Stocks Celebrate Government Shutdown By Surging To New Record High

And another rugpull for the bears.

With many pessimistic traders expecting that today’s US government shutdown would finally be the reason to short/sell stocks, that’s precisely what we got… for a few hours. And then stocks did what they always do since April: they blasted off and soared to new all time highs, appropriately enough on the day the US government is closed just to rub it in the panickans’ faces.

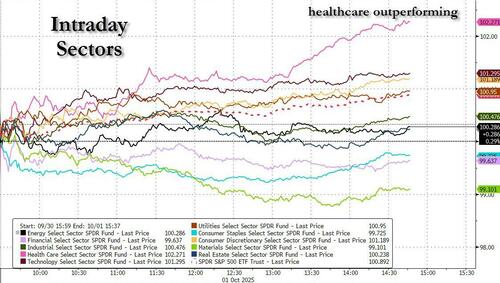

The meltup was also driven by generally listless activity: Goldman says that its desk was 5 out of 10 in terms of activity levels (with healthcare by far the biggest buy skew at 18%).

- LOs have a 20% buy skew concentrated in HC and Consumer.

- HFs are slightly better to buy in TMT and Fins.

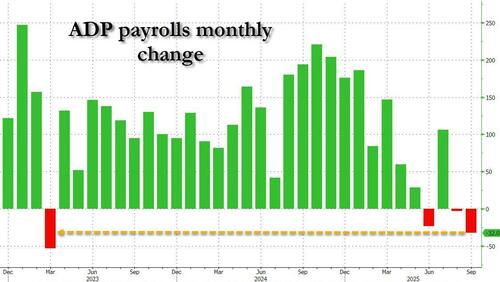

What sparked today’s rally was another batch of “bad news is good news”, when we got the latest ADP print which was an outright catastrophic -32K print, the 3rd negative month in the past 4 (after revisions) and the worst print since March 2023…

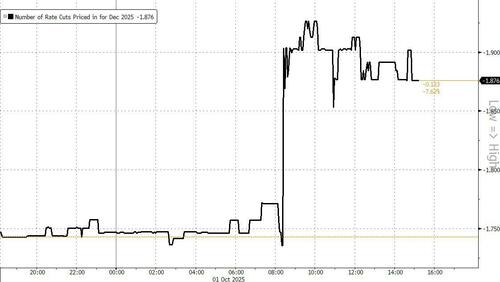

… and since there will be no NFP print this Friday due to the government shutdown, the market ran with the atrocious ADP number and not even the much more solid ISM mfg print later in the day was sufficient to reverse the spike in rate cut odds, which rose from 1.75 cuts priced in by December to as high as 1.95.

By sector, we had a rather boring distribution with tech and consumer discretionary outperforming, materials and financials underperforming but it was healthcare that stole the show rising more than 2%, and gaining on the back of yesterday’s TrumpRX announcement which helped boost what until yesterday was the year’s worst performing sector.

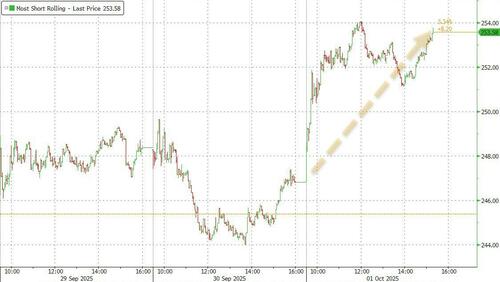

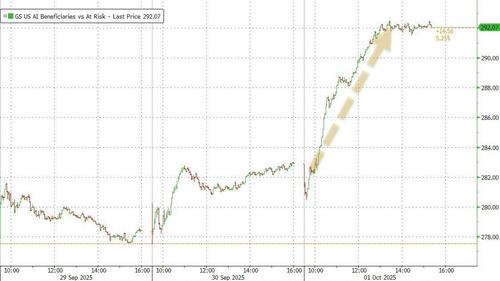

Broken down by factor, the first day of Q4 saw a bit of a mixed bag in price action out of the gates – Leading were Most Short +244bps…

… Non-Profitable TMT +250bps…

… and AI vs AI At Risk +265bps.

