Struggling Central Valley Residents Line Up For Groceries Amid California’s Cost-of-Living Crisis

Authored by Beige Luciano-Adams via The Epoch Times,

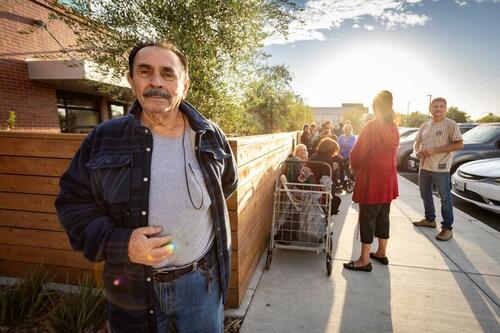

FRESNO, Calif.—Vicente, a man in his early 70s, arrives at the Fresno Mission at 11 p.m. on a Tuesday. By 7 a.m. Wednesday, he’s first in a long line that snakes through the parking lot, onto the sidewalk and around the block.

Like superfans camping out for concert tickets, people bring their folding chairs and huddle under blankets, sometimes for more than 12 hours. But they are not here for a show—they’re lining up for a market where they can get around $250 worth of groceries free of charge.

“I took little naps,” says Vicente, who declined to give his full name, his eyes bright after eight hours in the relative chill of early October. A cabinet maker, he runs his own shop, but work has been slow, and he has a mortgage and two cars to maintain.

Unlike a traditional food bank, he can pick and choose what he wants here—including fresh meat, eggs, and local produce—as he would in a normal supermarket.

Such basics have become a coveted luxury for people struggling to make ends meet in California, where runaway living costs have given the state the distinction of having the world’s fourth-largest economy and the nation’s highest poverty rates.

The vast majority who camp out for the market are not homeless. Many are homeowners; others rent, or live in subsidized housing. Most foodbank clients in the region have at least one working person in their household.

All of them are finding it increasingly impossible to stretch a fixed income or pension as gas, grocery, housing, and utility costs skyrocket.

“Every single month we feed 320,000 individuals, just in Central California,” Kym Dildine, co-chief executive officer for the Central California Food Bank, which operates the First Fruits Market at the Fresno Mission, told The Epoch Times.

Dildine says demand for the Food Bank’s services is similar to the level at the height of the pandemic.

One in four adults, and one in three children in the Central Valley, she noted, struggle with food insecurity, which the United States Department of Agriculture (USDA) defines as limited or uncertain access to adequate food. This is significantly higher than statewide estimates and a national rate of around 13.5 percent.

Among California’s low-income adults, 45 percent say they can’t afford food, according to a recent UCLA study.

Dildine also says that with the federal cuts looming following passage of the Republican One Big Beautiful Bill in July, the crisis may soon have more far-reaching impacts.

“We do anticipate with all the changes going into effect at the federal level with SNAP [Supplemental Nutrition Assistance Program] that there will be an increase in need in the coming years, but it’s really hard to tell,” she said.

“There are other economic variables that push people into our lines.”

A Middle Class Refuge

Some observers blame the end of COVID-era subsidies for the state’s high poverty rates, while others point to policies that increasingly trap people in poverty, or are hostile to the middle class, chasing them out of the state as traditional routes to upward mobility evaporate.

The Public Policy Institute of California in a recent report notes increased poverty rates directly followed the expiration of pandemic-era expansions of the Child Tax Credit, stimulus payments, and unemployment and food assistance.

“In 2023, about 2.6 million more Californians (6.7 percent) would have been in poverty without safety net programs,” the institute estimates, with CalFresh, the state’s SNAP program, accounting for about a third of that.

While poverty rates were highest in coastal areas, the generally more affordable Central Valley was particularly vulnerable: Without safety net programs, poverty here would be 12 points higher.

California has long had an affordability crisis. Residents pay nearly double the national average for housing, electricity, and gas, motivating millions of them to migrate to other states over the last two decades, a trend that continued last year, when California had one of the largest net domestic migration losses in the country.

