Electronic Arts Soars Most In Years On Reported $50 Billion Take-Private Deal

Shares of Electronic Arts (EA) surged late in the US cash session after a Wall Street Journal report revealed that EA is finalizing a deal to go private, potentially marking the largest leveraged buyout (LBO) ever, not adjusting for inflation.

The LBO is being led by a consortium of private-equity giants, such as Silver Lake, and Saudi Arabia’s Public Investment Fund is expected to announce the transaction as soon as next week.

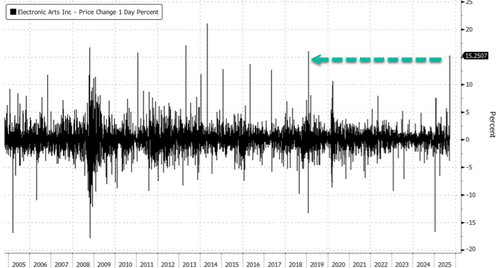

EA (known for FIFA/FC, Madden NFL, The Sims, and other top gaming franchises) shares jumped 15.5%, hitting record highs. Please note that EA has not yet confirmed the details of the story.

If gains are held through the end of the cash session, today’s 15.5% would be the highest since February 08, 2019.

EA’s market capitalization pre-WSJ report was around $42.8 billion. The deal could value EA at around $50 billion.

WSJ provided some context about the potential LBO transaction:

Assuming a deal comes together, it is likely to rank as the largest leveraged buyout ever, not adjusting for inflation. The largest to date was the 2007 purchase of Texas utility TXU by a group of private-equity firms for around $32 billion, which doesn’t include assumed debt, according to Dealogic.

Massive leveraged buyouts all but disappeared after a number of them performed poorly in the wake of the 2008-09 financial crisis. A group of private-equity firms made a big splash in 2021 when they agreed to buy medical-supply company Medline Industries for more than $30 billion.

Two decades of “EA SPORTS – It’s in the game.”

. . .

Tyler Durden

Fri, 09/26/2025 – 15:13ZeroHedge NewsRead More

R1

R1

T1

T1