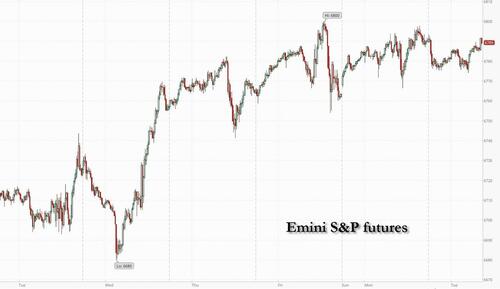

Futures Flat As AI Bubble Euphoria Takes A Break

Futures are flat after the S&P, Nasdaq and Russell all made new ATHs yesterday, driven by the AI theme and a broad-based rally. As of 8:15am, S&P futures are unchanged while Nasdaq futures eke out a 0.1% gain as trader keep an eye on TSLA’s new car announcement with Mag7 names mixed pre-mkt but Semis seeing a bid led by AMD (+3.6%), MU (+2%). Bond yields are higher while the USD gained for a second day as President Trump sent mixed messages about the state of talks with Democrats on their biggest demand to end the shutdown; the stronger dollar may pressure international/ADR plays today according to JPM. There are four Fed speakers today and a 3Y bond auction with the shutdown pausing official data.

In premarket trading, Mag 7 stocks are mixed (Tesla -0.6%, Nvidia +0.3%, Alphabet -0.5%, Microsoft -0.2%, Apple -0.3%, Amazon +0.1%, Meta Platforms +0.2%).

- Advanced Micro Devices (AMD) rises 3%, set to extend Monday’s rally, as Jefferies upgrades to buy following the chipmaker’s deal with OpenAI.

- Aehr Test Systems (AEHR) falls 21% after the maker of semiconductor equipment posted fiscal first-quarter revenue that fell from the year-ago period.

- Amkor (AMKR) is up 10% after the company broke ground on an outsourced semiconductor advanced packaging and test campus in Arizona.

- Constellation Brands (STZ) is up 3% after the owner of the Corona and Modelo Especial brands in the US reported comparable earnings per share for the second quarter that beat the average analyst estimate.

- Ford (F) slips 1% after the Wall Street Journal reported that the company faces months of disruptions to its business after a major fire at an aluminum plant in New York.

- IBM (IBM) rises 4% after the technology firm said it will integrate Anthropic’s Claude family of large language models into its software portfolio.

- Intercontinental Exchange (ICE), owner of the New York Stock Exchange, climbs 3% amid plans to invest $2 billion in Polymarket, a crypto-based betting platform.

- Trilogy Metals (TMQ) gains 220% as the White House said US will take a 10% stake in the small-cap mineral exploration company.

In corporate news, Tesla is said to plan unveiling a cheaper version of the Model Y today. Ford faces months of disruptions to its business after a major fire at an aluminum plant in New York, the WSJ reported. Elon Musk named a former Morgan Stanley executive as the CFO of xAI, the FT reported.

After hitting yet another AI-driven record high, stocks are seeing some fatigue as the rally runs on fumes. It’s hardly surprising, after the latest meltup, as traders contemplate the government shutdown stretching into a second week, political shocks overseas and the latest tariffs. Even tech might struggle, with Citi strategists cautioning that investors may want to cash in.

The market’s latest winning streak has been fueled by AI euphoria and optimism about earnings, but those drivers could reach a limit. “Profit-taking risks have rapidly risen across markets, and are particularly elevated for Nasdaq, potentially hampering further upside,” according to Citi’s Chris Montagu. Meanwhile, AI valuations are nearing extremes, with the SOX Index’s forward P/E ratio approaching three standard deviations above the 15-year average. Still, tech news keeps coming, and it seems like anything OpenAI touches turns to gold.

Monday’s AMD deal was the latest big-budget data center agreement this year. It follows last month’s announcement that Nvidia Corp. was planning to invest as much as $100 billion in OpenAI amid demand for tools like ChatGPT and the computing power needed to make them run. Tech firms are spending hundreds of billions of dollars on advanced chips and data centers, and the final bill may run into the trillions. The financing is coming from venture capital, debt and, lately, some more unconventional arrangements that have raised eyebrows on Wall Street.

