the USD and at the top of the G10 leaderboard with little in the way of newsflow out of Australia or New Zealand.

- As widely expected, the SNB refrained from delving into NIRP and kept its policy rate at 0%. The decision to do so was largely due to inflation coming in a touch above the SNB’s forecast (albeit only just above the bottom end of its target range) and a broader reticence to take policy below the 0% mark. The policy statement reiterated that the Bank remains ready to intervene in forex markets as needed. The SNB refrained from adding any language around the CHF, despite it being the best performing currency YTD vs. the USD. EUR/CHF saw some fleeting downside before returning to pre-release levels.

Fixed Income

- A contained start to the session for USTs as we await a packed afternoon and evening of US events. Firstly, weekly jobless data is scheduled and expected to rise to 235k (prev. 231k) while continuing claims, coincide with the BLS window for September, are seen lifting to 1.935mln (prev. 1.92mln). Last week’s better-than-expected claims (231.0k vs. exp. 240k) spurred a hawkish reaction, hitting USTs by around a full point over the course of one hour. There are also a slew of Fed speakers to keep markets busy.

- Bunds are firmer but holding in a very narrow 128.09 to 128.34 band, upside came as the European risk tone deteriorated. Specifics for the bloc are a little light so far, no read across from the SNB policy announcement to fixed benchmarks (see FX for more). Additionally, the morning’s EZ M3 and loan data passed without incident. Focus on the above US docket, but alongside that, attention is on political matters in France. As PM Lecornu is reportedly to unveil his first “budgetary guidelines” today, via Politico citing sources; will be posted in La Parisien, online at “the end of the day”.

- Currently, OATs trade broadly in-line with EGB peers. The key OAT-Bund 10yr yield spread widened a touch yesterday to just under 83bps and while it remains around that level today, it has not extended further.

- A slightly softer start to the session for Gilts, following the bias from peers at that point in time. However, Gilts have not been able to follow the very modest pick up seen in EGBs across the morning. Potentially a function of the slight relative outperformance seen in the first half of the week or as we look at the day’s supply docket. UK auctions this week have seen robust b/c, however the actual demand at the taps has been weak which, alongside the very chunk tail seen on Tuesday’s outing, has increased focus on supply. Today’s first tender passed without incident, with a 2.9x cover strong enough to prevent a sell off but not sufficient to break the modest bearish trend that has been in play this morning.

- Japan sold JPY 400bln in 40-year JGBs; b/c 2.6x (prev. 2.1x); highest accepted yield 3.300% (prev. 3.375%).

- UK sells GBP 1.25bln 4.50% 2034 Gilt via tender: b/c 2.90x, average yield 4.584%.

Commodities

- Crude was initially quiet and rangebound trade in a c. USD 0.50/bbl range after the benchmarks closed out Wednesday’s sessions with modest gains in proximity to highs of USD 65.05/bbl and USD 69.33/bbl for WTI and Brent respectively. Since, benchmarks have pulled back and are lower by c. USD 0.60/bbl at the low-end of respective USD 64.29-93/bbl and USD 68.91-69.33/bbl parameters. Market-moving energy newsflow has been light this morning; instead, the pressure seems to be a function of the increasingly downbeat equity risk tone.

- Spot gold is rangebound trade early in the session with a lift in prices coinciding with the SNB rate decision. A rebound that took spot gold from modest gains around the USD 3746/oz mark to a USD 3761.6/oz peak, but shy of USD 3779/oz and USD 3791/oz highs from the last two sessions. At the same time, silver saw a more pronounced rally lifting from USD 44.02/oz to a USD 44.87/oz peak.

- Copper is firmer, extending the aggressive bid seen in yesterday’s session following news from miner Freeport McMoran who declared force majeure in relation to contracts fulfilled by its Indonesian Grasberg mine. A facility that accounts for c. 3% of global supply.

- Goldman Sachs expects a 250–260kt loss of copper production from Grasberg in 2025, compared with its previous forecast of 700kt. After adjusting for disruption allowances, it incorporated a 160kt downgrade to its H2 2025 global mine supply forecast and a 200kt downgrade to its 2026 forecast. The bank lowered its 2025/2026 copper mine production growth forecast to +0.2%/+1.9% y/y from +0.8%/+2.2% previously. Goldman said the latest disruption means risks to its December 2025 LME copper price forecast of USD 9,700/t are skewed to the upside, with prices expected to settle in a USD 10,200–10,500/t range, and emphasised its long-term bullish copper price forecast of USD 10,750/t by 2027, according to Reuters.

