“Blow Up Risk Is A Real Possibility”: ‘Volmageddon’ Fears Reignite As Melt-Up Wipes Out Levered Short ETF

Have we learned nothing?

February 2018 saw the markets suffer what came to be known as ‘Volmageddon’ as a sudden surge in volatility triggered massive losses in short-volatility exchange-traded products (ETPs), such as the VelocityShares Daily Inverse VIX Short-Term ETN (XIV), losing over 90% of their value in a single day.

The S&P 500 dropped approximately 4%, and billions of dollars in investor capital evaporated as these leveraged products, designed to profit from low volatility, collapsed under the pressure of the unexpected volatility spike.

The event was driven by a combination of market concentration and the mechanics of hedge and leverage rebalancing.

A month ago we highlighted a note from BofA which warned “‘Volmageddon’-Triggering ETPs Are On The Rise Again“.

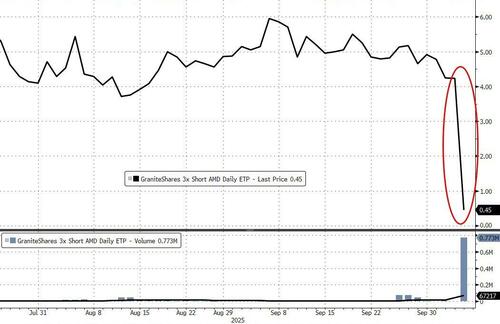

And this week, we may be seeing the first canary in the coalmine for next market structure crisis as GraniteShares was forced to shutter its 3x Short AMD exchange-traded product on Monday after shares of Advanced Micro Devices Inc. surged as much as 38%, wiping out its value.

The ETP – listed in London and Italy – aimed to offer three times the inverse return of AMD’s shares and had gathered about $3 million in assets before its closure, according to data compiled by Bloomberg.

As Bloomberg’s ETF guru Eric Balchunas noted in a post on X:

“We got our first termination event. The GraniteShares -3x AMD ETP in Europe is no longer. Forced termination, XIV-style…”

A notice on the GraniteShares website announced that “as the NAV is now zero, no redemption payments will be made. Trading in the affected ETP has been suspended and the securities will be delisted in due course in accordance with exchange procedures.” Will Rhind, CEO of GraniteShares, declined to comment.

Bloomberg reports that the product’s implosion comes days after GraniteShares – and a handful of other issuers, including Defiance ETFs, ProShares and Direxion – applied with the SEC for leveraged products designed to deliver three times the daily return of some of the market’s hottest trades.

Though such products already exist in Europe, they largely don’t trade in the US given volatility rules set by the regulator that cap how much leverage a fund can offer.

“I think this proves that blow-up risk is a real possibility for a 3x stock ETF,” said Bloomberg Intelligence’s Athanasios Psarofagis.

“But I doubt even such an event will deter investors.”

The filings come after 2x funds proved wildly popular with American investors.

“Single-stock blowups are practically inevitable, especially in today’s fast-paced environment,” said Todd Sohn, senior ETF analyst at Strategas Securities.

“The question is: when does it arrive in the US, a much larger market?”

While the scale of the GraniteShares ETF termination event is considerably smaller than that of XIV’s 2018 collapse, we suspect – given the level of levered retail participation in markets – that this will be the first of many (both long and short) levered ETF blowups to come.

Tyler Durden

Thu, 10/09/2025 – 15:45ZeroHedge NewsRead More

R1

R1

T1

T1