While equities worldwide have surged to successive record highs, worries over the US government stalemate and the political crisis in France have driven investors toward alternative assets such as gold and Bitcoin, sending both to new peaks in what has been dubbed the “debasement trade.” At the same time, a flurry of AI-related deals among chipmakers has propelled shares higher and fueled some concerns of a speculative bubble reminiscent of the late-1990s dot-com era.

“Enthusiasm for stocks is starting to wane after another record-breaking start to the week for Wall Street,” said Kathleen Brooks, research director at XTB Ltd. That keeps the debasement trade in play, she said. “As global political risks rise, this is continuing to drive demand, and we think that the early morning pullback in the gold price is likely to be used as a buying opportunity.”

In political news, the government shutdown extends into a 7th day and Trump said he would negotiate with Democrats over health care subsidies, a move that could open the door to resolving the shutdown. Carlyle Group is releasing its own estimates of US data to fill the void. The investment manager estimates that just 17,000 jobs were created in September, among the weakest results since the US economy emerged from the 2020 recession.

Meanwhile, Citadel’s Ken Griffin warned that investors are starting to view gold as a safer asset than the dollar, a development that the billionaire investor called “really concerning.”

Not everyone is concerned about the AI bubble however: there are the usual commission-based traders whose paycheck depends on a continuation of the status quo, like Pepperstone’s Michael Brown. The Mag 7 group of tech giants that have powered the bulk of the S&P 500 rally in recent years are trading at valuations in line with their five-ear averages, he said.

“If you’re now about to tell me that they’ve been expensive for five years, well those seven stocks have delivered a total return of >300% in that period of time, and look set to rally even further in the coming months,” Brown said. “In fact, the path of least resistance for the market at large continues to lead to the upside, as earnings growth remains strong, the underlying economy remains resilient, and as the monetary policy backdrop becomes increasingly loose.”

Elsewhere, Europe’s Stoxx 600 benchmark edged higher. France’s CAC 40 reversed an early decline as President Emmanuel Macron made a last-ditch effort to salvage the government after Prime Minister Sebastien Lecornu’s resignation on Monday. Truckmakers including Volvo AB and Daimler Truck Holding AG fell after US President Donald Trump said 25% duties on medium- and heavy-duty trucks would begin next month. Here are the biggest movers Tuesday:

- Kering shares rise as much as 5.4% to the highest since July 2024, after the Gucci owner was named the top pick among luxury stocks at Morgan Stanley and upgraded to overweight alongside LVMH

- NKT jumps to a record high after Jefferies raises its recommendation on the Danish energy transmission firm to buy, predicting strong expansion in high voltage capacity. French peer Nexans slips as much as 5.1%, on cut to hold

- Shell shares rise as much as 2.3%, the most since July. The company gave an October trading update that analysts saw as upbeat, forecasting higher 3Q integrated gas production and upstream volumes

- Ambu gains as much as 4.9% after Bernstein raised the recommendation to outperform from market perform, citing the medical device firm’s unique growth profile and strong market position

- Skanska shares rise as much as 5%, the most since April 10, after Jefferies upgraded the Swedish construction group to buy from hold, saying growing momentum in end markets like commercial property is underappreciated

- CVS Group shares rise as much as 10%, to the highest since March 2024, after the UK veterinary service and animal medicines company reported full-year results. Analysts were cheered by a year-on-year improvement in margins

- Imperial Brands shares rise as much as 3.7%, rebounding from a two-month low, after the tobacco company said it will increase its share buyback in FY26. RBC Capital Markets also sees scope for small upgrades to consensus

- Rentokil gains as much as 4.6% after Bernstein double-upgrades to outperform and installs a new Street-high 570p price target, saying the pest controller has a path toward stronger organic growth

- TomTom gains as much as 6.6%, the most in a month, after Kepler Cheuvreux upgraded the Dutch mapping and navigation company to buy on improving near-term free cash flow and attractive long-term prospects

- B&M European Value Retail shares drop as much as 22%, marking a record drop that has sent shares to an all-time low. CEO Tjeerd Jegen warned operational execution has been “weak” and weighed on first-half performance

- Rheinmetall shares fall as much as 2.8%, to the lowest level in nearly a month as analysts came away from a conference call expecting a slow 3Q. Deutsche Bank analysts say the firm’s quarterly results are likely to fall short