- Magnitude 5.6 earthquake strikes Zulia, Venezuela region, according to EMSC.

- China is studying measures to strengthen regulation on copper smelting production capacity.

Geopolitics

- Unidentified drones were observed over four airports across Denmark, causing one of them to close for several hours, according to Danish police.

- Denmark’s police reported sightings of multiple drones over Aalborg airport and said it is unclear if they are linked to those seen in Copenhagen on Monday, according to Reuters. The Local Chief Police Inspector in Aalborg said that if it is safe to do so, local police will ‘take the drones out’, according to Faytuks News.

- Denmark’s Chief of National Police said a state of national emergency may be raised, according to TV 2 Denmark, cited by Faytuks. Danish police later confirmed that operations against unidentified drones over Aalborg Airport have concluded, saying drones previously spotted in North Jutland are no longer present in the airport’s airspace, according to Reuters.

- Danish National Police Chief adds that there were events at military facilities.

- Danish Defence Minister says there is no evidence to say there is a link to Russia, decided not to shoot the drones.

- EU leaders have concluded that US President Trump is no longer a reliable ally, according to FT citing officials; Officials fear that Trump’s new rhetoric on Ukraine aims to shift the blame away from Washington if Kyiv falters in the war.

US Event Calendar

- 8:30 am: 2Q T GDP Annualized QoQ, est. 3.3%, prior 3.3%

- 8:30 am: 2Q T Personal Consumption, est. 1.7%, prior 1.6%

- 8:30 am: 2Q T GDP Price Index, est. 2%, prior 2%

- 8:30 am: 2Q T Core PCE Price Index QoQ, est. 2.5%, prior 2.5%

- 8:30 am: Aug P Wholesale Inventories MoM, est. 0.1%, prior 0.1%

- 8:30 am: Aug P Durable Goods Orders, est. -0.3%, prior -2.8%

- 8:30 am: Aug P Durables Ex Transportation, est. 0%, prior 1%

- 8:30 am: Aug P Cap Goods Orders Nondef Ex Air, est. -0.03%, prior 1.1%

- 8:30 am: Aug P Cap Goods Ship Nondef Ex Air, est. 0.3%, prior 0.7%

- 8:30 am: Sep 20 Initial Jobless Claims, est. 233k, prior 231k

- 8:30 am: Sep 13 Continuing Claims, est. 1932k, prior 1920k

- 10:00 am: Aug Existing Home Sales, est. 3.95m, prior 4.01m

- 10:00 am: Aug Existing Home Sales MoM, est. -1.5%, prior 2%

DB’s Jim Reid concludes the overnight wrap

Our big Q3 market survey closes today. We’re a little lighter than usual in terms of responses so all help filling it in will be gratefully appreciated. It should only take a few minutes and includes questions on Fed independence and bubble risk amongst other topics. Lots of fascinating answers so far.

Risk assets have struggled to find their footing over last 24 hours, with the S&P 500 (-0.36%) posting another modest decline after the AI-driven selloff on Tuesday. Overnight futures have recouped around half those losses, but it does seem that we’ve paused for breath in recent days. There hasn’t been a major catalyst driving this, but decent US housing data and stronger oil prices yesterday led to some doubts about the prospect of rapid rate cuts from the Fed. So that pushed Treasury yields higher across the curve, and there was a fresh yield curve steepening as Treasury Secretary Bessent called on the Fed to cut rates even more. Today’s US jobless claims are one to watch as last week saw a big fall, reversing the prior week’s spike higher. Since the FOMC and last week’s fall in claims we’ve seen a 10-15bps rise in 10yr US yields back close to pre-payrolls levels. So that and tomorrow’s core PCE will be important.

Back to yesterday and the noise around the Fed was there from the get-go, as Bessent said in a Fox Business interview that rates “need to come down”. Indeed, he said he was “a bit surprised that the chair hasn’t signaled that we have a destination before the end of the year of at least 100 to 150 basis points (lower).” So that’s a big contrast with the median dot from last week’s dot plot, which only pencilled in another 50bps of cuts by year-end. Bessent also offered a bit of commentary on the search for a new Fed Chair, saying that he was interviewing 11 candidates, and that there would be interviews happening next week. Meanwhile, existing Fed officials offered more measured signals. San Francisco Fed President Daly said further rate cuts were likely to be needed but stressed the need for careful decisions. And Chicago Fed President Goolsbee said in an interview that he was uncomfortable with “overly frontloading a lot of rate cuts” as inflation was “heading the wrong way” and the job market was still mostly steady.

