Recession And Bonds: Navigating The Next Slowdown

Authored by Michael Lebowitz via RealInvestmentAdvice.com,

It’s odd to consider, but a recession could flip our bullish outlook on bonds to bearish. It’s unusual because typically, inflation drops during a recession, leading to lower yields and higher bond prices. While we believe that if an economic downturn or recession occurs soon, the immediate effect on bonds will be favorable. However, the bigger question in our mind is how steep a decline in yields we might see.

While many factors will ultimately influence the answer, the primary constraint on a decline in yield may be the government’s response to a recession. In 2020 and again in 2021, the government issued checks to the public to stimulate economic growth. These checks, along with other large-scale fiscal spending and supply chain shutdowns, led to the highest inflation rates since the early 1980s. Although it’s unlikely that the next recession will face supply constraints like those during the pandemic, we worry that another round of fiscal stimulus, including direct payments to the public, could drive inflation higher. Moreover, grossly negligent fiscal deficits could further spur the bond vigilantes to pressure yields higher.

Some of our readers, upon hearing this concern, have asked us how Treasury Inflation-Protected Securities (TIPS) can protect them in such a situation. To answer their question, we review recent history and compare an actual TIPS to a non-inflation-adjusted Treasury bond (nominal bond) before, during, and after the 2022 inflation surge. Additionally, we provide an overview of TIPS to help you better understand their mechanics and when they might offer better returns than nominal bonds.

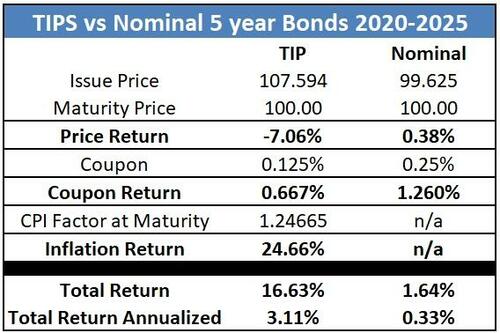

TIPS vs Nominal Bonds 2020-2025

In our opinion, a great way to help readers become better acquainted with TIPS is to illustrate how TIPS have performed over the last five years in comparison to a typical fixed-coupon non-TIP US Treasury bond (nominal bond).

To accomplish this, we selected a TIPS and a nominal bond with nearly identical maturities and issuance dates. Both bonds, detailed below, mature in October 2025, providing a complete performance picture.

TIP

-

Cusip: 91282CAQ4

-

Coupon: 0.125%

-

Issuance Yield: -1.32%

-

Issue Date: 10/15/2020

-

Maturity Date: 10/15/2025

Nominal Bond

-

Cusip: 91282CAT8

-

Coupon: 0.250%

-

Issuance Yield: 0.33%

-

Issue Date: 11/2/2020

-

Maturity Date: 10/31/2025

At issuance, the TIPS yield was -1.32% while the nominal bond yield was +0.33%. Therefore, at that time, the implied inflation rate, otherwise known as the breakeven inflation rate, for the next five years was 1.65%. Had the actual inflation rate over the next five years been 1.65%, the total return on the TIP would have been identical to that of the nominal bond at +0.33%. This calculation is based on the yield to maturity of -1.32% plus the inflation benefit of +1.65%.

It turns out inflation was almost 3% more than what the market expected. CPI, the index used for TIPS calculations, has averaged 4.43% since the bonds were issued. Thus, the yield on our TIP bond was not the -1.32% yield to maturity at issuance, nor the expected 0.33%, but 3.11% (-1.32% + 4.43%). Investors who bet that actual inflation would exceed inflation expectations were rewarded for choosing TIPS over nominal bonds.

The graph and table below show the total returns of both bonds. Total return includes the coupon payments, the inflation factor, and the price changes from issuance to maturity.

TIPS Mechanics

TIPS are debt securities issued by the U.S. government. Like most U.S. Treasury securities, TIPS have a specified maturity date and coupon rate. However, unlike other Treasury bonds, the principal value of TIPS changes in response to inflation. The so-called TIPS inflation factor is multiplied by the par value to determine the principal value. But, even if inflation is negative, the principal will never drop below the bond’s original par value (100).

The dollar amount of the coupon payment is not constant, unlike nominal bonds. For TIPS, it is the coupon rate times the inflation-adjusted principal value. However, unlike other Treasury bonds, the principal value of TIPS varies with changes in the inflation rate. In our example above, the factor increased from 1.00 at issuance to 1.246 at maturity. As a result, the final coupon payment was 24.6% larger than the initial coupon payment.

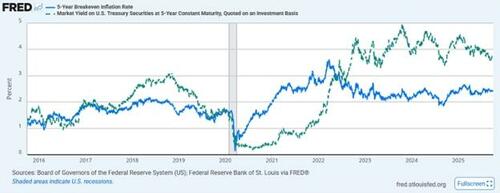

Breakeven Inflation, Not Yield To Maturity

When comparing TIPS to other bonds, investors should focus less on the yield to maturity. Instead, the breakeven inflation rate is far more important.

For example, as we mentioned earlier, even though the initial yield to maturity was -1.32%, the yield at maturity for the TIPS ended up being +3.11%, not the -1.32% it was at issuance. The yield to maturity at issuance and at maturity for nominal bonds is always the same.

The breakeven rate is simply the yield difference between TIPS and nominal bonds with the same maturity date. If realized inflation over the life of a TIPS is less than the breakeven rate, the investor earns a lower return than if they had bought a nominal bond with the same maturity. Conversely, as we showed earlier, in our example, if inflation exceeds the breakeven rate, the TIPS investor earns a higher return than a nominal Treasury bond.

Current Environment

Currently, the yield on a five-year TIPS and a nominal Treasury bond is 1.15% and 3.65% respectively. Thus, the breakeven inflation rate is currently 2.50%.

For some market context, consider the following estimates of inflation for the next five years:

-

University of Michigan Consumer Survey- 5 Year Inflation Expectations is currently 3.70%.

-

The New York Fed Survey of Consumer Expectations median inflation expectation is 2.90%.

-

The Cleveland Fed projects 2.32%

-

The Fed’s FOMC current long-range inflation projection is 2.00%.

As an investor choosing between a 5-year TIPS and a nominal bond, the key question to ask is whether the CPI will average more or less than 2.50%.

Keep in mind that the answer might change during a recession. Therefore, TIPS could appear much more appealing than nominal bonds for those who believe the government will boost inflation with heavy fiscal spending.

Summary

Markets have a long history of assuming the future will be just like the past. Until 2020, the market assumed inflation would be benign. Over the last five years, that assumption has fallen apart, as we illustrated in our example. However, looking forward, we must assess whether the recent high-inflationary period will persist, or will the sub-2% inflation of the pre-pandemic era reassert itself?

In relation to this article, the answer to the question above may depend on whether or not a round or multiple rounds of checks are written to the populace to combat a recession.

Tyler Durden

Wed, 10/08/2025 – 15:05ZeroHedge NewsRead More

R1

R1

T1

T1