- HelloFresh shares drop as much as 7.1%, slipping to their lowest level in almost a month, after the USDA’s Food Safety and Inspection Service issued a public health alert concerning ready-to-eat meals sold by the company

- Liontrust drops as much as 6.7% after reporting net outflows and a drop in assets under management in the second quarter. RBC said there has been a reversal in progress following two consecutive quarters in net flows

Asian shares traded steady after a six-day rally, as Japanese markets failed to hold initial gains amid an indecisive mood across global peers. The MSCI Asia Pacific Index gained as much as 0.4% before giving up the advance to trade little changed. Tech-heavy Taiwan shares were among key gainers, while stocks in Singapore and India also gained. Japanese shares ended flat. Markets in China, Hong Kong and South Korea remained closed for holidays. Australian stocks fell, bucking the broader region’s advance. A financial regulator approved Cboe Global Markets’ application to conduct local stock listings, spurring a decline in shares of the nation’s main exchange operator ASX Ltd. Stocks in India rallied for fourth straight session as the central bank’s recent credit easing measure boost local lenders.

In FX, the Bloomberg Dollar Spot Index rises 0.2% and stronger against most G-10 currencies, New Zealand dollar lags as investors ramp up bets on cuts by the central bank, which announces its latest decision on Wednesday.

In rates, treasury yields continue to grind higher led by long-end tenors, extending Monday’s curve-steepening selloff. Bunds underperform along with French bonds, which extend declines as President Macron seeks last-ditch talks to avoid a government collapse, giving outgoing Prime Minister Sebastian Lecornu 48 hours to negotiate. US yields are 1bp-3bp cheaper on the day with 2s10s and 5s30s curves steeper by less than 1bp; 10-year near 4.17% is up about 2bp vs Monday’s close with Germany’s cheaper by an additional basis point. Treasury auction cycle begins at 1pm New York time with $58 billion 3-year new issue, to be followed by $39 billion 10-year and $22 billion 30-year reopenings Wednesday and Thursday. Focal points of US session include 3-year note auction, first of this week’s three coupon sales, and several Fed speakers.

In commodities, gold swooned after hitting another record, but recovers to trade little changed at $3,959/oz. Oil prices falling, with Brent trading around $65.20/barrel.

The US economic calendar — still subject to delays from the ongoing government shutdown — includes August trade balance (8:30am), New York Fed 1-year inflation expectations (11am) and consumer credit (3pm). Fed speaker slate includes Bostic (10am), Bowman (10:50am), Miran (10:30am, 4:05pm) and Kashkari (11:30am).

Market Snapshot

- S&P 500 mini little changed

- Nasdaq 100 mini little changed

- Russell 2000 mini little changed

- Stoxx Europe 600 little changed

- DAX little changed

- CAC 40 little changed

- 10-year Treasury yield +1 basis point at 4.17%

- VIX +0.2 points at 16.55

- Bloomberg Dollar Index +0.2% at 1207.19

- euro -0.4% at $1.1665

- WTI crude -0.6% at $61.34/barrel

Top Overnight News

- The Trump administration is expected to announce a plan as soon as Tuesday to bail out U.S. farmers stung by trade disputes and big harvests, with the initial outlay potentially totaling up to $15 billion, according to sources familiar with the matter. RTRS

- In the midst of the shutdown, Senate Minority Leader Chuck Schumer said Monday there are no pending bipartisan talks over expiring health insurance subsidies despite a claim from President Donald Trump. Politico

- US White House memo says furloughed federal workers are not entitled to back pay for the time that is taken off during the government shutdown: Axios.

- A paycheck scheduled on Oct. 15 for the 1.3 million members in the armed services might convince legislators and the White House that missing the date won’t be worth the political cost. While the respective sides have dug in their heels regarding the fiscal budget, missing a pay period could rile public anger. At the least, it encourages a temporary bill known as a continuing resolution. CNBC

- Trump said layoffs could be triggered if the Senate vote on the shutdown fails, while he added that negotiations are ongoing with Democrats and he would make a deal on Affordable Care Act subsidies. Trump later posted “Democrats have SHUT DOWN the United States Government right in the midst of one of the most successful Economies, including a Record Stock Market, that our Country has ever had…I am happy to work with the Democrats on their Failed Healthcare Policies, or anything else, but first they must allow our Government to re-open.”