Even as Bessent was calling for faster rate cuts, a couple of factors led markets to dial back their expectations for the months ahead. Notably, new home sales came in at an annualised pace of 800k in August (vs. 650k expected), marking the fastest they’d been since January 2022, back when rates were still at the zero lower bound. So that undercut the recent message of housing weakness that had driven some of the calls for rate cuts. Then in the background, Brent crude oil prices (+2.48%) closed at $69.31/bbl, their highest since August 1, which added to concerns about inflationary pressures, particularly with the tariffs as well.

That context meant that US Treasuries sold off across the curve. For instance, yields on 10yr Treasuries (+4.1bps) were up to 4.15%, with the 10yr real yield driving the bulk of that with a +3.5bps rise to 1.77%. At the front-end, the 2yr yield (+1.8bps) also rose as investors dialled back their rate cut expectations over the months ahead. Indeed, the amount of cuts priced by the June 2026 meeting was down -2.3bps on the day to 85bps. In Asia, Treasury yields are back down half to a basis point across the curve.

One factor pushing oil prices higher yesterday were Trump’s comments on Ukraine late on Tuesday night that we discussed yesterday, where he endorsed them being able to retake lost territory rather than come to a negotiated settlement, a shift in US policy towards the war. So that supported oil prices, as well as defence stocks, with Rheinmetall up +3.48% yesterday, making it the second-best performer in Germany’s DAX (+0.23%). Meanwhile, the Kremlin said later in the day that the process of normalising relations with the US is “much slower” than they would like, and that the idea that Ukraine could win back territories is “deeply mistaken.” And taken together, these developments were collectively seen as raising the risk of an escalation, hence the increase in oil prices and defence stocks.

For equities, stocks were down despite another barrage of tech-positive news, including upbeat quarterly forecasts from Micron (-2.82%), Alibaba’s (+8.19% on the ADR) announcement of increased AI spending, Oracle’s (-1.71%) issuing $18bn of debt, and reporting by Bloomberg that Intel (+6.41%) had approached Apple (-0.83%) about an investment into the chipmaker. So, while the Mag-7 (+0.24%) were propped up by a +3.98% rise in Tesla, the S&P 500 (-0.28%) and the Nasdaq (-0.33%) fell for a second day running. In Europe, the mood was also mixed, with a fall in the CAC 40 (-0.57%) pushing the STOXX 600 (-0.19%) lower, despite the FTSE 100 (+0.29%) and DAX (+0.23%) edging higher.

In Europe, the mood wasn’t helped by the latest Ifo reading from Germany, which unexpectedly fell back in September after 6 consecutive monthly gains. So, the headline indicator fell to 87.7 (vs. 89.4 expected), which was a reversal in the upward trend since the fiscal stimulus announcements earlier this year. So that was a contrast with the stronger PMI numbers from Germany on Tuesday. Sovereign bonds were fairly steady, with yields on 10yr bunds (-0.1bps) and OATs (+0.5bps) seeing little change.

In trade news, the US Department and Commerce published a document lowering the tariffs on auto imports from the EU to 15% retroactively as of August 1, as well as making effective exemptions on products such as aircraft and generic drugs. This cemented the terms of EU-US framework trade deal whose outline was agreed in late July.

In Asia, sentiment has turned a little higher with the CSI index (+0.94%) showing the most significant gains. The Hang Seng index (+0.43%) is also up, with the Shanghai Composite index (+0.16%) seeing smaller gains. Elsewhere, the Nikkei index (+0.22%) and the S&P/ASX 200 index (+0.11%) are also both edging higher but with the KOSPI (-0.14%) dipping slightly. S&P 500 (+0.15%) and Nasdaq (+0.13%) futures are slightly higher.

To the day ahead now, and data releases include US August durable goods orders, the advance goods trade balance, existing home sales, September’s Kansas City Fed manufacturing activity, and the weekly initial jobless claims. In Europe, we’ll have the Eurozone’s August M3 money supply. From central banks, we’ll hear from the Fed’s Goolsbee, Williams, Bowman, Barr, Logan and Daly, and also get the ECB’s economic bulletin.

Tyler Durden

Thu, 09/25/2025 – 08:29ZeroHedge NewsRead More

R1

R1

T1

T1