Instead of decamping for Texas or Florida, some have opted to migrate to the Central Valley, where home prices are still relatively low—by some counts nearly half of statewide averages.

Rising demand for housing, more land, lower costs, and taxes all make the area ripe for continued growth. Historically, they’ve also made the region a refuge for those looking to climb the ladder to a middle-class life.

Kym Dildine and her husband, Matt, who is the CEO of the Fresno Mission, described their own return to the area nearly 14 years ago. They bought a home in Fresno for $300,000 at a time when they had a combined annual income of around $120,000. That same house today, Matt noted, is worth $650,000.

“Anybody could buy a house. One of the reasons people came to Fresno or stayed in Fresno is you could graduate and get a job teaching and you could buy a really nice house,” he said.

Average personal income in Fresno in 2023, according to the state, was under $53,000. Median home prices have risen eight times as much as Californians’ incomes over the past several decades, according to a recent report, and homeownership has dropped precipitously among Californians ages 25 to 45.

Now, he said, building costs and an infamously complex regulatory environment have made it nearly impossible to build for a price that would make rent affordable to someone on that salary.

“In Fresno there are two types of housing being done—you either have heavily subsidized government housing, or higher income housing,” Dildine said. “The problem that’s developing is that state economic policies have killed the ability to develop market-rate housing. It either has to be subsidized or it’s going to be very high.”

Rents here have risen at a higher rate than in many other areas, including the more expensive coastal regions.

What’s missing, Matt said, is multi-family housing that acts as a bridge for people climbing to the middle class. Rising rents, following rising construction costs, are pricing middle-income people out.

“It’s creating two forms of housing—the haves, and the have-nots. The people in the middle, the transition housing, all those things are non-existent,” he said.

“It’s literally hollowing out the middle class.”

Hunger in the Heartland

Central Valley, an agricultural and oil production powerhouse, and a growing renewable energy hub, is home to some of the highest food insecurity rates in the state and the highest electricity bills in the country.

The valley produces around a quarter of the nation’s produce, and nearly half of its fruits and nuts, making California the country’s top producer and exporter. Agricultural production in Fresno County alone reached a record $8.59 billion in 2023.

But people working and living in the center of it, including in economically distressed neighborhoods considered “food deserts,” don’t always have access to healthy food, or can’t afford it.

Seniors waiting since 3 a.m. for the First Fruits Market to open said their pensions don’t cover more than rent and electricity now.

“The prices have gone up so much—it’s so expensive, all the meat, and the eggs,” said Bianca, 68. “We appreciate more than anything the eggs.”

Most people interviewed by The Epoch Times declined to give their full names in order to protect their privacy.

Others were grateful for the family-sized, name-brand butter, or the baby back ribs they had in stock two weeks ago.

The market has a mix of purchased product—they spend around $30,000 each month—and donated items such as breakfast sandwiches rescued from local Starbucks outlets. Fresh, vibrant herbs, gleaming eggplants, and perfect tomatoes from local growers are offered alongside shelf-stable items and corn and flour tortillas.

“It’s a big help,” said Christina, a woman in her 20s, waiting in line with her 10-month-old baby, “especially when you have to buy diapers and have a lot of expenses.”

Many said the struggle started years before, but recent spikes put them over the edge.

“When the gas went higher, so did all the basics—the milk, the potatoes, the meat,” said Gloria, 61, who lives alone in subsidized housing and relies on Social Security to survive. “I have Section 8 [federally subsidized housing] but my light bill is like $200 to $300.”

She and a friend sitting next to her in line said they both had their food stamps more than halved recently.

“Need definitely outpaces what we’re able to serve,” says Kym Dildine, of Central California Food Bank.

The program, she said, is intended to be a stopgap—emergency food relief for families experiencing crisis. But some have been coming consistently—they’re allowed a visit every 15 days—since it opened in 2023.

“There are many people here who thought they did everything right in their working years, and now they can’t keep pace with property taxes and medical bills,” she said.

“Our average client has at least one working adult in the home.”

Catch 22: Work, or Housing?