- Schumer said Democrats will be at the table if President Trump is ready to work with Democrats on ending the government shutdown and get something done on health care for American families, while Schumer stated that Trump is not yet negotiating with US Congress Democratic leaders. Furthermore, he separately commented that they are making progress on the government shutdown.

- Democrat and Republican bills to end the US government shutdown failed to secure sufficient votes for passage in the Senate, as expected.

- Trump said he would invoke the Insurrection Act if people were being killed, and courts and local officials were holding us up, while it was later reported that Trump said what’s happening in Portland is insurrection, according to a Newsmax interview. Furthermore, Trump said he called into federal service at least 300 members of the Illinois National Guard until the governor consents to a federally funded mobilization.

- US federal judge declined to immediately block President Trump’s deployment of National Guard troops to Illinois, according to the New York Times.

- China is rapidly building oil storage capacity as the country rushes to accumulate energy stockpiles. RTRS

- French shares declined for a second consecutive session as President Emmanuel Macron made a last-ditch effort to salvage his government, giving PM Sebastien Lecornu until Wednesday night to form a plan. BBG

- The White House is looking to sell parts of the government’s $1.6T portfolio of student loans although doing so will be extremely complicated from a logistical and legal standpoint. Politico

- Japan had a solid 30-year bond auction with firm demand, calming a jittery market following the surprise victory of pro-stimulus conservative Sanae Takaichi in the ruling party leadership race. BBG

- The US Labor Department’s September employment report, whose scheduled release on Oct. 3 was among those that have been postponed since the shutdown began last week, was expected by economists in a Bloomberg poll to show a 54,000 increase in nonfarm payrolls from August’s total of about 159 million. Carlyle estimates that just 17,000 jobs were created, among the weakest results since the US economy emerged from the 2020 recession. BBG

- Goldman raised its Dec 2026 gold price forecast to $4,900/toz (vs. $4,300 prior) because the inflows driving the 17% rally since August 26th – Western ETF inflows and likely central bank buying – are sticky, effectively lifting the starting point of the price forecast. In contrast, noisier speculative positioning has remained broadly stable: GS

Trade/Tariffs

- Japan’s Chief Cabinet Secretary Hayashi said he is aware of US President Trump’s comments on truck tariffs, while he added that they will assess the details once clarified and will respond appropriately.

- Trump will meet with Carney at 11.45EDT/16:45BST on Tuesday.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded mixed despite the tech-led advances on Wall St with several holiday closures including Mainland China, Hong Kong and South Korea, while Japanese stocks rallied again as the post-LDP election euphoria persisted. ASX 200 was subdued amid losses in Telecoms, Consumer Discretionary and Tech, with sentiment also not helped by weaker Consumer Confidence. Nikkei 225 printed fresh record highs once again amid ongoing tailwinds from the dovish expectations associated with the incoming Takaichi government, while Japanese Household Spending also topped forecasts.

Top Asian News

- Japanese LDP chief Takaichi said she is truly hoping to work together with US President Trump to make their alliance even stronger and more prosperous, as well as advance a free and open Indo-Pacific.

- Japanese Finance Minister Kato said it is important for currencies to move in a stable manner, reflecting fundamentals, while he added they are closely watching FX moves and will thoroughly monitor for excessive fluctuations and disorderly movements in the forex market. Furthermore, he said the new LDP leader Takaichi will make appropriate policies given Japan’s fiscal situation.

- US FCC is to vote this month to tighten restrictions on Chinese equipment posing a national security risk, according to the FCC Chair.

- RBNZ is establishing a new Financial Policy Committee which will be given authority to make key policy decisions relating to financial stability.

- World Bank raises China’s 2025 GDP growth forecast to 4.8% (prev. 4.0%), and 2026 forecast to 4.2% (prev. 4.0%), but warned of slowing momentum next year.

- Japan’s Komeito Party Leader Saito says LDP leader Takaichi explained her stance on “our” concerns; says they have a shared understanding on history and foreigners, according to Bloomberg; talks will continue.

- Japanese LDP Leader Takaichi, following talks with Komeito party, says “We discussed three points, shared agreements on two”.

- UMC (2303 TT) September 2025 sales +52% Y/Y; Jan-Sept sales +2.2% Y/Y.

