America’s Sober Revolution Marches On: NielsenIQ Data Charts Continued Decline In Alcohol Sales

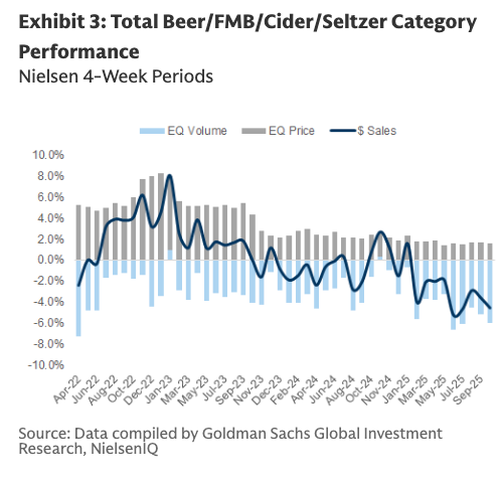

Reaffirming that the sober revolution in America is continuing full steam ahead into fall, a new Goldman report shows total alcoholic beverage sales fell 3.9% in the two weeks ending September 20, consistent with prior 4-week and 12-week declines.

There’s a lot to unpack in Goldman’s alcoholic beverage trends note, which cites NielsenIQ data through September 20. A team of analysts led by Bonnie Herzog wrote the report. Here’s the breakdown:

Overall U.S. Market

Total alcoholic beverage sales fell -3.9% in the 2 weeks ending 9/20/25, consistent with prior 4- and 12-week declines.

Volume remained under pressure (-3.0%), while pricing slipped slightly (-0.7%).

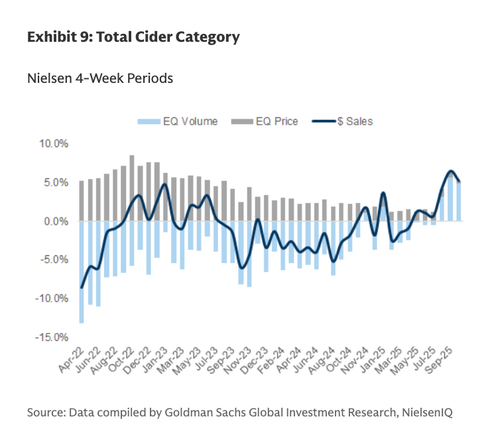

Spirits and Cider were the only categories avoiding volume contraction.

Beer Category

Beer sales declined -3.8%, driven by a -5.2% volume drop, partially offset by +1.5% pricing.

Modelo: Sales down -3.5% on weaker volumes (-4.6%) but modest price growth (+1.2%).

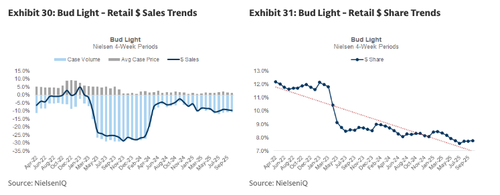

Bud Light: Sales fell -8.9%, losing 44 bps market share to 7.7%.

Michelob ULTRA: Grew +2.5%, gaining 55 bps market share to 9.0%.

Coors Light & Miller Lite: Both declined (-4.6% and -7.8%), with share erosion.

Flavored Malt Beverages (FMBs)

- FMB sales fell -6.8%.

Twisted Tea: Sales dropped -12.8%, though market share edged higher.

Simply Spiked: Severe weakness continued (-32.0%).

Hard Seltzers: Down -5.7%, led by Truly (-13.6%) with share loss.

Ready-to-Drink (RTD)

- Cocktails Strong growth continued: Spirit-based RTDs: +23.1% Wine-based RTDs: +28.5%

Promotions

- Promotional spend moderated slightly to 18.5% of sales (from ~18.6–18.7%).

Herzog’s team published an extensive chartbook visualizing the NielsenIQ data, underscoring a “sober revolution” that has gained momentum since the Covid lockdowns. Gen-Z sober behaviors are also changing the drinking landscape.

The charts line up with Gallup’s latest survey showing (read report), for the first time in the poll’s 90-year history, that a majority of Americans now view even moderate alcohol consumption as harmful to one’s health.

Bud Light sales remain depressed after a transgender TikTok in early 2023 nuked the brand.

Hmmm.

Related:

-

“Sudden Spike” In US Marijuana Substitution For Alcohol Ahead Of Trump-Era

-

Beer Distribution Data Signals “Rough Start” To Summer Drinking Season

For the full 75 charts and tables on the latest U.S. alcohol trends, ZeroHedge Pro Subs can access the report in the usual spot.

Tyler Durden

Fri, 10/03/2025 – 21:50ZeroHedge NewsRead More

R1

R1

T1

T1