Subpar 3Y Auction Stops Through Despite Pullback In Foreign Buying

The week’s first coupon auction just priced, and it was quite solid, taking advantage of the broader risk off mood.

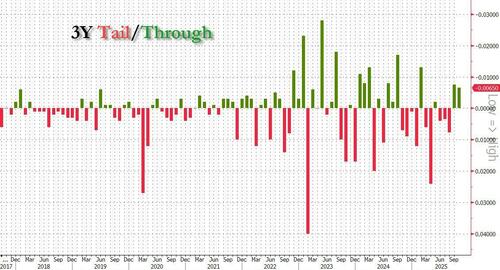

At 1pm ET, the Treasury sold $58BN in 3Y paper, at a high yield of 3.576%, up from 3.485% last month but not that far off the lowest high yield in the past three years. The auction stopped 0.8bps through the 3.584% When Issued, the biggest stop since February.

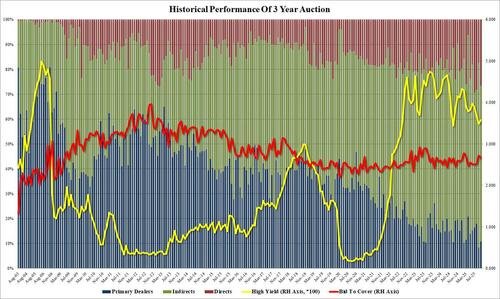

The bid to cover was 2.663, down modestly from 2.726 last month but above the six auction average of 2.550.

The internals were a tad soft, with Indirects taking 62.7%, down from 74.2% in Sept and also below the 64.1% six-auction average.

And with Directs jumping to 26.6% from 17.4%, that left just 10.7% to Dealers, just shy of the lowest on record.

Overall, this was a softish auction which despite the pullback in foreign buyers, did not have a problem stopping through amid the broader risk off that has seen yields slide for much of the session and hit a LOD just after the auction priced.

Tyler Durden

Tue, 10/07/2025 – 13:19ZeroHedge NewsRead More

R1

R1

T1

T1