European bourses (STOXX 600 -0.2%) opened mostly lower, albeit with very marginal losses. Though, soon after the cash-open sentiment slipped a touch to display a more negative picture in Europe, but without a clear driver. European sectors are showing a slightly more negative picture vs initially opening mixed. Food Beverage & Tobacco takes the top spot, boosted by a couple of reasons. Firstly, Imperial Brands (+3%) helps to prop up the sector after the Co. announced a GBP 1.45bln share buyback and confirmed its FY25 guidance. Secondly, alcohol names opened higher in a read-across following strong Q2 metrics from US-listed Constellation Brands (+3.2% pre-market); the Co. beat on its top- and bottom-lines, where it cited continued demand for its beer portfolio. The likes of Diageo (+1%) and AB InBev (+0.7%) both move higher. Energy and Telecoms complete the top three; the former is helped by Shell (+1.7%) after the Co. said it expects “significantly higher” gas trading in Q3, with its outlook for that quarter also positive.

Top European News

- French President Macron reportedly believes the current political situation can be turned around and the Socialist Party and Les Republicans will return to the negotiating table, via Politico citing sources.

- French National Rally (RN) leader Bardella says both options of fresh legislative elections and advanced presidential elections are on the table.

FX

- DXY is extending on Monday’s upside that was triggered by JPY and to a lesser extent, EUR weakness. The government shutdown continues to grip the US macro narrative but is failing to weigh on the USD at the start of the week. This view may be re-appraised in the event that it drags on and has a more tangible impact on the US economy. The shutdown still shows no signs of being resolved after Democrat and Republican bills to end the shutdown failed to secure sufficient votes for passage in the Senate. As such, it is looking increasingly likely that mass layoffs of Federal workers are on the cards. For today’s docket, given that trade and consumer metrics will not be published, markets will instead focus on US RCM/TIPP Economic Optimism, NY Fed SCE, Atlanta Fed GDP metrics and a slew of Fed speakers. DXY has ventured as high as 98.47.

- EUR remains on the backfoot vs. the USD with EUR/USD returning to a 1.16 handle as French political risks remain front and centre. In terms of the latest, outgoing PM Lecornu has been instructed by Macron to hold final discussion with political parties to see if there is a way forward. There are three paths the current crisis could take: 1) a new PM, which would appease opposition parties. 2) Fresh legislative elections. 3) An early Presidential election. France aside, German industrial orders disappointed this morning but failed to generate any traction in EUR. EUR/USD has delved as low as 1.1661.

- JPY is once again lagging vs. the USD but to a lesser extent than most G10 peers. Focus remains on the fallout from Saturday’s LDP leadership election in which, Abe-protégé Takaichi was declared the victor. However, it remains to be seen how much sway the incoming PM will have on policy at the BoJ. Accordingly, investors look to scheduled speeches from multiple BoJ officials ahead of the October meeting; however, Wednesday’s appearance by Governor Ueda has been cancelled. USD/JPY has been as high as 150.70 with the next upside target coming via the 1st August peak at 150.91. Note, Finance Minister Kato attempted to jawbone the currency overnight but it had little impact on JPY.

- GBP is softer vs. the USD but steady vs. the EUR. It remains the case that in the absence of any tier 1 data, focus in the UK is on the ongoing angst in the run-up to the November 26th budget. Ahead of which, Bloomberg reports that Chancellor Reeves is set to receive an unexpected GBP 5bln boost to her budget plans from inflation, which raises the taxable value of incomes, profits, and prices. The gain offsets higher debt servicing costs, helping narrow the UK’s projected GBP 20-30bln budget shortfall ahead of the budget. Cable sits towards the lower end of Monday’s 1.3417-90 range.

- Antipodeans are both are at the foot of the G10 leader board with NZD lagging its antipodean peer in the run up to tomorrow’s RBNZ rate decision, which is set to see a reduction in the OCR. The scale of easing remains in debate, with a Reuters poll finding that 15 of 26 economists expect a 25bp cut to 2.75%, while 11 look for a larger 50bp move.

Fixed Income

- USTs are flat. Specifics for the most part are light owing to the ongoing shutdown and the subsequent lack of US data. Several Fed speakers due, but in the absence of fresh data points it remains to be seen what they can add beyond recent remarks to the narrative. On the shutdown, there are some glimmers of progress. President Trump commented that he is willing to look at and make a deal on ACA subsidies, but the government must reopen first. From the Democrats, Senate Minority Leader Schumer said Trump is not yet negotiating with them, but progress on the shutdown is being made. Currently, USTs find themselves in a thin 112-11 to 112-15+ band.

