US Takes 10% Stake In Alaska Miner Trilogy Metals

Trump’s Industrial Policy juggernaut continues.

Moments after the close when we saw some abnormal moves in the stock of yet another North American small cap stock focused on mining strategic minerals, we quickly skimmed through Trilogy Metals’ just released presentation and told readers that yet another “Uncle Sam bear hug” deal was in the works, pointing out the company’s disclosure of DOD funding to develop a cobalt supply chain.

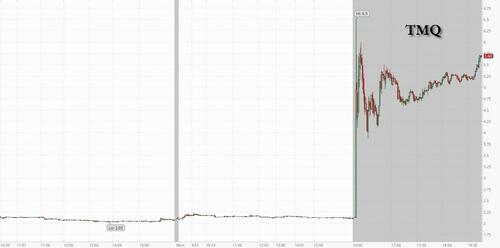

Trilogy Metals (TMQ) soars after microcap miner ($343MM market cap) reveals DOD funding of its “Bornite Project to advance domestic cobalt supply chain” pic.twitter.com/ILauxrLBrn

— zerohedge (@zerohedge) October 6, 2025

13 minutes later it was official: the US said it will take a 10% stake in Canadian minerals explorer Trilogy Metals as part of a $35.6 million investment to secure critical energy and mining projects in Alaska. The US deal also includes warrants to purchase an additional 7.5% of the Vancouver-based company.

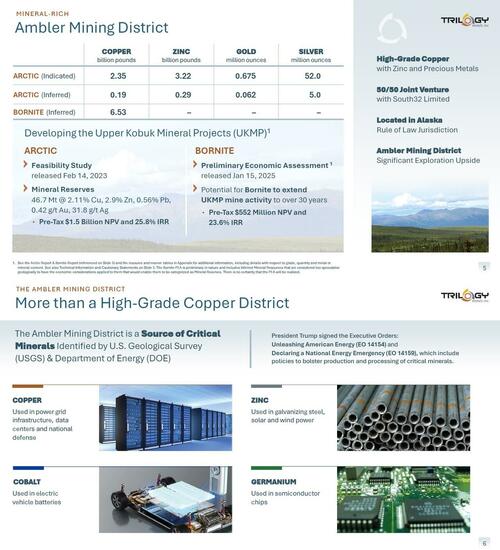

In an announcement Monday, President Donald Trump said the White House is reversing a Biden-era decision to reject Ambler Road, a project to help access vast critical mineral deposits in Alaska’s Northern Brooks Range – home to some of the world’s richest known copper-dominant polymetallic deposits – to open up critical energy and mining projects.

The 211-mile (340-kilometer) highway would connect a remote mining district with deposits of copper, cobalt, gallium, germanium and other minerals.

Trump’s move directs the Bureau of Land Management, National Park Service, and US Army Corps of Engineers to reissue any necessary permits needed to build the road.

“This was something that should have been long operating and making billions of dollars for our country and supplying a lot of energy and minerals and everything else,” Trump said during an event in the Oval Office.

Trilogy Metals has mining claims in remote areas of Alaska, including a joint venture with Canadian mining giant, South32 Ltd.

The planned investment is the latest example of the Trump administration taking stakes in North American critical minerals companies to help counter China’s dominance in the industry. Just last week, the US agreed to acquire a direct interest in Lithium Americas Corp., which is developing the Thacker Pass lithium project in Nevada. In July, the US Defense Department agreed to a $400 million equity investment in MP Materials Corp. to fund a plant for rare-earth magnets. It is expected to do the same with USA Resources and

Interior Secretary Doug Burgum said Ambler Road will be a toll road constructed from gravel, and will be sensitive to environmental concerns. Trump said the effort will include the construction of two bridges. The Interior Department blocked construction during former President Joe Biden’s term, folding to the pressure of one or more bluehaired environmental Karens, saying that the road would impact wildlife including caribou.

US shares of Trilogy soared more than 150% in after-market trading following the announcement of the deal. Billionaire John Paulson is a top shareholder in Trilogy, with an 8.7% stake through his investment fund Paulson & Co, according to the latest data compiled by Bloomberg.

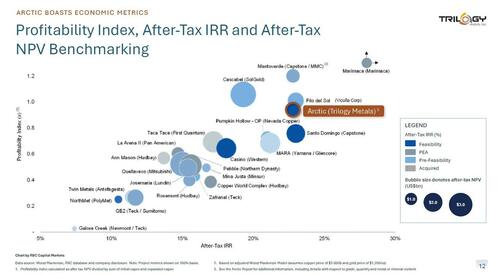

Those wondering who may be next, here is a snapshot of comps from the company’s own presentation.

Trilogy’s full presentation laying out the Ambler Road opportunity is below (pdf link).

Tyler Durden

Mon, 10/06/2025 – 18:58ZeroHedge NewsRead More

R1

R1

T1

T1