Q2 GDP Revised Sharply Higher To 3.8%, Best Quarter In Two Years

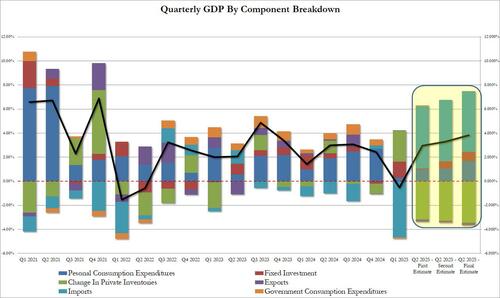

It started off as 2.960%; one month later it was revised higher to 3.290%, and moments ago the Bureau of Economic Analysis reported that Q2 GDP was revised once again, and even higher this time, to a whopping 3.830%, the highest print in nearly two prints, since the 4.70% in Q3 2023, and primarily reflecting an upward revision to consumer spending.

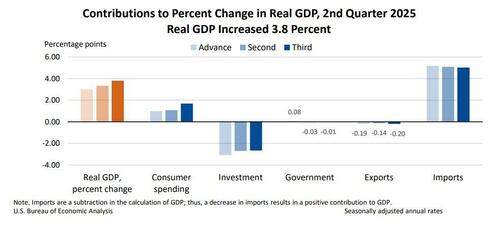

According to the BEA, the increase in real GDP in the second quarter primarily reflected a decrease in imports, which are a subtraction in the calculation of GDP, and an increase in consumer spending. These movements were partly offset by decreases in investment and exports.

Compared to the first quarter, the upturn in real GDP in the second quarter primarily reflected a downturn in imports and an acceleration in consumer spending that were partly offset by a downturn in investment. Real final sales to private domestic purchasers, the sum of consumer spending and gross private fixed investment, increased 2.9 percent in the second quarter, revised up 1.0 percentage point from the previous estimate.

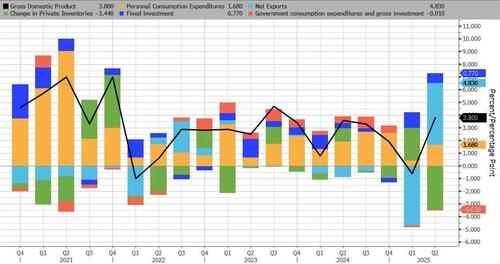

Here are the details:

- Personal consumption contributed 1.68% to the bottom line GDP print of 3.8%, or nearly half. This was revised higher from 1.07% in last month’s revision

- Fixed investment was also revised higher, to 0.77% from 0.59%

- The change in private inventories was revised lower, subtracting 3.44% from the bottom line print; down from 3.29% previously

- Net exports (i.e. exports less imports) was also revised slightly lower, adding 4.83% to the bottom line print, down from 4.95% last month.

- Government was flat, subtracting a negligible 0.01% from the GDP number, down from -0.03% previously.

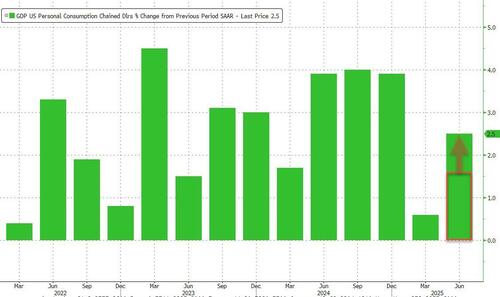

Of the above, the most notable revision was that of personal consumption which surged from 1.6% SAAR to 2.5%, despite clear signals that the average US consumer (middle class, if not so much the top 1%) is hurting.

Before Thursday’s figures, the Federal Reserve Bank of Atlanta’s GDPNow estimate penciled in a 3.3% rate of growth in the July-September period. However, economists are less upbeat about growth in the fourth quarter as weaker employment dims prospects for consumer spending.

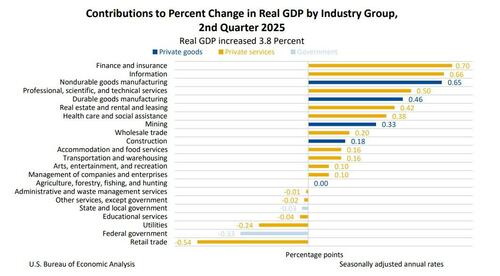

From an industry perspective, the increase in real GDP reflected increases of 10.2 percent in real value added for private goods-producing industries and 3.5 percent for private services-producing industries that were partly offset by a decrease of 3.2 percent in real value added for government.

Real gross output increased 1.2 percent in the second quarter, reflecting increases of 0.6 percent for private goods-producing industries and 1.7 percent for private services-producing industries that were partly offset by a decrease of 0.7 percent for government.

The BEA also issued its annual update of the national economic accounts, which covers GDP and related series in the past five years. While it incorporated newer, more complete source data, the agency said it was “unable to purchase” certain statistics related to tax returns for corporations and sole proprietorships.

The annual revisions were relatively minor as real GDP still increased at an average annual pace of 2.4% from 2019 to 2024. They paint a picture of an economy that quickly rebounded from the initial shock of the pandemic and has since transitioned to period of steadier, trend growth with lingering inflation.

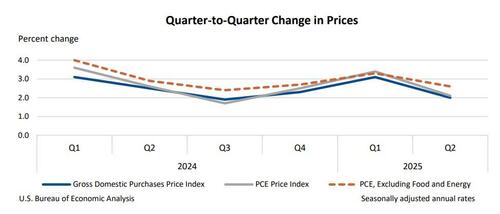

Turning to the inflation metrics, the revisions showed the Fed’s preferred inflation metric — the personal consumption expenditures price index, excluding food and energy — rose at faster clip throughout 2024 and was also marked up in the second quarter to 2.6%. Economists expect monthly PCE data, which are due Friday, to show the metric advanced nearly 3% in August from a year ago.

For Q2, the price index for gross domestic purchases increased 2.0% in the second quarter, revised up 0.2% from the previous estimate. The personal consumption expenditures (PCE) price index increased 2.1 percent, revised up 0.1 percentage point. Excluding food and energy prices, the PCE price index increased 2.6 percent, also revised up 0.1 percentage point.

That may limit the extent of Fed interest-rate cuts in the coming months. In lowering borrowing costs last week, policymakers also projected two more reductions this year, though some officials are wary given persistently high inflation.

Real gross domestic income (GDI) increased 3.8 percent in the second quarter, revised down 1.0 percentage point from the previous estimate. The average of real GDP and real GDI increased 3.8 percent, revised down 0.2 percentage point.

Profits from current production (corporate profits with inventory valuation and capital consumption adjustments) increased $6.8 billion in the second quarter, a downward revision of $58.7 billion.

Looking ahead, economists expect activity to only pick up somewhat in 2026, partly due to Trump’s tax law and lower interest rates, with most forecasters expecting sub-2% growth for the next few years.

Tyler Durden

Thu, 09/25/2025 – 08:59ZeroHedge NewsRead More

R1

R1

T1

T1