- JGBs picked up overnight following a strong 30yr JGB auction. Supply was in more focus than usual given the move seen in JGBs and particularly the long-end driven steepening that occurred after the weekend’s LDP election. Auction aside, potentially the most pertinent update has been BoJ Governor Ueda cancelling his speech on October 8th. As it stands, that was Ueda’s last scheduled appearance before the end-October BoJ; though, several other officials are scheduled before then. More recently, Takaichi met with the Komeito leader. A meeting of particular pertinence amid concern that Komeito could lead the alliance. However, the meeting was positive overall with agreements shared on two out of three points and talks set to continue on the third; the officials reportedly shared an understanding on history and foreigners.

- OATs are lower. On Monday, Takaichi met with the Komeito leader. A meeting of particular pertinence amid concern that Komeito could lead the alliance. However, the meeting was positive overall with agreements shared on two out of three points and talks set to continue on the third; the officials reportedly shared an understanding on history and foreigners. Thus far, the OAT-Bund 10yr yield spread is contained within yesterday’s parameters, been as high as 86.7bps but shy of the 88.2bps YTD peak that printed on Monday. As a reminder, the 2024 high resides at 90bps.

- Bunds are softer than USTs but foreign better than OATs thus far. For Germany, the main update was another soft industrial orders print for August, a series that is even worse if large orders are excluded. A German Bobl auction was exceptionally weak, but had little impact on price action. Now we await ECB’s Lagarde and Nagel.

- Gilts are also in the red, trading a little softer than Bunds at points throughout the morning but only marginally. The latest tender auction was strong, though did not spur any follow-through to the benchmark. For the UK, focus remains on the budget as commentators/desks continue to share their thoughts on what measures Chancellor Reeves may need to take to shore up the UK’s dire finances. Attention on an Oxford Economics note that the OBR’s price forecasts are likely to be revised higher, increasing the taxable value of profit and thus providing Reeves with a GBP 5bln boost.

Commodities

- Crude benchmarks are subdued despite limited crude-specific newsflow to start the European session. WTI and Brent have been oscillating in a c. USD 0.70-0.80/bbl range and thus far, remain relatively flat on the session. Early in the session, Russian Deputy PM Novak said OPEC+ did not discuss increasing quotas by more than 137k bpd and that increasing quotas after November was not discussed. WTI Nov resides in a USD 61.36-62.04/bbl range and Brent Dec in a USD 65.16-65.84/bbl parameter.

- Spot gold has pared back on ATHs formed early in the APAC session as the yellow metal continues to soar towards USD 4,000/oz. XAU peaked at a new ATH at USD 3,977/oz before falling back into the prior days range and currently trading at around USD 3,950/oz. Spot gold resides in a current USD 3,941.06-3,977.40/oz intraday range.

- Base metals remain calm following last week’s gains in copper which set the largest weekly gain since April on supply outages. 3M LME Copper oscillates in a tight USD 10.66-10.75k/t band, as the market awaits China to return from holiday.

- Russian Deputy PM Novak says OPEC+ nations did not discuss increasing quotas by more than 137k BPD in November. Increasing quotas after November was not discussed.

- Ukraine’s Energy Minister, following the Russian attack, says discussed with G7 additional gas imports; wants to increase gas imports by 30%. Ukraine is considering increasing LNG imports.

- Slovakian PM Fico says the nation has signed an agreement with the US for the construction on a new nuclear power plant.

Geopolitics: Middle East

- Senior Hamas official Mahmoud Al-Mardaw says “President Trump’s plan is mainly an Israeli plan”…” The resistance will not accept an agreement that does not end the war or one that can represent a reversal of the rights of the Palestinian people”. “Hamas emphasizes that it wants to end the war, and if the United States is serious about the aspiration to end the war, it must conduct negotiations and take into account the Palestinian demands”. “According to him, in the event that negotiations do not lead to an agreement, “the door will not be closed to any real diplomatic effort aimed at ending the war”.

- “Indirect talks between Israel and Hamas are ‘positive’ and to resume Tuesday”, according to Sky News Arabia.