In fact, about half of adult workers living in poverty in California are employed full-time, according to a recent report from the Public Policy Institute of California.

In regions with higher poverty rates among working adults, the report notes, “poverty was also higher among adults employed full-time—indicating that there are multiple challenges to making ends meet, including low wages, expenses such as child care, access to safety net resources, and the cost of living.”

Acutely aware that cost-of-living issues will continue to drive electoral fortunes, California’s Democratic leadership is touting efforts to tackle the state’s affordability crisis, including increased funding for low-income housing and a conspicuous defense of social safety programs targeted by the Trump administration.

Gov. Gavin Newsom expanded the state’s food assistance program in his $321-billion budget this year, and in late September announced funding for thousands more affordable homes, the vast majority reserved for low- to extremely-low income Californians.

That adds to billions allocated to the state’s signature housing program for people experiencing or at risk of homelessness, and the hundreds of millions annually from the federal government for similar programs, not to mention the $24 billion spent in recent years that the state has failed to track.

Down the street from its City Center campus, where the First Fruits Market is located, Fresno Mission is building a project to house families and foster youth with state funding.

Matt Dildine describes the dilemma that comes up again and again with state housing programs as the mission tries to help people achieve self-sufficiency and stabilize their lives.

Affordable housing categories like “low” or “extremely low” are based on calculations of area median income (AMI)—for the latter, applicants cannot make more than 30 percent of that AMI in order to qualify—and these are based on federally established minimums.

But in areas where average salaries are lower, this often puts people in a bind between joining or rejoining the workforce and keeping the housing that prevents them from being homeless in the first place, Dildine said.

“We’ve had foster youth that we’re serving here that they get into a place and they’re like, ‘OK, now I want a job.’ We’re like no, if you get a job, you lose your apartment because if you have a part-time minimum-wage job at McDonald’s, you make too much money,” he said.

In Fresno County, according to 2025 state estimates, the annual income limit for an “extremely low” housing unit would be $19,750.

“So now what are you supposed to do? Not work? Or not have housing?” he asks. “They have a devil’s choice.”

Without some kind of transition point between needed subsidies and self-sufficiency, he reasons, there is no bridge, no way out, short of something transformational to launch you into the next income bracket.

In this way, he said, people become trapped, dependent on meager subsidies to afford the now grotesquely overpriced basics.

“There’s no slow trajectory—I work hard, I get the promotion, I get another couple dollars, I get another job,” he said.

He recalls offering full-time, benefitted jobs to people participating in the mission’s programs.

“And they say no. They’re doing the equation in their head,” he said of the trade-off between income and subsidized housing, “and it’s not enough to make up to sustainability.”

Somewhat farther up the ladder, those working several jobs to escape the grim survival game face a 22 percent federal income tax on earnings in the range of $47,000-$100,000 a year, plus a state income tax of 6 percent to about 9 percent. Independent contractors also have to pay up to 15.3 percent in Social Security and Medicare, meaning their total rate can be more than 46 percent.

Such factors conspire to keep most Californians—the average annual salary is just under $71,000, according to the Bureau of Labor Statistics—from homeownership and a middle-class trajectory. But those who invested in homeownership to secure their futures are also facing new uncertainties.

Val, a 60-year-old woman in line for the market that Wednesday morning, walked from her house in this suburban, single-family-zoned neighborhood, just down the street.

“Everyone’s story is different. I had a profession, a career,” she recalls, before an injury led to early retirement. “When COVID hit, it hit my retirement, and there was no work. I had to live off that. Now there’s no money, and I still can’t work—I wish I could,” she said, adding that she took pain pills to be able to come out and stand in line all night.

“This is everywhere,” she said, indicating the line. “There are a lot of retired people where I live, they own their own houses, and if it’s affecting them, you can imagine everyone else.

“Remember back in the Depression there was nothing, no work, no food?” she asks. “And there were families all moving into one house together? I believe we may see that again.”

Tyler Durden

Wed, 10/08/2025 – 20:05ZeroHedge NewsRead More

R1

R1

T1

T1