Beyond Meat Crashes On Debt-Swap Plan As Fake Food Trend Goes Bust

Fake food company Beyond Meat (NASDAQ: BYND) crashed the most on record today after it announced that nearly all creditors agreed to a debt-swap deal that massively dilutes equity shareholders.

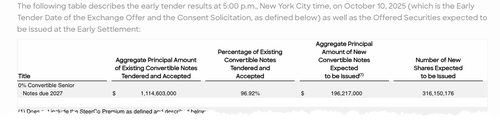

BYND wrote in a press release that 96.92% of holders of its 0% Convertible Senior Notes due 2027 agreed to participate in the debt-equity swap offer, clearing the 85% threshold required for the deal to proceed.

Under the terms, BYND will issue up to $202.5 million of new 7% Convertible Senior Secured Second Lien PIK Toggle Notes due 2030 and up to 326.2 million new shares of common stock. The exchange aims to reduce leverage and extend debt maturities.

The transaction, while providing liquidity relief, will heavily dilute existing equity owners and underscores Beyond Meat’s struggle to turn the sinking ship amid plunging sales and waning market share in the fake food space.

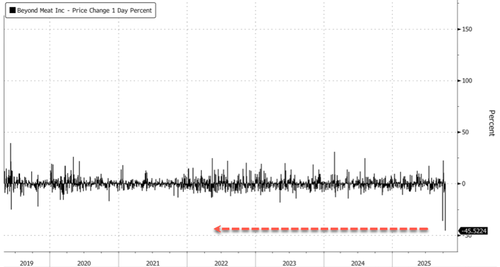

In markets, BYND shares in New York crashed the most on record…

…down as much as 58%. Shares of the fake meat company began trading in a 2019 IPO.

Fake meat has been an utter bust, even after years of globalist billionaires and their allies in the fake news media tried to persuade the world that real food is bad and fake food is good.

Related:

Tyler Durden

Mon, 10/13/2025 – 14:05ZeroHedge NewsRead More

R1

R1

T1

T1