- US President Trump said he did not tell Israeli PM Netanyahu to stop being negative about a deal, while he added that Hamas has been agreeing to things that are very important and he expects a Gaza deal soon. Trump said that he spoke with Turkish President Erdogan and noted a strong signal from Iran that they’d like to see this done, while Jordan’s King also discussed the Gaza plan with President Trump.

- Egyptian media reported that the round of negotiations between Hamas and the mediators ended amid a positive atmosphere, according to Al Arabiya.

- Iranian media reports that 2 people have been killed from the Revolutionary Guard in an attack West of the country.

Geopolitics: Ukraine

- US President Trump said he has made a decision on sending Tomahawk missiles to Ukraine, but wants to make sure what they are doing with them first, while Trump added that he is not looking to see an escalation regarding Russia-Ukraine.

- EU governments agreed to limit travel of Russian diplomats within the bloc following a surge in sabotage attempts that intelligence agencies say are often led by spies operating under diplomatic cover, according to FT.

Geopolitics: Other

- US President Trump called off the diplomatic outreach to Venezuela, according to The New York Times.

US Event Calendar

- 8:30 am: Aug Trade Balance, est. -61b, prior -78.31b

- 3:00 pm: Aug Consumer Credit, est. 14b, prior 16.01b

Central Banks (All Times ET):

- 10:00 am: Fed’s Bostic Speaks at Fisk University in Nashville

- 10:05 am: Fed’s Bowman Delivers Welcoming Remarks

- 10:30 am: Fed’s Miran in Fireside Chat

- 11:30 am: Fed’s Kashkari Speaks at Star Tribune Summit

- 4:05 pm: Fed’s Miran at Deutsche Bank Event

DB’s Jim Reid concludes the overnight wrap

Markets have had an eventful start to the week, with political surprises cascading across different asset classes. The biggest headlines came from France, where markets were weak yesterday after PM Lecornu announced his resignation, which reopened fears around the country’s debt trajectory. So that pushed the Franco-German 10yr spread to a 9-month high of 85bps, whilst the CAC 40 (-1.36%) posted a big decline. By contrast, Japanese equities are continuing to edge ahead after Sanae Takaichi’s victory in the LDP leadership contest, with the Nikkei up another +0.37% this morning, building on its huge +4.75% surge yesterday. And over in the US, the S&P 500 (+0.36%) posted a 7th consecutive advance to hit a fresh record, even as the government shutdown showed no sign of ending.

Lecornu’s departure came only 27 days after taking office, making him the shortest-serving prime minister in the history of the Fifth Republic. His downfall followed failed attempts to form a stable coalition and criticism that his new cabinet looked too similar to the previous one. The centrist alliance’s partners in Les Républicains ultimately withdrew support, leaving the government unable to pass a budget or advance deficit-reduction plans. Macron has asked Lecornu to continue consultations with party leaders to “define a platform for stability” and report back by tomorrow evening, but the political arithmetic remains unforgiving even if there’s an outside chance he salvages something.

With parliament deeply divided after last year’s snap election, Macron’s options are limited. He could appoint another prime minister, potentially from the left, but that would not change the parliamentary gridlock that toppled Lecornu and his predecessors. A second more likely option is to call fresh legislative elections—now possible since more than a year has passed since the last vote—but that risks shrinking Macron’s centrist bloc even further. A presidential resignation appears unlikely: Macron has ruled it out repeatedly, and the next election is not due until 2027. If the president does call new elections, polling suggests they would likely strengthen Marine Le Pen’s National Rally, which now commands about 35 % of first-round voting intentions. Markets have been fearful of such an outcome but are hoping that, if elected, the RN would follow a path similar to Italy’s Giorgia Meloni and become more mainstream and on debt offer limited but EU-compliant fiscal consolidation to preserve market access. So there is a scenario that fresh elections does help encourage a more market friendly outcome. The main market risks are that the RN don’t evolve like Meloni’s Brothers of Italy (Fdl) party or that the left’s influence increases and the pressure on the budget increases again.

