“Weakest Since Pandemic”: U.S. Heavy Truck Sales Collapse To Levels Rarely Seen Outside Recession

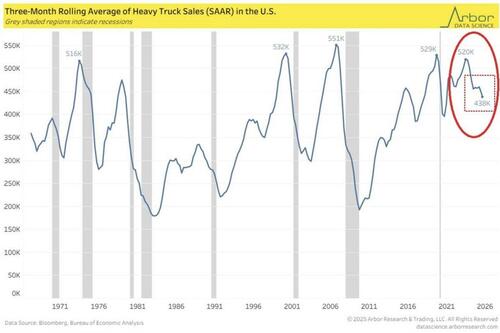

U.S. heavy truck sales are falling at a pace rarely seen outside of recessions, raising concerns about the health of the economy. Sales dropped by 20,000 in August to an annualized rate of 422,000, the lowest since January 2022. The three-month moving average has now slipped to 438,000—the weakest level since the pandemic downturn in 2020.

Since May 2023, sales have plunged by 131,000, or 24%, marking four straight months of decline. Economists note that heavy truck purchases often track broader economic cycles. “Economists are taking note because trucking has long served as a leading indicator of economic health. When freight companies and construction firms expect expansion, they buy more trucks. When they anticipate leaner times, they pump the brakes on new orders,” one analysis observed.

The downturn reflects multiple pressures. Freight volumes have weakened as consumers cut back, leaving fewer goods to move. Higher borrowing costs are delaying construction projects, while tariffs on steel, aluminum, and imported parts are squeezing manufacturers and operators.

“Consumers still aren’t feeling a lot of this,” said Kenny Vieth, president of ACT Research. “Goods cost 5% more… we’re just going to get 5% less stuff, and stuff is what trucks haul.”

Regulatory uncertainty is also weighing on demand. Fleet managers are hesitating to invest until future clean-energy tax credits and upcoming EPA emissions rules are clarified. Together, these headwinds suggest that businesses are conserving cash rather than betting on growth.

While the drop may not yet rival past recessions, the speed and depth of the decline is unusual outside of a downturn—leaving economists watching closely for signs that trucking is once again flashing red for the broader economy.

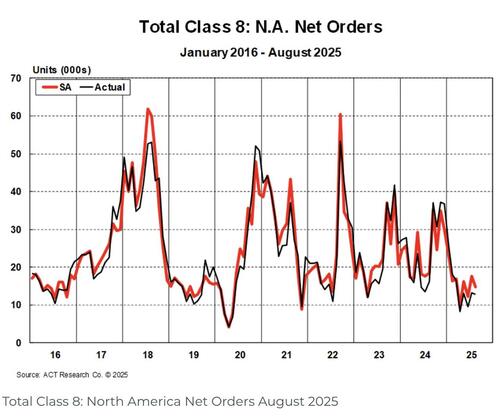

The weakness is showing up in new truck orders as well. Final North American Class 8 net orders came in at 12,844 units in August, down 21% from a year earlier.

“August marks the eighth consecutive month of y/y Class 8 order declines,” said Carter Vieth, Research Analyst at ACT Research. He noted that while August is usually a slow month, “this month’s tractor orders of 7,493 units, down 34% y/y, were notably weak, but in line with the trend since April. Current tariff and regulatory purgatory continue to sow industry uncertainty.”

Meanwhile, total Classes 5–7 orders slumped 24% y/y to 14,613 units, with Vieth adding that “MD orders have slowed notably this year, as still elevated inventories, a weaker economic outlook, and notable increased consumer pessimism weigh on MD demand.”

Tyler Durden

Fri, 09/26/2025 – 06:55ZeroHedge NewsRead More

R1

R1

T1

T1