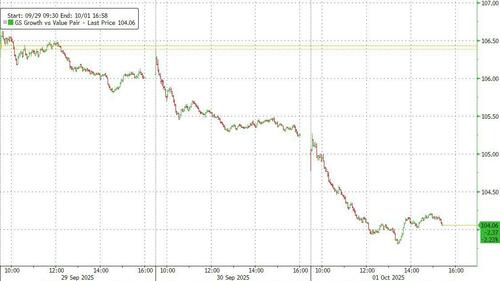

On the other end, the biggest laggard was Growth vs Value -120bps.

As noted above, today’s gains were led by Large Cap Pharma +500bps, which continues to be the big focus following the Trump drug pricing press conference yesterday.

According to Goldman’s trading desk, feedback on the outperformance is around the fact the initially lower prices on current marketed drugs will seemingly be isolated to just Medicaid, while new drug launches will include all payors (though investors are generally more comfortable around flexibility). Of course, it wouldn’t be the first time that investor optimism has proven to be wrong. In any case, the Goldman desk notes that today’s Medtech –> Pharma rotation is exploding with demand for pharma being driven primarily by HFs and some select pockets of generalist demand.

Away from stocks it was generally boring: the Bloomberg dollar index extended its recent slide, dropping for the 4th day with today’s weakness sparked by the shutdown.

Treasury yields largely followed the move in the greenback, with the 10Y yield sliding to a 1 week low after the dismal ADP print and trading near thje lows all session.

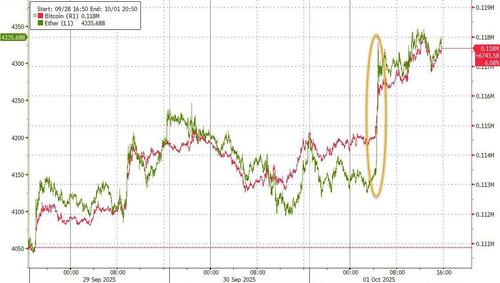

And while the jump in rate cut odds was a catalyst to send the price of bitcoin and ether higher…

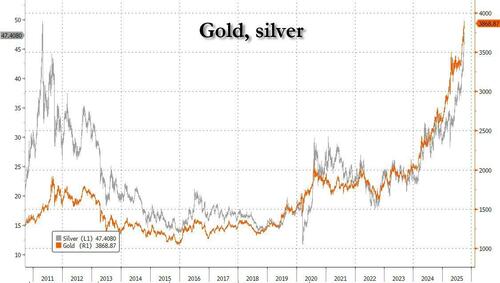

… it had little impact on gold and silver, both of which are trading near record highs.

Which is not to say it’s all smooth sailing ahead: while stocks continue to meltup, the credit-fueled foundation of the market continues to crack as the Blackstone private credit BDC slumped to a new multi-year low, down 7 of the past 8 days…

… and that other private credit player, Blue Owl, not doing any better.

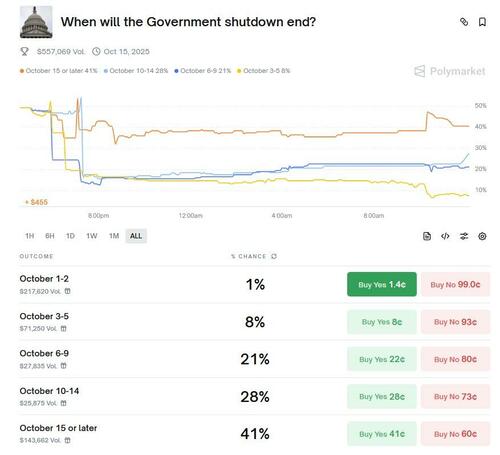

Looking ahead, with the US gov’t shutdown indefinitely, and likely at least 10-15 days…

… which will translate into a delay in econ data, earnings will be the next catalyst as investors prepare for the next potential leg higher into year end. To that end, we are 10 days from the kickoff of Q3 earnings season. Consensus estimates for SPX 500 are +6% (Mag 7 +14%/493 +4%). This is tracking towards Goldman’s forecast for 2025 of +7% YoY growth. As a reminder, in its latest forecast, Goldman forecast 7% EPS growth for FY 2026 and has a 12-month SPX price target of 7200.

Tyler Durden

Wed, 10/01/2025 – 16:05ZeroHedge NewsRead More

R1

R1

T1

T1