The resignation led to an immediate reaction among French assets, with France’s 10yr yield spiking by +5.9bps yesterday to 3.567%, well above the +1.2bps increase for 10yr bunds. So investors are continuing to view France as an increasingly risky sovereign relative to its peers, and the Franco-German 10yr spread hit a 9-month high of 85bps. Notably, the Franco-Italian 10yr spread moved up to 2.7bps as well, which is its biggest gap so far since the two crossed over last month. Meanwhile for equities, France’s CAC 40 (-1.36%) underperformed, with bigger losses for banks including Société Générale (-4.23%), Crédit Agricole (-3.43%) and BNP Paribas (-3.21%). And in turn, that dragged down the Europe-wide indices, with the STOXX 600 (-0.04%) slipping back from its record high on Friday.

Whilst European markets were clearly affected by political developments yesterday, US markets continue to be unfazed by matters in Europe or the ongoing shutdown. Indeed, the S&P 500 (+0.36%) and the NASDAQ (+0.71%) both moved up to new record highs. That was in part down to a huge surge for AMD (+23.71%), which came after the news that OpenAI had agreed to purchase tens of billions of dollars of chips from them. So that easily left AMD as the top performer in the S&P 500, with the index posting a fresh gain, even as just over half its constituents moved lower on the day. After the US markets had closed, the US announced that it would be taking a 10% stake in Trilogy Metals, a Canadian mining company based in Vancouver (the stock was 215% higher in after-market trading). The mining company has claims in remote areas of Alaska and comes as the Trump administration continues to focus on critical minerals, including a similar deal with Lithium America Corps last week.

In terms of the government shutdown, last night saw a fresh vote on a stopgap bill to reopen the government. The vote failed as expected, with a margin of 52-42. Republican leadership needed 60 votes to advance the bill. Late on Monday, President Trump told reporters that he was open to negotiating with Democrats over the healthcare subsidies, saying “We are speaking with the Democrats, and some very good things could happen with respect to health care.” While Senate Minority Leader Schumer denied that claim, he remained open to discussing the subsidies. The comments indicated there was a potential path to a deal, but betting markets continue to see a large divide. So on Polymarket for example, it now suggests there’s a 68% chance of the shutdown not ending until at least October 15, that is down from 74% before President Trump’s comments. Polymarket is pricing in a 22% chance that this shutdown breaks the 35-day record. In the meantime, US Treasuries lost further ground given the earlier Japanese move and general risk-on tone in the US, with the 10yr yield (+3.3bps) moving up to 4.15%. We’re half a basis point lower across the curve this morning.

Asian equity markets are mixed this morning, as trading volumes remain subdued due to market holidays in China, Hong Kong, and South Korea. Across the region, Japanese stocks are continuing to climb, reaching fresh record highs, following yesterday +4.75% surge, marking its best performance since April, when it responded to the 90-day reciprocal tariff extension. As I check my screens, the Nikkei (+0.37%) is edging higher, while the S&P/ASX 200 (-0.22%) is lower. S&P 500 (-0.06%) and NASDAQ 100 (-0.04%) futures are a touch lower.

Early morning data indicated that Japanese household spending increased at a faster rate than anticipated in August, suggesting that consumers are feeling relatively optimistic, which is a positive indicator for the recovery of private consumption. Consumer spending rose by +2.3% year-on-year in August, marking the fourth consecutive month of growth and significantly surpassing the median market forecast of a +1.2% increase.

Meanwhile, the Japan 30-year auction saw stronger demand than its 12-month average, alleviating investor concerns following Sanae Takaichi’s election victory over the weekend. Yields on the 30-year JGBs have decreased by -2.6bps, trading at 3.28%, while the 10-year JGBs are down by -0.5bps, currently standing at 1.68% as we go to press.

Finally yesterday, the rapid ascent for gold prices in 2025 continued, rising another +1.92% to $3,961/oz. The latest move now means they’re up more than +50% on a YTD basis, leaving them well on track for their fastest annual gain since 1979, when they rose +127% amidst a surge in inflation after the oil crisis that year. Elsewhere, Bitcoin (+2.03%) also hit a new record, closing above the $125,000 mark for the first time at $125,260.

To the day ahead now, and data releases include the US trade balance and German factory orders for August. Otherwise, central bank speakers include ECB President Lagarde, the ECB’s Nagel, and the Fed’s Bostic, Bowman, Miran and Kashkari.

Tyler Durden

Tue, 10/07/2025 – 08:36ZeroHedge NewsRead More

R1

R1

T1

T1